Note: If cannot view then click this http://www.sharetisfy.com/2020/01/limit-up-most-upside-potential-stock.html

Hi to all investors and traders!

Today I would like to share my thoughts to the following counter:

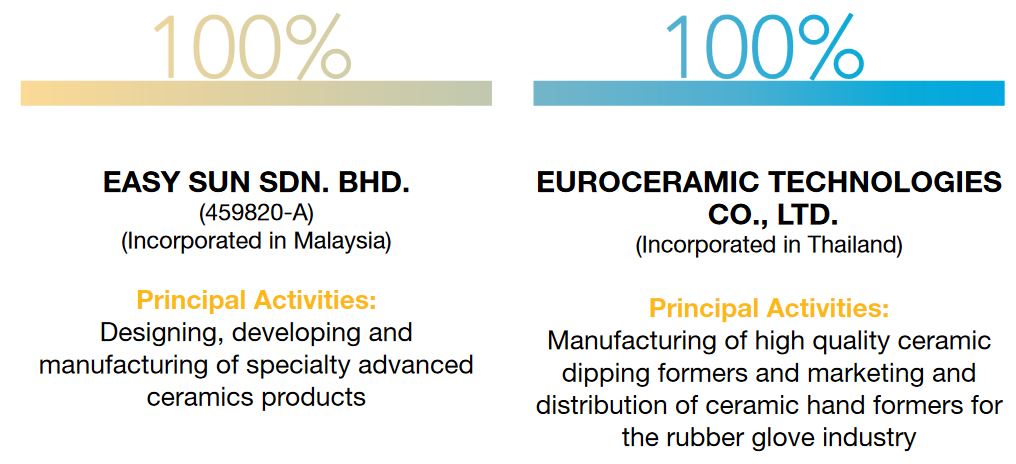

ES CERAMICS TECHNOLOGY BHD or ESCERAM (Code 0100, ACE Market, Industrial Products & Services)

1. ABOUT ESCERAM

Their website can be referred at http://www.esceramics.com.my/

Some Description of the products:

The usage of the ceramic hand formers sets it apart from the conventional ceramic products. Ceramic hand formers are for continuous industrial use under heavy-duty conditions, to withstand the complex processes involving heat and chemicals to produce gloves, the formers need to have a high degree of resistance to industrial chemicals, exceptional mechanical strength, high thermal shock resistance & a very narrow range of dimensional fluctuations. Therefore, a substantial amount of raw materials in use to produce the ceramic formers are also raw materials for advance ceramics. All these requirements differentiate the ceramic hand formers from other ceramic products. That it is being applied under very complex processes to produce the end products that are important to produce various types of gloves like medical glove, surgical glove, industrial glove and, house hold glove.

2. Why Esceram?

By looking at VIS(0120) which keep breaking high, I actually would like to find a stock which is support by fundamental and technical like VIS, it is better if it also fulfill the market sentiment pick, here is the requirement:

- Consecutive QR improvement (a come back), have dividend, potential heading to a price breakout, with an uptrend.

- Technical Rebound, a Cup with U shape turning up and breakout.

- Right Sentiment, the recent hot topic is about the WUHAN Coronavirus, it is good if the business can get advantage from it.

