AGES-PA: Where is the money?

BLee

Publish date: Thu, 22 Jul 2021, 08:33 PM

Please excuse me if I have make any mistake as I am a non-Accountant trying to dissect the cash flow from AGES-PA conversion to Mother shares. I am publishing this article as part of my continuation (similar topic on 'Focus-PA: Where is the money?' link: https://klse.i3investor.com/m/blog/BLee_AGES/2021-07-03-story-h1567802175-Focus_PA_Where_is_the_money.jsp ) of studies on my ICPS investment. For information, I am holding AGES-PA and AGES mother shares; both in negative territories.

The AGES ICPS Rights Issue details..

i. Issuance of new irredeemable convertible preference shares in Ageson Berhad (formerly known as Prinsiptek Corporation Berhad) ("Ageson") ("ICPS") to the entitled shareholders of Ageson pursuant to the renounceable rights issue of 3,860,754,392 new ICPS on the basis of 13 ICPS for every 1 existing ordinary share in Ageson held as at 5.00 p.m. on Wednesday, 19 February 2020 at an issue price of RM0.01 per ICPS; and

ii. Issuance of 750,000,000 ICPS to Daya Intelek Usahasama Sdn Bhd for the acquisition by Prinsiptek Properties Sdn Bhd, a wholly-owned subsidiary company of Ageson, of a parcel of development land measuring 7,395 square metres identified as Lot No. PT 129 held under Title No. H.S.(D) 18991, Section 1, Town of Batu Ferringi, District of Timor Laut, Pulau Pinang for a purchase consideration of RM57.00 million to be satisfied via combination of RM49.50 million in cash and RM7.50 million in issuance and allotment of 750,000,000 ICPS at an issue price of RM0.01 per ICPS

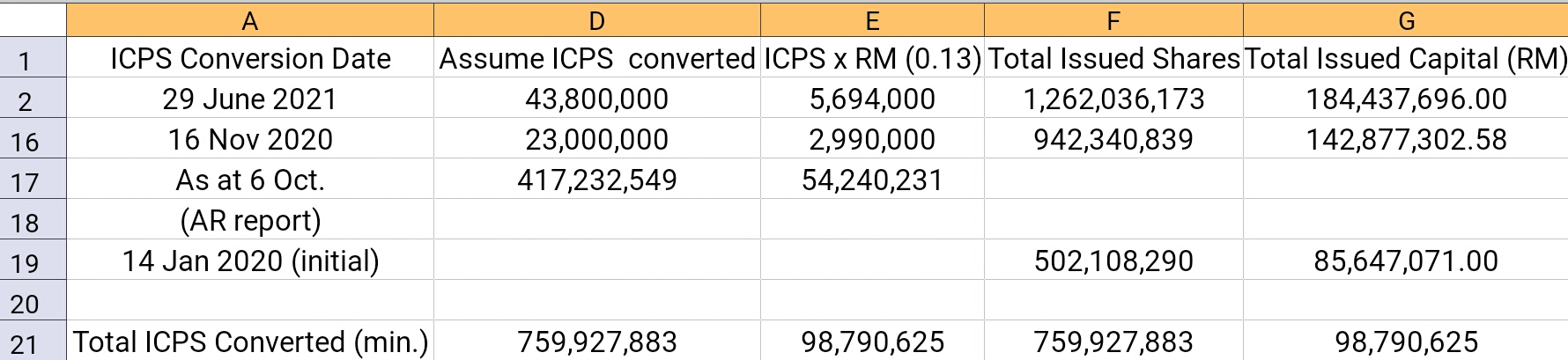

Detail 1: The First conversion dated 5 May., 2020

- Believed conversion based on 1 ICPS plus 12 sen cash for 1 mother share.

Detail 2: The conversion dated 30 June, 2021

- Believed conversion based on 1 ICPS plus 12 sen for 1 mother share.

Detail 3: Summary of the conversion

- My calculated cash collection: RM98.79 million

- Total ICPS shares converted equal increased in issued shares. Therefore, the assumption of 1 ICPS plus 12 sen cash converted for each mother share is correct.

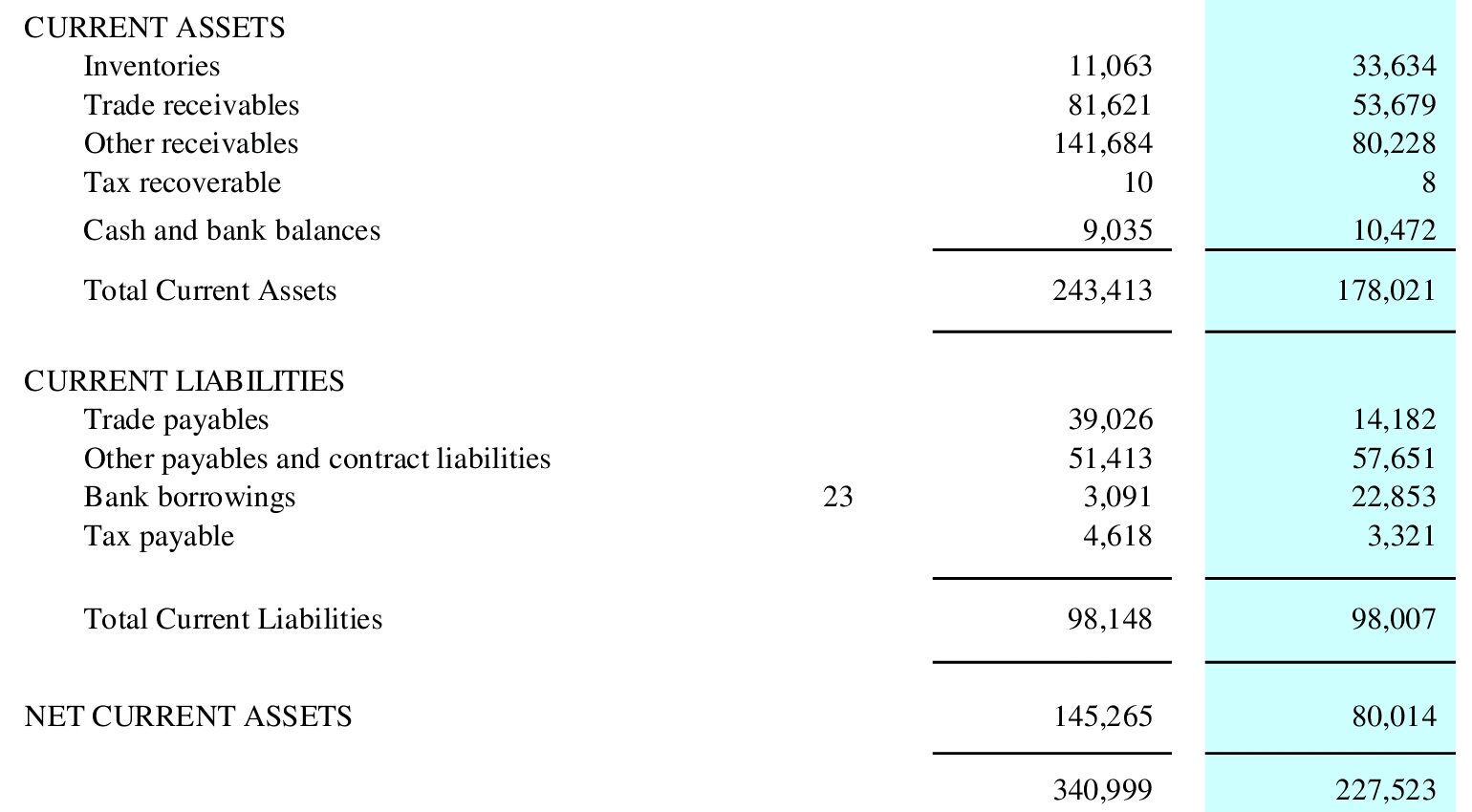

Detail 4: Last Quarter Current Assets

- Increased from RM 80million to RM 145million..

- Red flag? Very high receivables..

