SEREMBAN ENGINEERING BERHAD (5163) - A LITTLE KNOWN COMPANY THAT IS ABOUT TO SHINE?

TheAlphaTrader

Publish date: Fri, 05 Nov 2021, 12:52 PM

Today we will look at SEREMBAN ENGINEERING BERHAD (SEB) and explore a very promising trade setup in the weeks ahead.

FUNDAMENTALS

SEB was incorporated in 1979 and listed on the KLSE Main Board in 2010 at an IPO price of RM0.85. The issued number of share stands at only 80M giving a market capitalisation of RM94M.

Over the years, SEB has grown to provide a host of engineering services including fabrication, engineering support, offsale installation, maintenance and shutdown works for palm oil refineries, water and waste treatment, food, glove, chemical plants and oil & gas industries.

The price of SEB has not done much in the past 9 years since listing. The stock price ranged between a low of RM0.20 to a high of RM0.85 over the past 9 years. It was only in October 2019 that things started to get interesting for the company.

More specifically, on 17th October 2019, saw the emergence of a new controlling shareholder MIE Industrial Sdn Bhd (MIE), a leading Engineering, Procurement & Construction Management (EPCM) service company in Malaysia. A Mandatory General Offer( MGO) was triggered with an offer price of RM 0.50, which led to MIE owning 72% of the company. The synergy with MIE has helped SEB penetrate into new markets including civil construction, structural works for projects and plant expansions in the oil & gas industry as well as the gloves industry.

I believe MIE had big plans when they first took over SEB back in Oct 2019 but were unfortunately, hampered by the pandemic outbreak in March 2020. The synergies of the new shareholders in SEB is probably now starting to SHOW as we move into the recovery phase.

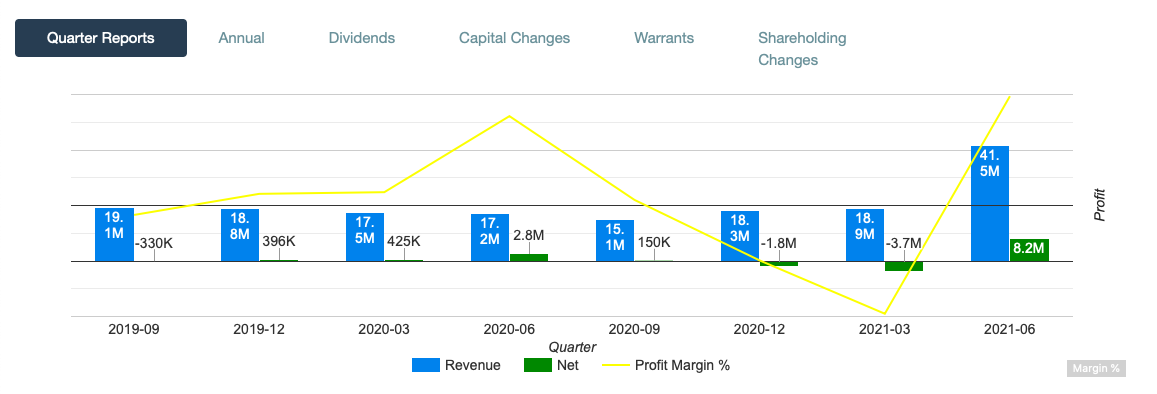

What is interesting to note is the record profit and turnover achieved in the latest quarter!

The turnover of RM41.46 million and net profit of RM8.16 million was by far, the highest level in the company’s history. Even after subtracting the one-off profit of RM3.69 million from the disposal of a piece of industrial land in Gombak, the operating profit remains at an impressive RM4.47 million! The higher turnover which more than doubled from a year ago was driven mainly by a few high value projects in the oil & gas and rubber glove industries. Hopefully, the company can maintain the same (or even better) performance, which could present a great turnaround story for next year, and the possibility of a re-rating since a single digit PE stock for an EPCC company would be too cheap! SEB is due to announce its next quarterly result by 30th November 2021.

TECHNICALS

Technicals often reflect how well a company is doing. As observed from the daily chart, SEB is already up RM 0.49 or 71% year-to-date! The stock hit an ALL-TIME HIGH of RM1.57 on 7th Oct 2021 in response to the record profits announced on 30th Sept 2021

As we can see from the weekly chart, the long term resistance of RM 0.85 was taken out on the 2nd June 2021, reaching a high of RM 1.02. A subsequent SUCCESSFUL retest of the long term resistance-turned-support price of RM 0.85 was triggered on the 27th Sept 2021. (just 2 days prior to the announcement of the blockbuster results)

The subsequent move to the all-time high of RM1.57 was done with increased volume that reflects a new awareness and interest in this little known stock. So as with all parabolic moves, a retracement is to be expected and this offers a good opprtunity for those who missed out on the initial move to participate.

