Triumph in Bursa

SUCCESS (7207) Related to Electric Vehicle, LED, PowerPlant, Semicon & Metal Industry, - By TriumphInBursa

ValueBuy 1619

Publish date: Mon, 18 Jan 2021, 10:34 PM

SUCCESS (7207)

NTA 1.40 (40% Below now)

PE 34

Financial Health : almost 0 Debt, cash rich.

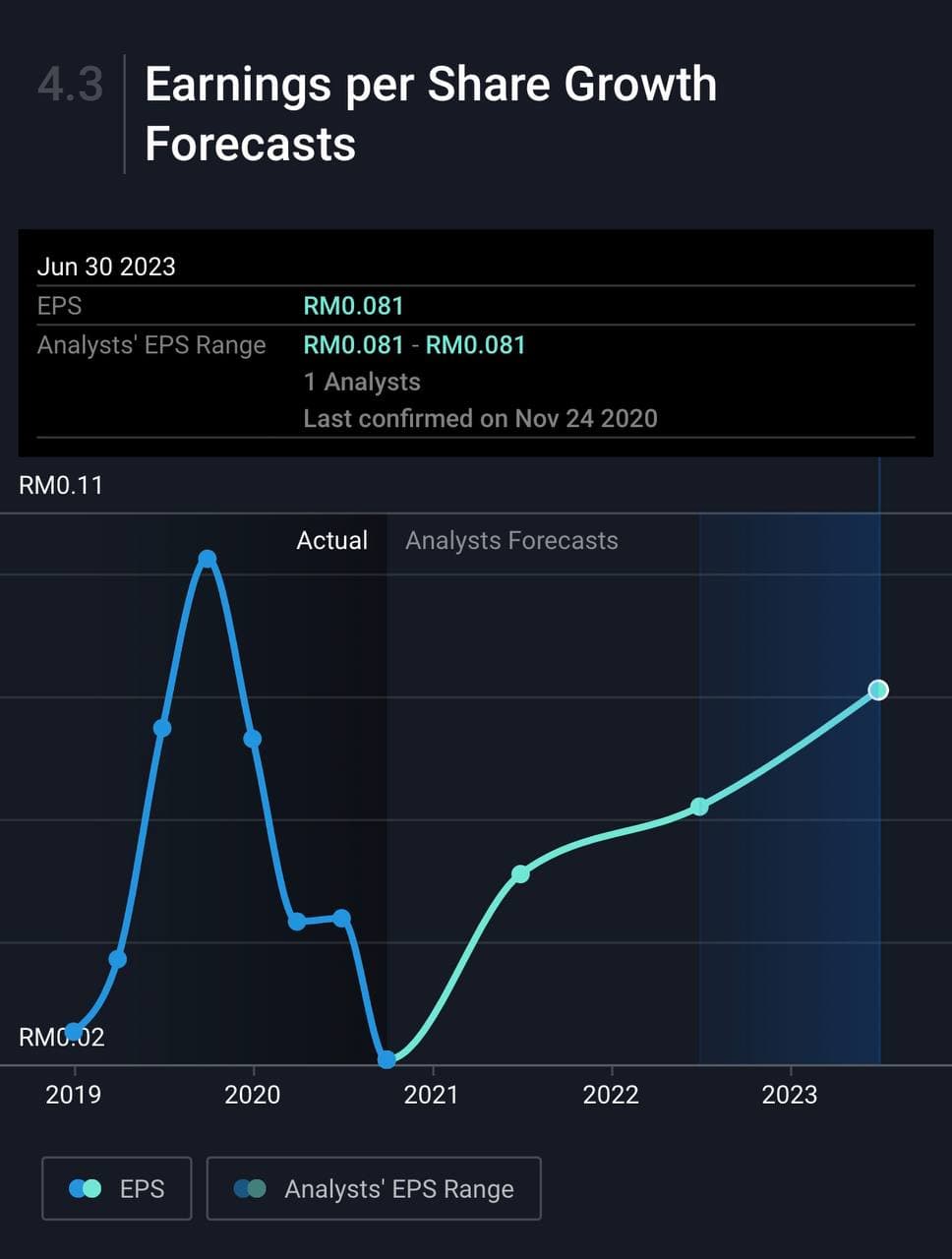

QR FY : Recovering strongly. Great EPS growth prediction by analyst.

