A rising tide lifts all boats…..and FPSOs.

Lau333

Publish date: Sun, 29 Oct 2017, 09:55 PM

Market, as seen through the prism of human behavioral, can be defined by a swing between fear and greed. In the grip of fear, we drove down stocks way below its valuation as if bankruptcy is the only certain fate. Buoyed by hope, we float among the stars and dream of its infinite possibilities. A sector re-rating is simply a shift in investors' sentiments. The fundamental may still be the same but the investors' optimism is on the rebound. In BURSA O&G universe, those in the first tier - DIALOG, YINSON, SERBADK - have already moved up in the last few weeks. The O&G sector's gold bearer is definitely DIALOG. Any change in Dialog's results recently? Yes, it is getting better results YoY but the fact is it has been posting quarterly growth YoY for a long long time except 2 quarters in FY2016. On news side, no new development but smooth progress on the Pengerang project, which again is known for a long time ago. There’s indeed the news on Dialog acquiring MISC's stake in Langsat Terminal. Certainly nice, but in the scheme of things, RM193m (including debts) for an RM12.7b company is really a drop of a water in a cup. So, nothing really changes on the fundamental side. That means the impact must be from the sentiment side.

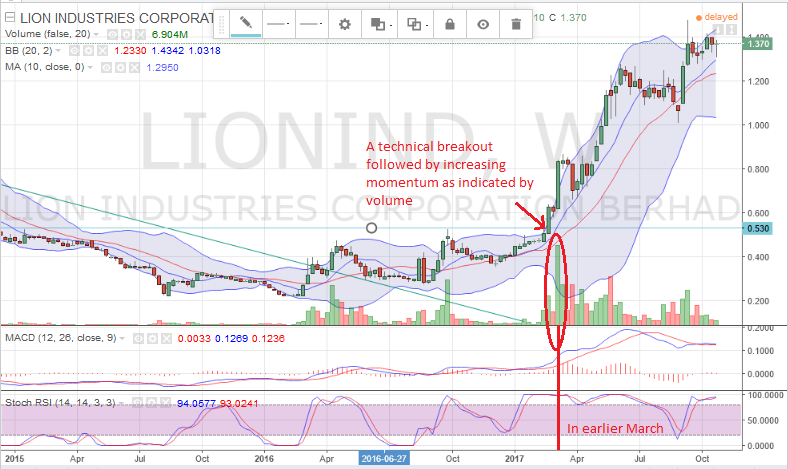

High tide lifts all boats. Steel sector will be a good example. The sector rally was first led by first tier stocks, followed by 2nd tiers and 3rd tiers. You don't have to dig too much. Just take a look at ANNJOO (1st tier) and LIONIND (2nd tier) chart. Use a weekly time frame. Notice anything standout? One clue, look at the date. Spend some time there before continue reading...

ANNJOO

LIONIND

Aside from all those minor technical breakout or trend line breakout, what we are looking for is the clear statement that the companies are really moving to the next stage. Thus, the emphasis is on a technical breakout followed by momentum as seen in record volume. Both the chart pattern are rather similar from that point onwards. The time lag observed is nearly 6 months for ANNJOO and LIONIND case but this is not important but rather as must feature. What we see here is the wave pattern of breakout, each succeeding wave lifting lower and lower quality of stocks. The categorization in tiers is never about which categories the stock belong but rather the quality of their earnings. ANNJOO has the lowest cost bar none in Malaysia while LIONIND is the perennial lost-making company since the earlier 2000s.

Now, back to O&G sector, record earnings from oil majors and as of Friday, 1st breach of $60 by Brent crude within 2 years should be the clearest signs that the worst is over. Many have repaired the balance sheet and as seen in the majors, have lower their breakeven price much below $50. So, even a repeat of 2015/2016 plunge wouldn't be that devastating. That itself would be a catalyst to sector re-rating.

Then who would be good candidate for second tier? ARMADA like YINSON is in FPSO business. Unlike YINSON, who is doing one project before moving to another, ARMADA piled up mountain of debt with 4 projects at one go. Little surprise, YINSON never posted loss while ARMADA was sinking into the abyss…

ARMADA

Yes, ARMADA won't die but is not thriving, at least yet, either. All the 4 projects - Armada Kraken, Armada Olombendo, Karapan Armada Sterling III and Armada Malta are now running and contributing to revenue. Armada Kraken may still not be running to its full capacity but at least it is running. As for Armada Perkasa and Armada Perdana, the long feared non-payment by its African clients have happened and really couldn't get worse from there. The long delays, technical problems and client problems haunting ARMADA may be nearly put to the rest. Peak capex investment was over as can see in nearly RM400m positive cash flow flowing in the latest quarter. The long term charter for its FPSOs makes ARMADA more like a toll operator once all its FPSOs start operating. Of course, ARMADA still have the OSV division which is still limping around. ARMADA is quite fairly valued around RM0.70-RM0.80. Take a look at ARMADA chart, you would have noticed the long consolidation which make it a prime candidate to break out either side. But sector re-rating plus better Quarterly YoY comparison (more because of low base effect rather that significantly better performance) should tip the breakout to above rather than below...

Disclaimer:

A sharing of personal investment idea and thought and is not a recommendation to buy or sell. The author view ARMADA as a short term technical and macro play, more than the normally fundamental oriented pick.

More articles on Lau333's Journal

Created by Lau333 | Feb 26, 2018