The Tale of Two Companies - Debts

teoct

Publish date: Sat, 15 Jun 2019, 10:20 PM

The Tale of Two Companies

Dayang & Perdana - Debts

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way—in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only – Charles Dickens: A tale of two cities.

This is the final instalment, enjoy.

Introduction

A tale of two cities was written in 1859. It is so apt for what had happened to Dayang’s share price.

Dayang won the bulk of HUC/MCM contracts for two cycles (2013-2018 & 2018-2023) when it started its association with Perdana back in 2011. The low oil price from 2015 to 2017, caused Dayang to miss the RM 1B revenue. Without Perdana, Dayang would not have the potential to reach RM 1B level (revenue) so quickly.

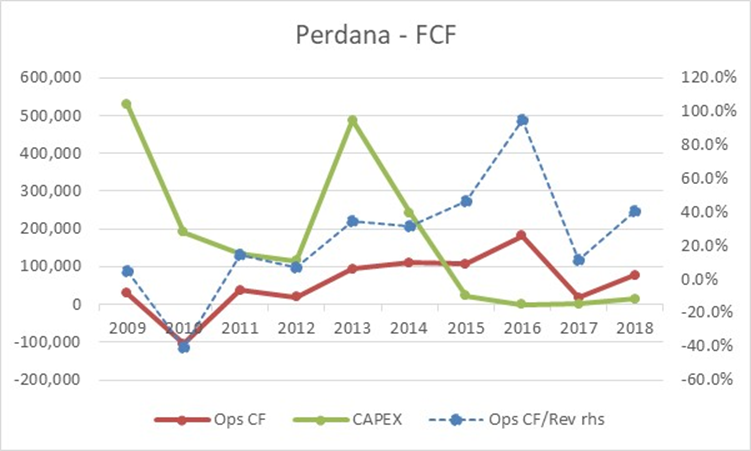

Perdana increased its fleet in late 2000s. That was the time of high oil price (>U$ 100/bbl). New vessels continue to be delivered right up to 2014.

Oil price dropped and stayed low for longer – late 2014 right up to 2017, causing untold trouble to most if not all oil and gas service companies in Malaysia and the world over. Oil majors slashed their maintenance & exploration budgets. Perdana – provider of accommodation work boats/barge (AWB) and anchor handling tugs (AHTS), was not spared.

Debts restructuring

There just was not enough work to generate the cash flow to service the loans taken to expand the fleet. In fact, a couple of vessels under construction were cancelled incurring much losses to Perdana and by extension, Dayang too. A very painful episode in Dayang / Perdana history.

It was a miracle that a SUKUK of RM 635M was issued in April 2016 to Perdana. Still, work never materialized like in the go go days of late 2000s.

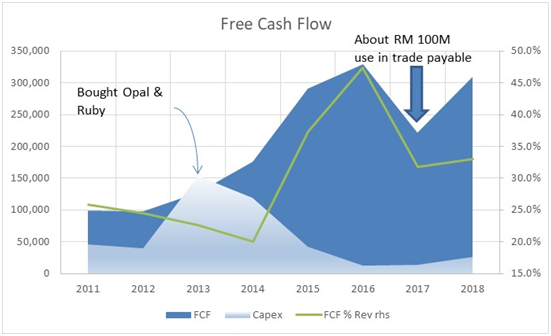

Dayang, on the other hand is a money machine. Cash flow remains good despite the lower maintenance work being carried out from 2015 to 2017.

And it was Dayang that held the fort, so to speak, of Perdana. Advancing up to RM 280M to date (includes latest RM 90M to clear the sukuk payment paid on 26 April 19).

Improving times

However, as the saying goes, the bankers always take away the umbrella when it pours, is never truer here.

Perdana cash flow is improving, but not enough.

Interest payment at Perdana is crushing – RM 74M (2016), RM 60M (2017) & RM 56M (2018) and about RM 50M (2019).

Debt at Perdana came down from RM 999M (2015) to RM 633M (2018), courtesy of Dayang.

This can go on (Dayang keep paying Perdana debt) but there are many issues: -

- Inter-subsidiary borrowing issues (e.g. what interest rate to charge)

- Different entities, different shareholders - fairness

- High probability of default (by Perdana)

Perdana is under-capitalized. So it is Perdana that should be doing the right issues, I was wrong, yes (RCPS) & no (Dayang RI / PP).

So Perdana debt problem became Dayang problem, while Dayang problem is Dayang problem.

