The Tale of Two Companies - A personal journey

teoct

Publish date: Sun, 09 Jun 2019, 11:10 AM

A Tale of Two Companies

Dayang & Perdana – Introduction: A personal journey

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way—in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only – Charles Dickens: A tale of two cities.

Start of journey and the pain

A phone call towards end February 2019 started the ball rolling on Dayang.

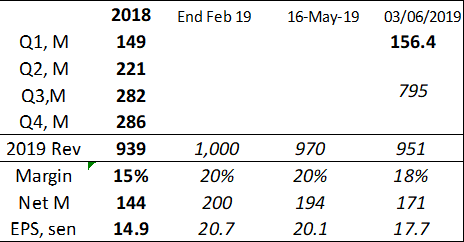

Quick review gave 2019 EPS at about RM 0.20, using PER of 8 would give (potential) share price of RM 1.65; thus, there was some merit in the potential re-rating of Dayang share price to RM 2 or more from the RM 1 it was trading then.

Indeed, Dayang share price rocketed to 1.71 by 15 Mar 2019. Then, the shout of RM 3 grew louder and louder.

Greed overcome the urge to sell, that is, a 70+% gain just over two weeks.

Much water have flown under the bridge;

- Three investment banks cautioned to the downside (negative, hogwash)

- Foreigner bought over 5% of Dayang (positive, wow, see, see, up)

- Dayang to have rights issue to cover Perdana debt (negative, hmm, why?)

- Q1 result losses (negative, gosh, knee also weak)

The above four “factors” directly impacted Dayang share price, especially the double whammy of the last two.

Trade war turning from bad to worse somewhere in between the 4 identified above had an indirect negative impact (whole market fell).

But did or have Dayang’s fundamental business changed, for instance, will revenue drop and or profit margin become worse for 2019.

Much research later, conclusion is, revenue should be better than 2018. Profit margin (net) is expected to be around 18% (2% below average), due to increase manpower cost.

Remember, initial estimate was a quick review only. The 2018 revenue was actual amount. Bold amounts are announced while italic are estimates.

Quarter 2 result will be announced (end of) third week of August while third quarter will be third week of November. Some tweaking may be done to update above accordingly.

This is a whole (financial) year forecast, not for a month or a quarter. The information would help provide a base to the value of Dayang, not its share price movement daily, weekly or monthly.

Share price is controlled by emotion more than facts, no prediction of share price is provided. Only EPS are provided. One can use whatever PER to one’s heart content. EPS is derived with current shares issued and not diluted from the expected right and private placement issues.

Late February 2020, this forecast accuracy will be known.

The journey continues

In the process of the subsequent review / research, there was a light bulb moment; Perdana is an important part of Dayang. Thus, the journey became even more winding. Following this will be write-up further discussing the following in more details:

Daynag & Perdana – Revenue

Dayang & Perdana – Profit Margin

Dayang & Perdana – Debt

Why journey

In writing, hope to crystallize the thoughts, assumptions made, follies encountered and not to make them again (hopefully).

By posting, hope to gather the “wisdom of crowd” as postulated by Philip Tetlock (& Dan Gardner), writers of Superforecasting. This is the selfish part.

The altruistic part is hopefully some in the crowd would benefit and not make similar mistakes.

Thank you all for reading and look forward to the critiques.

Disclaimer

I (and my family) have much skin in Dayang and Perdana.

Dayang and Perdana did not pay me to write this. I wrote this on my own.

This is not to ask you to buy or sell Dayang or Perdana or any other shares in Bursa. You do so at your own risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-21

DAYANG2024-11-21

PERDANA2024-11-21

PERDANA2024-11-21

PERDANA2024-11-21

PERDANA2024-11-18

DAYANG2024-11-18

DAYANG2024-11-18

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANGMore articles on TeoCT

Created by teoct | Jul 23, 2020

teoct

thank you for the likes.

2019-06-12 16:18