ATFX Market Analysis

Here is why I would short EUR/AUD over EUR/USD

ATFX

Publish date: Wed, 23 Dec 2020, 12:25 PM

Retail traders keep on fighting the trend in the EURUSD pair. Data from a large European broker shows that 61% of traders are short. I don't know why they do it, but trading against the trend is the default trading style of leveraged traders. While it can be rewarding at times, 70% to 80% of traders lose money according to the risk-disclaimers of the typical European broker. A higher EURUSD exchange rate in the weeks ahead is therefore likely given the poor track record of retail traders.

I turned bullish on November 25 when the EURUSD breached 1.19, and I think the trend will remain upwards as long as the price trades above 1.2099. The only reason for shorting the EURUSD right now would be if one was banking on a total collapse of the EU-UK trade talks. But even in this scenario, it is likely that the EU and UK will impose custom exceptions for at least three if not six months, so imports and export flows continue unhindered. We might therefore not see a big move in the EURUSD, but a range of 500 pips would not be unsurprising.

EUR/AUD Slides to a Fresh Monthly Low

Traders that can't stop themselves to short-sell the Euro might do better by focusing on the EURAUD. The Australian dollar is well-positioned to take advantage of the outperforming Chinese economy, and the likely reduction of trade wars with President Trump failing to extend his presidency. If there is a hard-Brexit, we might also see the Euro add to its losses. A favourable EU-UK deal is what the market is currently pricing-in. Thus a trade deal might not cause the Euro to surge.

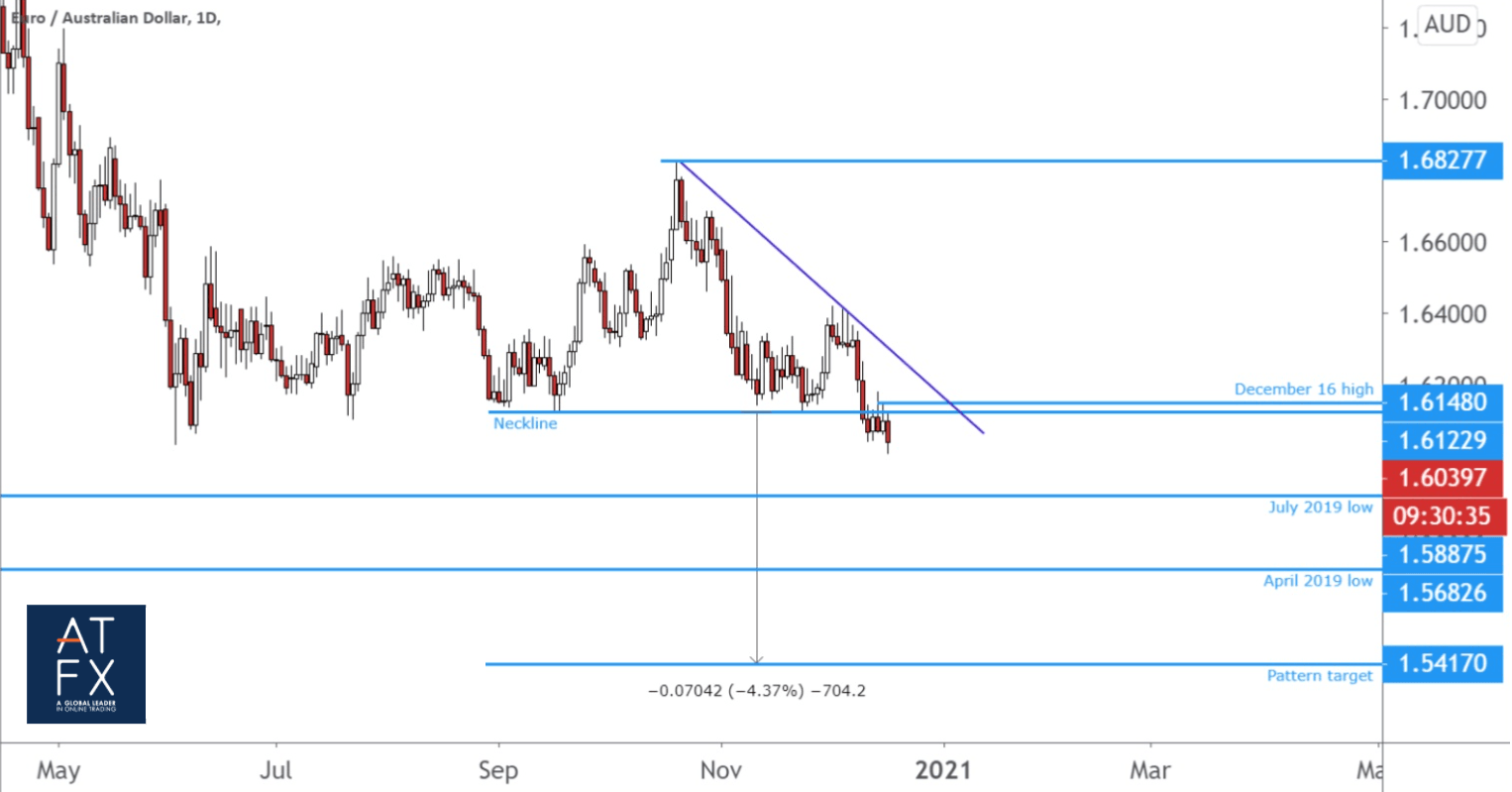

From a technical point of view, the EURAUD is in a clear downtrend, with the price trading to a fresh monthly low this morning. Over September and December, the price created a descending triangle pattern, as the price bounced from 1.6122 on September 2 and 16, and November 24. However, fast forward to December 10, and the price breached this support level.

The pattern objective is derived by subtracting the difference between 1.6122 level, and the October 20 high of 1.6827, from the 1.6122 level. The target is 1.5417, and this pattern will remain in play as long as the price does not trade above yesterday's high of 1.6148. If the price indeed manages to trade above yesterday's high, it would be likely that the pattern would fail, and the EURAUD might turn higher. But for now, it remains a high risk-reward ratio setup.

EUR/AUD Daily Chart

Written by Alejandro Zambrano, ATFX Global Chief Market Strategist

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.07% of retail investor accounts lose money when trading CFDs / Spread betting with this provider. You should consider whether you understand how CFDs / Spread betting work and whether you can afford to take the high risk of losing your money.

ATFX is a co-brand shared by a group entities including:

- AT Global Markets (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom with registration number 760555. The Registered Office: 1st Floor, 32 Cornhill, London EC3V 3SG, United Kingdom.

- AT Global Markets LLC is a Limited Liability Company in Saint Vincent and the Grenadines with company number 333 LLC 2020. The Registered Office: 1st Floor, First St. Vincent Bank Bldg, James Street, Kingstown, St. Vincent and the Grenadines.

- ATFX Global Markets (CY) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the license no. 285/15. The Registered Office: 159 Leontiou A' Street, Maryvonne Building Office 204, 3022, Limassol, Cyprus.

- AT Global Markets Intl Ltd is authorized and regulated by the Financial Services Commission with license Number C118023331. The Registered Office: Suite 207, 2nd Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebène, Republic of Mauritius.

More articles on ATFX Market Analysis

Could accelerating inflation and Job growth pressure the Fed's decision

Created by ATFX | Jul 28, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments

.png)