Six month Ahead update 1

teoct

Publish date: Sat, 24 Mar 2018, 11:03 PM

A month ago, I put up an estimate for two items that would have big impact on the economy and thus the share market. This one month, much has happened and lets revisit whether the estimated value is expected to changed either way.

Oil price

World oil consumption (demand)

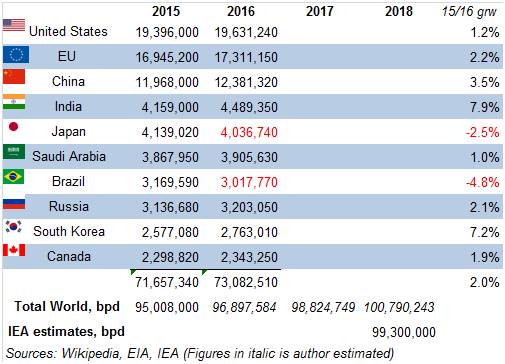

The top 10 nations / bloc (EU) make up 75% of world total oil consumption while US alone is 20%.

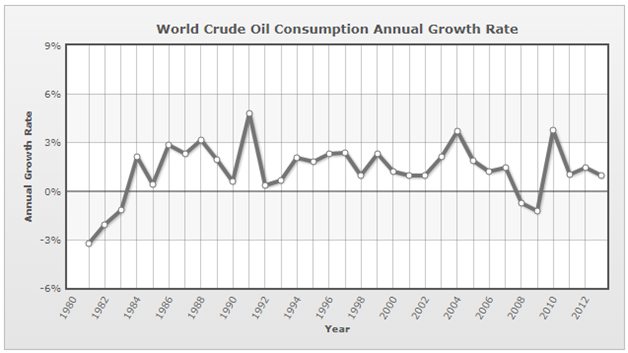

Oil consumption growth rates over the years:

A growth rate of about 2% for year 2016 to 2017 and to 2018 is used given the synchronized growth of the three countries / bloc – US, EU and China. So total world oil consumption is estimated to be:

2017 – 98.8 million barrel per day (mbpd)

2018 – 100.8 million barrel per day

This is an increase of about 2 mbpd.

Japan oil consumption reduces yearly is structurally while Brazil was due to the depressed economic climate in 2016. Brazil is estimated to consume more in 2017 and 2018 as it recovers.

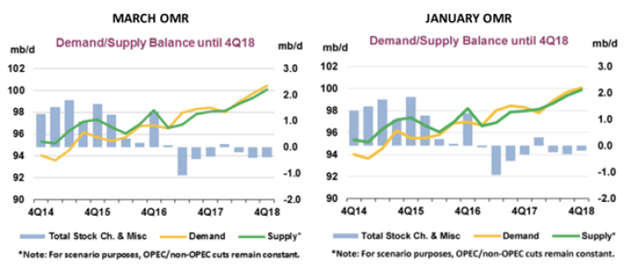

International Energy Agency (IEA) always assumed consumption on the low side – 99.3 mbpd in January 2018 as can be seen in the graph below. This month (March), IEA has revised consumption upward, i.e. >100 mbpd in 4Q18.

Oil SUPPLY

Supply on the other hand, just about meets demand. One of the biggest drops in supply is Venezuela, from 2.4 mbpd (2016) to 1.55 mbpd (Jan 2018). It is expected to drop further due to the ongoing turmoil there. By end 2018, Venezuela production is expected to be about 1.1 mbpd – a lost of about 0.5 mbpd.

US had been the savior of sort. Shale oil production (Jan 2017 – 4.25 mbpd to Dec 2017 – 5.2 mbpd) has increased by about 1 mbpd. This increases more or less covered the loss from Venezuela. Total US production is expected to hit 11 mbpd by end 2018 making US probably the largest oil producer in the world then.

The low oil price from 2015 to mid 2017 has caused most if not all oil producers to cut back on maintenance as well as exploration. This has the effect of generally reducing oil production going forward this year and next of about 0.5 mbpd.

