Long Steel Subsector Outlook:ANNJOO, LIONIND, MASTEEL & SSTEEL

Lau333

Publish date: Tue, 28 Nov 2017, 10:12 PM

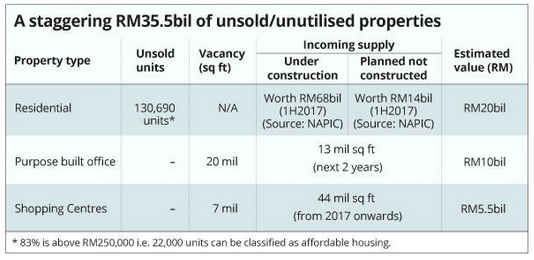

If you read the property outlook 2017 by CBRE-WTW and report by National Property Information Centre (NAPIC), you likely would have noticed the undertone – softening residential market and perhaps an even bigger problem lay in the overcapacity of shopping mall (retail space per capita has exceeded Hong Kong & Shanghai) and office tower (expected vacancies expected to rise to 32% in 2021 from 24% in 2Q2017). And of course, a sharp slowdown in the construction sector, which has the highest multiplier effect, will probably lead to a general recession.

Source : The Star Online

Soft Property Market, No Slowdown

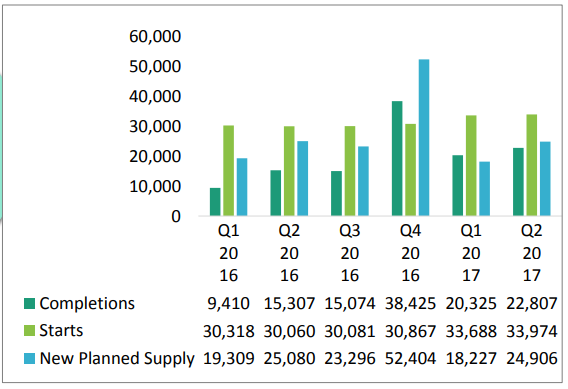

But, at least as of now, there is no slowdown detected. In the same NAPIC slide, both Q1 and Q2 2017 jolted notable increase in number of starts on YoY basic.

NAPIC: Residential Market Inventories.

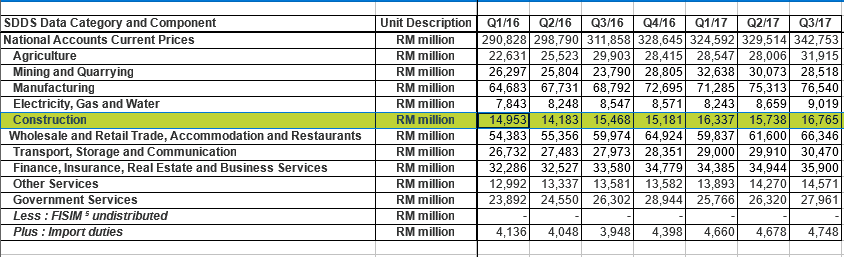

Construction Sector Is Still Growing

Let’s try to check the latest Q32017 data from Bank Negara site. So far, the construction sector is still growing. It must be noted that property segment still account for more than 60% of all construction activities.

Source: Bank Negara Website

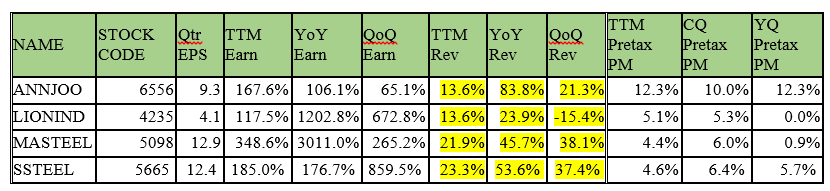

Good Results from Long Steel Product Subsector

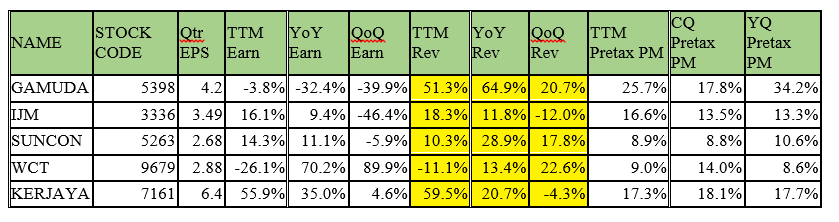

Current quarterly results from steel – long (steel bar/billet/wire) subsector is still showing growth. Revenue is largely growing on TTM (Twelve Trailing Months), YoY & QoQ basic. Pretax margin for current quarter is mostly higher than TTM basic, which means margin is still expanding.

Reiterating that Construction Sector Is Still Growing

Similarly, the biggest 5 construction companies by market cap are showing strong revenue growth. Sharp contraction in QoQ earning for both Gamuda and IJM can be attributed to one-off factor: the former due to impairment of SMART tunnel while the latter due to inclusion of gain from land disposal in the previous quarter.

