Six months ahead updates 4

teoct

Publish date: Sat, 21 Jul 2018, 10:57 AM

Since the last update (in 24 May 2018), much has happened:

- OPEC had its meeting (22/6) – decision to increase production to meet the “production cutback” 100% (confusing isn’t it)

- OPEC+ meet (23/6) - agreed to increase production to meet agreed production in 2016

- POTUS had twitted (several times) to Saudi

- Saudi “promised” to increase production

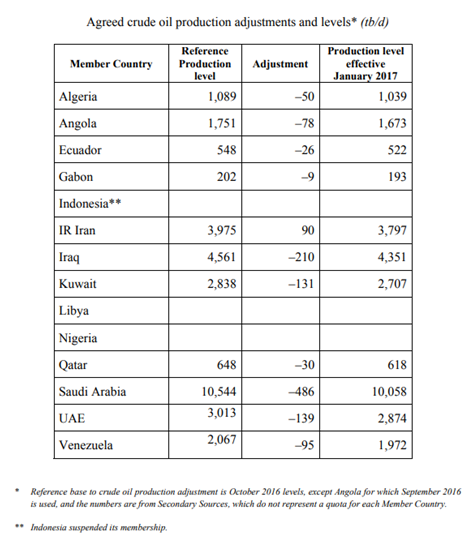

Recap – the cut back agreed by OPEC in November 2016 is 1.2 mbpd. That is OPEC will produce no more than 32.5 mbpd, the respective members agreed production is as per table.

One month later (December 2016), OPEC also got non-OPEC members (Russia, Azerbaijan, Bahrain, Bolivia, Brunei, Equatorial Guinea, Kazakhstan, Malaysia, Mexico, Oman, Sudan and South Sudan ) to cut back 558,000 bpd as shown below.

The breakdown in proposed reduction by non-OPEC country is as follows:

- Azerbaijan to cut 35,000 barrels a day

- Bahrain to cut 12,000 barrels a day

- Bolivia to cut 4,000 barrels a day

- Brunei to cut 7,000 barrels a day

- Equatorial Guinea to cut 12,000 barrels a day

- Kazakhstan to cut 50,000 barrels a day

- Malaysia to cut 35,000 barrels a day

- Mexico to cut 100,000 barrels a day

- Oman to cut 45,000 barrels a day

- Russia to cut 300,000 barrels a day

- Sudan to cut 4,000 barrels a day

- South Sudan to cut 8,000 barrels a day

Since the agreement was put in place, production in OPEC came in lower than 32.5 mbpd. What the agreement reached on 22 June 2018 is that OPEC should produce 32.5 mbpd.

Now let’s see whether this is possible:

-

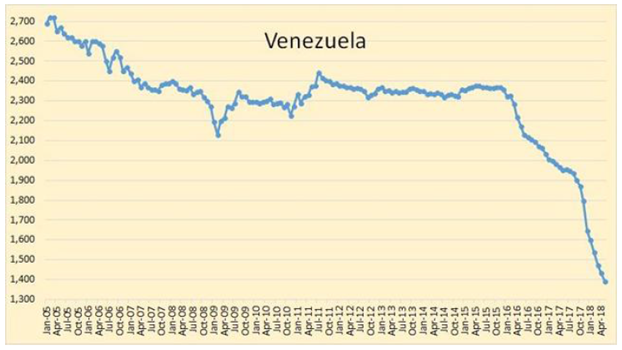

Venezuela – This is the latest production records.

Venezuela has the largest proven oil deposit in the world. Also it is rich in other minerals - – diamond, bauxite, gold, iron ore, gas. And its women won many beauty contests:

- Seven — Miss Universe titles (1979 • 1981 • 1986 • 1996 • 2008 • 2009 • 2013 • )

- Six — Miss World titles (1955 • 1981 • 1984 • 1991 • 1995 • 2011 • )

- Seven — Miss International titles (1985 • 1997 • 2000 • 2003 • 2006 • 2010 • 2015 • )

- Two — Miss Earth titles (2005 • 2013 • )

What happened?

