SIN KUNG LOGISTICS BHD (0305) - A NICHE LOGISTICS PLAYER

TheAlphaTrader

Publish date: Fri, 10 May 2024, 09:31 AM

BACKGROUND

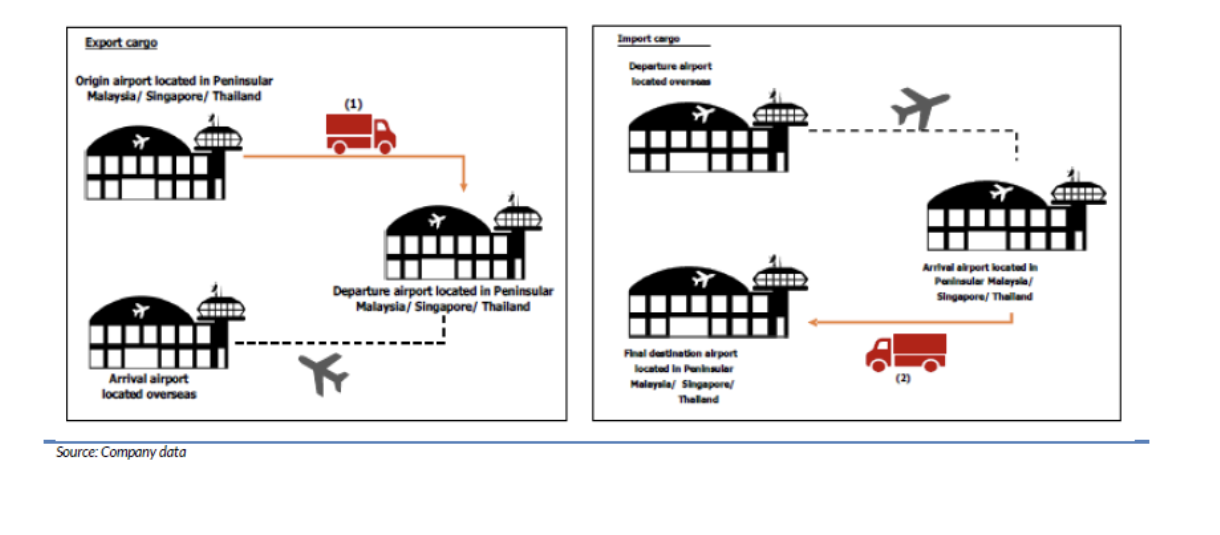

Sin Kung Logistics (SKL) is slated to list on the ACE Market on 15 May. SKL is an integrated logistics service provider, specialising in airport-to-airport road feeder services.

To explain further on the business, it means that SKL uses its trucks to transport cargo between airports, largely between KLIA, Penang International Airport, Senai International Airport and Changi International Airport.

Over half of SKL’s profits are derived from these services, with the balance coming from point-to-point trucking services, warehousing and distribution, container haulage and other services. The main clients of SKL are the airlines – both cargo and passenger, and other sales agents. These collectively contribute 91% of group revenue.

WHAT SETS SKL APART FROM THE REST?

