Insas vs MFCB: Both having a good Meteoric Rise this 1Q2024 (Updated on 3rd April 2024)

BLee

Publish date: Mon, 26 Feb 2024, 12:42 AM

How do we define value traps?

Below is one of conversation in Insas forum:

“Forumer Lxxx

correct lor

do not get TRAP like ax txxx or Lxxx…or keep 1 share, so that when INSAS reach RM 60 RINGGIT

all insas shareholders can laugh at u mar ....”

“Bxxx

I have traded during the last RPS RI, selling Offer Rights, 80% of mother shares close to a Ringgit and balance becomes zero cost. (Will find time to dig out the traded record for sharing). Hopefully, will only be trapped until close to NTA; will consider ‘untrap’..

Happy Trading and TradeAtYourOwnRisk”

Is the share price below NTA for a long period considered a value trap? or

Is the NTA moving up over the years at a greater rate than the share price considered a value trap? or lately

Is the share price moving up at a greater rate than NTA, can it be considered no longer a value trap?

Since NTA and share price are not static, and both are moving up although at different rate; I personally rate Insas not a value trap.

Almost every 5 years, Insas will issue RPS RI to replace the previous matured RPS, I have taken the opportunity to cash out at 20% gain in the form of Insas mother share. As of today, my average price is almost double but not the NTA..

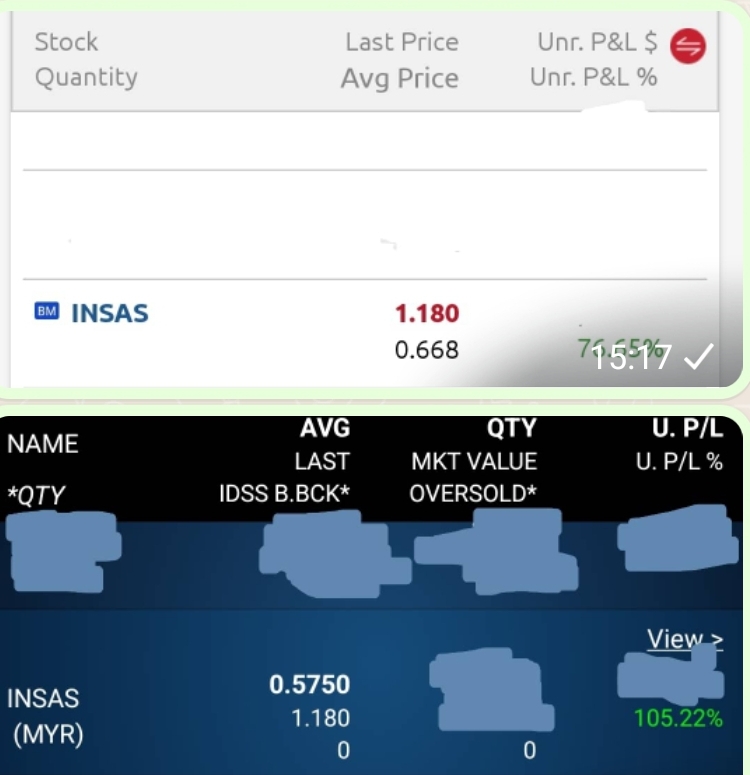

Detail 1: My average price with 2 Trading House

Detail 2: Some records of my Tradings. I almost getting double LU for Insas RPS Offer Rights. Sold the Rights few sen lower, invested more in mother shares and managed to sell a week later…

_______________________________________

Update today date: 28 March 2024, on below topic:

"Insas: Comparison of Dividend vs NAPS 30/6/2014 RM 1.728 to 30/6/2023 RM3.375 a CAGR of 7.72%."

Question: What is the return for Insas Principal plus Dividend for the last 10 years vs NAPS 30/6/2014 RM 1.728 to 30/6/2023 RM3.375 a CAGR of 7.72%?

Assumption:

1. Investment of RM10k at 50sen (1st scenario) or 60sen (2nd scenario) from year 2014 to today 27 Mar 2024 (base price holding).

2. Reinvestment of Dividend of 1sen per share from FY14 to FY18 at buying price of 50sen (or 60sen), 2sen per share from FY19 to FY21 at a buying price of 60sen (or 70sen) and 2.5sen per share from FY22 to FY24 at a buying price of 70sen (or 80sen).

3. The calculation of 4 fold gain do not include Dividend assuming the buying and selling out of Dividend entitlement and RI of RPS period..

A few tables tell A few thousands words; therefore hope NO explanation required, and hope no input of wrong formula/data..