As readers can see from my blog posts, I like to enter trades that have well-defined moves, combining that with positive catalysts and a good chart structure. I usually like to join a trend on a retracement move to improve my probability of success. As the saying goes, “we cannot control the outcome of a trade but we can control the probabilities of the trade!”

INTERESTING OBSERVATIONS

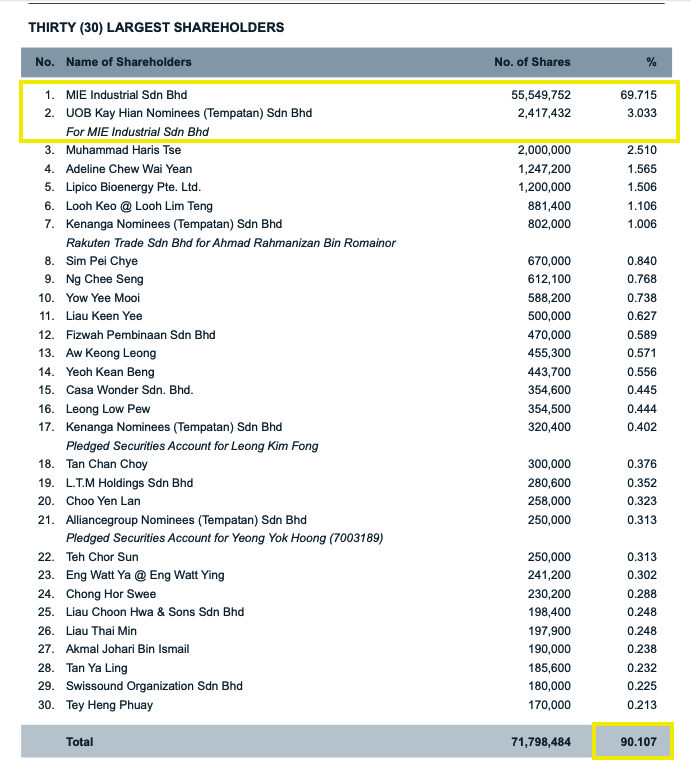

1) TOP 30 SHAREHOLDER LIST ( As of 1st October 2021)

From the latest annual report, we can see that the top 30 shareholders collectively own 90% of the company. The biggest shareholder MIE, owns 72% of the company. This could probably mean the following:

i) EXPLOSIVE PRICE ACTION

With a positive price catalyst like a good quarterly report could see an explosive and extreme price movement to the upside as witnessed after the last quarter report on 30th Sept 2021. This is due to the small number of issued shares (80 million) and the small free float of shares available.

ii) POSSIBLE BONUS ISSUE?

As we have seen from many profitable companies recently, a BONUS issue is a great exercise to reward existing shareholders and increasing liquidity in the stock. The case for SEB to do a BONUS Issue is very compelling from a low liquidity and small share base case.

2) CHART STRUCTURE TELLS A STORY

I believe new multi-year highs in prices usually indicate that there is a fundamental shift that could be occurring in the company which is usually reflected in the price but is unknown to the public - yet (unless it is a pure pump-and-dump operation!) So the big breakouts in long-term charts should be respected and capitalised for a hugely profitable trade!

Two stocks that come to mind are KGB Bhd and Hextar Global Bhd. These 2 stocks clearly moved to multi-year highs prior to any positive newsflow. So is SEB a potential candidate to be a multi-bagger in the years to come? The chart does look promising!!

CONCLUSION

Since nothing has fundamentally changed for SEB from 7th Oct 2021 (when the all-time high of RM1.57 was hit) we will assume that the retracement to RM1.18 represents a good entry level for this trade, with the potential target of reaching NEW HIGHS in the weeks ahead! With the synergies of MIE starting to pay off and the upcoming release of the next quarter report, it is an exciting time to own SEB!

Seeing that this is a fairly illiquid stock, I would set my stop loss at a wider level of RM 0.85 (resistance turned support level) which I do not expect to be reached given the current chart structure and fundamentals of the company!

Have a good week and happy trading!

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks.Consult your financial consultant before making any financial investments.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Alpha Trader

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Created by TheAlphaTrader | May 31, 2024

Created by TheAlphaTrader | Mar 06, 2024

Discussions

Aya ! making 3 sen /sh what to highlight better buy Supermx earning 147 sen /sh mah!

2021-11-07 17:47

sherlockman

so refreshing to read about a new stock!! last couple of days all i saw was AYS and palm oil

2021-11-05 13:11