The Solutions – RI & RCPS

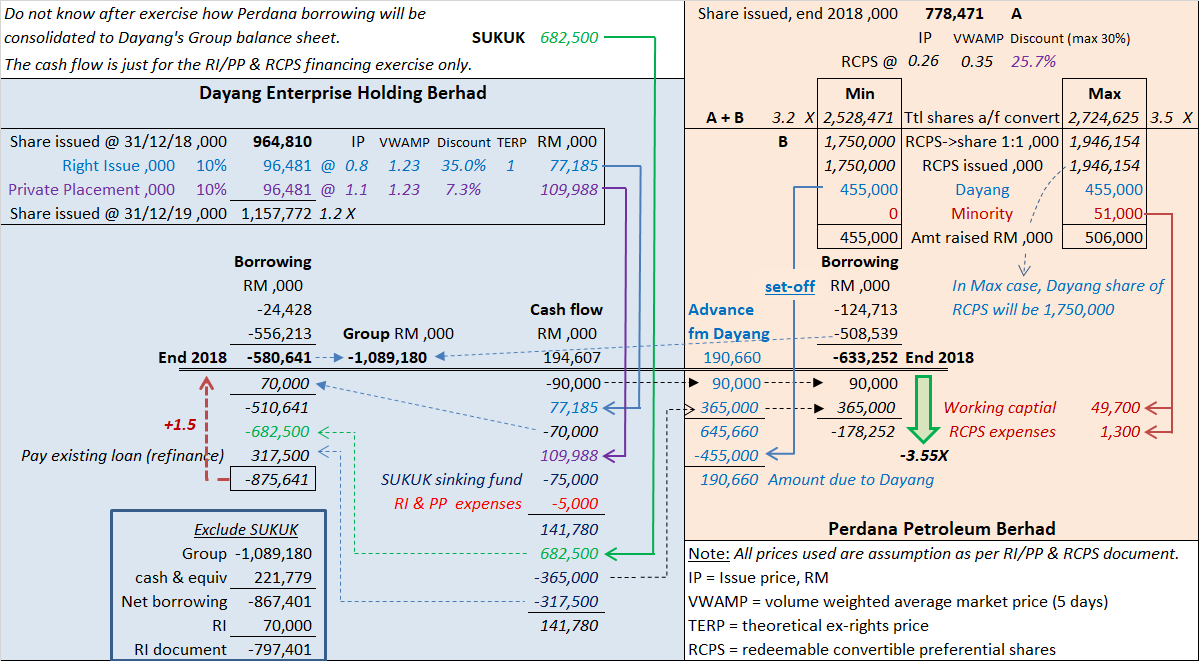

Dayang proposes Right Issues (& Private Placement) and SUKUK

Perdana proposes RCPS – redeemable convertible preference share

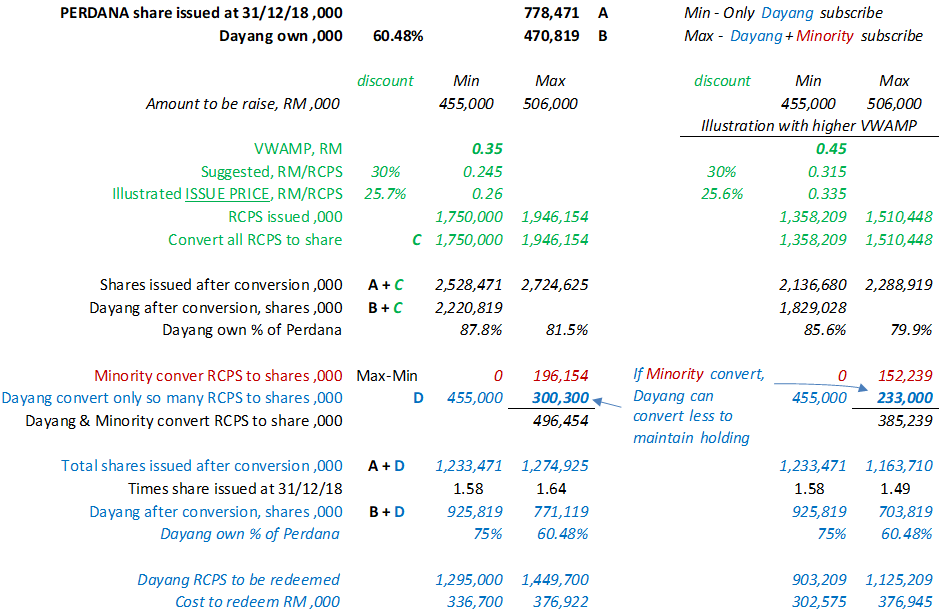

As everyone knows by now, RCPS (redeemable convertible preferential shares) and how it will help reduce the debt level of Perdana to RM 368,912,000 from RM 633,252,000 (end 2018). Reducing debt is always good, lowering interest payment, the saving goes straight to the bottom line and re-focus attention of management to the core business. The downside is, there will always be an injection of equity, thus shares base increases, diluting all the per shares matrixes (within 10 years). Shareholders will need to come up with cash, you don’t, then your holding further diluted.