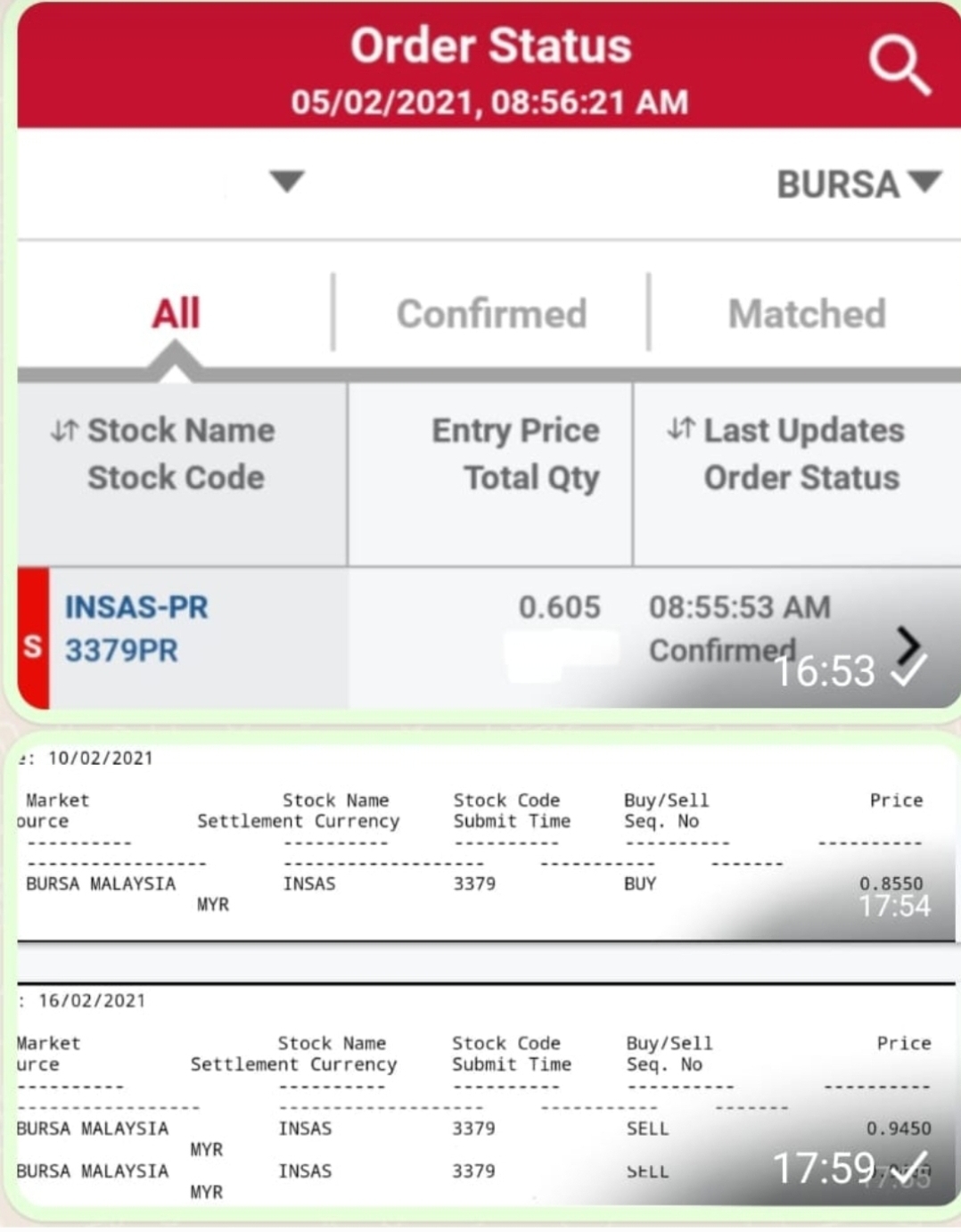

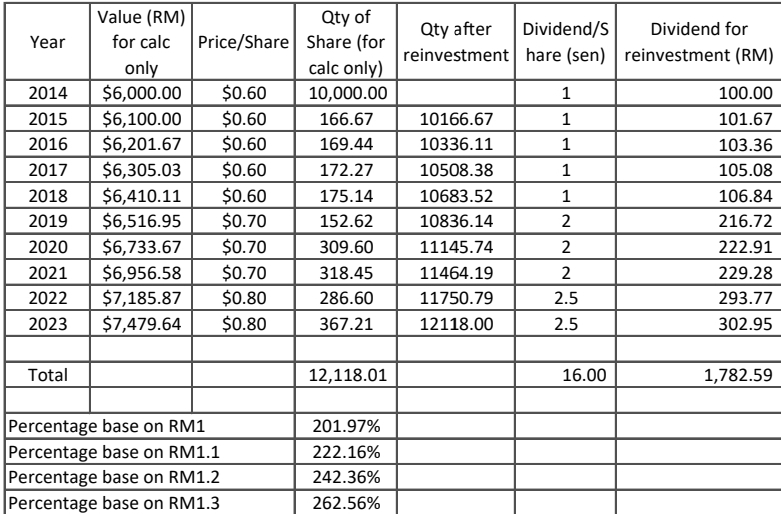

Table 1: Initial buy-in price of 50sen (1st scenario) , close to my average buy-in price of RM0.575 as shown above.