It all started in 1998 when Hugo Chavez was elected President.

As most politician, he went about to perpetuate his rule by taken over the four arms of government – executive, legislative, judicial and military by first adopting a new constitution in 1999.

Kept afloat by high oil price in the early 2000s, Chavez introduced socialist programmes and nationalized key industries. Initially there were improvement in poverty, literacy, income equality and quality of life. He even sold oil, cheap, to fellow Latin American countries. As usual, power corrupt, (https://theconversation.com/how-todays-crisis-in-venezuela-was-created-by-hugo-chavezs-revolutionary-plan-61474) and it all went downhill from there.

In 2007, Venezuela started nationalizing foreign oil majors’ (Exxon, ConocoPhillips, Total, BP, etc) assets in the country and compensating less than what the oil majors felt was fair.

Slowly initially but accelerating now, brain drain, underinvestment, theft and mis-management, production went into a slow decline and when the oil price plunge from 2014 to 2016, the shortage of revenue (cash) became even more acute and today, coupled with ConocoPhillips seizing Venezuela asset (https://www.reuters.com/article/us-conocophilipps-pdvsa/conoco-authorized-to-seize-636-million-in-venezuela-pdvsa-assets-idUSKCN1ID0QP), production just nose-dived.

In addition, Venezuela produces heavy crude and requires “diluent” to be added to ensure it flow in pipelines. Diluent is mainly imported condensate. With the shortage of fund / fund diverted to support the regime, this (import of condensate) is also becoming a bottleneck to export.

The fear is a total collapse for Venezuela.

Why did it become like this for Venezuela – nature or nurture?

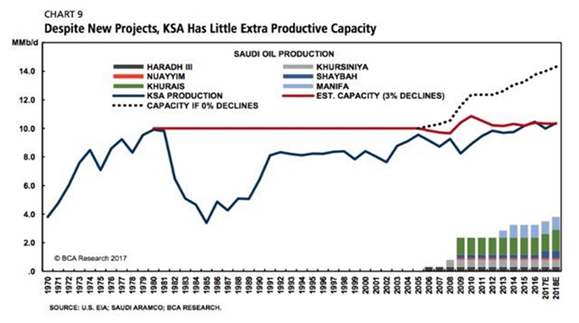

- Saudi pumping more

So is the Saudi King just paying lip-service to POTUS?

Saudi oil production facilities have many problems:

In addition to the normal upstream problems, such as black powder, corrosion, biological fowling and misuse of seawater injection for decades, other issues could also affect overall capacity. Sources have seen major pipelines being blocked by corrosion and scaling, while other production has been hit by major sludging threats. These production issues are known, but the impact has never been able to be assessed fully.

Latest news coming out of Saudi is that they will cut production by 100,000 bpd.

As you can see, total production has been below the agreed 32.5 mbpd since start of 2018.

- Natural depletion

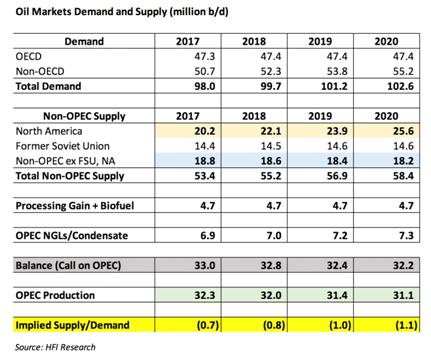

Current world oil production is 95 mbpd (balance 4.7 mbpd comes from biofuel). Natural depletion ranges from 4% to 8% for conventional oil fields per annum. Using 6%, about 5.7 mbpd would be gone by this time next year. So, new oil fields will need to be brought on-stream to cover this natural depletion.

Too high, let’s use 3% then, it is 2.85 mbpd. So assume Saudi has 2 mbpd spare capacity, it is not enough to cover this depletion assuming demand remains static at 99.7 mbpd.

The production figures above assume Iran is producing at about 2 mbpd.

Conclusion:

World demand is estimated to increase from 98 to 99.7 mbpd by the end of 2018 and 101 in 2019.