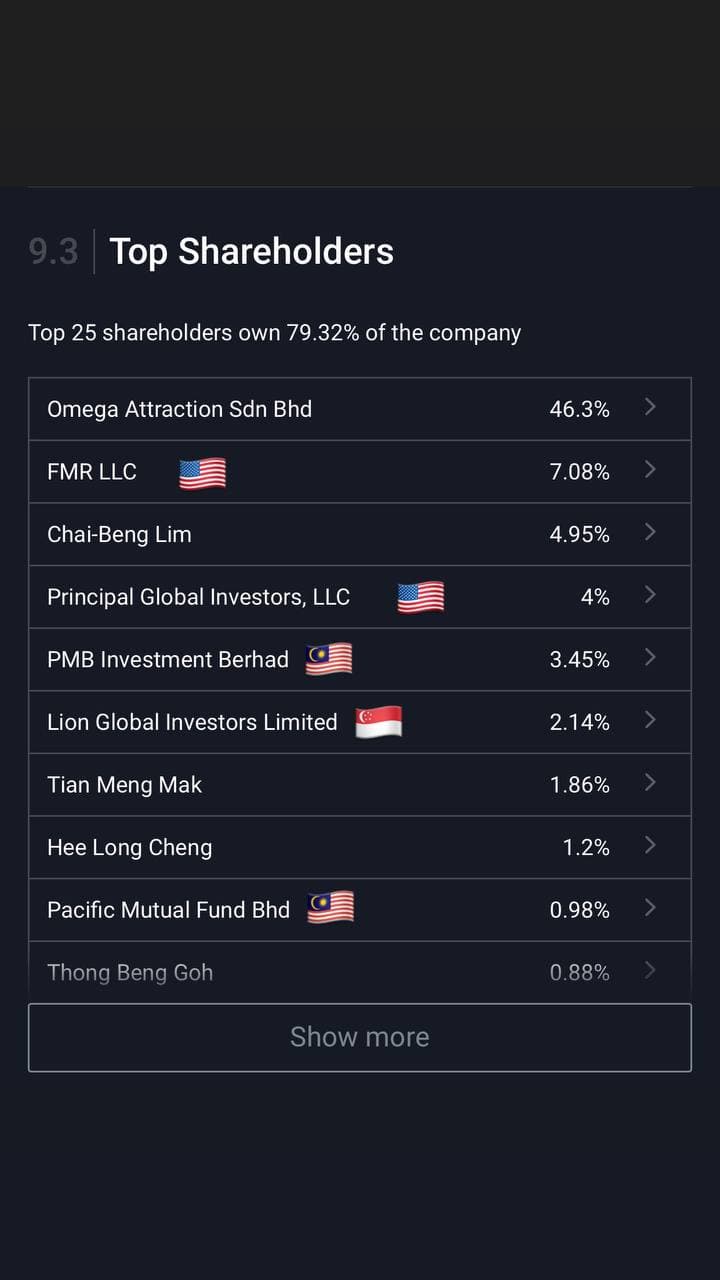

Shareholder (Fundhouse)

