ATFX Market Analysis

Could accelerating inflation and Job growth pressure the Fed's decision

ATFX

Publish date: Wed, 28 Jul 2021, 05:53 PM

Focus now subsides from the tech stocks and earnings frenzy to the Federal Reserve’s policy two-day meeting and policy decision on Wednesday. No policy change is expected but investors are still waiting for labor market clues and expect the fed to signal or talk about cutting back on the asset purchases through-out the 2-day meeting.

Unemployment levels have taken more significance recently with the rise of inflation and Fed officials repeatedly sizing down inflation to be a problem with every month “its transitionary” speech.

Fears of covid-19 latest highly infectious delta strain has been slowing down the economic recovery outlook as cases surge once again and is raising concerns over the monetary policy path. It’s also one of the reasons tech stocks are back to the top as investors somewhat cut on all types of other stocks that are currently being affected by covid-19 and concentrate on mainstream stocks.

Powell, reiterated in the last June policy meeting that “it will take around 6 months to really know inflation and how much it is transitionary” so this meeting the dialogue could potentially change.

In terms of figures, inflation has topped expectations last month the highest in 13 years despite expectations that it would drop. The consumer price index jumped 0.9% in the month of June VS its 0.6% gain in the month of May. This could most definitely also alter the Feds position as well.

Another factor to pin point out is if the job market is where the Fed wants it to be! Earlier last month, Powell has also mentioned that inflation isn’t enough to increase rates quickly and that they have a labor market goal to achieve, which hasn’t been met yet. Unemployment figures rose to 5.9% in June VS 5.8% in May despite strong growth seen in the second quarter especially with countries re-opening and business running and hiring. Hence there’s still a gap to fulfil in terms of Unemployment.

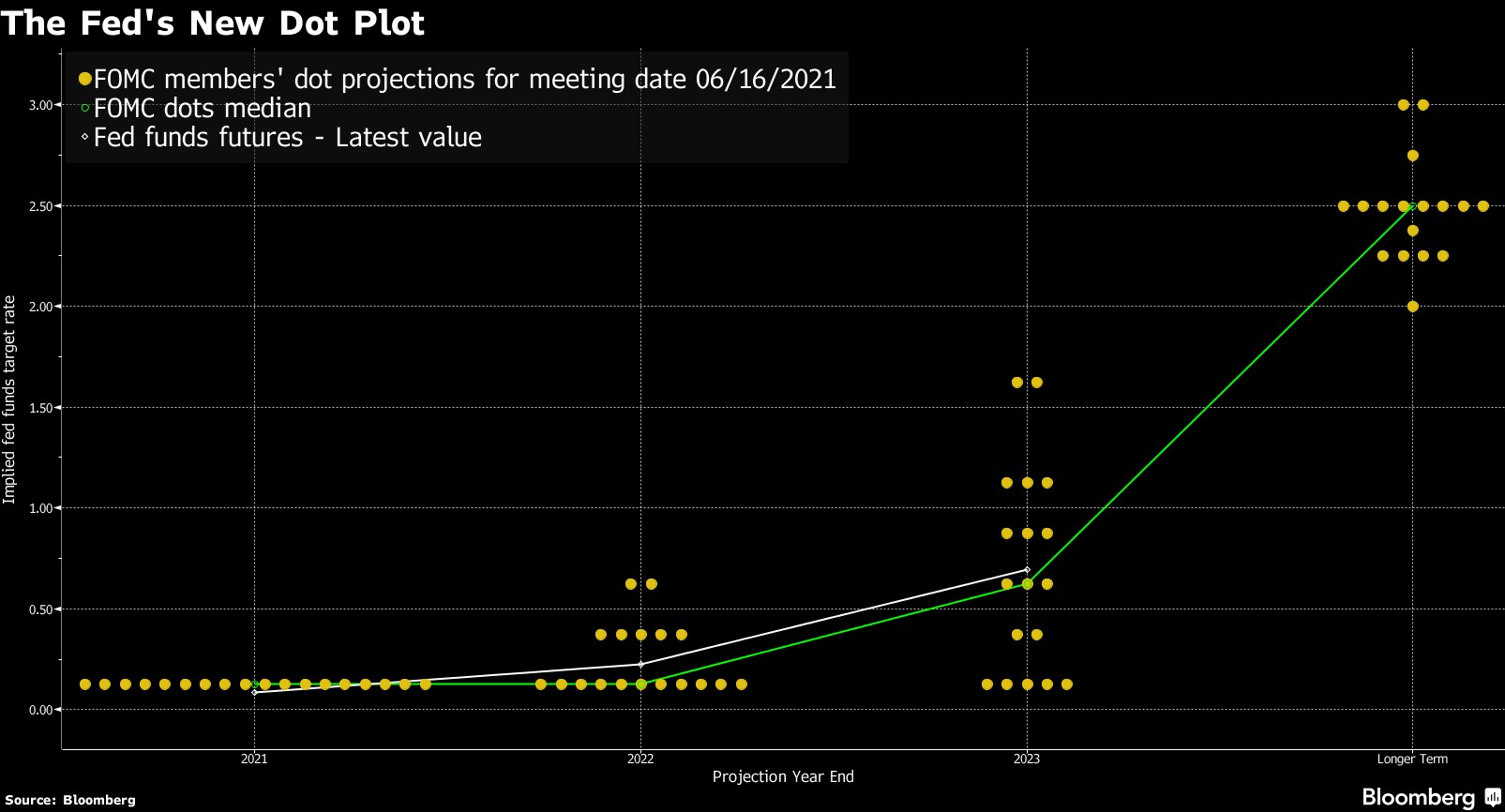

The dot plot chart from June’s Fed meeting

In conclusion, with the above factors the Fed should sound less dovish but the reality is, that the Fed will keep sizing down inflation and repeat that recovery is still running smooth, till eventually inflation doesn’t slow down and then they might push back with an unexpected statement then.

Written by Nadia Amr, Market Analyst ATFX MENA (UAE)

ATFX is a co-brand shared by a group entities including:

- AT Global Markets (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom with registration number 760555. The Registered Office: 1st Floor, 32 Cornhill, London EC3V 3SG, United Kingdom.

- AT Global Markets LLC is a Limited Liability Company in Saint Vincent and the Grenadines with company number 333 LLC 2020. The Registered Office: 1st Floor, First St. Vincent Bank Bldg, James Street, Kingstown, St. Vincent and the Grenadines.

- ATFX Global Markets (CY) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the license no. 285/15. The Registered Office: 159 Leontiou A' Street, Maryvonne Building Office 204, 3022, Limassol, Cyprus.

- AT Global Markets Intl Ltd is authorized and regulated by the Financial Services Commission with license Number C118023331. The Registered Office: Suite 207, 2nd Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebène, Republic of Mauritius.

More articles on ATFX Market Analysis

Discussions

Be the first to like this. Showing 0 of 0 comments