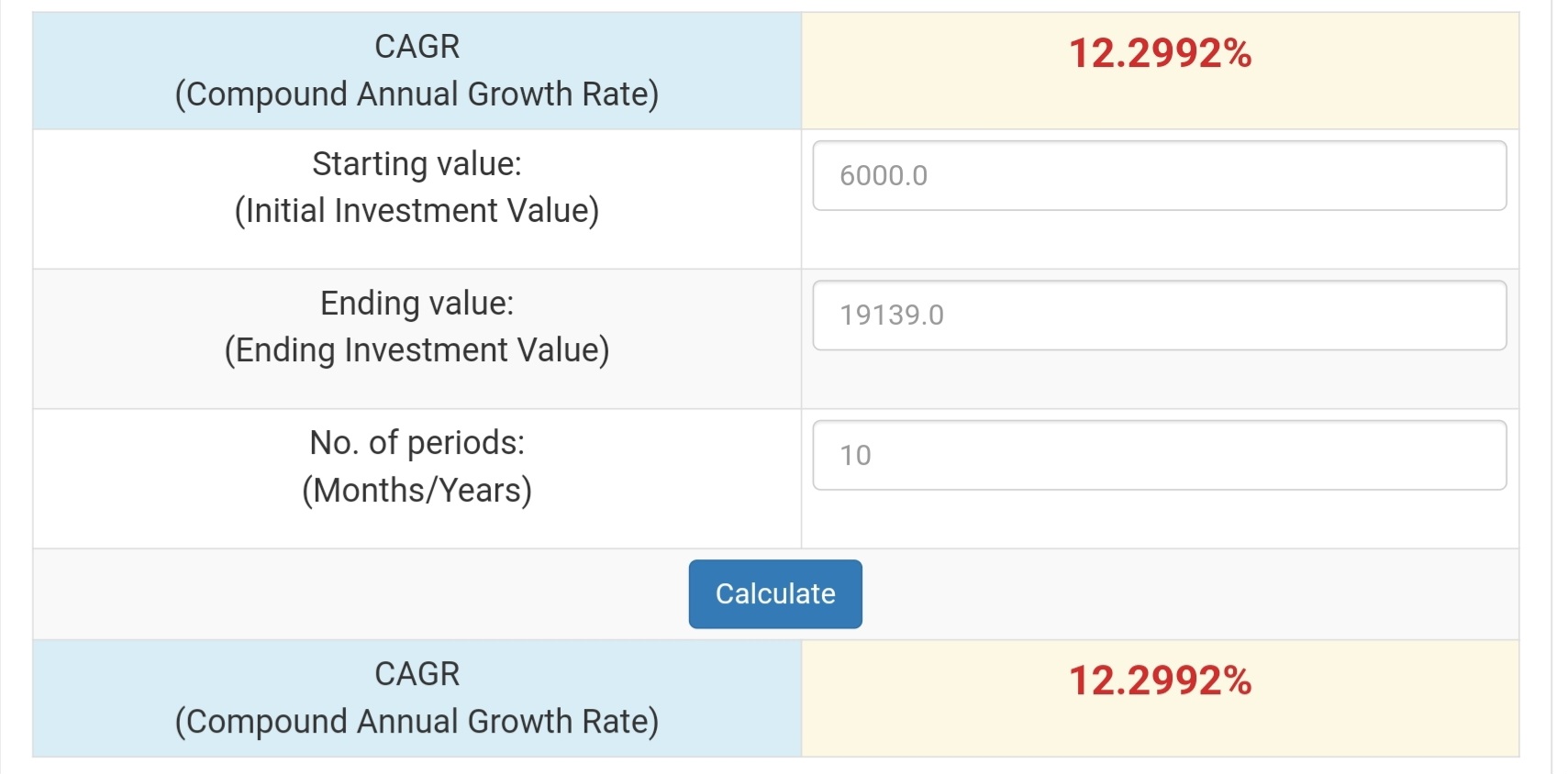

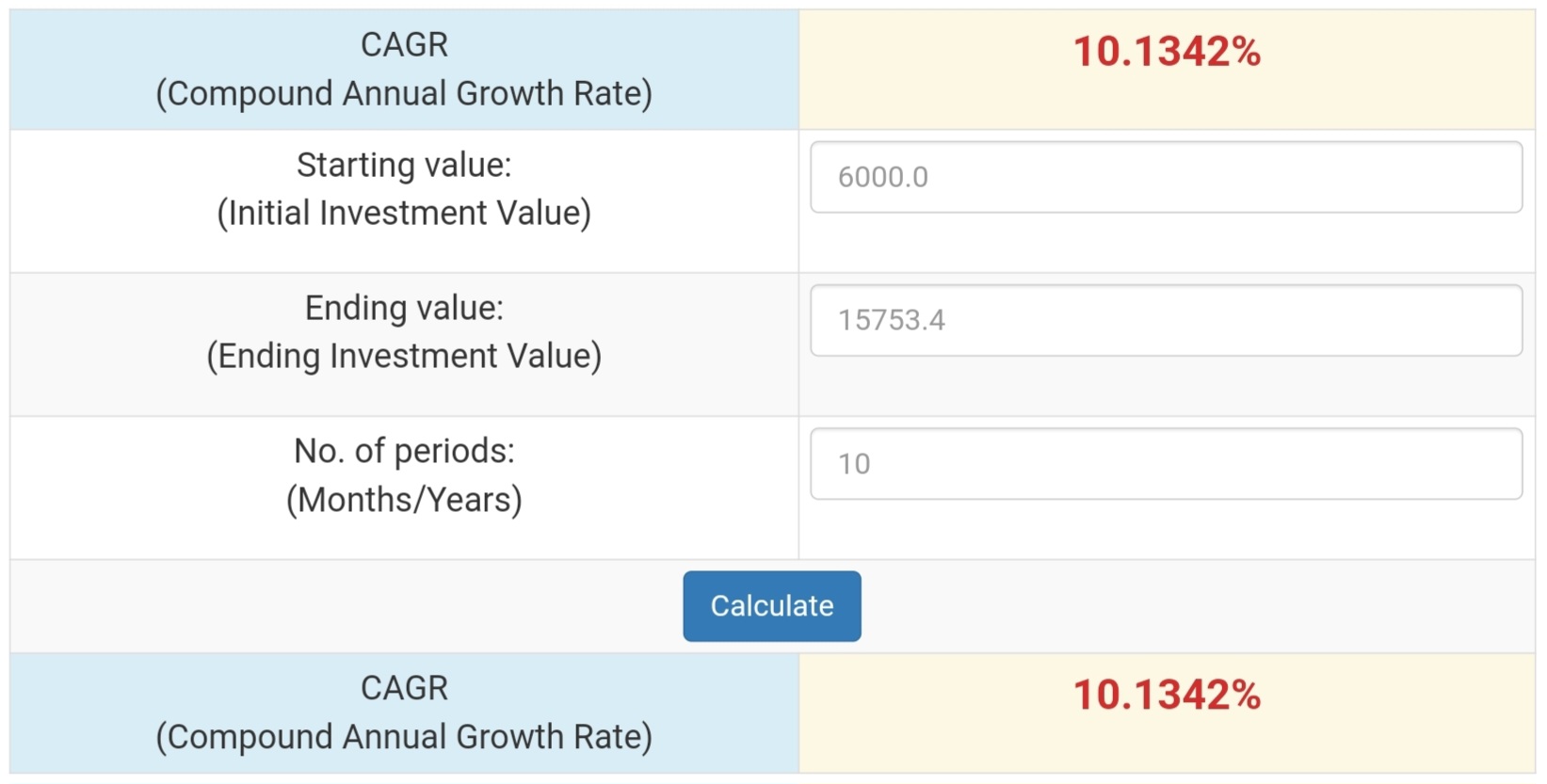

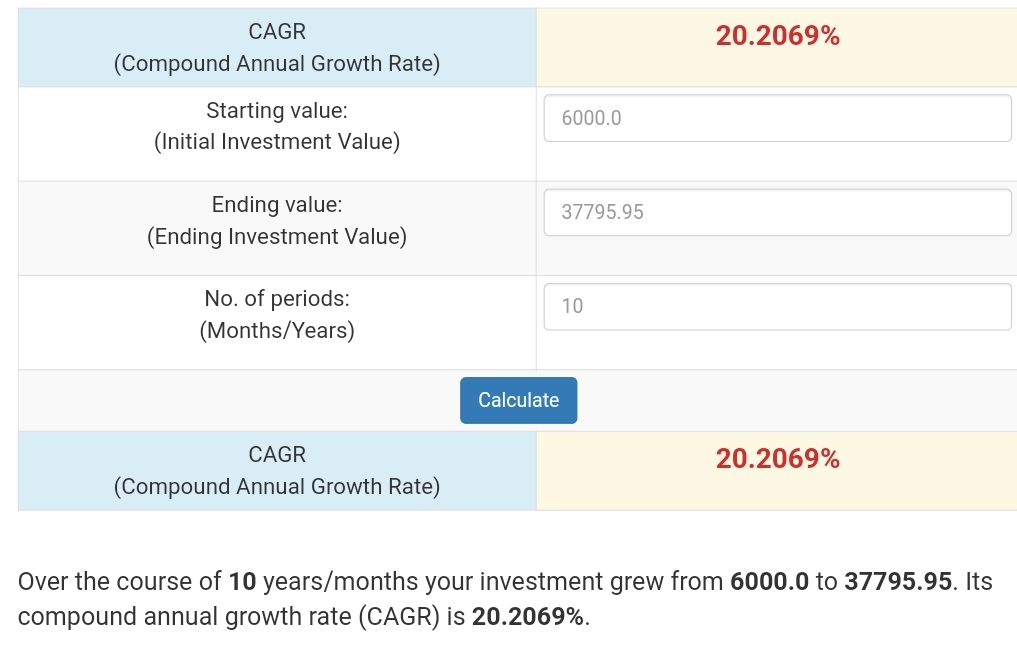

Table 2: CAGR final price of RM1.30 (max) and initial investment cost of RM6k at 50sen.