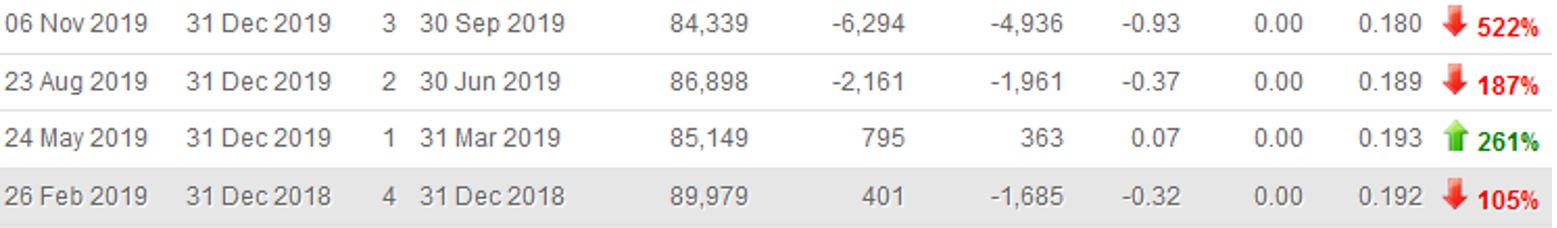

3. Result and technical charting

First we look at the result of ESCERAM, the recent 3 QR it made improvement and show the signal of come back, the stock price should start to rise to response to these result.

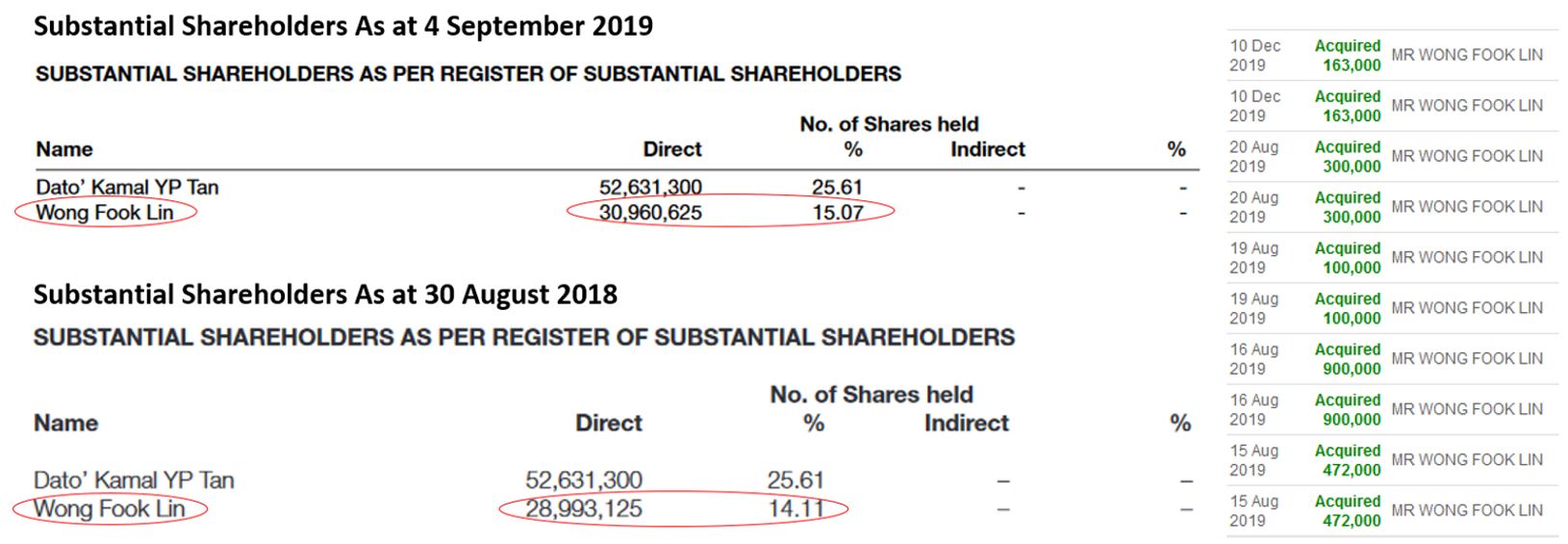

Also, one of the major Shareholder actually keep buying the share over a year, see the difference from Annual report 2018 and 2019, if the future is bad, why the Shareholder increase the shares?

Now we look at the chart, the share price fall from 0.6 to 0.15 for the past few years, and now starting to rise to 0.26, this form a CUP with U shape turning uptrend, once breakout 0.3 it will fly very high. With result and technical support, the price now still consider very cheap and undervalue, it should trade at higher price.