Let’s start with the RCPS – no interest, tenure is 10 years (long), conversion is 1 RCPS to 1 Perdana share within tenure and Perdana can redeem, also within tenure at issue price.

Therefore, issue price must be low (max 30% discount to 5-days Volume Weighted Average Market Price nearer to time of subscription) to entice (minority) shareholders to subscribe in the hope that given the long 10 years tenure, company performance will improve leading to higher share price. Thus, holder of RCPS will convert to normal share to enjoy the difference. But this conversion will increase the share base leading to dilution – a vicious circle this.

Possibility to redeem - why

At the same time, Perdana can redeem (when it has enough fund) at the same (low) issue price. As a (minority) shareholder, it is a “double edged” sword.

Will Perdana share price advance above issue price?

It appears that there is a feeling no one other than Dayang will subscribe (Dayang got no choice) as it will undertake to pick up minimum RM 455M worth of RCPS.

Subscription would be after Q2/3 report (better result), otherwise the base will be even larger than illustrated as the VWAMP would be less than RM 0.35 in Announcement issued on 17 May 2019.

When Dayang convert the RCPS, it will end up owning more than 75% of Perdana as per below: -

Dayang could then give dividend-in-specie (to Dayang’s shareholders) to ensure that it did not exceed the 75% rule, OR,

Perdana could, within the 10 years tenure, redeem part of Dayang RCPS so that Dayang does not breach the 75% rule. Number of RCPS to be redeem is as shown. A higher ISSUE PRICE of RM 0.335 per RCPS is given to show the lower overall number of shares that may be converted leading to lower dilution.

Dayang RI (PP) and SUKUK

For above RCPS to work, Dayang must secure RM 682.5M SUKUK, advance RM 365M to Perdana to pay off its SUKUK and use remaining RM 312M to refinance existing loan/borrowing.

A condition by bankers before giving the RM 682.5M is that, Dayang does a RI to show commitment from major shareholders, so, minority shareholders are caught (I was caught) too. From the grapevine, the private placement (PP) was part of the requirement (of bankers).

Both RI and PP will be 10% of current share issued (964.8M), that is, RI – 96.48M, PP – 96.48M given a post exercise of 1,157.8M shares (rounding error) – a 20% dilution.

It will be interesting who the PP will be given to – EPF, KWAP, some "special" firms or maybe not issued at all. The announcement said the PP will be used in 36 months – why?

The complex flow of money is as shown: -

Sorry, accountants among the readers, this is just my layman view.

Yes, the RI and PP will raise more than RM 70M and RM 75M, balance will be used either as working capital and paying the bankers for the fund-raising exercise.

What a wonderful instrument, RCPS – issue some papers and voila, Perdana debt (amount due to Dayang) reduced!

Dilution

For Dayang, the dilution for EPS is a maximum 20% or less should PP be less than 10%.

As for Perdana, the dilution for EPS is astronomical, 3.2 to 3.5 times while the NA per share only drop about 39% (from Announcement).

However, for Perdana, debt will drop from RM 824M to only RM 369M (external plus Dayang advance) resulting in an estimated interest saving of RM 16M (6% interest rate) that will go to the bottom line.

Ten years, the duration that all (debt restructuring committee members) think will solve all (financial) problems, how to then value the RCPS? To subscribe or not? A (minimum) 3% coupon rate would be more enticing.

Oh, my love, my Dayang

I've hungered for your touch

A long, lonely time

Time goes by so slowly

And time can do so much

Are you still mine?

I need your love

I need your love

God speed your love to me - to the tune of "Unchained melody"

https://www.youtube.com/watch?v=4MJwXaGhjrA

Love hate relationship

One cannot do away of the other, but one gets into trouble because of the other.

Moving forward, one cannot look at Dayang in isolation, one must understand Perdana too. When Perdana do well, Dayang’s result will be excellent.

Why don’t then, Dayang just take Perdana private? I have no answer.

With the latest (Perdana) contract announcement, wining the umbrella contract from Petronas is a major win. It requires 11 vessels (6 AHTS & 5 AWB), 68% of Perdana 16 vessels. And with the many vessels already committed to Carigali and Dayang, Perdana is stretched (an understatement). Coming quarters will be better than 2018. Therefore, Dayang coming results will also be better than 2018.