Source of calc: https://cagrcalculator.net/result/

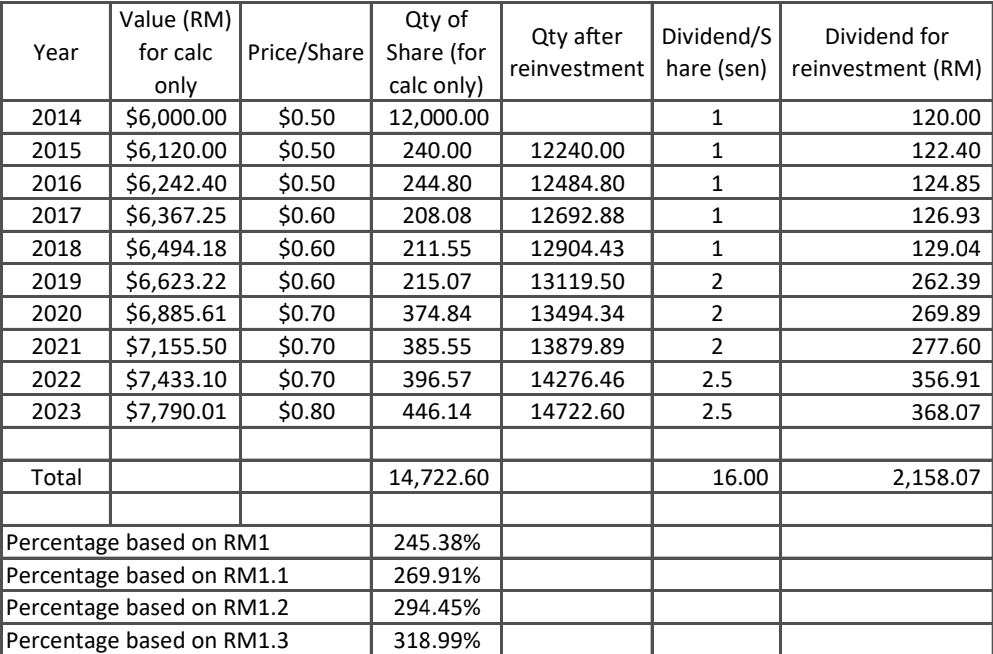

Table 3: Initial buy-in price of 60sen (2nd scenario), comparable to example as below reference.. excluding gain of RI of RPS every 5 years in order CAGR can be compared.

Table 4: CAGR final price of RM1.30 (max) and initial investment cost of RM6k at 60sen.

Table 5: Dividend payouts over the years. Source: https://www.klsescreener.com/detail.php?code=3379

Reference:

Below post details:

1. “Common Stocks and Uncommon Profit.

Do you know Insas growth it NAPS 30/6/2014 RM 1.728 to 30/6/2023 RM3.375 a CAGR of 7.72%

But the NAPS growth did not reflect into its share price.

Why?? Inefficient of market?

But even then people like xxx still can make a 4 fold gain.

My question isn't xxx method qualified him as the true method on turning Common Stocks into Uncommon Profit?

So why you insist Fisher method is the only right method?

If you buy 10,000 shares at 60 sen, sells all at RM1.10 your original RM6,000 becomes RM11,000 and with that amount you can later buy back say, 15,000 shares at around 70 sen. Then sell the 15,000 shares at RM1.20 to get RM18,000. Later when price drops back to say, 80 sen, you can buy 22,500 shares. And after selling off 22,500 shares at say, average price of RM1.30 you realised a total of RM29,250 , that's a gain of RM23,250 from your initial cost of investment of RM6,000 , almost 4 fold gain”

My conclusion: If initial buy-in price is low, Dividend return could be a good "value trap" as CAGR calculated around 12%. At present price, the Dividend payouts could not even compare with current bank FD rate, therefore a "value trap"..Dividend payouts is good or bad is another story.

______________________________________

Insas vs MFCB: Both having a good Meteoric Rise this 1Q2024

Below is my conversation with an i3 forumer on MFCB:

“Forumer xxx

Next resistance 5.40 ...???

19 minutes ago”

Yes, MFCB is having a good meteoric rise this year. Few days ago, I did a calc for Insas' CAGR, also checked on MFCB over a 10 year period. The results are much better than Insas. Will find time to post the results, maybe over the coming weekend.

Happy Trading and TradeAtYourOwnRisk”

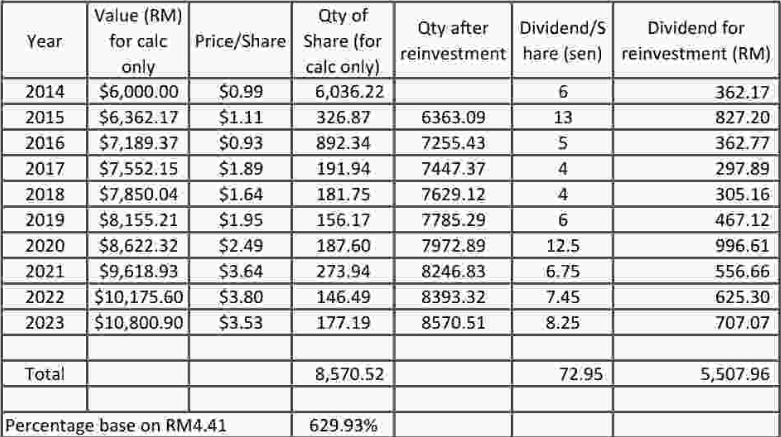

The results as tabulated below:

Detail M1: MFCB 10 year Dividend record. The value shown is for total for each Financial Year.