2 From USA

1 From Singapore

2 From Malaysia

BUSSINESS

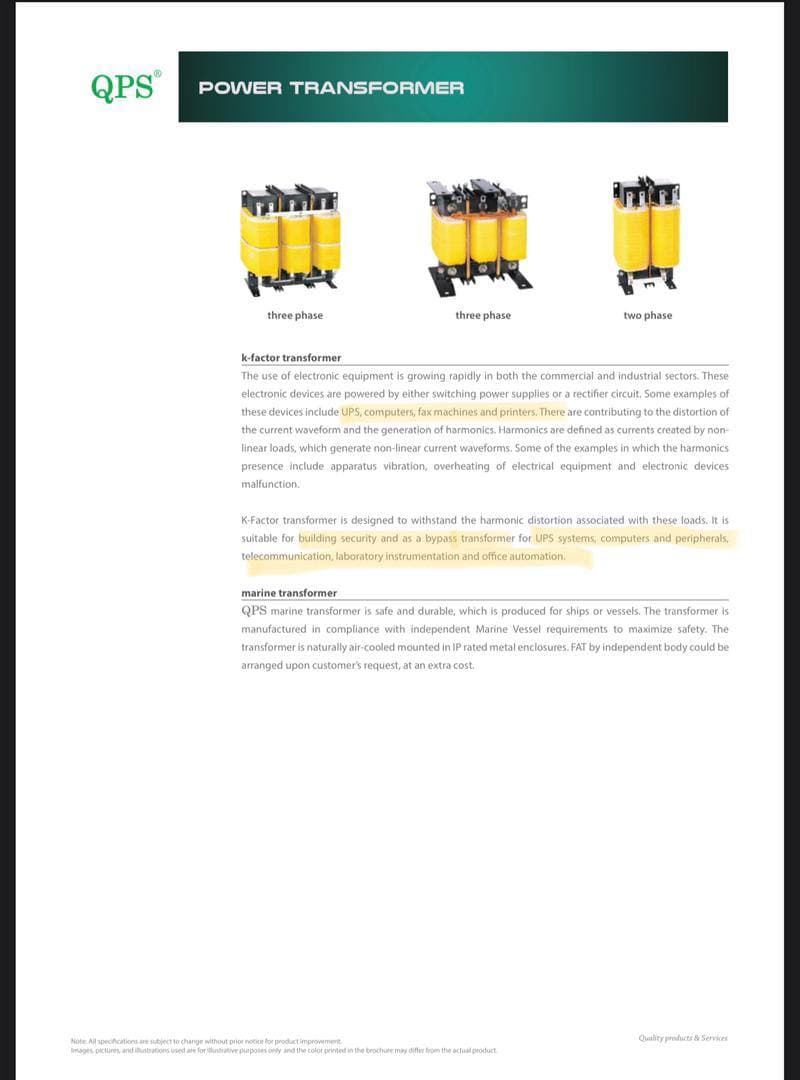

QPS & SES (Transformer)

- Capable of producing power transformers with capacity of up to 2500KVA.

- Power transformers are typically used in marine industry, oil & gas and Semiconductor factory, Power Plant.

- Core competency is the manufacture of electrical apparatus such as automatic voltage stabilizers, detuned harmonic circuit filter reactor and line reactor.

NIKKON (LED Lighting Division)

- Free of maintenance with an enormous service life of more than 50,000 hours.

- Characterized by optimal energy efficiency; less electricity, leading to less CO2 emissions.

- Produce less waste and don’t contain hazardous substances such as mercury.

- LED luminaires are smaller than conventional products, packaging and transport effort is also reduced.