4. Sentiment Analysis and the History of SARS

The WUHAN Coronavirus is the recent hot news, it is very similar to the incident of SARS happened during 2013, this WUHAN coronavirus has the average 10 days incubation period, because of this incubation period, the outbreak is just the beginning, you can refer to the data below retrieved from the website of National Health Commission of the People's Republic of China, the data show that the number of new patients added actually rapidly increase, the worst is yet to come, and will be getting more serious in the coming months.

| DATE | Total Confirmed cases | Total Critical Patients | Total Death | new added death | new added cases |

| 26/1/2020 | 2744 | 461 | 80 | 24 | 769 |

| 25/1/2020 | 1975 | 324 | 56 | 15 | 688 |

| 24/1/2020 | 1287 | 237 | 41 | 16 | 444 |

| 23/1/2020 | 830 | 177 | 25 | 8 | 259 |

| 22/1/2020 | 571 | 95 | 17 | 8 | 131 |

| 21/1/2020 | 440 | 102 | 9 | 3 | 149 |

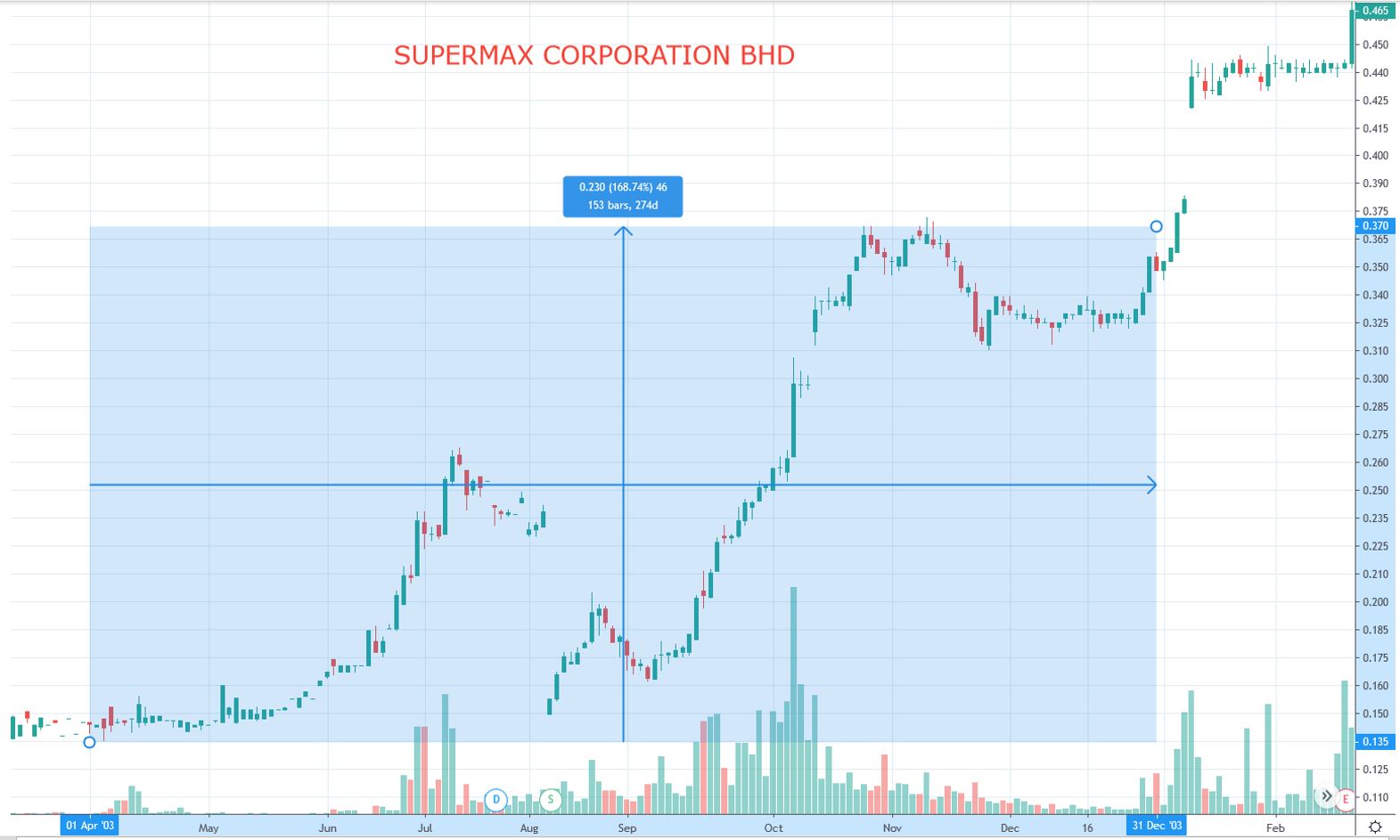

So how the glove stocks performing during the SARS incident happened at April 2003? We will study the BIG 3 glove stocks in the market, TOPGLOV(7113), KOSSAN(7153), and SUPERMX(7106). The HARTA(5168) still not listing during the 2003, so we exclude it. I will give you the summary, you can also refer to the charts below:

During April 2003 – Dec 2003

- TOPGLOV – From 0.07 up to highest 0.215, 200% gained!

- KOSSAN – From 0.07 up to highest 0.145, 111% gained!

- SUPERMX – From 0.135 up to highest 0.370, 168% gained! (share split)

- TOPGLOV – Closing RM 5.54

- KOSSAN – Closing RM 4.75

- SUPERMX – Closing RM 1.61

Thus, for this WUHAN Coronavirus, it is also possible for small cap glove stock to take advantage to expand the business, before and during the 2003, the KOSSAN, SUPERMX and TOPGLOV all have some result supported, you can refer the QR below which retrieve from KLSE screener, it is clear that the result show improvement of the business.