Link: https://www.klsescreener.com/detail.php?code=3069

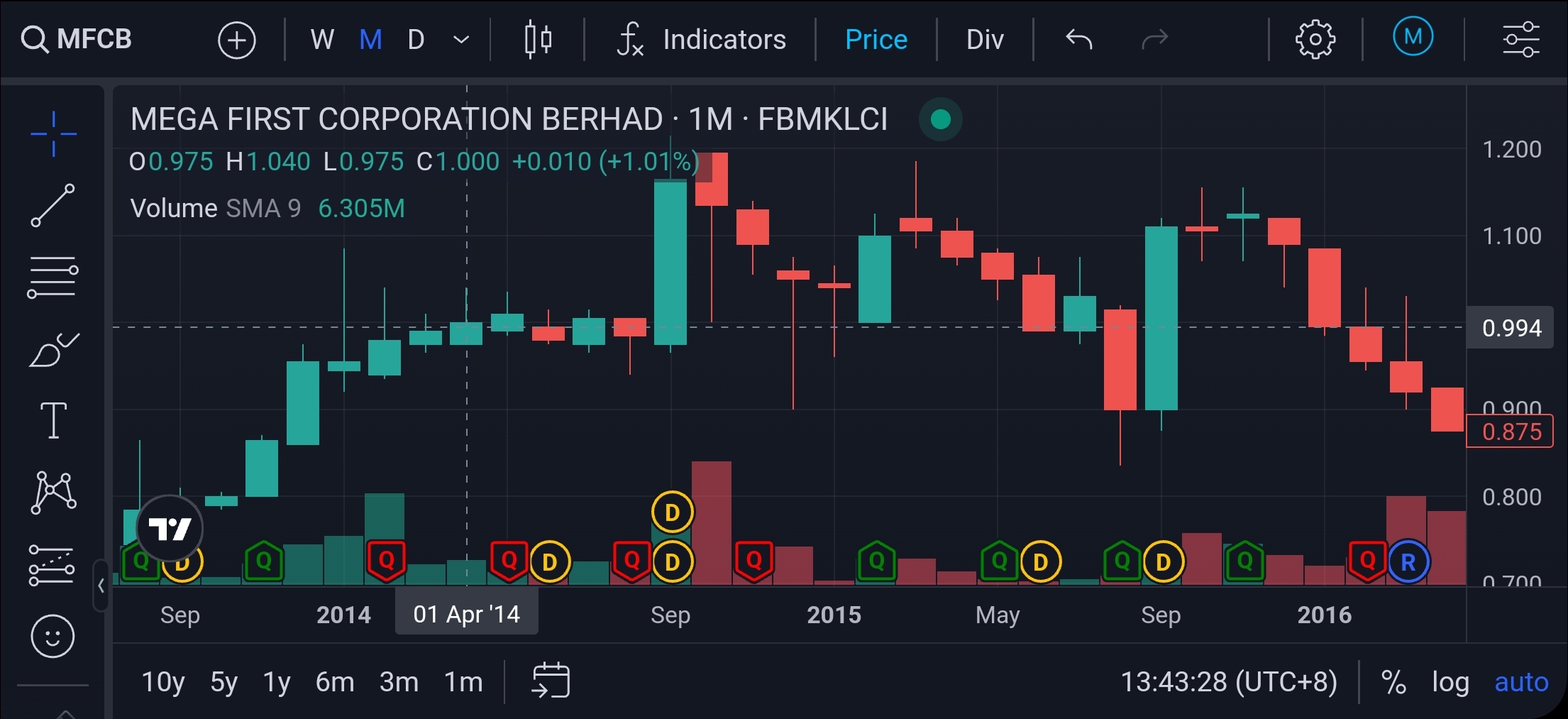

Detail M2: MFCB Graph showing Price for 2014.

Detail M3: MFCB 10 year Graph.

Detail M4: MFCB Spreadsheet Calc.

Assumption M1: Calc based on RM6K as to compare with Insas investment initial cost.

Assumption M2: Although Dividend declared more than once a year, the total value used for each Financial Year (FY) for reinvestment.

Assumption M3: Reinvestment value based on early April of each FY.

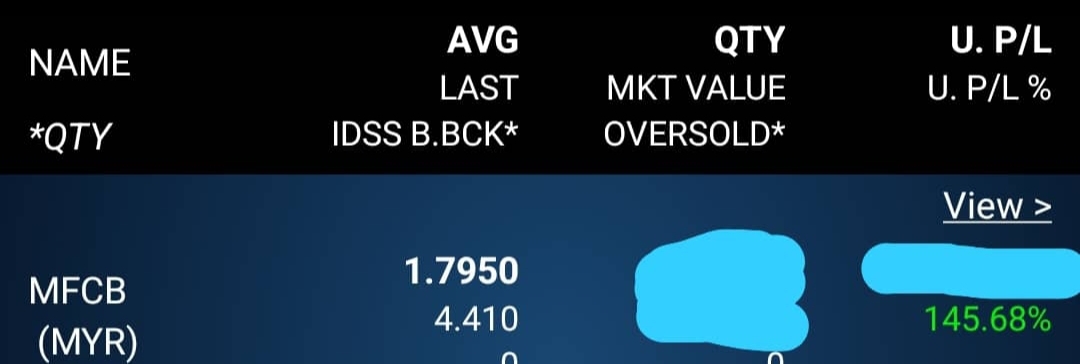

Detail M5: MFCB CAGR calc based on closing price as at 3rd April 2024.

Detail M6: My average investment price as at 3rd April 2024. With reinvestment, the increase will be quite substantial??

Conclusion: MFCB paying very good Dividend and the value of adjustment for each Dividend paid recovered quite substantially. Reinvestment of Dividend most likely a good strategy for growth Stocks, as seen in the calc...

Disclaimer: This is NOT a buy, hold or sell recommendation. Happy Trading and TradeAtYourOwnRisk

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

“calvintaneng

INSAS OK LAH

TRAP IS GOOD LIKE BEAR GO CAVE HIBERNATE

LATER COME OUT STRONG STRONG HOR…”

Hi Uncle calvintaneng, welcome to my blog, but please promote Palm Oil somewhere else, as you are like honey to the bee's, and attracting the mouse to your Palm Oil promotion…no offense intended. Tq

Note: I am very much interested in Southern Johore properties investment; might learn something from you. I almost moved my base to near JB second link, near Tuas, Pekan Nanas, Pasir Gudang or Mount Austin/Ulu Tiram area before the C19 strike..

2024-02-26 12:17

Eventually one day people who holds zero cost portion of Insas will get tired seeing that Insas share price is flattish. Then one by one start selling resulting in a waterfall.

2024-02-26 14:18

Yes eventually everyone will just hold 0NE (1.0) share waiting to sell at RM 60.

2024-02-26 14:27

To a person who holds zero cost portion selling 100,000 shares of Insas at average price of say, RM1.18 means a profit of around RM118,000.

2024-02-26 14:28

Even a person who holds zero cost portion selling 100,000 shares of Insas at 1.10 makes a gain of RM110,000.

2024-02-28 10:19

What Is a Value Trap?

A value trap is a stock or other investment that appears attractively priced because it has been trading at low valuation metrics, such as price to earnings (P/E), price to cash flow (P/CF), or price to book value (P/B) for an extended period.

2024-02-29 16:05

A value trap persuades investors because the trade appears inexpensive relative to historical valuation multiples of the stock, industry peers, or the prevailing market multiple. A value trap can drop further after an investor buys into the company.

KEY TAKEAWAYS

Value traps are misleading investments trading at low levels that present buying opportunities for investors.

For a value trap investment, the low price is often accompanied by extended periods of low multiples.

