[Alex™] Investor's Biases in Financial Decision

Alex™

Publish date: Sat, 22 Dec 2018, 09:31 PM

Tuan-tuan and puan-puan, I know that many lose mood over many small caps plunge as well as lacklustre KLCI performance. New year is coming, and life goes on. I wish all traders and investors at i3 a resilient year ahead as we look forward to the uncertain future with the determination to do better for ourselves and our loved ones.

Here are some homework I did as part of my preparatory examination into the PhD programme. I will be embarking a journey in the area of behavioral finance. Specifically, I focus on the role personality plays in making financial decision. Potential mediating factors include investor's biases, which is the purpose of this post. If you find it boring, maybe this picture will help (that's what I will be studying).

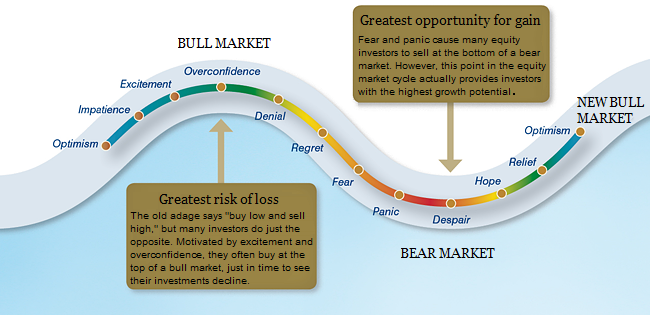

As an introductory work, there are some two dozens of biases documented and studied in the ivory tower of academia. The surge of interest on behavioral finance (as opposed to rational finance) is seen on wealth management. Questions like why we tend to buy at the tops and sell at the bottoms, for example, have a deeper explanation. If time permits, I will present my work-in-progress as I slowly chew and digest this field of knowledge.

Recent drama at i3community on margin calls, people losing their underpants, or betting too big on one position is not a novel phenomenon. Yet, it is novel every time it surfaces on public forum like this, because it helps us to be sober and exercise due diligence in our decisions. To quickly capitalize these stories as enduring lessons (hopefully), here are few biases as a start:

