Hengyuan - what next II (update)

teoct

Publish date: Sun, 07 Jan 2018, 04:20 PM

Hengyuan – what next II (UPDATE)

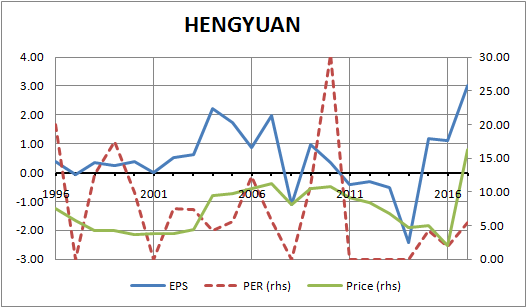

In my article dated 21 Dec 2017, I showed the chart of Hengyuan EPS from 2006 onward. Recently, I came across past data from 1996 and here is the updated chart:

The PER (red dash line) can be averaged to 9.2. This ignore the many years where EPS is less than 0 (1997, 2001, 2008, 2011-2014) and the anomaly of 2010 where PER was 30.3.

This showed that the Malaysian investing public has over the (20) years given an average PER of 9.2.

Based on the many (bloggers) estimates of Hengyuan (HY) final earning for 2017 ranging from RM3.1 to RM 3.7, then the possible price could be RM 28 to 34.

So why is HY still valued at about PER 4.6 to 5.5 (5/1/18 closing of RM 17.14)?

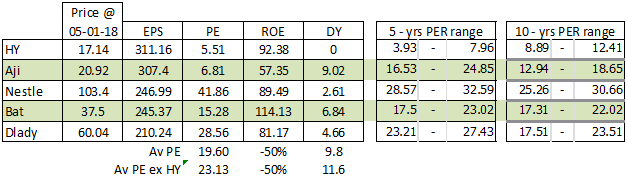

Let’s have a look at companies that have similar earnings as HY and what is their valuation:

Source: KLSE Screener and Dynaquest

Yes, HY is no Nestle, Dlady , etc but think for a moment, they are all businesses where:

1) capital had to be deployed or reinvested

2) research and development had to be done (new food/packaging, improve refining)

3) manpower nurtured

4) manufacturing efficiency maintained or improved

The major differences are:

- HY do not need to do marketing. In fact I think Nestle, Dlady, BAT and Aji have to invest heavily in marketing and subject to trend / habit that can change quite quickly, more risk.

- And HY is limited to Malaysia market is also not correct as oil / refined products in my opinion is saleable worldwide. So one day SHELL says thank you, HY can decide to sell outside Malaysia should demand in Malaysia be satisfied by PDag and PetronM. That is, the government want to kill jobs if HY is asked to close.

The existential risk is electric vehicles and it is a long time away. Yes it will come (EV), many estimates say at least 25 years from now…… and it is cyclical - depended on the crack spread (which for the 2018 to 2019 seem in balance between the supply (refineries) and demand of refined products).

But of course, to have PE same as Nestle, Dlady & BAT is out of the question (in fact looking at current PE, Nestle appears overvalued compared with 5 years and 10 years range).

A 50% discount to the average would give 9.8 to 11.6, so the 9.2 (20 years PE range) is fair.

But like everything, PERCEPTION, PERCEPTION, PERCEPTION ………. It will take a while to change one’s mind.

Disclosure: I own Henyuang and PetronM shares

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

More articles on TeoCT

Created by teoct | Jul 23, 2020

Discussions

Bursalearner - base on the historical figures that was my conclusion. But the market (now) do not think so. So I really do not know.

3iii - which part? Comparing with Nestle, Dutch Lady, Aji or halving the PER? Please explain so that I can understand, thank you.

I have never invested in refinery before but drawn to it last year, 2017. And up till now still trying to understand why market behave the way it did. It sure is a complex business (high capex with wild fluctuation in revenue) and since they are people doing it, it must be profitable, otherwise why do it, there are so many other businesses one can do that is less complex and have a steady income with predictable profit.

Maybe we human just like to take risk, the more riskier the more kick.

2018-04-24 17:38

Bursalearner

@teoct with hindsight n HY at 7.82 today, do you still stick to your analysis and methodology to evaluate HY? thks

Hengyuan - what next II (update)

Author: teoct | Publish date: Sun, 7 Jan 2018, 04:20 PM

A 50% discount to the average would give 9.8 to 11.6, so the 9.2 (20 years PE range) is fair.

24/04/2018 16:01

2018-04-24 16:02