DGB?, DGSB? & DBE? The Top 3 Running Dog Shares of Bursa in This Year of The DOG (Calvin Tan Research)

calvintaneng

Publish date: Tue, 06 Mar 2018, 04:37 AM

Hi guys/gals,

I kept seeing these 3 Stocks in Top 30 of Bursa being traded - DGB, DGSB & DBE

So I am doing a little study on them.

Ha! They all looked like Pump & Dump Conman Stocks?

Well almost but not all.

I think of the three - 2 look like Pump & Dump. Except one - DBE

Why so?

Let Calvin explain

Let's lookj at their 3 Charts & SEE

1) DGB

DGB ASIA BERHAD (0152)

Company Website

Annual Report

General Meetings

WOW!

It jumped from below 4 sen to a high of 22 sen. A jump of more than 500%

Any justification?

Let's see

SUMMARY OF KEY FINANCIAL INFORMATION

|

|

INDIVIDUAL PERIOD

|

CUMULATIVE PERIOD

|

||||

|

CURRENT YEAR QUARTER

|

PRECEDING YEAR

CORRESPONDING QUARTER |

CURRENT YEAR TO DATE

|

PRECEDING YEAR

CORRESPONDING PERIOD |

||

|

31 Dec 2017

|

31 Dec 2016

|

31 Dec 2017

|

31 Dec 2016

|

||

|

$$'000

|

$$'000

|

$$'000

|

$$'000

|

||

| 1 | Revenue |

14

|

382

|

2,535

|

7,848

|

| 2 | Profit/(loss) before tax |

-400

|

982

|

-260

|

461

|

| 3 | Profit/(loss) for the period |

-400

|

982

|

-260

|

461

|

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent |

-395

|

982

|

-255

|

459

|

| 5 | Basic earnings/(loss) per share (Subunit) |

-0.08

|

0.20

|

-0.05

|

0.09

|

| 6 | Proposed/Declared dividend per share (Subunit) |

0.00

|

0.00

|

0.00

|

0.00

|

|

AS AT END OF CURRENT QUARTER

|

AS AT PRECEDING FINANCIAL YEAR END

|

||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) |

0.0700

|

0.0800

|

||

Whoa!

Revenue is a mere Rm14,000

NTA only 7 Sen

And One year Revenue only Rm2.53 Millions

And lost Rm255,000

BY ALL YARDSTICK THIS ONE LOOKS LIKE A PUMP & DUMP CONMAN STOCK

NOW WHO HAS GONE UP THE PIRATE SHIP?

PLEASE TAKE CARE HOR!

2) DGSB

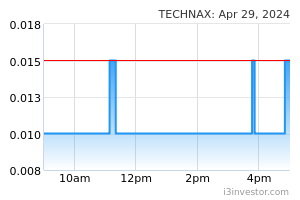

DIVERSIFIED GATEWAY SOLUTIONS BERHAD [S] (0131)

Company Website

Annual Report

General Meetings

AHA! THIS ONE PUMPED FROM 2.5 SEN TO A HIGH OF 15.5 SEN (UP 600%?)

Let's dig deeper

SUMMARY OF KEY FINANCIAL INFORMATION

|

|

INDIVIDUAL PERIOD

|

CUMULATIVE PERIOD

|

||||

|

CURRENT YEAR QUARTER

|

PRECEDING YEAR

CORRESPONDING QUARTER |

CURRENT YEAR TO DATE

|

PRECEDING YEAR

CORRESPONDING PERIOD |

||

|

31 Dec 2017

|

31 Dec 2016

|

31 Dec 2017

|

31 Dec 2016

|

||

|

$$'000

|

$$'000

|

$$'000

|

$$'000

|

||

| 1 | Revenue |

16,604

|

21,152

|

56,628

|

52,498

|

| 2 | Profit/(loss) before tax |

99

|

580

|

1,077

|

3,675

|

| 3 | Profit/(loss) for the period |

42

|

-233

|

1,096

|

1,513

|

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent |

42

|

-233

|

1,097

|

1,471

|

| 5 | Basic earnings/(loss) per share (Subunit) |

0.00

|

-0.02

|

0.08

|

0.11

|

| 6 | Proposed/Declared dividend per share (Subunit) |

0.00

|

0.00

|

0.00

|

0.00

|

|

AS AT END OF CURRENT QUARTER

|

AS AT PRECEDING FINANCIAL YEAR END

|

||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) |

0.0336

|

0.0

|

||

THIS ONE GOT NTA ONLY 3.3 SEN? NO NTA BACKING OR MARGIN OF SAFETY

IS IT AN IT GROWTH STOCK?

REVENUE IS RM56.6 MILLIONS

EARNING 1.1 MILLIONS

SO?

THAT'S 1.9% PROFIT AND P/E 51.45?

AMAZING SORCHAI ARE HERE?

NOW LET'S SEE

3) DBE

D.B.E. GURNEY RESOURCES BERHAD [S] (7179)

Company Website

Initial Public Offering Document

Annual Report

General Meetings

+

THIS ONE HAS FALLEN TO A LOW OF 3.5 SEN FROM 16 SEN (5 YEAR CHART)

SO PRICE HAS GONE DOWN BY 79%? SO NO PUMP & DUMP YET.