2024-02-29 16:05

Posted by godhand > 1 hour ago | Report Abuse

If you make a decision based on your statement above to decide and demand me to say I have been wrong whether Insas a value trap or not, that is your prerogative, and I respect your opinion. My point of view is just different from you as I looked at a whole lot of different things, all in the article itself.

Do you expect everyone thinks the same?

what is your definition of value from the perspective of a minority shareholder.

Lets put it this way. as a minority shareholder what is your certainty? I'm not going to say that Insas is a trap but it simply lack the certainty. It also could be the nature of their business that they have to hoard the cash and re-invest. What guarantee the minority that they can have the piece of cake? I think whatever the author say here is irrelevant. what is more important is the direction and promise that the this company made and deliver in stages to the shareholders

2024-02-29 16:20

Posted by xiaoeh > 0 seconds ago | Report Abuse

both of you are talking the same topic but in different forum

TheContrarian & Godhand

2024-02-29 16:20

Insas still looks like value trap to me... there are other better stocks to pick than Insas until they change mgt.

2024-02-29 18:43

"TheContrarian

Even a person who holds zero cost portion selling 100,000 shares of Insas at 1.10 makes a gain of RM110,000."

Correct ³, in addition getting 2.5sen dividend over the zero cost portion; how can it be "value trap"?

Let's compare latest Quarter report:

Basic earnings/(loss) per share (Subunit)

Q23Dec of 3.61 vs Q22Dec 7.20 and Cumulative QPE23 of 6.59 vs QPE22 9.71; is 2.5% dividend justifiable as value trap?

Therefore, another question in addition of questions raised earlier,

Is the last quarter with decreasing EPS over quarters (Q) and Cumulative Quarters PE (CQPE), yet giving same dividend considered a value trap? or

(Questions raised earlier)

Is the share price below NTA for a long period considered a value trap? or

Is the NTA moving up over the years at a greater rate than the share price considered a value trap? or

Is the share price moving up at a greater rate than NTA, can it be considered no longer a value trap? or

Edited: lately (NTA of increment of 3.57-3.56=0.01 vs price up by over 30sen from this YE Quarter reporting) moved out from 'value trap'??

My Conclusion: At different timing and reporting, there are many factors to consider such as NTA, EPS, ROI, etc to conclude is it a 'value trap' or not; that's make share investing interesting.

Happy Trading and TradeAtYourOwnRisk

2024-02-29 23:29

Nothing to argue whether Insas is a value trap or not a value trap stock. As long as you can make money from your investment in Insas then Insas is a good stock.

2024-03-01 08:19

“Posted by Sslee >

Nothing to argue whether Insas is a value trap…”

Yes, agreed. Very good discussion, and achieved the intention of my write-up; i.e. bringing out a balanced view of Insas investment. I will let the profit (dividend+capital gain if any) run, as if sold, nothing to get my interest in Insas forum..tq

2024-03-01 08:48

Insas, a name that whispers promise,

A value play, some investors entice.

But hold, dear friend, before you take the bait,

This siren song may lead to a bitter fate.

The price sits low, a number that enthralls,

A hidden gem, a bargain for all.

Yet stagnant waters, though alluring to the eye,

May hold unseen depths, where dreams can die.

Years tick by, the share price barely moves,

While others soar, a tale the market proves.

Is it a value, or a value trap so deep?

Where hopes descend, and fortunes fall asleep.

Think twice, dear friend, before you invest your trust,

In promises whispered, turning into dust.

For in the market's dance, a truth is plain to see,

Not all that glitters, is a golden jubilee.

2024-03-05 21:42

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

Define a value trap in share investing

ChatGPT

A value trap in share investing refers to a situation where a stock appears to be undervalued based on traditional financial metrics such as low price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, or dividend yield. Investors may be attracted to these seemingly cheap valuations, hoping for potential future gains as the market corrects and recognizes the stock's true value.

However, the danger of a value trap lies in the fact that the stock may be cheap for a reason. The company might be facing fundamental problems, such as declining revenues, poor management, industry headwinds, or an outdated business model. Despite the apparent value, these issues can prevent the stock from recovering or experiencing the expected growth, leading to a prolonged period of underperformance or even permanent loss of capital for investors.

Investors need to be cautious and conduct thorough research to distinguish between genuinely undervalued stocks with strong fundamentals and those that are value traps. Simply relying on low valuation metrics without understanding the underlying reasons for the low valuation can expose investors to significant risks. Due diligence, analysis of the company's financial health, competitive position, and future prospects are essential to avoid falling into the trap of investing in a stock that may not deliver the expected returns.

2024-03-06 08:10

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

Main difference between an undervalued stock and a value trap is:

one is a genuinely undervalued stocks with strong fundamentals and the other is not; it is valued low for a reason (a value trap).

Accordingly, a stock is trading at a low PE and maybe appropriately priced or even a value trap. Still has to do a lot of analysis of its quality, management and fundamentals.

2024-03-06 08:16

Did any one know for the past 10 years Insas NAPS grow at CAGR of 7.72%?

https://klse.i3investor.com/servlets/stk/fin/3379.jsp?type=last10fy

2024-03-06 08:21

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

User

How do value traps unfold to deliver value eventually

ChatGPT

A value trap may eventually deliver value if certain conditions change, leading to a positive reevaluation of the company by the market. Here are some scenarios in which a value trap might unfold to deliver value:

Operational Turnaround:

If the company successfully implements strategic initiatives to improve its operations, cut costs, or innovate its products and services, it could lead to improved financial performance. Investors may recognize these positive changes, causing the stock price to rise.

Industry Rebound:

If the industry in which the company operates experiences a turnaround or a period of growth, the company's fortunes may improve. A broader industry recovery can positively impact even struggling companies within that sector.

New Leadership:

A change in leadership, particularly if it brings in experienced and effective executives, can lead to a revitalization of the company. Strong management can implement new strategies, improve efficiency, and restore investor confidence.

Market Recognition of Undervaluation:

Sometimes, the market may eventually recognize the undervaluation of a stock. As more investors become aware of the discrepancy between the stock's price and its intrinsic value, demand for the stock may increase, driving up its price.

Resolution of Temporary Issues:

If the company is facing temporary challenges, such as legal issues, regulatory hurdles, or short-term economic difficulties, a resolution of these issues can pave the way for the stock to rebound.

Strategic Partnerships or Acquisitions:

Strategic partnerships, mergers, or acquisitions that enhance the company's competitiveness and market position can contribute to a positive reevaluation by investors. Such moves may improve growth prospects and overall business stability.

Positive Earnings Surprises:

If the company consistently outperforms market expectations and delivers positive earnings surprises, investor sentiment may shift, leading to increased confidence in the company's ability to generate value.

