MTAG GROUP BERHAD (0213)- WHEN FUNDAMENTALS AND PRICE ACTION ARE ALIGNED!

TheAlphaTrader

Publish date: Mon, 26 Dec 2022, 10:59 AM

Alpha Trader is always on the lookout for stocks that are in play and have potential for new highs and beyond. Hence, when I recently came across MTAG Bhd and was very pleasantly surprised! It has all the right catalyst and drivers to make it a stock to watch in 2023!

BACKGROUND

MTAG Group Bhd (MTAG) is a leading labels and stickers printing and materials converting specialists in Malaysia. They are also the authorised distributor of industrial tape and adhesive products for two world renowned brands in 3M and Henkel. MTAG was established in 1995 with a diversified clientele including MNCs from industries such as Electrical & Electronics (E&E), automative, precision tooling, mechanical & engineering and construction.

MTAG listed on the ACE market on 19 September 2019 with its IPO price at RM0.53. It was oversubscribed by over 3,84 times but had a rocky first day of listing with its share price closing at RM0.515 despite going to a high of RM0.70 intraday.

PRICE CHART

From the daily chart, we see a gap and run move at RM0.505 on 24 Nov 2022 which was triggered by the market reaction to the record profits announced the prior day. It continued to trend nicely along but with low volume indicating a slow and steady accumulation by the smart money. However, the structure changed on 20 Dec 2022 with aggressive buying on record volumes noted that pierced through the breakout pivot point of RM0.635 touching a high of RM0.725, which also represents a new year high for 2022.

Given the huge volume traded on 20 Dec 2022, the profit taking and selling pressure on T+2 settlement day was shallow and the price was able to hold above the pivot breakout point of RM0.635 suggesting that the upward motive move is still intact with a test of RM0.725 likely and then a challenge of its all time high price of RM1.22 recorded back in Aug 2020.

POINTS OF INTEREST

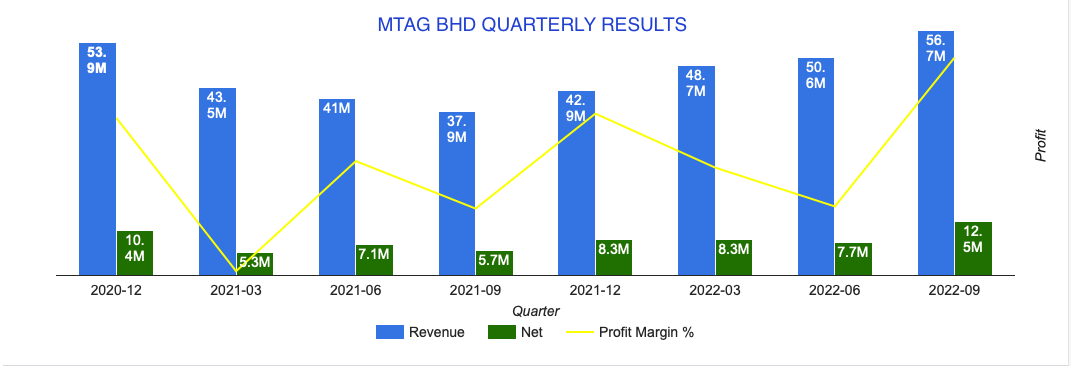

1. BLOWOUT EARNINGS

MTAG has been profitable every quarter since listing and reported its highest ever quarterly profit ever of RM12.5 million last month! It is trading at a historical PE of 12 times but if the current profits can be maintained or improved, we are looking at potential single digit PER going forward.

2. VERY HIGH NET PROFIT MARGINS

MTAG enjoys very healthy net profit margins of 18% to 20%, which is very impressive by any measure. The reason it can command such high margins can be attributed to its position as a leading label and sticker printing supplier as well as strong barriers to entry via its technical expertise in the niche printing and converting industry for the E&E industry in the last 23 years.

3. NET CASH COMPANY

MTAG is a net cash company of RM128 million with no borrowings. So on an ex cash basis the stock is trading at a prospective PE of only 7 times!

4. PROMINENT SHAREHOLDERS

Looking at the top 30 shareholders list from the latest annual report we find a 2 very prominent shareholders ie. Eastspring Investments who hold 31.3 million shares of MTAG and the legendary Fong Siling aka Coldeye (1 million shares), a very well known fundamental investor in Malaysia who needs no introduction.

Also interesting to note that the biggest shareholder and Managing Director of MTAG, Mr Chaw Kam Shiang, has not made any sale of MTAG shares from the time of listing. This is viewed very positively as it shows his long-term commitment and belief in the company.

CONCLUSION

Based on the latest quarterly earnings of RM12.5 million, MTAG could be looking at a prospective ex cash PE of only 7 times! What is more exciting, is the chart setup for the stock. It has all the characteristics of a stock that is in the midst of making a new motive move to retest the previous all time highs of RM1.22 and hopefully breaking through it! This coupled with the fact that MTAG is only up 26% from its IPO price, despite its consistently proven financial track record. Most of the recent IPOs have been going up much more than that despite not having as good a track record as MTAG!

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks. Consult your financial consultant before making any financial investments.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Alpha Trader

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Created by TheAlphaTrader | May 31, 2024

Created by TheAlphaTrader | Mar 06, 2024

pokerpro88

Interesting stock!

2022-12-26 14:37