ATFX Market Analysis

Learn why Silver prices have more to lose despite today’s big slump

ATFX

Publish date: Wed, 31 Mar 2021, 02:21 PM

Silver prices have just crashed to levels we have not seen since December, and there is a heightened risk we could see even lower prices in the weeks ahead. Driving silver prices lower are a strong dollar and higher US government bond yields.

Was it evitable?

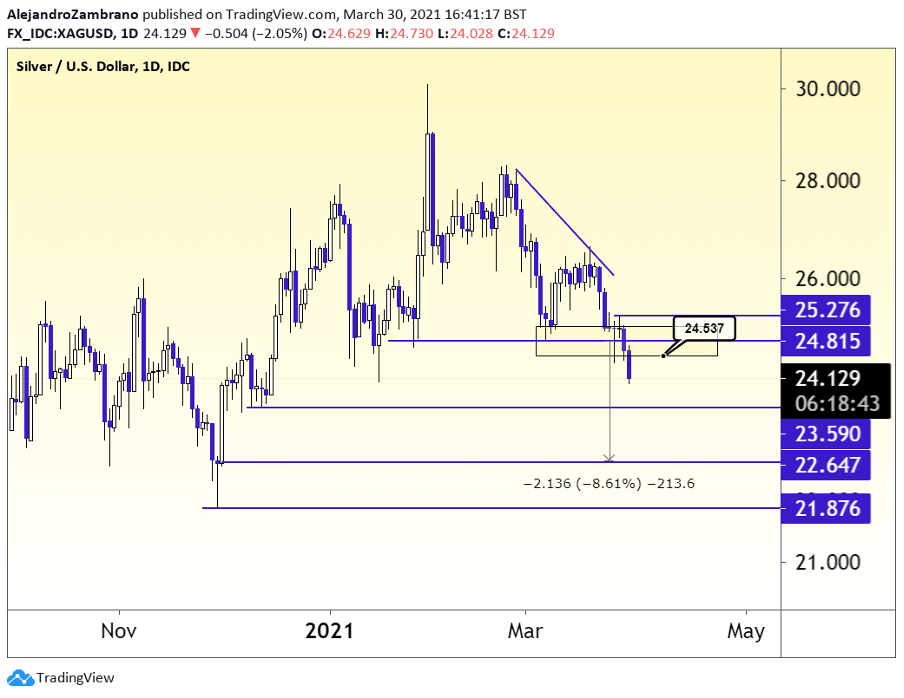

Already on Thursday last week, silver prices tried to trade lower, but the bears’ attack was swiftly crushed. Today, it looks like they have succeeded in triggering a large descending triangle pattern with a target of 22.64.

The descending triangle was in the making since January 28. On that day, the price bounced from 24.81, and it also bounced from the same level on March 5. A downward sloping trend line goes via the February 25 and March 18 highs. The horizontal level and the trend line form the triangle, and it says that as long as the price does not trade firmly back into the triangle pattern, the price could reach 22.64. I think the March 26 high of 25.27 is probably as high as the price can trade before the pattern is void.

If we look at the short-term levels, traders will probably hold off with shorting at current levels. They will probably wait for a correction to at least 24.53 before turning bearish once again.

What is driving silver prices lower?

The dollar’s strength is probably the single factor that is driving silver lower. The dollar index is now back at levels seen in November 2020. The reason for the dollar turning higher is that people are lifting US government bond yields from their record lows, as people now see a future without Covid-19. Also, the large US fiscal deal is increasing the likelihood of inflation down the road, and that also lifts yields, making it expensive to hold silver and gold.

What is interesting is that people will usually buy silver and gold to hedge against inflation. But today the focus is on the dollar. One explanation could be that positioning in the futures markets was extremely bearish until recently, with speculators not being this short of the USD for more than 11 years. Also, relative growth and inflation trajectory looks to top the European economy, which will put pressure on the EURUSD, and this should further depress silver prices.

Written by Alejandro Zambrano, ATFX Global Chief Market Strategist

ATFX is a co-brand shared by a group entities including:

- AT Global Markets (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom with registration number 760555. The Registered Office: 1st Floor, 32 Cornhill, London EC3V 3SG, United Kingdom.

- AT Global Markets LLC is a Limited Liability Company in Saint Vincent and the Grenadines with company number 333 LLC 2020. The Registered Office: 1st Floor, First St. Vincent Bank Bldg, James Street, Kingstown, St. Vincent and the Grenadines.

- ATFX Global Markets (CY) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the license no. 285/15. The Registered Office: 159 Leontiou A' Street, Maryvonne Building Office 204, 3022, Limassol, Cyprus.

- AT Global Markets Intl Ltd is authorized and regulated by the Financial Services Commission with license Number C118023331. The Registered Office: Suite 207, 2nd Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebène, Republic of Mauritius.

More articles on ATFX Market Analysis

Could accelerating inflation and Job growth pressure the Fed's decision

Created by ATFX | Jul 28, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments