ECONFRAME BHD (0227) - A MARKET LEADER WITH UNCHARTED STOCK PRICE MOVEMENT!

TheAlphaTrader

Publish date: Thu, 01 Dec 2022, 07:19 PM

Alpha Trader loves price action and always believes in trading stocks with good chart structure and sound fundamentals. Econframe is a stock that definitely fits both criteria. Despite not widely covered by Research Houses, that may soon change with the strong price catalyst!

BACKGROUND

Econframe is a one-stop total door system solutions provider that is principally involved in the design and manufacturing of metal door frames, manufacturing of metal doors and fire resistant door sets and trading of wooden doors and ironmongery.

The company was listed on the ACE market in October 2020 with the IPO price being oversubscibed by 40 times. The company has actually been around since 2001 and has been supplying to projects across residential, commercial, mixed and industrial properties in Malaysia.

Econframe’s clients include well known names like Ecoworld, Gamuda, IJM Land, IOI properties, LBS Bina, Mah Sing and Sime Darby.

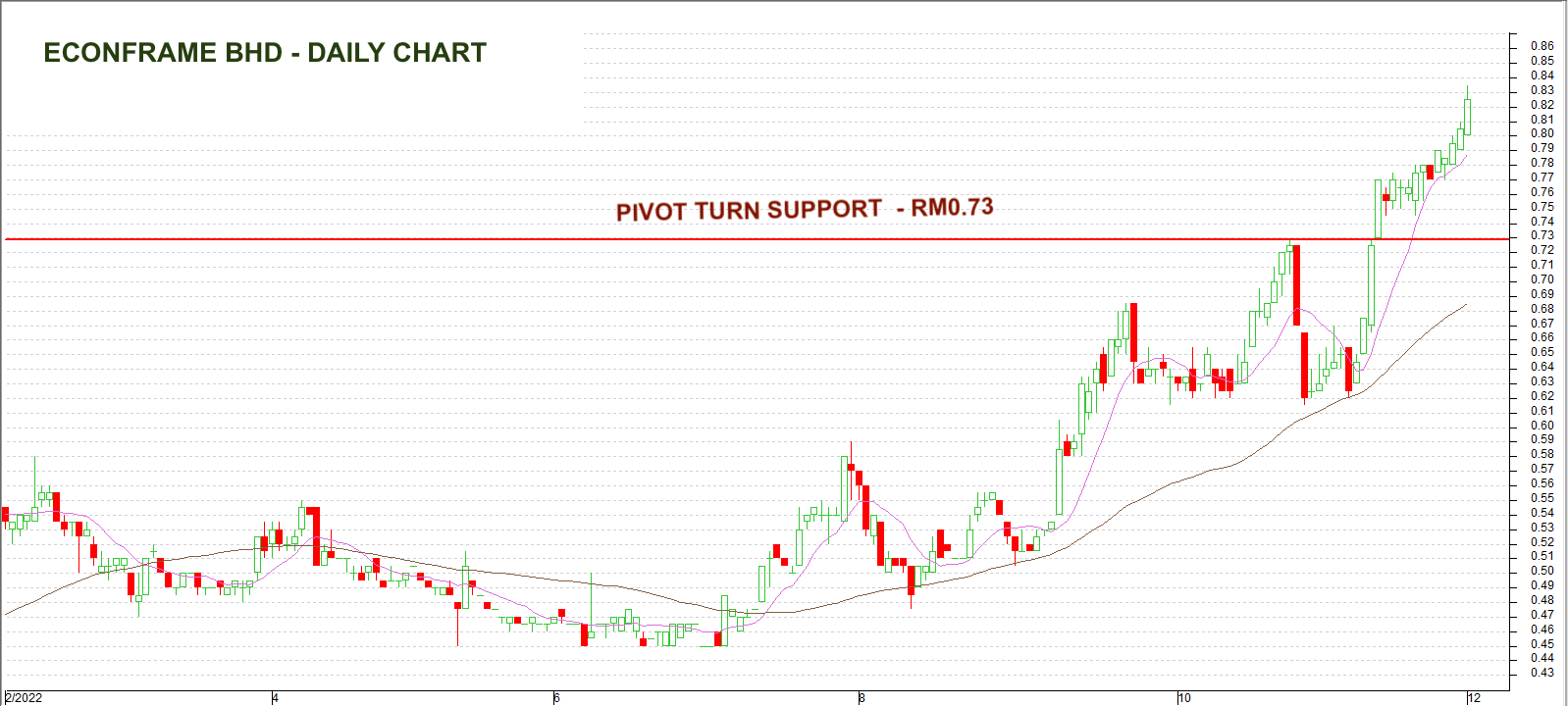

PRICE CHART

The chart structure is clearly very bullish as it is trading at ALL-TIME HIGHS and the current motive move started from 10 Nov 2022 is accelerating in pace. The 1st support level sits at RM 0.73, which is also the recent breakout pivot point level. The shallow retracement on T+2 settlement days in the past few trading days suggest that the smart money is still busy accumulating shares at the current levels.

POINTS OF INTEREST

1) A strong leader with 80% of market share

Econframe has an estimated 80% of market share in the metal door frame segment. The reason for this can be attributed to company’s cutting-edge technology to customize door frame sizes to suit any specifications. That is why they are able to accomodate the needs of different projects for all their customers on demand as opposed to its competitors.

2) Very High Profit Margins

Profits have been rising steadily over the previous quarters with the latest quarter resulting in a PAT of RM2.97 million. This translates to a PE multiple of 22 times. Though the PE may not be cheap in comparison to the property sector, there is actually a premium in Econframe’s business model as it has a virtual monopolistic status in the metal door frame segment. That is why it can command very high profit margins of 15% to 20% for this segment. The company is net cash company of nearly RM26 million.

3) No rivals in the Public Listed Space

There are no listed companies on Bursa Malaysia that are in the same business of making metal door frames. Ajiya Bhd previously had a subsidiary in the manufacturing of metal door frames but has since been discontinued. As with Ajiya and the other of Econframe’s competitors, they are not able to customize the door frame sizes similar to what Econframe is capable of doing. That is a huge advantage for Econframe, placing them in the space as a market leader.

4) Diversification into other synergistic areas

Apart from being the leader in manufacturing metal door frames, Econframe also ventured into the manufacture of fire-resistant doors and also the trading of wooden doors and iron mongery. This places the company as a ‘One Stop Shop’ for property developers. The company also has exclusive rights to distribute and sell Onvia’s smart home and security systems for the non-store retailing segment in Malaysia.

5) Recent corporate developments

In Aug 2022, Econframe proposed a free warrant exercise on the basis of 1 free warrant for every 2 existing shares. This proposal was approved by Bursa Malaysia on 10 November 2022 and subsequently, the EGM was held on 30 November 2022 to vote on the proposal, which was passed. By observing the recent price movement, the acceleration in price took place after 10 November ,which implies that the free warrants are probably a strong catalyst for investor interest.

CONCLUSION

Econframe certainly has all the criteria to be a multi-bagger stock in the future. Thanks to its unique position as a monopolistic business and high barriers to entry, Econframe will be a stock to watch in 2023 and beyond! The free warrants will be a sweet kicker if the share price continues to make new all time highs! (Note that the ex date for the free warrants has been set on14 Dec 2022).

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks. Consult your financial consultant before making any financial investments.

More articles on The Alpha Trader

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Created by TheAlphaTrader | May 31, 2024

Created by TheAlphaTrader | Mar 06, 2024

pokerpro88

excellent stock!! buy n hold

2022-12-05 14:37