LET'S SEE MORE

SUMMARY OF KEY FINANCIAL INFORMATION

|

|

INDIVIDUAL PERIOD

|

CUMULATIVE PERIOD

|

||||

|

CURRENT YEAR QUARTER

|

PRECEDING YEAR

CORRESPONDING QUARTER |

CURRENT YEAR TO DATE

|

PRECEDING YEAR

CORRESPONDING PERIOD |

||

|

31 Dec 2017

|

31 Dec 2016

|

31 Dec 2017

|

31 Dec 2016

|

||

|

$$'000

|

$$'000

|

$$'000

|

$$'000

|

||

| 1 | Revenue |

26,872

|

29,055

|

111,729

|

112,980

|

| 2 | Profit/(loss) before tax |

-16,740

|

-1,086

|

-20,523

|

96

|

| 3 | Profit/(loss) for the period |

-16,536

|

-932

|

-20,314

|

250

|

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent |

-16,536

|

-932

|

-20,314

|

250

|

| 5 | Basic earnings/(loss) per share (Subunit) |

-1.15

|

-0.10

|

-1.41

|

0.03

|

| 6 | Proposed/Declared dividend per share (Subunit) |

0.00

|

0.00

|

0.00

|

0.00

|

|

AS AT END OF CURRENT QUARTER

|

AS AT PRECEDING FINANCIAL YEAR END

|

||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) |

0.0300

|

0.0600

|

||

Ok. This one got Revenue of Rm111.7 Millions. But a lost of Rm20 millions So it is bleeding losses.

NTA is 3 Sen. OK its price has fallen to 3.5 Sen

So FAR ALL 3 LOOKED BAD. Now Let's Turn on The Search Light

Go See What are Insiders' Moves?

1) DGB

WHOA DIRECTORS HAVE BEEN DUMPING ALL THESE YEARS

NEW HOLDERS?

WHOA CONFUSING SIGNALS. SOME BOUGHT AND SOME SOLD

THIS ONE LET IT PASS

2) DGSB

WHOA DIRECTORS HAVE BEEN DUMPING ALL THE TIME

LET'S SEE INSIDERS

WAHAHA!

LOOKED LIKE ALL INSIDERS HAVE PARACHUTED!

THIS PUMP AND DUMP DGSB IS A DISEASED MAD DOG THAT GONNA BITE WHOEVER GET NEAR IT

SO BETTER STAY FAR AWAY!!

3) DBE

OF ALL THREE - TWO ARE ALREADY UP

ONLY DBE IS THE LAGGARD

Looks like this One is Still Beuing in Accumulation?

SOMETHING IS BREWING HERE SOON?

WHY THERE IS ACCUMULATION?

CALVIN THINK THESE ARE THE REASONS

1) DBE IS CALLING OFF JV WITH QSR/KFC AS SUPPLYING BASIC CHICKEN MEAT IS UNPROFITABLE AS CHICKEN PRICES ARE CONTROLLED FOOD ITEM LIKE SUGAR & FLOOR. AS RINGGIT CRASHED IMPORT COSTS ESCALATE

SO DBE HAS BEEN BLEEDING LOSSES

2) AND DBE IS STARTING ITS OWN FAST FOOD STORE LIKE KFC CALLED HARUMI.

A KG BROILER CHICKEN WORTH RM4.10 CAN BE SOLD FOR 10X MORE IF WELL COOKED AND SOLD AS GOURMET FOOD. SO DBE WILL MAKE MORE MONEY BY OPENING ITS OWN FOOD OUTLETS

3) PLUS WITH STRONG RINNGIT NOW RAISING CHICKEN WILL BE PROFITABLE AS IMPORT OF FEEDSTOCK LIKE MAIZEOR CORN WILL BE CHEAPER. JUST LIKE NESTLE & F&N BENEFITTED BY STRONG RINGGIT

4) THE CHICKEN BROILER FARM LAND VALUE BY VIRTUE OF ITS LOCATION IN LUMUT INDUSTRIAL ZONE WILL ALSO APPRECIATE IN VALUE AS PANGKOR ISLAND IS NOW ADUTY FREE PORT

5) PLUS THE OPENING OF WEST COASTAL HIGHWAY IS AN OPPORTUNE TIME TO GO INTO PROPERTY DEVELOPMENT TO CATCH THE COMING BOOM IN PULAU PANGKOR & CONNECTIVITY CREATED BY WCE EXPRESSWAY

ALL THESE ARE TURNIING POINTS FOR DBE

INSIDERS KNOW THEIR PROSPECTS ARE THEREFORE LOADING UP.

INSIDERS LOADING UP?