Market Rotation or Trends:

Changes in market trends or investor preferences can lead to a rotation into previously overlooked sectors or stocks. If the market starts favoring value stocks, the stock that was once considered a value trap may attract renewed interest.

Share Buybacks or Dividend Initiatives:

Companies using excess cash to repurchase shares or initiate dividend payments may signal confidence in their future prospects. These shareholder-friendly actions can attract investors and contribute to stock price appreciation.

Macroeconomic Factors:

Improvements in macroeconomic conditions, such as interest rate changes, economic growth, or regulatory shifts, can positively impact a company's outlook and contribute to a reevaluation by the market.

It's important to note that not all value traps eventually deliver value, and investing always involves risks. Thorough research and ongoing monitoring of the company and its industry are essential to identify any positive developments or changes that may contribute to a turnaround. Investors should remain vigilant and adapt their strategies based on evolving market conditions and company fundamentals.

2024-03-06 08:23

I think human is doomed as ChatGPT already taking over the thinking process from human.

Mind ask ChatGPT is insas an undervalued stock or a value trap?

2024-03-06 08:33

Please also ask "if majority holders control 51% of a company, how to break out of value trap? Tq

2024-03-06 08:39

Insas controlling shareholders Dato' Sri Thong and PAC officially only hold 32.96%.

Thus Insas cannot do SBB and controlling shareholders cannot buy Insas without trigger the MGO threshold of 33%

2024-03-06 08:46

Reading the report is just one small part of factor in determining a company valuation.

2024-03-06 08:49

Because of controlling shareholders officially only hold 32.96% hence on and off rumour of someone making a hostile take over will cause share price to spike up.

2024-03-06 08:55

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

>>>

BLee Please also ask "if majority holders control 51% of a company, how to break out of value trap? Tq

06/03/2024 8:39 AM

>>>

Yes. Many Malaysian companies are controlled by families. The rewards to the minority shareholders are dependent on the generosity and thinking of the major controlling shareholders.

Some examples: KSL did not pay dividends, though profitable. However, development and construction company are best avoided, as it is difficult to value such company. Also, difficult to track its true accounts.

SAB is another. It pays dividends but has not increased its dividends for many years. Its NTA continues to grow due to retained earnings. It is undervalued, an asset play and also I suppose, if you wish to get your reward quickly, a value trap. :-)

There are many companies in the same category. In past, Juan Kuang paid little dividend, kept most of the retained earnings in the company, the directors enjoy good remunerations and perks, and at the appropriate time, the company was taken private for a song. The minority shareholders did not benefit from the good fortune of this company. Thus, it was appropriately priced at very low valuation in the stock market at that time. (I do not own this stock, but know the history.)

2024-03-06 08:59

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

>>>

In past, Juan Kuang paid little dividend, kept most of the retained earnings in the company, the directors enjoy good remunerations and perks, and at the appropriate time, the company was taken private for a song. The minority shareholders did not benefit from the good fortune of this company. Thus, it was appropriately priced at very low valuation in the stock market at that time. (I do not own this stock, but know the history.)

>>>

Previous listed and taken private many years ago, Juan Kuang is a very good past example of a value trap stock. It was profitable, the company grew its equity yearly through continuous retained earnings, it distributed pittance dividends (if at all?), its valuation was by various measures "cheap" (*low PE, low P/BV, DY relatively high*) and finally it was taken private at a small premium to its very low market price.

Those who invested into Juan Kuang hoping for its price to climbed closing the price to book value gap were all disappointed.

2024-03-06 09:10

I think the term 'value trap' is not accurate or so called book value is irrelevant in most cases. Rather can you trust the management integrity. We are investing into human not books

2024-03-06 09:18

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

Was KAF a value trap when it was listed?

This company was taken private by its major shareholders a few years back at ?2.80 per share.

For a very long time, it was trading at a price of 1.50 per share. For this, you obtained a regular dividend equivalent to 5% yield, well above the risk free fixed deposit rate at that time.

For those who knew the assets within this company, it possessed a valuable piece of land in the KLCC area, which was not re-valued. Of course, this real estate got more and more valuable each year.

Those who bought into this company, which was "undervalued" based on its assets was at least able to console themselves that they received regular dividend incomes equivalent to 5% annually.

Nothing moved for years and decades. One fine day, the major shareholders (Khatijah & Friends) made an offer to take the company private. Those who had this share were thus rewarded for their patience. And yes, a lot of patience indeed. Yet, can one be certain that the investment will play out according to your book?

I have this stock since its listing and when it was taken private, it was a 5x + multibagger, excluding the dividends.

2024-03-06 09:18

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

Oriental Holdings

.

Is this another value trap? It is undervalued, no doubt.

It holds valuable asset. Possibly, asset play.

However, it is not growing its business. Where are the growth areas?

It pays dividends. Its dividends have increased yearly.

Its DPO ratio is low and it retained most of its earnings at low ROE.

Will you be willing to hold this stock with a low dividend income and no good growth prospects for the short and medium term?

What will unlock the full value of this stock .. and when?

2024-03-06 09:51

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

When a undervalued company with good fundamentals become value trap?

Benjamin Graham, the father of value investing, specialised in this group of stocks. He has a check list to select these stocks. His advice is to buy a group of them, and based on probability, the outcome of the group will be a positive, though at an individual stock level, this maybe unpredictable. (This approach is unlike that of Buffett, another value investor.)

According to Benjamin Graham, he observed these stocks and locked in the profits through selling when the prices crept upwards towards its "intrinsic value". Those undervalued stocks that did not "perform" by the end of 2 years, he sold. There is an opportunity cost for holding onto underperformers or poor performers for too long.

The approach of Buffett was different. He identified a severely undervalued stock. He bought a lot of it. Then he became an activist to get the management to take actions to realise the full value of the stock. He even got into the board of director of the company to influence the management. Then he cashed out with his profits.

2024-03-06 10:08

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

The classic most well known value trap company is Berkshire Hathaway.

Buffett acquired BH as he assessed it to be very undervalued. It was in the textile mill business which was in a long period of decline. Its assets were depreciating. To update its manufacturing facilities, it required injection of much needed new capital. Yet, these new capital did not achieve any returns, probably negative returns. He was forced to restructure his business, closing down plants, retrenching workers and not putting new capital into existing business. Competition was fierce from international companies which had lower cost advantage.

BH was indeed a classic value trap. It was comforting to know that even Buffett was not infallable.

Eventually, he restructured BH to be what it is today, a totally different company from the time he bought it.

