(Tradeview 2020) - Weekend Time (Q & A : 1st of August) Gloves Vs Vaccine

tradeview

Publish date: Sat, 01 Aug 2020, 01:30 PM

Dear fellow readers,

As my gesture of thanks for all the support these years has led me initiate a new weekly segment of "Tradeview Weekend Time".

So similarly, the ending of this pandemic would naturally spell an end to the fairy tale run of the glove makers. It doesn't mean they will not be profitable. It is just that they will be less profitable than now. True, when we administer vaccination (assuming it becomes compulsory), medical professionals need to wear gloves. However, the % of those who may use gloves are not in the same proportion, intensity and quantity of those who uses gloves to attend to urgent patient cases at the peak of Covid-19. Additionally, the usual nature of human to take things for granted will reduce their eagerness to procure and stockpile gloves or PPE in the event vaccination are readily available. So the fear and psychological needs for gloves would reduce. Furthermore, the glove players are all expanding capacity to meet the shortfall, hence the demand gap narrows. Therefore, what the analysts are saying is not wrong and in fact, reasonable. I believe there is still upside to glove stocks in terms of their earnings and share price. But we must also be prepared for the run to taper off eventually should the pandemic resolves because we of the gradual slow down in earnings. Remember that the share price of a stock is always forward looking 3-6 months.

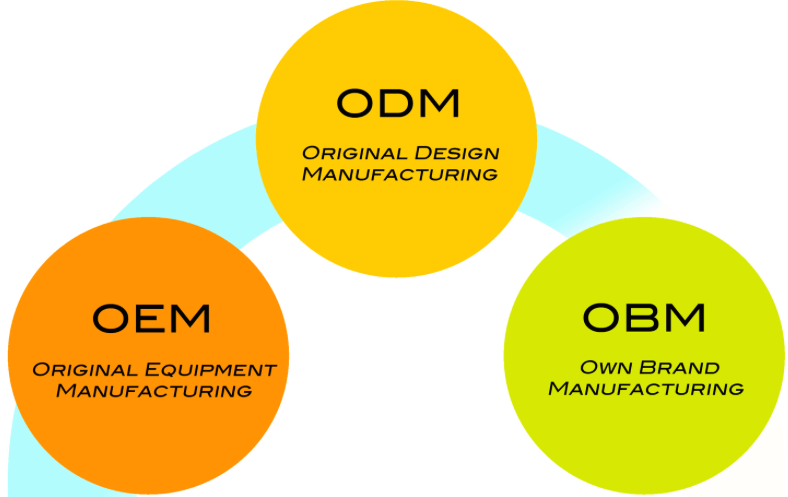

My favourite is Riverstone Holdings Ltd. I have not sold a single share until now. However, your question is not about Riverstone. So I shall move on. I think it is known fact that Top Glove has the largest manufacturing capacity is the one with the largest market capitalisation. Supermax is an OBM player instead of OEM like the others with own distribution channels and sales outlet. Comfort is a smaller OEM player which is slowly increasing capacity. All 3 are not exactly in the same basket.

Now OBM player would enjoy better profits margin as they control their own selling, distribution and manufacturing price. OEM player controls only the manufacturing price. Hence Supermax would enjoy Supernormal profits as they can enjoy the full end to end. Top Glove cant. However, Top Glove have volume, and with volume, comes big profit especially in a time like this where demand far outweights supply. However, as your question is quite general, I will just assume you are asking which is better to invest in and make profit from the share price. At this juncture - Supermax and Top Glove is neck to neck. Reason is because although Supermax went up more in % terms and Top Glove is laggard, Supermax is coming from a lower base and poorer performance in past years due to higher distribution cost as a result of being an OBM player. However, Top Glove still have a US Customs Detention issue lingering over their head. If this matter resolves successfully, it will be catalyst for Top Glove to push past RM30 at the very least.

Finally for Comfort, it is smaller cap stock which got the interest of retailers who may find the bigger cap stocks like Supermax and Top Glove expensive. In actual fact, whether a stock is expensive or not depends not on the absolute price but the valuation. This is a general retail investor misconception. I think Comfort at RM5 is pushing their valuation unless their coming Quarterly Results will give everyone a shock.

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me at : tradeview101@gmail.com

Food for thought:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021

Discussions

With vaccine in, glove and mask no longer compulsory....vaccine will. Dpharma the only halal provider has the biggest potential. Halal business is huge market

2020-08-02 20:55

Bro, why invest in Mt bottles when the vaccines is not even there. Kairy J will be laughing to the bank and your get your finger burnt. The pandemic will be very long and the best is rubber gloves.

2020-08-02 23:47

Vaccine is the way forward. Germany ppl now frustrated of wearing mask.

Eventually even vaccine success rate is 60-80% , vaccine need to carry out even every year with one or two dose. USA vaccine will be the worst and last similar to the way they handle the virus.

2020-08-02 23:54

Most likely China vaccine already in mass production and use for front liner.

2020-08-03 00:01

As a medical health personal, we use gloves frequently as PPE. Even with the discovery of vaccine (which I also hope ASAP), we will still have to use gloves and other personal protective equipment. It's to protect the health care workers. We use alot of them. Thanks.

2020-08-03 23:14

Dttinseng

Hi,

Really like your factual and truthful articles.

Thanks

2020-08-02 15:10