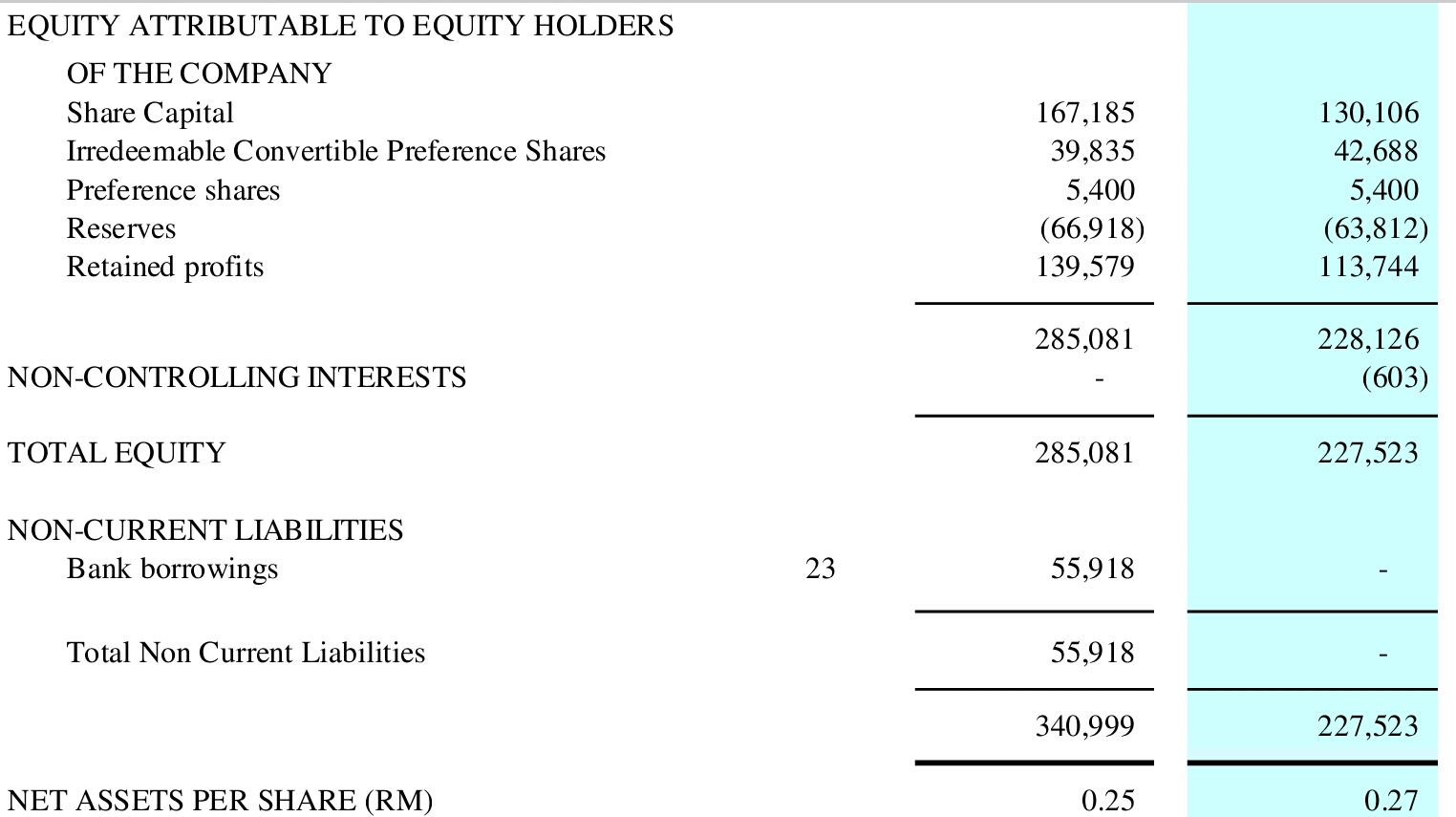

Detail 5: Equity Details

- Net Assets per shares reduced from 0.27 to 0.25 mainly due to ICPS conversion??