CAREPLS(0163) and ESCERAM(0100) are 2 ACE market counters related to glove, both are small cap stocks, I strongly confident ESCERAM will be the pick because it just deliver good result last week, and CAREPLS has no result deliver, you can see below how bad the CAREPLS result is, it is difficult to move far and sustain, not to mention next month (FEB) is the result month for CAREPLS.

5. CONCLUSION

For all the reasons above, I believe ESCERAM will be the best pick for the future, the QR improving, technical uptrend, and if you look at how SARS bring up the BIG 3 of glove stocks, TOPGLOV(Rm0.07 to 5.54), KOSSAN(Rm0.07 to 4.75), SUPERMX(Rm0.135 to 1.61), sadly ESCERAM listed on 2005 which is after the SARS incident and can not enjoy the share price rise that time, so the current time it is the big opportunity for ESCERAM and also for all the investors, TP1 is RM 0.5, TP2 RM1 above.

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Calvin comments:

This is an excellent article showing the Spectacular Growth of TopGlove, Kossan & SuperMax from penny stocks to Blue Chip Status Due to 2003 SAR

Since ES_CERAMIC only listed in year 2005 it missed the SAR Bull

Is it Now On Time for 2020 COVID 19 BULL

So best time to enter while still cheap!

Additional comments:

INVESTMENT BANKS HAVE CONSTANTLY RERATING UPWARD ALL 4 MAJOR GLOVE PLAYERS TO HIGHER AND EVEN HIGHER PRICE TARGETS WHILE NEGLECTING GLOVE PRODUCTION SUPPORTING COMPANIES LIKE ES_CERAMIC

Latest Interview between Melissa Goh (CNA Spore News Reporter from Singapore. Top Glove Boss revealed that they will make 4 to 5 New Glove Factories This Year & Up to 5 More New Glove Factories Next year making it a Total of 10 NEW GLOVE FACTORIES

