ECB Jan 2021 Monetary Meeting Overview

ATFX

Publish date: Wed, 20 Jan 2021, 12:32 PM

Widely anticipated ECB meeting will be taking place on Thursday the 21st of January of this week. As the first-rate setting meeting of the year, with latest lockdowns, the pace of vaccinations and prospects of recovery in focus.

The central bank is highly expected to keep its main monetary policies unchanged and Christine Lagarde, ECB president has already signaled that it could expand its main bond-buying program further if vaccinations are delayed and lockdowns remain in place for longer than expected.

In the last ECB meeting, back in December, the ECB had announced a new policy package extending and increasing the level of monetary policy accommodation until March 2022. The central banks emergency bond-buying program was extended to 1.85 Tn Euros. This decision came into effect amid the second wave of the pandemic and some positive news regarding vaccine availability. The meeting definitely listed its concerns over unemployment and delayed recovery and higher exchange rate affecting inflation levels negatively.

With increased recession risk for the eurozone economy from longer and stricter lockdowns and vaccination programs that are taking more time than expected, the ECB could just want to stay at the sidelines for this one, till a clearer perspective for 2021 comes into place by Q2.

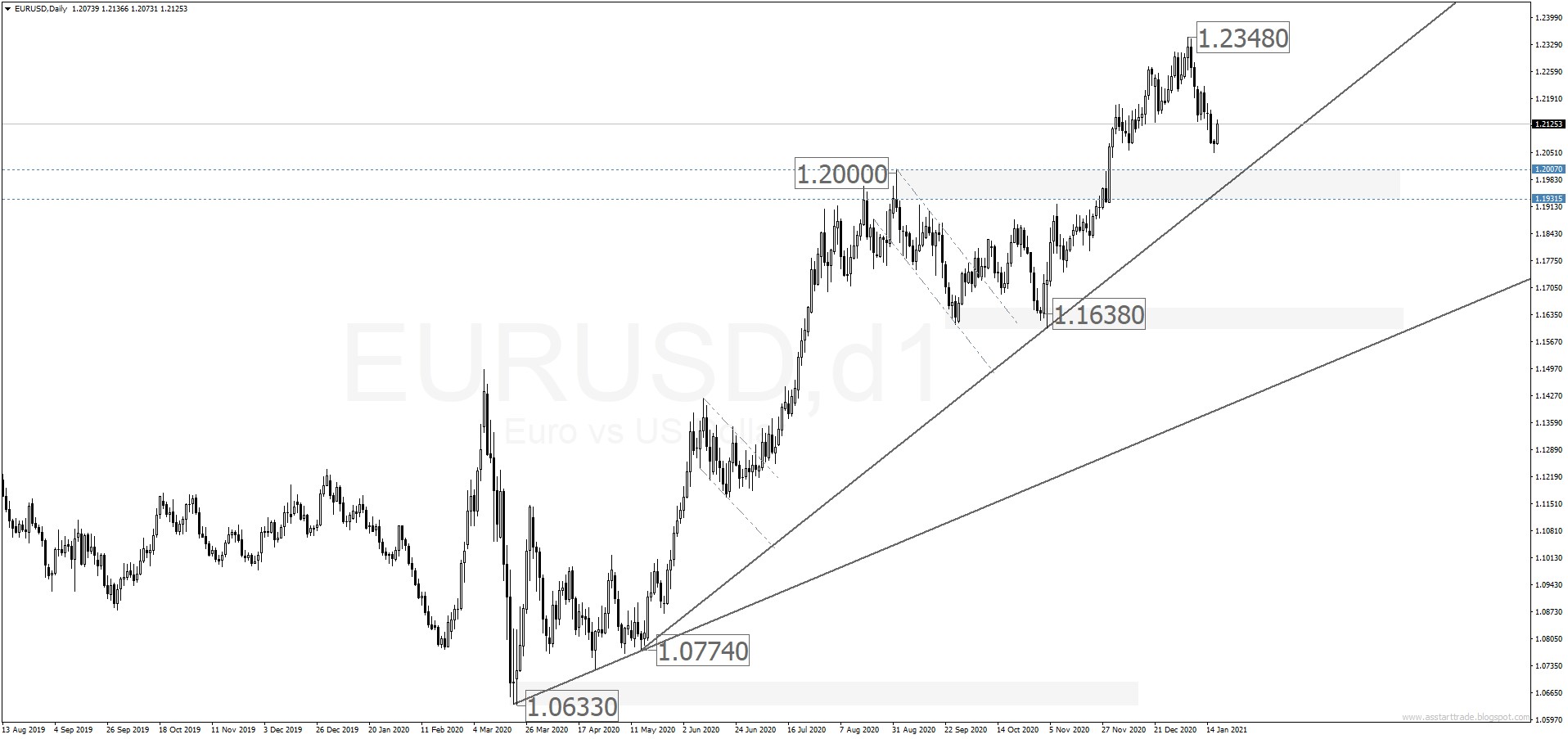

Lastly, the ECB will keep a close eye on the recent rise of the EUR/USD which is expected to put downward pressure on inflation. As the euro has been seeing positive momentum while the USD has not. On the bright side, Christine Lagarde was optimistic last week predicting an economic recovery and warned against the early tightening of stimulus efforts as she talks about the efforts put into place to control the pandemic.

Written by Ramy Abouzaid, ATFX (CY) Dubai Rep Office Head of Market Research.

ATFX is a co-brand shared by a group entities including:

- AT Global Markets (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom with registration number 760555. The Registered Office: 1st Floor, 32 Cornhill, London EC3V 3SG, United Kingdom.

- AT Global Markets LLC is a Limited Liability Company in Saint Vincent and the Grenadines with company number 333 LLC 2020. The Registered Office: 1st Floor, First St. Vincent Bank Bldg, James Street, Kingstown, St. Vincent and the Grenadines.

- ATFX Global Markets (CY) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the license no. 285/15. The Registered Office: 159 Leontiou A' Street, Maryvonne Building Office 204, 3022, Limassol, Cyprus.

- AT Global Markets Intl Ltd is authorized and regulated by the Financial Services Commission with license Number C118023331. The Registered Office: Suite 207, 2nd Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebène, Republic of Mauritius.

More articles on ATFX Market Analysis

Created by ATFX | Jul 28, 2021