2024-03-06 10:24

“Posted by Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)

BLee: Please also ask "if majority holders control 51% of a company, how to break out of the value trap?” Tq

06/03/2024 8:39 AM

>>>...and at the appropriate time, the company was taken private for a song.”

Agreed. I have had invested in Brem before taken private; making a small loss excluding dividend and bonus. It might just be a myth that taking private is good??

Another subject; why Insas doing RPS every five years?

My take: Interest for RPS lower than borrow $ from financial institutions and RPS/Warrants could be an instrument for protecting any take-over at a very low cost?? Any good discussion is welcome.

Happy Trading and TradeAtYourOwnRisk

2024-03-06 15:46

If after paying for shares of a valued company the price stays flat or drift down for months/years then you have fallen into a value trap.

2024-03-06 20:02

Thanks to a contributor at i3 forum, who highlighted a good read as in the link below, able to give me a new insight of ‘value trap’ and partly answering my article questions…

https://www.thestar.com.my/business/business-news/2024/01/29/beware-the-value-trap

Happy Trading in the coming weeks.

2024-03-10 10:17

RI of RPS with free warrants is to reward the shareholders who take up the RI.

And at the same time for controlling shareholder Dato' Sri Thong to hold warrants to safeguard his interest incase of a hostile takeover.

2024-03-10 10:40

@MrSslee, main purpose is to safeguard Ah Thong's interest from hostile takeover.

2024-03-10 11:20

Did Ah Thong sell any of his Insas-WA and Insas-WB previously before they expired?

2024-03-10 11:22

“So 2 times RI raise funding ard RM 260 million .. no wonder so Rich .. Another RI fund raising exercise by 2026 ke …

No worries still can issue RI many times looking at the present NOSH …”

There is some misconception of RPS vs Insas Company WC vs Call Warrant (CW).

Abbreviation R in RPS stands for Redeemable which means upon maturity, Insas needs to pay the holders the face value. Instead of taking $ from the coffer, new RPS issued to pay for the redemption; no addition of capital.

For Company Insas-WC, there is no Redeemable but Convertible whereas Call Warrant Cx, example Insas-CA,CB,CC cannot be converted as NOT issued by the Company’s. Market maker only for Call Warrant so that CW issuer will reduce the risk for any fluctuation of counter prices..chances the issuer losing money is minimized as they freely ‘play’ the market..

This is my own understanding of this topic, any critique is welcome.

2024-03-10 11:53

One paragraph at the Star article:

“While it may make some sense to buy such stocks, a “cheap” stock can also mean a value trap, meaning it is merely masquerading as a compelling buy.”

Is Insas “masquerading”?? Can it become another topic? Insas can be cash rich, so is all the bank, as all the cash is tied to depositors and ‘paper money’ in the form of bank guarantee??

Although I am a long term Insas investor, I always keep an open mind and look the other ways..Happy Trading

2024-03-10 12:13

as the big bosses enjoy fat salary do little to reward shareholders appropriately . for 15 years below 1 rgt mostly while out up war at conversion of 90 sen -1.00 . can’t they set it at 60 sen ?

2024-03-10 16:39

I think more to this statement in the same article: "Such heavy control tends to leave little freedom for investors to have any say in the goings-on of a chaebol, thus making them unpalatable investments." and recently, "could start with a corporate exercise to jolt their shares from slumber, attract some interest and allow some of the tired, trapped investors to exit after what seems like a lifetime." Interesting, is it??

Can't they set it at 60 sen? Yes, can. Then the NTA will come down drastically with RPS and Insas-WC fully converted using RPS face value of MYR1 together with 1 WC; balance of 40 sen will be returned. What is the point of this RPS exercise?

The conversion details extracted below:

"The difference between the exercise price of the Warrants (or the adjusted exercise price of the Warrants in accordance with the terms and provisions of the Deed Poll, as the case may be) and the issue price of the Rights RPS shall be repaid by the Company within 1 month from the date the Warrant holder exercising his Warrant".

2024-03-10 19:24

Good Morning, ytd updated my article with the following topic during the day off:

“Update today date: 28 March 2024, on below topic:

"Insas: Comparison of Dividend vs NAPS 30/6/2014 RM 1.728 to 30/6/2023 RM3.375 a CAGR of 7.72%.

Question: What is the return for Insas Principal plus Dividend for the last 10 years vs NAPS 30/6/2014 RM 1.728 to 30/6/2023 RM3.375 a CAGR of 7.72%?”

The results of my calc are:

Scenario 1: At initial cost of RM6k over 50sen price, the CAGR calculated to be 12.2992%.

Scenario 2: At initial cost of RM6k over 60sen price, the CAGR calculated to be 10.1342%.

The capital increase for both scenarios are quite satisfactory, at least more than 2 fold increase based on this year's max price of above RM1.30.

Happy Trading and TradeAtYourOwnRisk.

2024-03-29 06:36

2018 is the year I attended Insas AGM where I reason with Dato Sri Thong controlling shareholder CEO for hours that a 1 sen dividend is unreasonable, unfair and unacceptable. Dato Dr. Tan try to come to Dato' Sri Thong rescue and that cost him many vote against his reelection as director.

Note: Dato Dr. Tan aguement is if you want dividend then invest in Inari. On hindsight I should have listen to his advise.

The next year new CEO Dato' Wong increase the dividend to 2 sen and ever since then every AGM I reasons with Dato Wing to increase the dividend.

2024-03-29 08:39

I still keep some of my Insas because I believe one fine day I should be able to sell my Insas at my TP of RM 1.50

2024-03-29 08:50

“speakup >

you guys still in Insas? OMG! 😱”

Why not, considering the CAGR of more than 10% and 2 to 4 fold of capital increase over a 10 years period. Only caution, past performance NOT necessary future trend.

The update yesterday just to analyze am I right to hold my investment for so many years against another investor of getting 4 fold capital gain.

Another point, my initial investment of around RM0.50 will be roughly equivalent to a 5% dividend of declared 2.5% per share, i.e. low price will get more shares as dividends are based on quantity of shares. Sorry for the long-winded as I would like to give a clearer picture. Tq

2024-03-29 09:17

Article updated to include MFCB as a comparison with the title "Insas vs MFCB: Both having a good Meteoric Rise this 1Q2024" after MFCB showing a 'breakout' recently...

2024-04-03 22:59

calvintaneng

INSAS OK LAH

TRAP IS GOOD LIKE BEAR GO CAVE HIBERNATE

LATER COME OUT STRONG STRONG HOR

NOW SEE

https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2023-07-10-story-h-246422030-A_LOOK_AT_DIVIDEND_PERFORMANCE_BETWEEN_PALM_OIL_BANKS_Calvin_Tan

2024-02-26 11:45