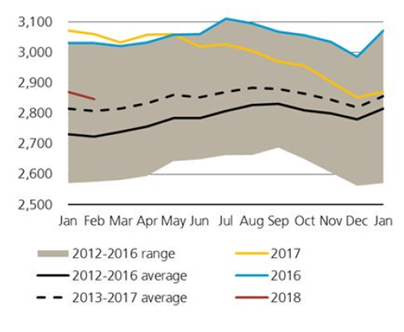

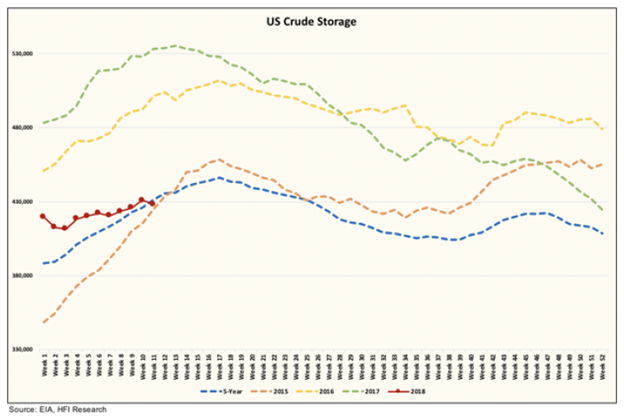

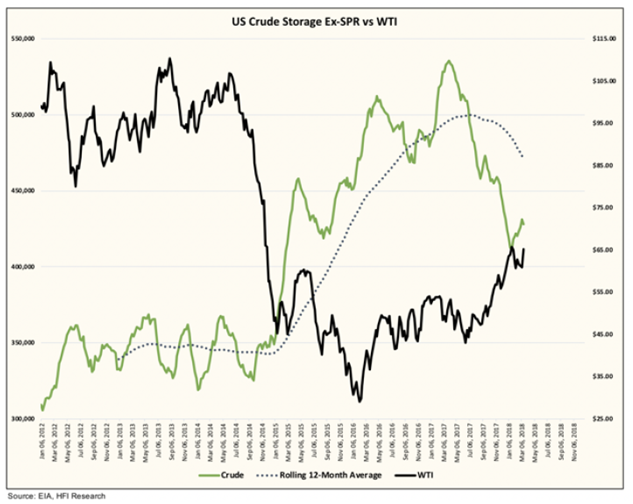

Coupled with the continuous production cut by OPEC and Russia+others of 0.75 mbpd, oil storage inventory / storage in US and OECD had been depleted toward the 5-years average. This is shown in the two graphs below.

Source: IEA made by Giovanni Saunovo

In US, the 20% of world oil consumer, the storage story is no different:

A tight demand / supply situation. And the driving season has not started yet!

Demand can also surprise on the upside, especially India where oil consumption grew 7.9% from 2015 to 2016.

As storage dive towards 400 million barrels (in US), the price (WTI) would move higher towards USD 70 per barrel. Simultaneously Brent will follow.

Trade war between China and US could scupper this thesis of high demand. I think consumption / demand would only be affected next year as all this take time to materialize, if there is going to be a trade war. Donald is calling a bluff to extract some concession from China and China will oblige somewhat. There is just too much at stake for both US and China to go into a trade war.

Another risk that would cause oil price to move higher is geo-political risk. This is Iran. Donald has appointed John Bolton as his National Security Advisor and he is against the nuclear deal from day 1. There is now a potential supply disruption from Iran / Middle-East going forward.

As such the oil price (Brent) six months from now is revised from USD 70 to 75 per barrel.

|

Months |

Brent Oil price (USD) |

Interest Rate - % |

||

|

Predict |

Actual |

Predict |

Actual |

|

|

August 2018 |

75 |

|

3.25 |

|

|

September 2018 |

75 |

|

3.5 |

|

|

October 2018 |

75 |

|

3.5 |

|

Interest rate

(Bank Negara overnight policy rate)

This is left unchanged as I do not see the economy accelerating beyond the estimate 5.3% growth of GDP. In fact downside risk is higher.

The increased of 25 basis point in September 2018 is more to cover FED proposed / intended increase to ensure premium (to US Treasury) is sort of maintain. But now, not like before, there is no outflow of foreign fund everytime the FED increase the rate.

Will monitor this as time goes by.

Thank you for reading.

Have a good week ahead.

More articles on TeoCT

Created by teoct | Jul 23, 2020

probability

Actually due to IMO 2020, extra sweet Crude from Malaysia will have increasing value compared to sour crude elsewhere.

PETRONAS would be minting money...

just that mostly goes to invisible pockets..

Ringgit should actually strengthen.

2018-03-24 23:39