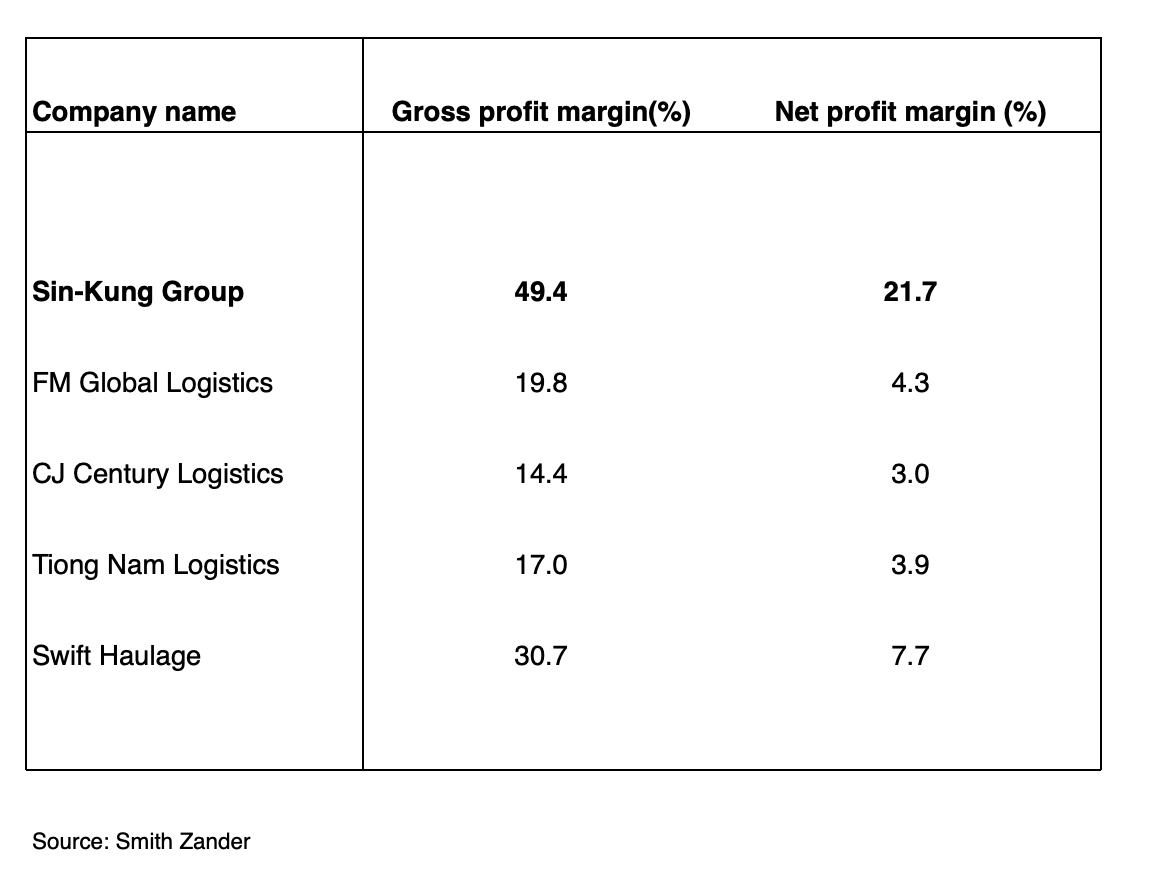

Referring to the above table, it appears that SKL’s margins are far superior to the rest of the logistics industry. This is due to its unique business model as explained above. SKL helps its airline customers expand its connectivity via its trucking network to deliver the airlines cargo from one airport to another. As trucking freight cost accounts for a fraction of the air freight revenue, airlines are willing to pay premium rates to SKL to ensure that its goods are reliably delivered and clears customs on-time, in order for the airline to then fly out its goods to the final destination.

VALUATION

After reviewing the various IPO research reports on SKL, it appears that analysts have derived various fair values between 11.0 sen and 17.0 sen, applying P/E multiples between 11.5x – 15.0x on either FY24 or FY25 net profit.

- Our view is that in deriving fair values for stocks, the market always looks at a one-year forward P/E, which means FY25 as we are currently already in the middle of FY24.

- The industry that SKL operates in cannot be deemed as a monopolistic industry (meaning many companies are offering competing services, i.e. the standard trucking and haulage model). Rather, SKL operates in a duopoly market, where by only two players are dominating the market, in this case, it is SKL and MASkargo , the cargo division of Malaysia Airlines. This explains its superior margins to other logistics companies. As such, SKL should be accorded with premium valuations. To cite other examples of duopoly industries in Malaysia are the breweries (Carlsberg and Heineken Malaysia), and the telco industry (Maxis and Celcom-Digi). In both these industries, these stocks trade at premium valuations. The breweries trade at 17-18x P/E while the telcos trade at 28-30x P/E. Bearing in mind that these are industries with little to no growth as they are operating in a matured market.

- SKL is benefitting from strong tailwinds arising from rising air cargo demand (and rising rates) due to the Red Sea conflict and the ongoing wars in the Middle East and Russia. Freight rates have doubled since the start of these conflicts and we believe that these have yet to be reflected in analysts’ forecast numbers.

- We therefore, believe that the fair value of SKL should be between 20-25x P/E (taking the average of the breweries and telco sectors), giving a valuation range of RM280-350 million market capitalisation, which translates to 23-29 sen/share applied to the average FY25 EPS estimate on the street.

We have attached HLIB Research report for readers who wish to dive into more details of the IPO.

Sinkung-Logistics-20240430-HLIB (1).pdf

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks.Consult your financial consultant before making any financial investments.

More articles on The Alpha Trader

Created by TheAlphaTrader | Nov 20, 2024

Created by TheAlphaTrader | Nov 01, 2024

Created by TheAlphaTrader | Oct 01, 2024

Created by TheAlphaTrader | Aug 16, 2024

Created by TheAlphaTrader | Jul 27, 2024

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Lsly88

TQ AT....wont miss the opportunity

2024-05-10 16:16