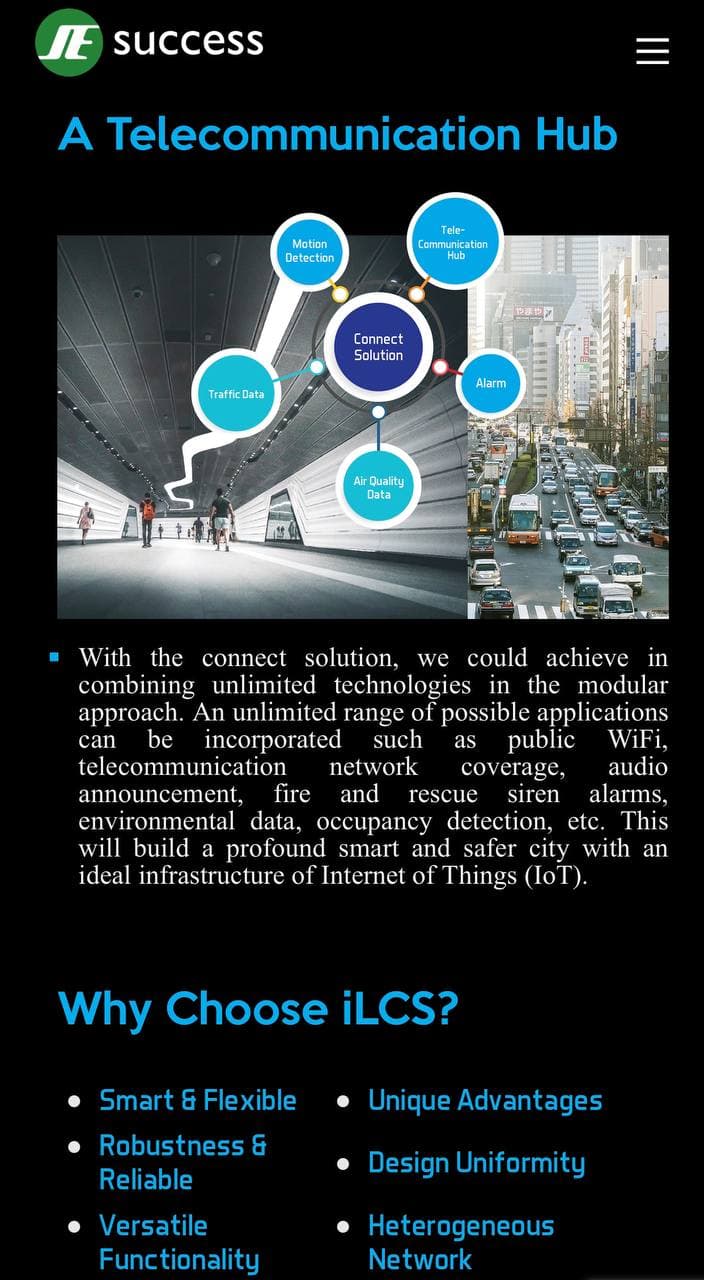

- iLCS® helps municipalities to enhance communal public safety, security and surveillance demand. This will build a profound smart and safer city with an ideal infrastructure of Internet of Things (IoT).

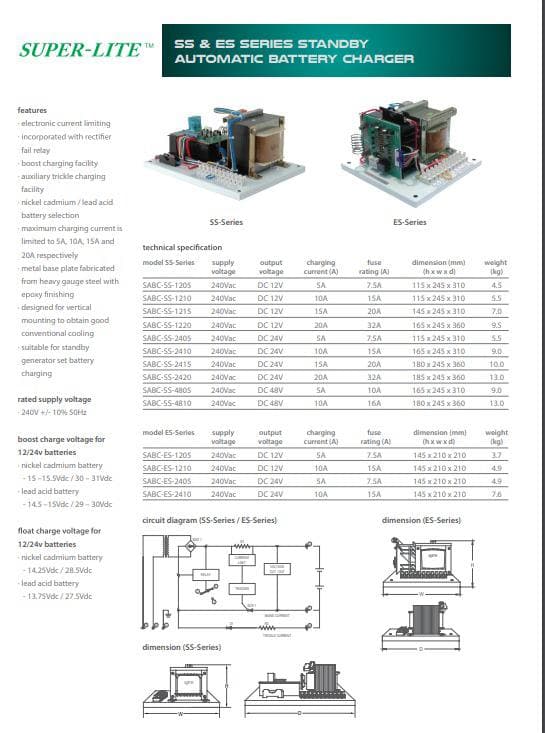

SUPERLITE (Battery Charger)