- OPEC could not produce more than 32.5 mbpd

- Venezuela is the main reason why not, as the country is collapsing and skilled (oil) workers have become economic refugees

- Saudi just do not have the spare capacity to cover losses from other OPEC nations

- Natural depletion at a low 3% will result in 2.85 mbpd being lost – Saudi assumed 2mbpd spares will not cover this depletion.

With the coming sanction on Iran, another 1 to 1.5 mbpd will be removed from supply side by November 2018.

SUPPLY JUST CANNOT MEET DEMAND, today, tomorrow, next month or next year.

Of course, POTUS is now threatening to release SPR. This was discussed in update No. 2. The release of SPR is subject to Congress approval, so it is not so straigntforward.

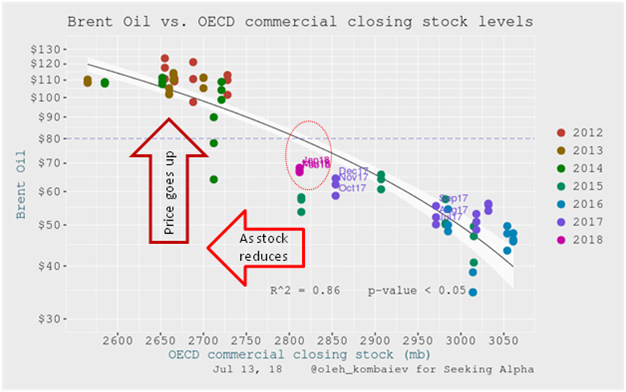

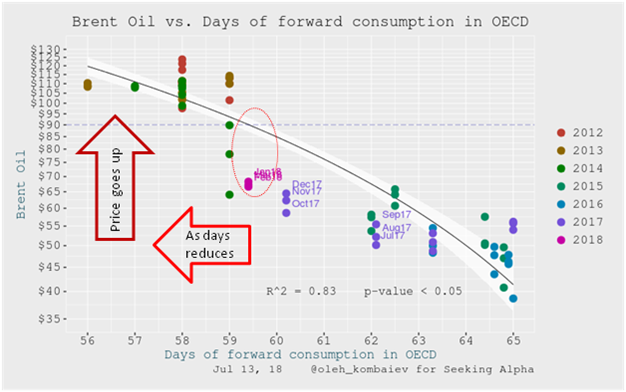

So base on 101 economic, the price just needs to go higher. How high? The two graphs may provide answer.

Have a pleasant weekend.

More articles on TeoCT

Created by teoct | Jul 23, 2020

Discussions

How about shale oil from US. I suppose it can fill up the gap from Venezuela low production and Iran sanction, no ?

2018-07-21 12:51

US shale oil production from jan17 to mar18 increased by 1.1 mbpd. USA is now the largest oil producer at 11 mbpd. Venezuela in the same period reduced by about 0.6 mbpd. The increase in demand is 99.7-98 = 1.7 mbpd. So shale increase 1.1 less 0.6 = 0.5 mbpd is still less than 1.7 mbpd of increase demand. One can argue that the demand is less than 1.7 mbpd. OK even at 1 mbpd, still shale oil cannot cover the increase in demand.

And now at Permian (Texas shale oil acreage), the pipelines have reached full capacity, thus shale oil production at this (most prolific) area will be capped (estimated until end 2019). Other shale areas are limited.

That is why, storage is being used up.

I will try to provide some information on companies in the oil sphere next few weeks.

Have a good weekend.

2018-07-21 14:21

BTW, the table on demand and supply has included shale oil (booked under North America).

2018-07-21 16:08

Thanks TeoCT for info sharing. I understood your point now. The increase in shale oil is not sufficient to cover (the decrease of output from other oil producers + increase in oil demand).

The global oil storage will be depleting and therefore oil price is expected to rise in coming future.

2018-07-22 22:46

The risk that may disrupt oil demand is US-China trade war. The catalyst that may boost oil price is Iran sanction as it will further reduce global oil supply.

2018-07-22 22:50

qqq3

what happened to shale?

2018-07-21 12:40