1) Commitment bias

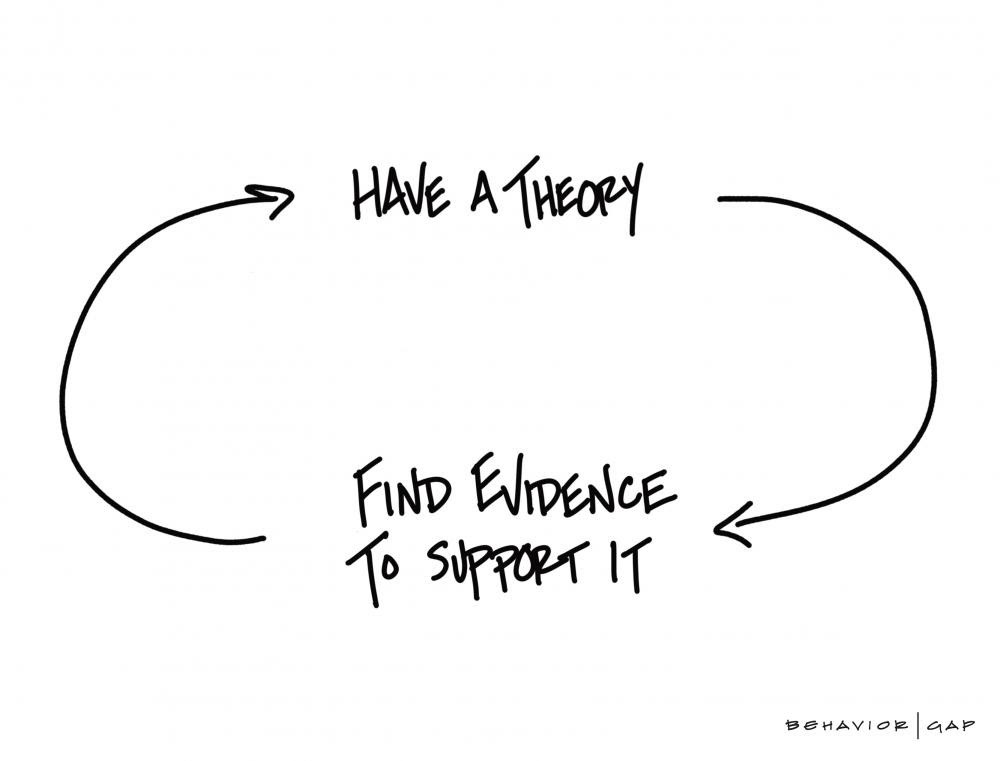

2) Confirmation bias

3) Overconfidence bias

Let's start with commitment bias. Imagine that you're in a poker game. You are half way through the game, and the money on the table gets larger. You betted a meaningful portion of your wealth too. Now what do you do? All the people are watching at your next action. Commitment bias says that one tends to consistently support a past idea or decision because of the ongoing effort (time, money, resources) invested on a particular task. Commitment bias is present when one favors his own position over increasing evidence against his thesis. You can't stop halfway. You need to keep raising the stake in order to win the game.

Confirmation bias works hand-in-hand with the commitment bias. What the former does is that because of increasing resources dedicated to one's position, he or she seeks to further confirm his stand by selectively gathering new information that supports his earlier decision. This is popular in the debate scene, where one conveniently ignored arguments made by the counter party. I must be right, and here is my evidence.

Overconfidence bias, as self-explanatory as it was, is the killer of execution. A person get confident when he has done his homework. A person then get over confident when with his homework he has a consecutive winning records under his belt. This is normally depicted by star fund managers who outperformed the benchmark over a few years period. If left unchecked, it can lead to flowerly promise. All it takes is one wrong forecast, or one bad year to wipe his reputation off the market. What this bias essentially points to us is that when we get over confident, we tend to equate ourselves as someone capable. I made money, it must be me. The reality is, stock market return is outside one's control.

What do you think? Can we overcome these three biases in financial decision? Happy winter solace and Merry Christmas.

|

To vote for Bursa's Templeton Meter: |

|

To ask a question: |

More articles on Alex™

Discussions

wow..i fall into species under extinction.....LOL!

i think so different than others..its good in a way

Posted by Alex™ > Dec 22, 2018 09:54 PM | Report Abuse

@probability

hehe, I speak on behalf of data only

https://imgur.com/a/HhEYb8J

2018-12-22 21:58

KLCI Index dipped 79%, 46% & 47% respectively within 1997-98, 2000-01 & 2008-09. Currently, the index dipped 14%. Now you guys say in panic stage, I think a bit optimistic.

2018-12-22 22:22

ramada...thats the take-away...despite market being pessimistic, KLCI dropped like 20% only...

meaning, they all feel the price are not reflecting true fundamentals...

as if its a hoo-haa created by the trade war...which has to inevitably end

as trade-war causes pain to all..including U.S

2018-12-22 22:31

but of course we dont know if the survey sampling represents the true market makers

2018-12-22 22:36

depend on what price u bought? If u lose a lot, a counter got prob and u still say thumbs up, and keep saying how good how good, then u know what case is this

If u fear market, say crash crash crash then u know...

if horse run away, then u regret but this regret got booby trap one loh bcoz they pull ikan bilis in then slam back down, so regret may not necessary be a regret loh, might be a nightmare.

2018-12-22 22:57

s hold your line, when time comes u strike swiftly,silently and unexpectedly.

2018-12-22 22:59

Betul juga.. I3 many retailer play only... But retailer so fast pessimistic already? Big plate drop 15%, but small plate many already icu...

2018-12-22 23:03

One thing I like about holandking is that his comment always lead ppl away from Holland... Haha..

2018-12-22 23:04

darn, i'm leading ppl away from holland? Guess I'm doing badly since i'm suppose to welcome ppl to holland?

2018-12-22 23:09

Now many retail not at panic, confirm despair alrdy, sold all cut loss haha

2018-12-22 23:15

You study PHD for behavioural finance true? Why choose 0 revenue and boss HS selling ctr Sumatec to invest? You not a gambler more true?

