GOLD CONTINUES TO SHINE

TheAlphaTrader

Publish date: Fri, 29 Mar 2024, 10:27 AM

Last weekend over coffee with some market friends, we were discussing about how gold prices are trading at such lofty levels, having stayed above the key USD2,000 level thus far as we move into the second quarter of 2024. We all agreed that USD2,000 now seems to be the new long-term support price and is fundamentally justified at the current price. That prompted me to revisit one of my earlier articles posted on I3 investor almost 2.5 years ago, which I wrote on Gold and Tomei Bhd.

I am reposting the link from the article here for the benefit of new readers since Gold seems even more relevant today with the advent of inflation and declining interest rate trends.

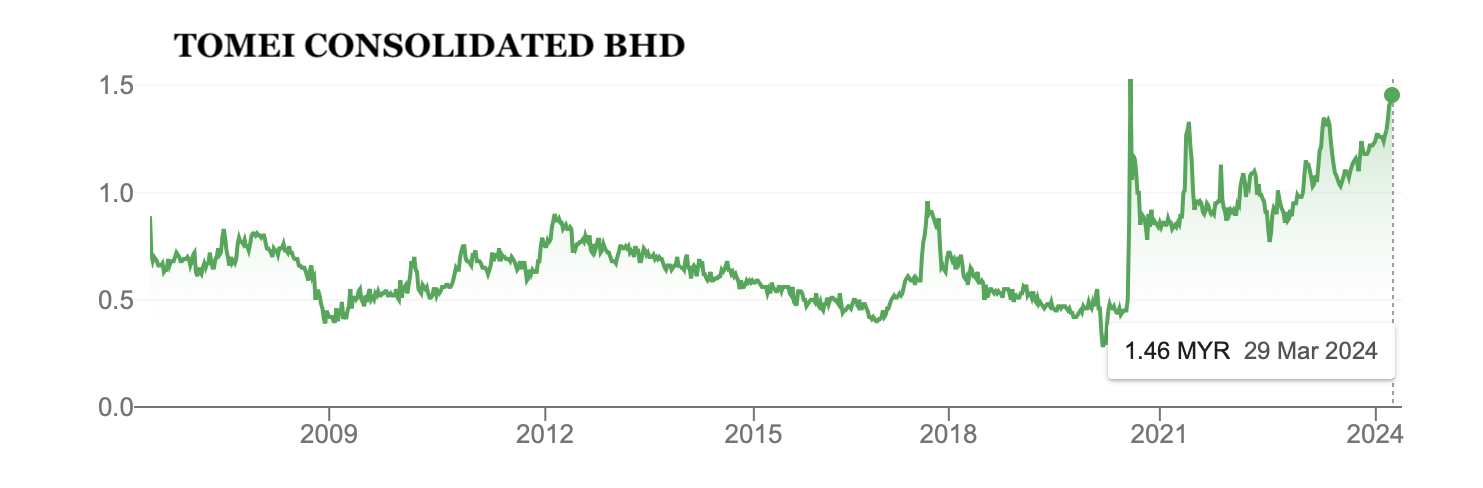

PRICE CHART FOR GOLD AND TOMEI BHD

Both charts are clearly still on a long term uptrend. Correlations are very strong between the two although owning the underlying is always a better proposition.

SUMMARY

I believe holding some Gold be it in physical form, futures, ETFs or Gold Stocks is a must for a balanced investment portfolio. In the face of rising inflation and a declining interest rate environment, demand for gold is expected to stay strong.

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks. Consult your financial consultant before making any financial investments

More articles on The Alpha Trader

Created by TheAlphaTrader | Nov 20, 2024

Created by TheAlphaTrader | Nov 01, 2024

Created by TheAlphaTrader | Oct 01, 2024

Created by TheAlphaTrader | Aug 16, 2024

Created by TheAlphaTrader | Jul 27, 2024

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

ahbah

In the face of rising inflation and a declining interest rate environment, demand for gold is expected to stay strong. Buy some gold, please. Thanks.

2024-03-30 21:39