SEE

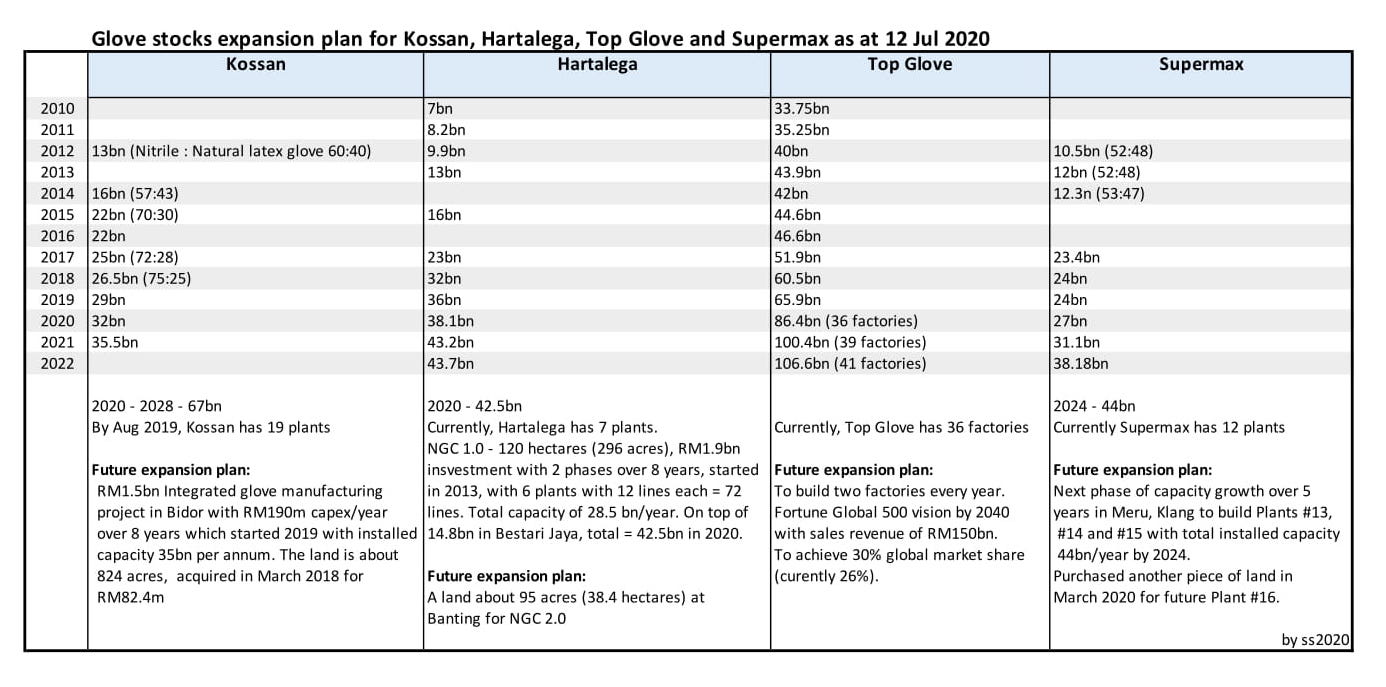

Glove stocks expansion plan for Kossan, Hartalega, Top Glove and Supermax as at 12 Jul 2020

(right click image for larger view)

PLEASE CLICK BELOW AND VIEW:

SUPERMAX REVEALED IT IS BUILDING 3 NEW GLOVE FACTORIES CONCURRENTLY & PURCHASED ANOTHER SITE FOR 4TH ONE

KOSSAN BOUGHT THE ADJOINING FACTORY FROM CBIP TO START PRODUCTION IMEEDIATELY PLUS ITS BIDOR LANDS ALSO PLANNED FOR GLOVE CITY

SRI TRANG THAI GLOVE JUST HAD IPO FOR MULTIYEAR EXPANSION. THE 8 ACRE ES_CERAMIC FACTORY IN THAILAND WILL SUPPLY HAND MOLDS TO SRI TRANG

.png)

calvintaneng

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/2020-04-24-story-h1506110752-ES_CERAMIC_0100_WILL_ALSO_JOIN_COMFORT_GLOVE_SUPERMAX_LUXCHEM_ADVENTA_I.jsp

2020-07-14 08:10