2018-12-23 04:01

5354 bro... Sumatec is speculative play. Yes please do your own due diligence. As they always say, the decision is always yours.

2018-12-23 08:58

Oil drop 0 revenue boss HS cabut why you think is good? After get your PhD want to takeover is it? If Suma close shop(I heard 5 mths deadline to get out PN17 true?) bef you get your PhD how?

2018-12-23 11:27

Unless all your i3 comrades(or whoever new buyer) who has expertise to dig oil in Kazakhtan where HS fail then you can make big gain. Or else if close shop your 1.5 sen can even become 0.

2018-12-23 11:33

Lin Yutang, China literature giant warned us about such PhDs many many years ago.

2018-12-23 11:46

Survey people but find ds(or BuahCiku, etc) interesting sifus to follow? Why choose HRC and Sumatec if not follow ds, BC, etc?

2018-12-23 12:46

Chinese are more practical people....u should leave all these surveying people stuffs to guailos......

2018-12-23 14:05

One thing i observed...those read book too much n like to talk a lot of theories one normally perform so so

2018-12-23 14:12

In sumatec, nothing but only price attractiveness is a trap. With greed, you had jump into the trap, hoping greater fools. This is financial behavior study. You became the study subject.

2018-12-23 14:17

Lin Yutang has many jokes about PhD students doing people survey while in New York ....He believes Chinese scientists are not like that....and not so stupid.....

2018-12-23 14:32

Dear Alex,

Your question: What do you think? Can we overcome these three biases (Commitment bias, Confirmation bias and Overconfidence bias) in financial decision?

Before I try to answer these questions allow me to state that I was one of the 28 respondents of your Templeton Meter pushing the Panic!! Button not because I am in panic sales but on my assessment of the current state of Bursa. How else to explain the free fall of JAKS, VS, or for that matter all the metal and construction counters or even KSL with increase Q earning the stock remain dead. For me personally I still have my full time job that pay me well and I shall allocate part of my monthly salary into buying some value stocks and hopefully I do not need to use my FD to buy financial stocks that sell for a song when the Bursa reach the “DESPAIR STATE”

Come to your questions: I recall someone wrote this:

Generally, there are 4 camps of blogger or members in i3.

A. The first type is those who have bought the shares and keep promoting them.

They can be small investor that only buy a few lots but making a lot of noise. Some are more intellectual that can write very detail analysis. These can be professional analyst or simply intelligent individual with very good investment background and experience. A few of them are remisier that may or may not own any shares, but issues buy call for their subscriber. The last one is some superinvestor that has a large position enough to move the market. Sometimes, the share may not be good but with their purchasing power and followers, this can be turned into a self-fulfilling prophesy.

B. Second type is those who keep attacking and spreading fear.

They would like to buy the shares with lower price. Once they bought the share, they will become type “A” promoter. The more sophisticated one can be those hired by certain parties that issue warrant so that they don't need to pay when the warrant is expired. For some, they may simply want revenge when they notice certain member that have attacked their shares before and is trying to promote another share.

C. Third type is neutral

They have other means of earning a living. They can be a lecturer and running some course. They may be observer and don't own a particular share but simply like to chip in.

There is one type that is more cunning. They actually go to the hottest stock and give very sensible comment when the share price is being hit. You will be wondering why they are so actively doing this. For this kind of person, they will come out like a hero or saviour and they will finally promote some shares and gain some follower.

D. Fourth type is the silent one.

Don't underestimate the fourth type. They can the newbies but with cash rich. They can also be serious investor. They can be some working for investment bank or asset management that are not allowed to post. They come to i3 to read the blog by gathering the information and the sentiment of the market. You may be surprised that they can be computer armed with sophisticated machine learning and AI that can trigger a sell or buy.

For e.g. The famous 1987 black Monday that caused the market crash. 30 years onwards, the algorithms are much more sophisticated, and you can see the speed of recent sell off in DJIA.

Of course, people said no body point the gun to your head to buy a share and you need to judge by yourself. However, some very experience blogger can use a lot of convincing points to lure you to buy into their shares or vice versa. This is what I call type A super investor.

