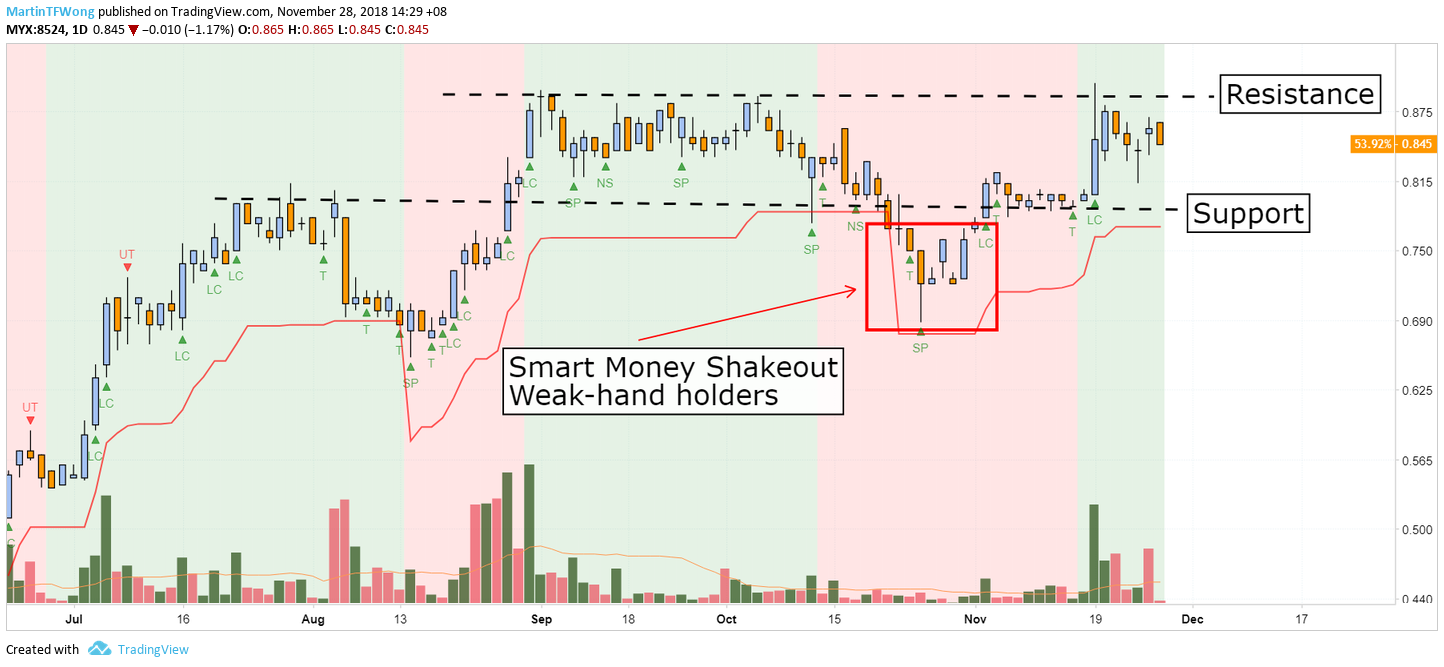

Is Smart Money shaking out Taliworks (8524.KL)?

TradeVSA

Publish date: Wed, 28 Nov 2018, 03:09 PM

Analysing the stock markets using Volume Spread Analysis (VSA) signals can detect imbalance of supply and demand. The shakeout signal is a way for the Smart Money to shake out the weak holders from the stock., i.e. force them to sell. The weak-hand holders are the retail traders and if the price of a stock begins to plummet, they begin to panic and force to sell, especially if the shakeout is influenced by extremely bad news.

Based on the daily chart above, the price dropped below the support level on 22 October. After the mark-down, TradeVSA have spotted hidden potential buying on 25 October. The bar formed a Spring signal and subsequently the price closed back to the re-accumulation level on 2 November.

The Spring signal is the final shakeout by Smart Money to remove all the weak-hand holders. Currently price is moving sideways in the re-accumulation level and offering a low risk trading opportunity. Looks for confirm Spring or No Supply signal at the support level to give you a better edge. Smart Money tends to test the supply at support level before mark-up the price.

Visit TradeVSA website for the FREE Spring Screener to look for next Shakeout trades:

https://tradevsa.com/screener/spring.php

Interested to learn more?

· Follow & Like us on Facebook via: https://www.facebook.com/MartinTFWong/

· FREE Webinar, 9 December (Sun), 2pm: https://bit.ly/2PwmviH

· Visit our website for FREE Stock Screener: https://tradevsa.com/

· Contact us via: email at support@tradevsa.com or Call/WhatsApp at +6010 266 9761

Disclaimer

This information only serves as reference information and does not constitute a buy or sell call. Conduct your own research and assessment before deciding to buy or sell any stock.