Various type of Battery Chargers

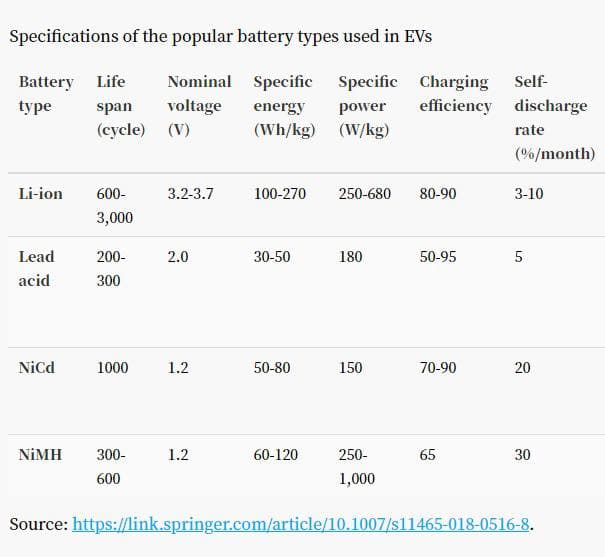

Nickel Cadmium (NiCd) & Lead Acid Battery both are popular battery type of Electric Vehicle (EV)

OMEGA (Metal)

Customizing of metal-based products such as casings, enclosures, sheet metal fabrication and laser-cutting services.

If you like our sharing,

Join our Telegram Channel:

https://t.me/TriumphinBursa

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Triumph in Bursa

THIS COMPANY DIVIDEND = 208x of Fixed Deposit Rate (2% p.a) - By TriumphinBursa

Created by ValueBuy 1619 | Sep 15, 2020

(Covid-19 Related Again?!) DNONCE ! Nearly Limit Up in single day. (4/8) By Triumph in Bursa

Created by ValueBuy 1619 | Aug 05, 2020

S5 ? Whats going on ? ANCOM ANCOMLB NYLEX MYEG Involved. - By TriumphinBursa

Created by ValueBuy 1619 | Jul 19, 2020

GLOVE need RUBBER? Who are the RUBBER company BOSS? HEXTAR GLOBAL (5151) - by TriumphinBursa

Created by ValueBuy 1619 | Jul 13, 2020

TECH Stocks MELETUP (BUT!!!! ONE LAGGER TECH GIANT BULL) - INARI AMERTRON - By TriumphinBursa

Created by ValueBuy 1619 | Jul 11, 2020

Discussions

Be the first to like this. Showing 1 of 1 comments

CreativeAnalyst

I started off by searching for Abigail and realize she was an American billionaire businesswoman. Since 2014, She has been president and chief executive officer of American investment firm Fidelity Investments and chairman of its international sister company Fidelity International.

For the board member, they have TAN SRI DATO' AHMAD FUZI BIN HJ ABDUL RAZAK which work as the chairman. Tan Sri has many designations in various companies. He was previously the Secretary-General of the Ministry of Foreign Affairs Malaysia.

Looking at the quarterly result, in the 2020 1st quarter it seems they were making a huge profit but upon checking the financial report from KLSE. It was told that there were dispose of process equipment segment amounting to RM 6.09 million and increase in sales from transformer and lighting segment. So, if we minus Rm 6.09 from 11.31 mil, it means their actual profit is only 5.22 million which is similar to the profit generated for 2019 first and second quarter.

The lower in revenue for the FYE 30 June 2020 was mainly due to discontinued operation of the process equipment segment

as a result of the Disposal and lower sales recorded in transformer and lighting segment.

Looking at the cash flow statement, it has a positive cash flow even during MCO lockdown. For a company like this with good records, good management, good finances, and good prospects, it is worth my attention to pay more attention.

So, moving forward what will be their revenue stream?

1. Replacement for the LED for existing customer/ new customer

2. Oversea orders for street lighting

3. Involve in the smart city project

*4. Work with respected organizations in the Electric Vehicle (EV) market to

develop and supply both custom low and medium-voltage transformers and substation lineups for integration into electric vehicle charging systems.

*assumption only

2021-07-23 10:19