Perak Transit’s new areas of growth

pinchofsalt05

Publish date: Wed, 02 Mar 2022, 07:40 PM

Perak Transit’s new areas of growth

Kuala Lumpur (Mar 2) – Perak Transit Bhd has seized the opportunity to lease out part of the integrated public transportation terminals (IPTT) the company owns as logistics hubs, leveraging on growing demand for logistics services over the past two years as many turns to e-commerce amid COVID-19 movement restrictions and state border closures.

The Ipoh-based operator of IPTTs and buses have, since September 2021, leased out space in Terminal Meru Raya and in Kampar Putra Sentral, to logistics firms for an estimated RM2.5 million to RM3 million a month.

Perak Transit executive director Datuk Cheong Peak Sooi says in a recent media interview that the company does not discount leasing out space for logistics hubs in other IPTTs it is constructing, namely Bidor Sentral, which will be completed in 2023, and Terminal Tronoh, where construction is to commence in 2023.

Cheong also shared that there are also synergies between bus operators using the company’s terminals and logistics operators, as these operators can collaborate with bus operators who traverse throughout Peninsular Malaysia and Singapore to make deliveries.

The company is also looking to terminal management contracts (TMCs) that involves capex of less than RM10 million, versus building and operating its own terminals where capex could be above RM100 million. The company has secured two TMCs and is seeking to secure more, eyeing terminals outside Perak.

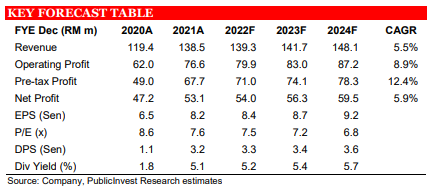

PublicInvest analyst Denny Oh, who has a “trading buy” on the stock in a Feb 23 report, expects Perak Transit’s earnings growth trajectory to resume as footfalls traffic for terminals recover while noting that the company’s strategy to transform some commercial areas in its IPTTs into logistics hubs have gained traction.

The company posted financial year ended 31 Dec 2021 (FYE2021) net profit of RM53.2 million, the highest ever annual net profit, with an increase of 26.6% versus FYE2020.

Revenue for FYE2021 was up 16.1% at RM138.6 million compared with the corresponding period of the previous year while profit before tax gained 38.3% to RM67.8 million.

Perak Transit declared a first interim dividend of 0.8 sen per share, payable on 20 May 2022. The company’s share price is valued with a forward ROE for 2022 of 10.1% and forward PE of 7.5x.

#peraktransit

More articles on Corporate Updates

Created by pinchofsalt05 | Nov 08, 2023

Created by pinchofsalt05 | Nov 06, 2023

Created by pinchofsalt05 | Jul 15, 2023

Created by pinchofsalt05 | Jul 03, 2023

changary

Great News!

2022-03-04 11:44