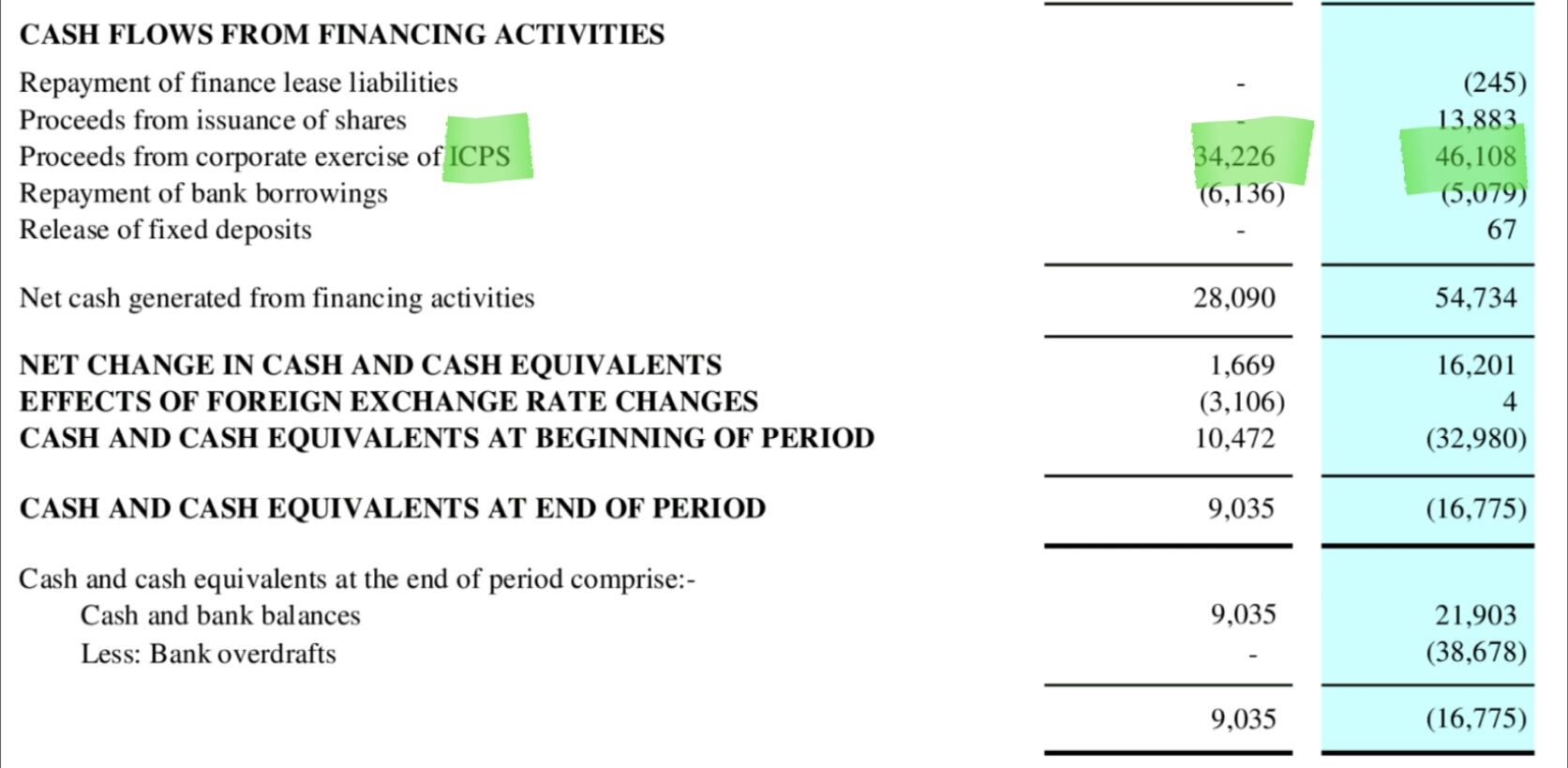

Detail 6: Cash flow from financial activities

- Noticed that ICPS has had improved the cash flow from previous year.