YES! WHEN THINGS WERE BLEAK IN HUAAN ONE INSIDER BOUGHT UP LOTS OF HUAAN SHARES WHILE CHEAP

SEE

[HUAAN] Change In Director's Shareholding - MR CEDRIC CHOO SIA TEIK on 24-May-2016

Director's Particular:

Details of Changes:

VERY SMART MOVE BY HUAAN INSIDER BUYING 1.3 MILLION HUAAN SHARES AT ONLY 3 SEN. LATER HUAAN UP 2,000& TO 66.5 SEN

SO THESE INSIDERS WHO BOUGHT DBE AT 3.5 SEN NOW ARE MAKING SMART MOVE LIKE THOSE IN HUAAN? IT REMAINS TO BE SEEN

SEE THEIR BUYING BELOW:

|

|||||||||||||||||||||||||

| DATO' DOH JEE CHAI | 02-Mar-2018 | Acquired | 40,000,000 | 0.000 |

|

| DATO' DOH JEE MING | 02-Mar-2018 | Acquired | 40,000,000 | 0.000 |

|

| DATO' DOH TEE LEONG | 02-Mar-2018 | Acquired | 40,000,000 | 0.000 |

|

| DOH PROPERTIES HOLDINGS SDN BHD | 02-Mar-2018 | Acquired | 40,000,000 | 0.000 |

THESE ARE SOME FINDINGS BY MY INVESTIGATIONS

ALL HAVE TO THINK AND DECIDE

NO BLAME GAME PLEASE

WARMEST REGARDS

Calvin Tan Research, Singapore

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Aug 30, 2024

Created by calvintaneng | Aug 30, 2024

Created by calvintaneng | Aug 29, 2024

Created by calvintaneng | Aug 28, 2024

Created by calvintaneng | Aug 23, 2024

Created by calvintaneng | Aug 22, 2024

Discussions

Always a convincing read, but is it any surprise, DBE's directors are buying into their dying company ? can always use as a pump n dump operations later.

Caveat emptor , let the buyer beware ! greed of easy money in stock market , is often the cause of much misery , as often people only see what they want to see.

Prudent investors should just avoid such high risk, gamble companies as DGB, DGSB, DBE.

The long term future/viability of DBE, to go into its own fast food business, is very much in doubt.

Invest based on fundamentals of solid earnings companies is a surer bet.

2018-03-07 06:43

Good morning

BILLC,

DGSB SHARE HOLDERS AND INSIDERS HAVE DUMPED THEIR HOLDINGS AND RAN FOR THEIR LIVES. YET DGSB COULD STILL GO UP?

LAST TIME MEGAN MEDIA WAS TOUTED AS A GREAT STOCK AND JUMPED TO I THINK RM2.00

DIRECTORS AND INSIDERS SOLD ALL. LATER IT WAS DISCOVERED THAT ALL THE ASSETS WERE FICTITIOUS. RECEIVABLES WERE COOKED UP. EVEN THE FACTORY THEY BOUGHT WERE NON EXISTENCE. MEGAN MEDIA LATER GONE BANKRUPT.

I CANNOT SEE BUT IF SO GOOD INSIDERS WOULD NOT HAVE DUMPED AND RUN

2018-03-07 09:15

YES NOPLAYBALL

YOU ARE CORRECT. BETTER BUY WELL PROVEN SHARES WITH SOLID GROWTH STORY.

DBE COULD BE ANOTHER PUMP AND DUMP NOW ENGINEERED BY INSIDERS. SO ALL MUST BE VERY CAREFUL.

SINCE INSIDERS ARE STILL HOLDING FROM 3.5 SEN TO 7 SEN COST I THINK THE DANGER IS LESS.

BUT BETTER GO FOR A SOLID GROWTH STOCK LIKE TA.

2018-03-07 09:17

AGAIN DBE HAS REAL BUSINESS SINCE ITS ONE YEAR REVENUE WAS RM111 MILLIONS

ONLY PROBLEM WAS ITS LOSSES DUE TO

CHICKEN BEING A PRICE CONTROLLED ITEM.

AND ITS COST ESCALATE DUE TO WEAK RINGGIT AS FEED STOCKS ARE IMPORTED IN HIGH FOREIGN EXCHANGE

SO THERE IS A REASON FOR LOSSES.

NOW WITH STRONG RINGGIT IMPORTS WILL REVERSE AND BE CHEAPER. SO SHOULD BE BETTER FOR DBE

AND DBE SCRAPPED SUPPLY CONTRACT WITH QSR DUE TO LOW MARGINS ALSO GOOD.

NOW CAN GO FOR HIGHER VALUE SALES THROUGH HARUMI

OF COURSE LIKE ALL OTHER NEW BUSINESSES THERE IS ALWAYS A RISK.

NOW INSIDERS HOLDING COST IS 7 SEN TO 3 SEN. SO IF INSIDERS ARE STILL BUYING DBE HAS A 50/50% CHANCE. MUCH BETTER THAN PUMP AND DUMP STOCKS HIGHLY INFLATED WITH NO FUNDAMENTAL AT ALL

2018-03-07 14:48

Calvin, how much you think DBE could go up to with the property development business?

2018-03-09 15:34

.png)

king36

V Good.

Thank you Calvin.

2018-03-06 05:19