Market easily forgets...

Lau333

Publish date: Fri, 20 Oct 2017, 08:23 PM

...one off losses as long as they do not impair the company's fundamentals.

On 31st July, LCTITAN announced a much weaker than expected results largely attributed to one-off water stoppages. Total direct & indirect losses due to the up-to-11-days "immaterial" stoppage may be a mere RM118m but the reputational damages to the company is much more severe as seen in the share price which plunged as much as 36.3% from IPO price at the worst point. But, does it have a lasting impacts?

History may not repeat itself but it usually rhymes. Restricting archive search to mid and large cap stocks, the 2 following examples are illustrating.

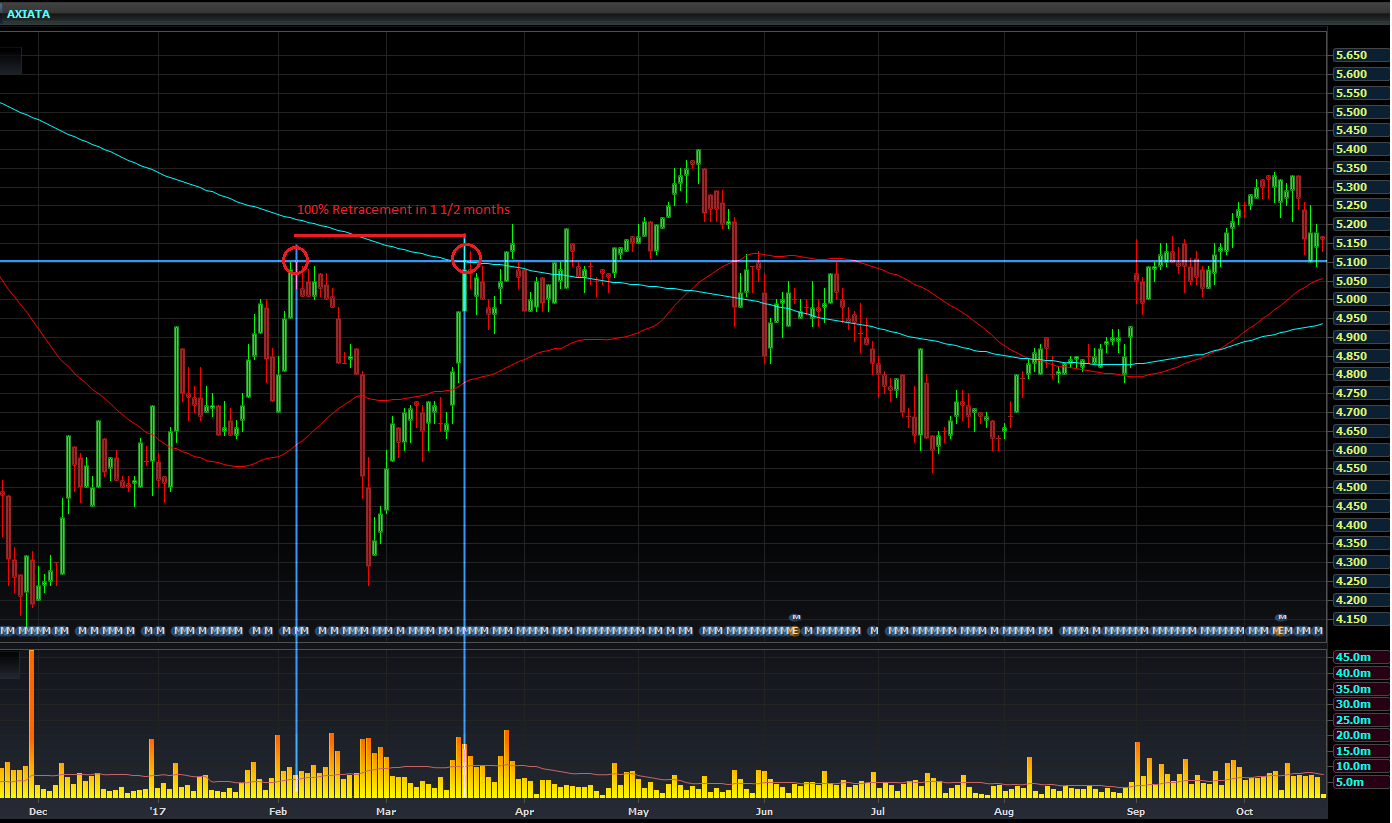

1) AXIATA

Axiata posted its first ever loss in 6 years in 4Q2016, largely due to one-off currency losses incurred on the US dollar debt that Axiata took on in 2015 to acquire NCell. Share price dropped sharply, hitting a low near RM4.24. However price rebounded strongly, completing 100% retracement in a mere 1 1/2 months.

2. CMSB

CMS posted weaker results across all segment in 1Q2016. An already weak results was exacerbated by a swing of nearly RM30m at its 25% owned OMS, largely due to one-off forex hedging that went wrong. Unsurprisingly, 1Q2016 Results sent CMS price crashing down to RM3.20 level. Again, it took just slightly over 3 months for the price to almost retrace fully back to pre-drop price.

Moral of the story

In short, price always recovers from the shock of one-off items. One-off items are by the definition are not recurring. LCTITAN's management probably needs some good spanking on the backside for their mismanagement of the water stoppage issue. Do note however that this is the same management that ran both the naptha crackers at close to 100% utilization rate for last 2 years and substantially cut down both the planned and unplanned downtimes during the same period.

As time move along, businesses will normalize and earnings will recover in tandem. And yes, the market will most likely forget the episode soon and will look forward to the next chapter of the company...

Disclaimer:

A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

More articles on Lau333's Journal

Created by Lau333 | Feb 26, 2018