This shows Petronas commitment to carry out the many projects outlined in their Activities Outlook. And one can rest assured there are works a plenty out there.

In conclusion, these proposals - RI / PP / Sukuk / RCPS will resolve the under-capitalization at Perdana at the same time reduces debt and advance (from Dayang) for an increase debt level at Dayang that Dayang should be more than able to service. Quite elegant.

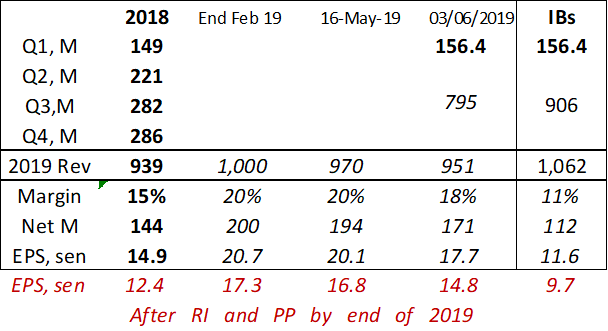

To recap, here is the forecasted revenue, net profit, EPS, fully diluted included for completeness.

Epilogue

There is a push / pull for PETRONAS to do more. Malaysia economy is in the doldrum. And PETRONAS has said that they are committed to doing more. My friend’s rubbish collection business is also benefitting from the higher activities offshore now (rubbish must be brought onshore for disposal), multiplier effect!

For all the above (RCPS, RI/PP) to work, “someone” will need to push the prices of both Dayang and Perdana to at least near or higher than the VWAMP shown in both Announcements. Otherwise the whole deal may fall apart, especially Dayang RI and PP.

This series is to highlights the differences between IBs research and my assumptions.

This is the last episode/instalment/part of this (Tale of two companies) journey. Much like the “Camino de Santiago”, one (reader) can join anywhere or start at the very beginning. Don’t get me wrong, I am not religious and my knowledge of GOT is from my son, I have not watched a single episode of GOT.

Or as Philip (Superforecasting) said “no better than a monkey throwing dart”, I hope I am nearer toward being Bran.

But the journey continues …. it is never ending, hopefully the follies become fewer and fewer.

Disclaimer

I (and my family) have much skin in Dayang and Perdana.

Dayang and Perdana did not pay me to write this. I wrote this on my own.

This is not to ask you to buy or sell Dayang or Perdana or any other shares in Bursa. You do so at your own risk.

References:

- www.malaysiastockbiz.com – Dayang’s quarterly section

- Dayang and Perdana Annual Reports

- Bursa company announcements section

- Petronas Activity Outlook 2019 to 2021

- Hong Leong Investment Bank research

- Kenanga research

- MIDF research

- Public Investment Bank research

- The Edge Financial Daily

- Superforecasting by Philip Tetlock & Dan Gardner

- A Tale of Two Cities by Charlies Dickens

- Camino de Santiago - http://santiago-compostela.net/

Our eyes are placed in front because it is more important to look ahead than to look back, yes, but one must have (past) experience to know what to look for.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-06

DAYANG2024-12-31

PERDANA2024-12-31

PERDANA2024-12-31

PERDANA2024-12-31

PERDANA2024-12-31

PERDANA2024-12-31

PERDANA2024-12-31

PERDANA2024-12-27

DAYANG2024-12-27

DAYANG2024-12-27

DAYANG2024-12-27

DAYANG2024-12-26

DAYANG2024-12-26

DAYANG2024-12-26

DAYANG2024-12-26

DAYANG2024-12-26

DAYANG2024-12-25

DAYANGMore articles on TeoCT

Created by teoct | Jul 23, 2020

Discussions

Thanks for all the good articles. I am very skeptical about OnG businessess, as the oil prices very cyclical. Those umbrella contracts, excuse me if I am wrong, are actually binding contracts on rates, but not on values?? If oil prices drop below certain values, work will be on hold without compensation for any preparation works done?? This is one of the risks?? The ?? mark is for my naive on this topic, happy trading.

2019-06-16 10:05

what a beautiful graph and table presented

even if they keep placing the cash generated on FD...earnings will explode eventually and you cant contain its price at this level.

cash is king

2019-06-16 14:54

Teoct , thanks for putting up a comprehensive business fundamentals of dayang and perdana .You have highlited the key points that Dayang profitability is a function of not only dayang 's profitability itself but also 60 % of perdana P and L. Based on the details of debt restructuring , it appears that Dayang is "burdened " with the acquisition of Perdana at relatively high cost .However , The management of Dayang had repeatedly emphasised that the acquisition is synergistic with dayang 's business .They also attributed their ability to get a big chunk of the HUC and other maintainance business due to the synergy of dayang and perdana . In the last annual report , the CEO attributed the 2018 record earnings and revenue from this synergy. With better 2019 Q1 yoy results for both Dayang and Perdana , we expect both companies to do well in 2019 .

