Vroom Vroom: Will MBMR Myving Back to Life?

Lau333

Publish date: Thu, 09 Nov 2017, 07:15 PM

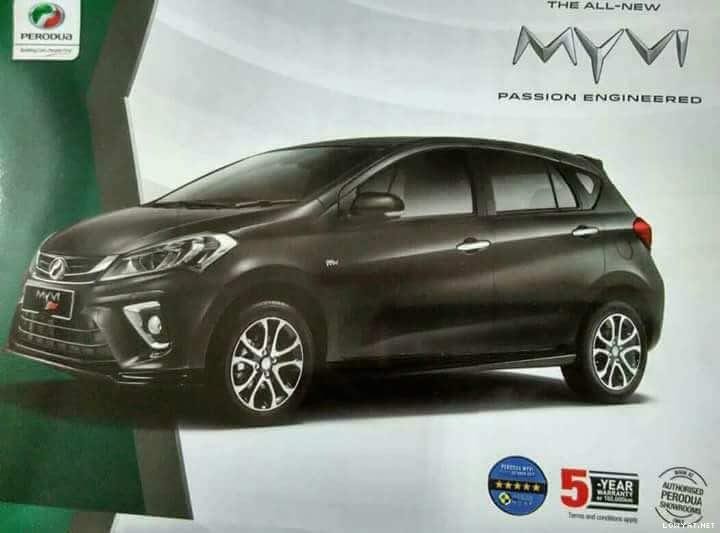

3rd generation Myvi is available for booking beginning today, with price starting from RM44,300 to RM55,300. There are five variants n offer, and they are the 1.3 Standard G (MT), 1.3 Standard G (AT), 1.3 Premium X, 1.5 High and 1.5 Advance. Powering the new Myvi are 1.3 and 1.5-litre Energy Efficient Vehicle (EEV) engines, with the former shared by the Bezza 1.3L and the later also used by the Toyota Vios. All models will come with bells and whistles found only in higher priced car such as LED headlamps, idling stop system and keyless entry with push start as standard across the board.

Perhaps, the biggest boost has been in the safety features with the aim of securing a 5-star rating from ASEAN NCAP. All variants will get minimum four airbags (1.3L - 4 airbags (front and side); 1.5L - 6 airbags (front, side and curtain), Anti-lock Braking System (ABS), Electronic Brake Distribution (EBD) and Vehicle Stability Control (VSC) as standard. More impressively, the range-topping get the big surprise – Advance Safety Assist (ASA). ASA is a suite of safety features that includes Pre-Collision Warning, Pre-Collision Braking, Front Departure Alert and Pedal Misoperation Control. Quoted from paultan.org ".....the only car below RM100k to have active safety features such as these, never mind in the B-segment or the national car market. The next cheapest cars to have AEB are the Hyundai Ioniq (RM114k), high-spec Mazda 3 (RM125k) and high-spec Peugeot 308 (RM128k)". As a reference, all current Myvi variants only have 2 airbags (front) while ABS/EBD are only available on higher variants and none is equipped with VSC.

|

Many were shocked by the new 2018 Perodua Myvi's initial specs that was revealed this morning. Unsurprisingly, as the third-generation Myvi will come with... |

First impressions of the new Myvi release were largely positive. On social media sites including paultan.org, many commentaries are directed on the relatively low price of the new Myvi given the feature list and the safety feature especially the ASA.

As a side note, the author hasn't contemplated a career switch to car salesman or a car dealership. Such is the natural talent of the author's salesmanship that he would probably be standing in the hottest spot under a blazing sun and yet fail to sell a single ice-cream for the whole day! So, the focus on this article is not about promoting new Myvi, but on MBMR (5983) which owns 20% stake in Perodua.

The launch of new Myvi will benefit MBMR in two ways. Firstly, the palpable excitement over the new Myvi will translate into higher sales for its 20% associate, Perodua. The expected increase in sales will flow down to its 51% indirect subsidiary, DMM Sales which is the largest independent dealer for Perodua. Secondly, by making a minimum 4 airbag as standard across the board for its new Myvi along other safety features, Perodua has essentially raised the bar for the safety standard in the affordable car category, therefore compelling its competitors to response in kind. Bear in the mind, currently most of its competitors including Proton Persona, Proton Iriz, Toyota Vios, Honda City and Nissan Almeria only include dual airbag as standard. This will likely drive the future sale for airbag at its 51% subsidiary Autoliv Hirotako, a JV with Autoliv AB, Sweden, which is currently the largest supplier for airbag and seatbelt in Malaysia.

A cursory look on the long term chart for MBMR will remind us that all is not well in MBMR. Total industry volume for Malaysia automotive sector is expected to increase only 1.7% to 590k in 2017 after peaking at 667k in 2015 before plunging to 580k in 2016. Meanwhile, losses at its alloy wheel subsidiary, OMI Alloy will continue until total output hit 550k pa which is only expected in FY18.

MBMR (5983) Weekly Chart

From technical point of view, MBMR share hit double bottom in Jan 2016 and June 2016 at RM1.94. Since then, MBMR has been trading largely within the range of RM1.94-RM2.60. Today's close at RM2.14 is above Feb low of RM2.08 and 50-DAYS SMA of RM2.10, which is positive. On the upside, further gain will be resisted by convergence of 200-DAYS SMA and 50-WKS SMA around RM2.26/2.27. Only a close above RM2.60 will truly flip the stock from bearish to bullish. Meanwhile, on the downside, a close below RM1.95 would trigger traders to cut loss. Readers must however be reminded that while picking bottom may be appealing, this is a risky endeavor especially to those without trading discipline and a tendency to rationalize any loss into long-term investment. Those with more conservative profile may choose to enter only upon close above RM2.60.

Disclaimer:

A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Lau333's Journal

Created by Lau333 | Feb 26, 2018