Hengyuan: Is Dividend the Antidote to Current Institutional Investor’s Malaise?

Lau333

Publish date: Sun, 05 Nov 2017, 08:48 PM

Back in 2014, SRC suffered badly from poor refining margin. Net loss for FY14 was RM 1.19 billion, of which RM461m was due to an impairment loss. The impairment loss was primarily due to the lower estimated future cash flows with the implementation timeline of Euro 4M and Euro 5 diesel compliant fuel specifications by 2018 and 2020, which the refinery plant is unable to economically produce without having to carry out substantial capital investments. SRC had painted a very tough business landscape with excess capacity of three million barrels per day (bpd) in the global market, which was projected to double by 2020, hence their decision not to upgrade. The sales of 51% stake to Hengyuan was subsequently announced in Feb 2016 and the rest is history.

Reversal of the decision to shut in FCCU at Convent Refinery, Louisiana by Shell

Shell made another call back in 2014 to idle the fluidic catalytic cracking unit (FCCU) at the Convent refinery because it was unprofitable. The plan was to permanently decommission it by 2018. The air of pessimism began to lift when refineries around the globe begin to report spectacular surge in profit in their quarterly earnings, i.e Valero, Marathon Petroleum, Philip 66 and the like. Furthermore, Shell recently announced the reversal of the decision made in 2014 to shut in FCCU in Convent refinery for good. This is indeed an encouraging news as Shell shifted gear from the pessimistic stance and signaling an upbeat margin outlook at least for the next 4~5 years.

Quoted: “Shell re-evaluated the cat cracker end-to-end economics and determined that the business case was strong to run the FCCU for another cycle,” The news from Reuters is accessible from here.

Pending reversal of RM 461 million impairment in Hengyuan’s book

Under the new stewardship, Hengyuan announced on 16/6/2017 that it has approved investment in the Euro 4M Mogas Project and The Atlas II project totaling some US$160m. Both the projects are expected to come on-stream by 2H2018 and are critical to ensure that Hengyuan will meet the timeline of 1/10/2018 of Euro 4M gasoline specification. The Euro 4M plant can be further upgraded to produce Euro 5M mogas when the specification change is mandated. This essentially has removed the justification of the RM461m impairment in the first place but the exact amount and timing of the reversal would still depend on the joint assessment with the company's external auditors.

A reversal of the RM461m impairment will add additional RM461m to the equity base and RM1.54 to NTA. Using the latest quarterly report, the impact will reduce debt/equity from 43.2% to 32.1%.

| Debt/Equity | FCF (RM million) | |

|---|---|---|

|

2Q2017 |

43.2% |

486,847 |

|

Revised |

32.1% |

486,847 |

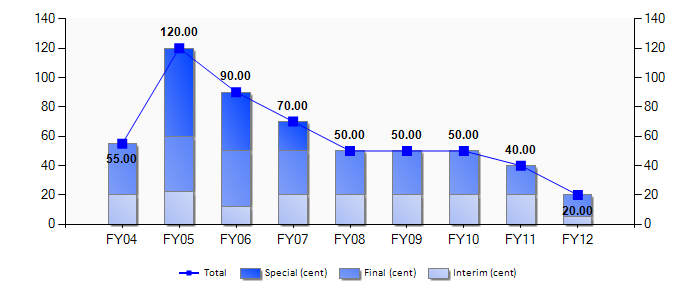

SRC last paid a dividend on 2012. Before that, SRC has consistently paid dividend each year with peak dividend at RM1.20 on FY06.

| Debt/Equity | FCF (RM million) | Dividend (sen) | |

|---|---|---|---|

|

2012 |

67.6% |

(408,285) |

20.0 |

|

2011 |

38.0% |

(295,463) |

40.0 |

|

2010 |

14.3% |

77,152 |

50.0 |

|

2009 |

9.9% |

121,287 |

50.0 |

|

2008 |

13.1% |

278,696 |

50.0 |

|

2007 |

12.2% |

357,977 |

70.0 |

As can be seen above, reversing the impairment will bring down the debt/equity ratio of 32.1% well below 2011 ratio.

| PETRONM | Debt/Equity | FCF (RM million) | Dividend (sen) |

|---|---|---|---|

|

2Q2017 |

Net Cash |

286,035 |

? |

|

2016 |

11.7% |

397,294 |

22.0 |

|

2015 |

39.2% |

471,998 |

20.0 |

Comparing with Petron Malaysia, a revised Hengyuan's debt/equity ratio is below Petron's 2015 level and has a superior Free Cash Flow. Based on the above, it can be implied Hengyuan is in solid position to declare dividend of RM0.20-RM0.40. It must be noted however, given the strong FCF and plunging debt/equity ratio, Hengyuan should be able to declare dividend irrespective of the reversal of impairment.

At the turn of tide

As of 2016 Annual Report, the only notable institutional shareholders are Amanah Saham Wawasan 2020 (3.68%) and Amanah Saham Bumiputra (6.62%), which unfortunately has been accelerating disposal of its share. Gone were the days where the list include who's who institutional shareholders such as EFP, KWAP, GIC, Great Eastern, etc. Shell’s decision to overhaul the FCCU at Convent refinery can be implied that, at the macro perspective, the days of squeezed margin and massive losses may be over. A stable crack margin and a relatively modest capex could provide a base for a dividend bonanza in the years ahead. Will a dividend prove to be an antidote to current institutional investors' malaise? And a better valuation?

Disclaimer:

A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Lau333's Journal

Created by Lau333 | Feb 26, 2018

Discussions

Aero1, the link to Reuters should work now. Thanks for the feedback.

https://www.reuters.com/article/us-refinery-operations-shell-convent/shell-shelves-plan-to-close-convent-gasoline-unit-in-2018-idUSKBN1D20SZ

2017-11-06 07:01

Aero1

Impactful article for investors to make impactful decision. Thank you

2017-11-05 22:13