2019-06-16 22:03

In the history of acquisitions, no acquisitions are perfect,some are disasters . Topglove acquired a Singaporean company but later was found to have overpaid by a few hundred millions. Supermx also acquired two companies in 2008 but later found that these 2 companies are a burden and disasters. These two companies moved on and managed it be it a good or bad acquisitions. In my opinion ,dayang is a growth company if you look at the 10 years record of dayang financials .It has grown more than 4x in terms of revenue and earnings . It also means that the growth in revenue and earnings are about 15 % per annum . Its growth in Free Cash Flow is even more impressive at a whopping 6x within 10 years . This growth in both revenue , earnings and FCF are attributes of good fundamentals of a company. The FCF is about 25 to 30 % of revenue on average . This high FCF has enabled dayang to pay off more than 700 million debts in the last 3 years . With the debt restructuring and perdana is better financial footing ,dayang should do better in the next few years premised on its more than 3 billion order book.

2019-06-16 22:26

Thank you so much for the likes and all the kind comments - make it worth writing and sharing.

BLee, your question on payment for preparatory work - there should be payment (under engineering I think). Of course it will also depend on the amount actually spent, too small, Dayang may not claim for goodwill purposes.

During the low oil price recently, Dayang's revenue was not chicken feed, RM 730M. So even should oil price drop, there will be at least RM 700+M yearly revenue.

pjseow, yes, the insights most correct, thank you very much.

Bless you all, have a productive week ahead.

2019-06-17 09:27

From 20 Jun 2019 to 8 Jul 2019, HLIB has raised the target price from 0.88 to 1.26 to 1.49 (all before RI/PP). What a turn of event. Welcome. But this is still short of the intrinsic value of RM 2.09 to 3.64 (Ben's formula to 2-stages DCF method+28% discount).

Have a good week all.

2019-07-08 10:27

Wow !

Teoct done a very details report for dayang & perdana.

Super good report prior ro their r.i.

Many thanks bro.

2019-07-08 10:36

i really admire you, auntie venfx....you bought Eg above 1.00 and average down on year 2017.... you are truely a professional trader, lol

Can you share with me your secret of success, auntie venfx? lol

Posted by VenFx > Jan 16, 2017 1:07 PM | Report Abuse

I would pay close attention to see hiw things are evolved, frankly this is an deeply undervalued counter in my watch list still.

If everything set out well accept by the market, $1.30 - 1.50 will be on the card.

Posted by VenFx > Jun 20, 2017 11:42 PM | Report Abuse

我 储备了

持续 买进

Golden EGgs

两年,,, 一来 可以平衡成本

也可以 与 金蛋 一起 发

EGgs 的 爆发期 很可能是 2018 。

Posted by VenFx > Jul 12, 2017 7:17 AM | Report Abuse

如果 投机, 肯定不爽 。

投资的 朋友照理会默默耕耘

收割期 来临

又一春 咯

Posted by VenFx > Aug 1, 2017 7:02 PM | Report Abuse

就让 EG 接下来的业绩 来 告诉他 吧 !

没有 $1.30 以上 别出货

Posted by VenFx > Aug 1, 2017 7:09 PM | Report Abuse

还可以 乘 Eg-or 出炉时

在市场 直接买了 (理想加, 不超过 $0.33)

过后缴 $0.95 的提交,

等收 1凭单 : 1 红股 吧 !

平均每股 本钱

低到不行 :)

Posted by VenFx > Aug 1, 2017 7:17 PM | Report Abuse

怕 麻烦的,

就 买 女儿 吧

$0.450 太便宜了 :)

2019-07-08 10:41

Had a closer look at the two IBs re-rating. While one had increased earnings (net profit) by 16% for 2019, the other earnings remains unchanged. Both their earnings are around 10 sens. But PER had been increased to 15 for one and 12 for the other.

I am still of the opinion that the profit margin used by both these IBs are low. So, there definitely is room for further er-rating to EPS greater than 15 sens for FY2019. Using their latest PER will gives RM 1.80 to RM 2.25

Happy investing.

2019-07-11 22:15

Choivo Capital

I love the flow of your mind.

However, thus far, i feel the crux of the matter (for me at least) have not been answered.

What is the economic edge of the company compared to their competitors?

How sustainable are the current earnings?

How probable and sustainable are the future growth?

What are the points of ruin in this investment (or is it a trade?)?

I look forward to your future articles.

2019-06-16 02:48