GLOVE Up? Healthcare Up? HIDDEN GEM behind them yet to Discover. UEM EDGENTA - By TriumphinBursa

ValueBuy 1619

Publish date: Sun, 12 Jul 2020, 10:54 PM

Join our Telegram Channel : https://t.me/TriumphinBursa

12 July 2020

52wk High : 3.52

52wk Low : 1.88

Current @ 2.04 (8.5% recover from bottom) (72% to reach High)

UEM Edgenta has been doing the backstage jobs for the hospital as their core business.

Hospital used tonnes of GLOVE, PPE, MASK ? But who help them clean the mess up?

Somemore their STATs are so CANTIK ! High Dividend Yield, Low P/E, Good Profit Margin, Nice NTA

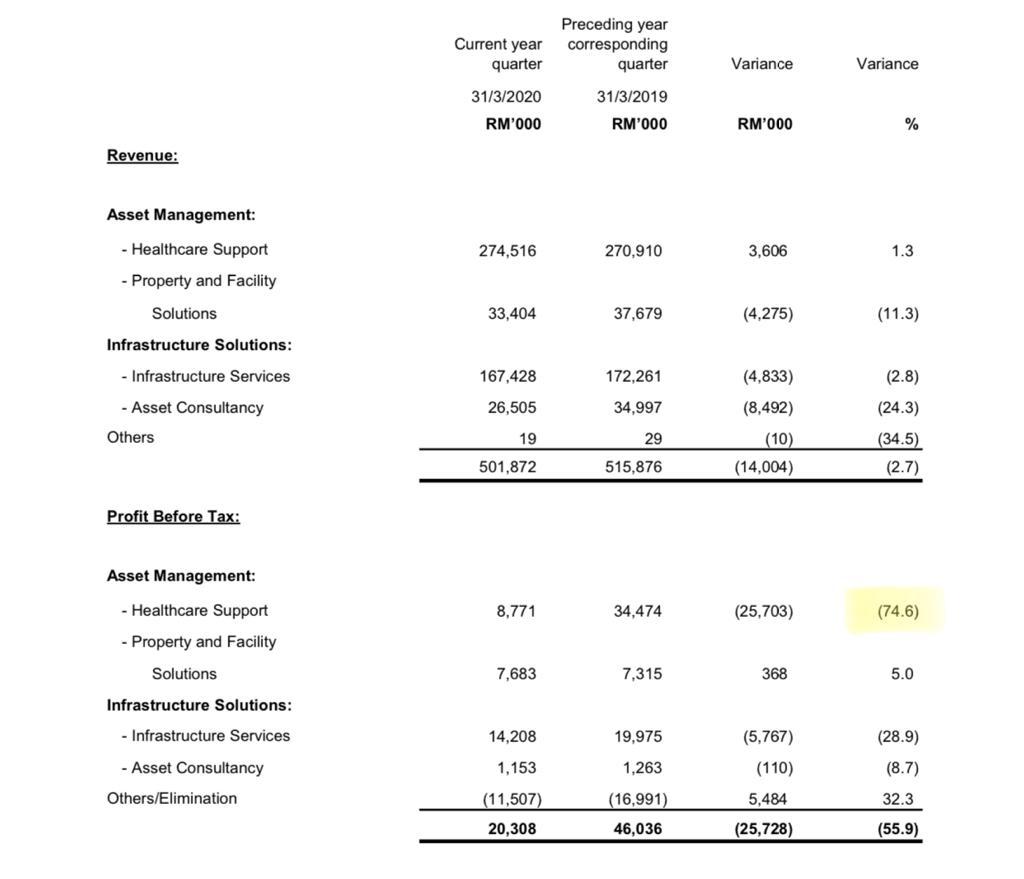

THEIR Q1/2020 see growth in Healthcare Support but Profit drop due to compressed margins.

LATEST NEWS :

Recently (9July) they have secured contracts estimated to be worth up to RM284.02 million to provide hospital support services to the Ministry of Health of Singapore’s restructured hospitals.

https://www.theedgemarkets.com/article/uem-edgenta-unit-secures-rm284m-worth-hospital-services-deals-singapore-govt

AND (July 10): RHB Research has upgraded its rating for UEM Edgenta Bhd to “buy” with a higher target price (TP) of RM2.75 from RM2.70.

https://www.theedgemarkets.com/article/rhb-upgrades-uem-edgenta-buy-after-new-hospital-contract-wins

We believe Edgenta still a bargain BUY now. And more to come contracts secured in future.

If you like our sharing, Join our Telegram Channel : https://t.me/TriumphinBursa

If you like our sharing, Join our Telegram Channel : https://t.me/TriumphinBursa

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Triumph in Bursa

Created by ValueBuy 1619 | Sep 15, 2020

Created by ValueBuy 1619 | Aug 05, 2020

Created by ValueBuy 1619 | Jul 19, 2020

Created by ValueBuy 1619 | Jul 13, 2020

Created by ValueBuy 1619 | Jul 11, 2020