As for me, previously I wrote: “In i3 community, we have super-investors, professional fund managers, investment educators, preachers, old-timers, syndicate manipulators, day traders, part-timers, naysayers, jokers, haters, sadists, dreamers, idealist, PLP king and newbie. These had make i3 a diverse and plural community with diverse views and opinions, all are welcome.” By now you should have know many of them by their comments or blogs in i3.

So the answer to your question “YES” everyone here are biases toward their vested interest either monetary or intelligently. And if you wants a more detail as of how they are biases? You need to separate them to different groups and ask the question what is the end result they aim to achieve by their financial decision?

1. Age group.

2. Core faith, culture and education background

3. Full time or part time (retiree)

4. Investor or trader

5. Invest for own self or other people money

Is it my hope, young people like you will learnt to accept different views and humility that there are not perfect solution/answer to human greed and fear and by the way TA is a tool to study human behavior decision and someone say if you can’t beat them join them.

Merry Christmas and Happy New Year to you.

Thank you

P/S I will buy some KSL but not the KNM.

2018-12-23 14:53

Stock: [HENGYUAN]: HENGYUAN REFINING CO BHD

Nov 29, 2018 01:38 PM | Report Abuse

Haha....

Everybody has to pay for tuition fees.

But outcomes are different.

Some pay and learn something, not going to commit same mistake (or less mistake)

Some pay and learn nothing, all tuition fees go to the drain

Some keep on paying and learn very slowly, they believe one day they will become sifu too

Some have graduated and enjoying their golden year right now

Some pay but dead half way, they are having meeting in holland

So which category do you belong to?

Ask yourself sincerely.

Nobody is going to judge whether you are right or wrong

Only to measure how successful you are in this market

2018-12-23 15:12

If you have not experience 1997/98 crash, you may now half dead.

Meaning you have lost half your capital.

Again 1997/98 is the worst case scenario I ever come across.

So far our market still not reach that stage yet.

May be when we witness US and world market crash after 1 Mac 2019 when full scale trade war started, and perhaps trade war already developed into hard war, then prolong recession will set in just like Great Depression in 1929.......

2018-12-23 15:30

agreed.... behavioural finance, a new branch of finance.... many people/investors are irrational in investing e.g. herd instinct, fear, greed, etc.

2018-12-23 15:31

In 1997/98, you were not sure which counter would be hit with multiple limit downs, you were not sure which bank going to close shop next day.

Remember depositors took out money from local banks and deposited next door foreign bank.

It may be UOB, HSBC, or The Chartered Bank.

Who dare to put money in Maybank or Public Bank then?

2018-12-23 15:35

oetaybodoh > Dec 23, 2018 03:32 PM | Report Abuse

bodoh qqq3

========

stock market far from rational....

still , there are winners and there are losers....

2018-12-23 15:41

i also think it is fair for sslee to donate some salaries to the stock market......

2018-12-23 15:46

by UnicornP > Dec 23, 2018 03:58 PM | Report Abuse

I'm in despair. Kind of no hope for stocks d.

===========

good news.....there is life beyond stock market.

2018-12-23 15:59

OK la...every 10 years sure one time crash. Just make sure during the bull time you've already made a lot. A typical bear just last max 1 year plus only. Very quick bull again. Be patience and optimistic.

2018-12-23 16:07

Hehe thanks sslee for supporting my ksl... Itu ksl boss got promise div, but not until now still dun have... How to give angpow on cny like that?

2018-12-23 16:22

Unicorn bro... Equity market is volatile, and along with rides come human emotion too. If really painful to watch, always good to switch off and do other stuff.

2018-12-23 16:25

Yes having a paid day job help cushion the volatility in the market. Very few can live off trading income, especially this year 2018 when downtrend stocks vastly outnumbered the rising ones...

2018-12-23 16:27

Ks55 bro... It's painful as a trader to keep giving back profit to the market... Hopefully after giving tuition fee to the market every now and then it helps me to understand what I hold (investor), and how well I execute a strategy (trading, technical).

2018-12-23 16:31

Alex™

@probability

hehe, I speak on behalf of data only

https://imgur.com/a/HhEYb8J

2018-12-22 21:54