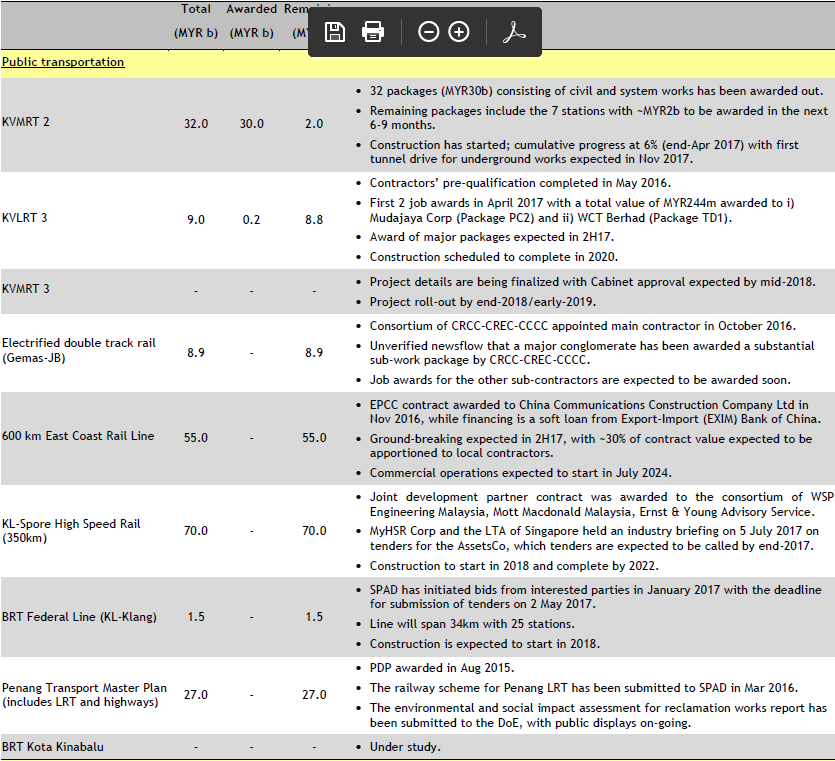

And of course, we must be aware of a glut of railway projects to be awarded in the coming months.

Conclusion

Properties segment’s softness will be compensated by ramp-up in the infrastructure segment. Over time, the growth rate should converge to the national GDP growth rate. That said, we must always remember both the properties and construction sector are cyclical stocks. Just ride the wave to the top, we may never know where the top is but on balance, there should still be a few quarters more to go. Caution is necessitated in a general bearish market but there is no need for over-reaction.

Disclaimer:

A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Lau333's Journal

Created by Lau333 | Feb 26, 2018

Discussions

KYY sees things as it happens unless it's a straight forward road where you know eg. there is an R&R 20km ahead on the left hand side. I believe he can't forcast like some very experienced and qualified economists. His luck on VS, Lat. etc...just sheer punting or guesswork even though he talked so much on ECONOMIC SENSE but in actual fact, he can't really practise it, Not easy ..

2017-11-29 09:37

Very good conclusion "Just ride the wave to the top, we may never know where the top is but on balance, there should still be a few quarters more to go."

2017-11-29 09:48

Rebar price up so much but only so much profits registered by those millers, what if rebar price no up? My guess the result will be even so so only.

2017-11-29 11:23

Interested to know if any impact from the new steel plants in the region such as Alliance

2017-11-29 21:31

@ Occa888,you have raised a very pertinent point. The Alliance plant’s 3.5m tonnes capacity (Commencement of Operation Q12018) and an even bigger 5.0m tonnes steel plant in Samalaju, Sarawak (mid 2020) will definitely have huge impact given that domestic steel consumption is only 10.3m (2016 data) once they are fully operationalized. Export will be everybody’s salvation but we probably need another planet to trade with given the excess capacities worldwide! The key words here is “fully operationalized”. Given the initial startup difficulties, products qualification lengthy processes and distribution & marketing challenges, probably there is around a year before the impact will start to be felt.

2017-11-30 07:19

@Lau333 sorry lots of questions, just want to understand more how to distinguish between the steel players and who are competitors: Any info on Alliance's local/export %? The product range similar or difference from our big 4 steel plants? There was a post on cost structures difference between the big 4 by davidtslim (http://klse.i3investor.com/blogs/david_masteel/139566.jsp), would be good to know if Alliance and Samalaju/ Bintulu got any cost advantage and product range difference over our big 4.

2017-11-30 10:45

@occa888, Alliance is not a listed entity and hence scarcity of information for in-depth analysis. ANNJOO has 800 KTA, MASTEEL 500 KTA, LIONIND 2400KTA (some not in operation) & SSTEEL 180 KTA. Quoted from Lionind 2015 annual report.

It is unlikely any export strategy will work in the post-Trump era. So, it depends on its cost competitiveness, execution and bank balance at its parent companies.. Last check it is 2 largely unknown SOE from Guangxi province, not the hub of steel making giants in China. End of the day, it is still about cost-competitiveness. Unfortunately, the scale of the operation is one of the biggest determinant.

2017-11-30 12:38

@Lau333 very much thanks for your viewpoint, I'll take them into consideration for my big 4 positions

2017-11-30 14:42

Btw, the production capacity figure of Allliance is from google. That may need further validation.

2017-11-30 15:13

Locally, the new steel supply from Alliance Steel will gradually increase the supply of wire rods and steel bars in the local markets. That will be the supply shock if not exported to China as originally planned.

2018-02-27 20:34

jackfruit

Just why Lion Ind already resume production in their Antara steel plant in Johore and now getting ready to reopen their Banting plant . Why because mega infrastructure projects order already started coming in.

2017-11-28 22:51