(Tradeview 2020) - In Conclusion, Is the Glove Sector a

tradeview

Publish date: Sat, 20 Jun 2020, 02:00 PM

Dear fellow readers,

__________________________________________________________

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me : tradeview101@gmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-26

HARTA2024-07-25

SUPERMX2024-07-25

SUPERMX2024-07-25

TOPGLOV2024-07-25

TOPGLOV2024-07-25

TOPGLOV2024-07-24

SUPERMX2024-07-23

HARTA2024-07-23

SUPERMX2024-07-23

SUPERMX2024-07-23

TOPGLOV2024-07-22

SUPERMX2024-07-22

TOPGLOV2024-07-19

TOPGLOV2024-07-18

HARTA2024-07-18

HARTA2024-07-17

HARTA2024-07-17

HARTA2024-07-17

TOPGLOV2024-07-16

SUPERMX2024-07-16

TOPGLOVMore articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021

Discussions

In this of environment u need to protect your downside & at optimise your upside potential mah...!!

Wtk remain a good selection that fulfil your stringent requirement mah.!

2020-06-20 14:30

Very good

Gloves now in MAJOR 3

Wtk in minor iii

So Wtk got more upside growth than gloves by virtue of it being still in primary school

Can buy more Wtk then

There is only one more now in kindergarden or pre school = WZ Satu.

This one is pre bull so will offer the best upside like Supermax when it was only Rm1. 73

Wz satu at 24 sen going back to its pre bauxite ban years of 2017 means Above Rm1. 50 then

So Wz satu has a potential upside of over 600%

2020-06-20 15:23

600%?

Can or not?

Of course can!

Calvin bought Supermax C87 at 34.5 sen and sold half at Rm2. 96 (still keeping half for higher)

How much is 34.5 sen to Rm2. 96?

It's 757% gain. Whooppee!!

So?

Anyting is possible if you can spot a potential

preBULL stocks

There is sifu pureBULL

So there are

preBULL stocks

presentBULL stocks like Gloves

postBULL stocks like dayang which is game over

2020-06-20 15:31

all sifus need a game and this is the perfect game for them....... the greater fool theory

2020-06-20 23:05

who are the desperado I wonder.... those shouting buys or those laughing?

2020-06-20 23:10

Well said. Sellers needs Buyers. Some late buyers will end up losers. The billlion ringgit question is WHEN?

2020-06-21 11:08

Who sold?

Qqq3..philip (2m+ topglove at average rm8+) n lot of tai ling ngong who hv sleepless nights after they sold..

2020-06-21 11:13

Is philip smiling or laughing after he sold all his 2m topglove few weeks ago?

U better ask him loh

2020-06-21 11:14

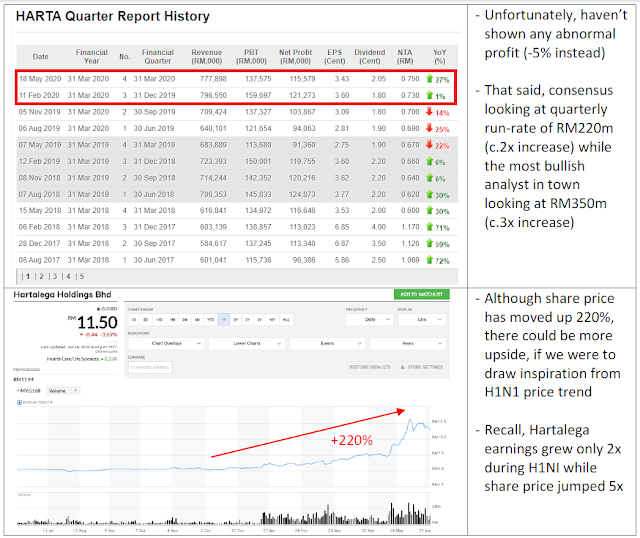

Riverstone - $3.31, Topglove - RM 20.56. Supermax - RM 10.86, Kossan- RM 11.32 and Hartalega - RM 16.44. Compared to when we highlighted in our back to back articles in June glove sector plunge, where the price was (Riverstone - $2.28, Top Glove - RM 14.60, Supermax - RM 6.80, Kossan - RM 7.70, Hartalega - RM 11.60), the entire sector has rerated entirely. Even abroad, UG Healthcare is S$1.81, Sri Trang Gloves is THB 68.25, Sri Trang Agro $1.53. The sector with good earnings outlook with sufficient tailwind is this sector. Hence, do not rule out further upside as the earnings / reporting season approaches.

2020-07-08 18:23

stockraider

Wtk share price creeping up mah...!!

MUST JUMP IN VERY EARLY LOH...!!

In a nutshell u cannot go wrong investing in WTK why ??

1. It has net cash of Rm 371m even more than topgloves

2. It has more prudent acquisition on its neighbour plantation increasing its ha size and most importantly enhancing its efficiency mah....!!

3. The palmoil price has started rising.

4. The timber price has stabilise & recovery

5. Its listed tape business under listed subsidiary CIC is doing well with covid19 social distancing.

6. Govt incentive on house buying will boost demand for plywood loh..!!

7. Most importantly the CEO of WTK has started buying a positive vote of confidence mah...!!

8. The company has been doing aggressive share buy back recently.

9. Wtk has declare a dividend of 1 sen giving a 3% pa dividend yield.

10. Its NTA is more than rm 2.00 loh....!!

Yes buy Wtk for its future cpo increasing output due to palm trees maturity plus increase hectarage and increase in price, and also please remember there is a palm oil mill too...which wtk can benefit efficiently too.

correctloh....that means WTK palm 5 to 8 years old which are young & increasing maturity has potential high growing future output mah....!!

palm tree generally takes 4-6 years, when it start to grow from seed to its highest at around 10 years old.

That means wtk benefits from increasing palm output plus increase in milling profit mah...!!

A double happiness profit for wtk mah...!!

If u invest in Wtk u really sleep well bcos it has the highest margin of safety and quality mah...!!

U cannot go wrong investing in plantation near growing city like MIRI the 2nd largest city in sarawak and near a rich Brunai just a stone throw away mah...!!

The director is willing to buy 37 sen and now it is 36.5 sen it is a bargain buy mah...!!

This is a good indicator to buy & buy more loh...!!

Posted by calvintaneng > Jun 12, 2020 7:32 PM | Report Abuse

Very good latest news

Director bought 300,000 Wtk shares from open market at 37 sen

DATO' SRI PATRICK WONG HAW YEONG 11-Jun-2020 Acquired 300,000 0.370

This is the highest amount and the highest price since March 10 the 2020

Why Wtk is likely to do much better than Rsawit leh??

This is bcos Wtk is very cash rich mah...!!

2020-06-20 14:26