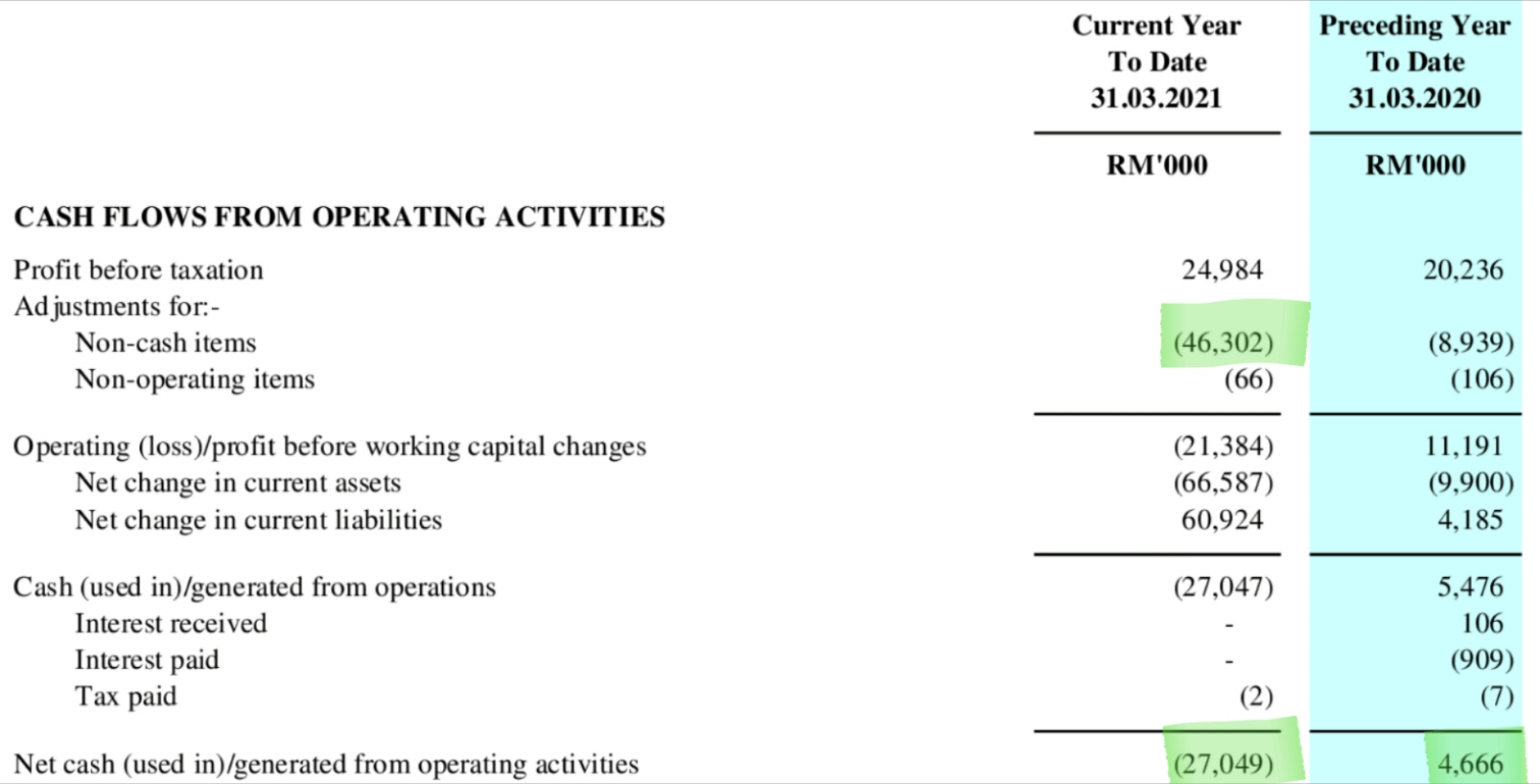

Detail 7: Cash flow from operating activities

- Red flag? High adjustment for non-cash items?

Detail 8: Group borrowings

- Loan restructered? Overdraft converted to Term Loan?

Sources of Details: KLSE Screener

My conclusion: Out of the RM98.79 million cash converted as in detail 3, RM7.599 million ( 759.9M x 0.01) already accounted for in exchange of land in ICPS issuance. The balance could be seen in increase of current assets of RM65 million (RM145.265M At End Of Current period to date 31.03.2021 vs RM80.014M Preceding Year To Date 30.06.2020); not within full ICPS conversion period. Where is the rest of the money??

I am asking myself one silly question; how can I profit from ICULS issuance if I have already invested in both Ages-PA and Ages mother shares? Silly question will get a silly answer!!

My experience of EPCC (mainly on procurement) entails me to differentiate an apple (Ages ICPS) from an orange (Ages ICULS). The only different costing for both apple (13sen) and orange (most likely at 10 sen) are at two different timing. Definitely it is unfair for the oranges cost less than the apples in exchange for the same items (mother shares).

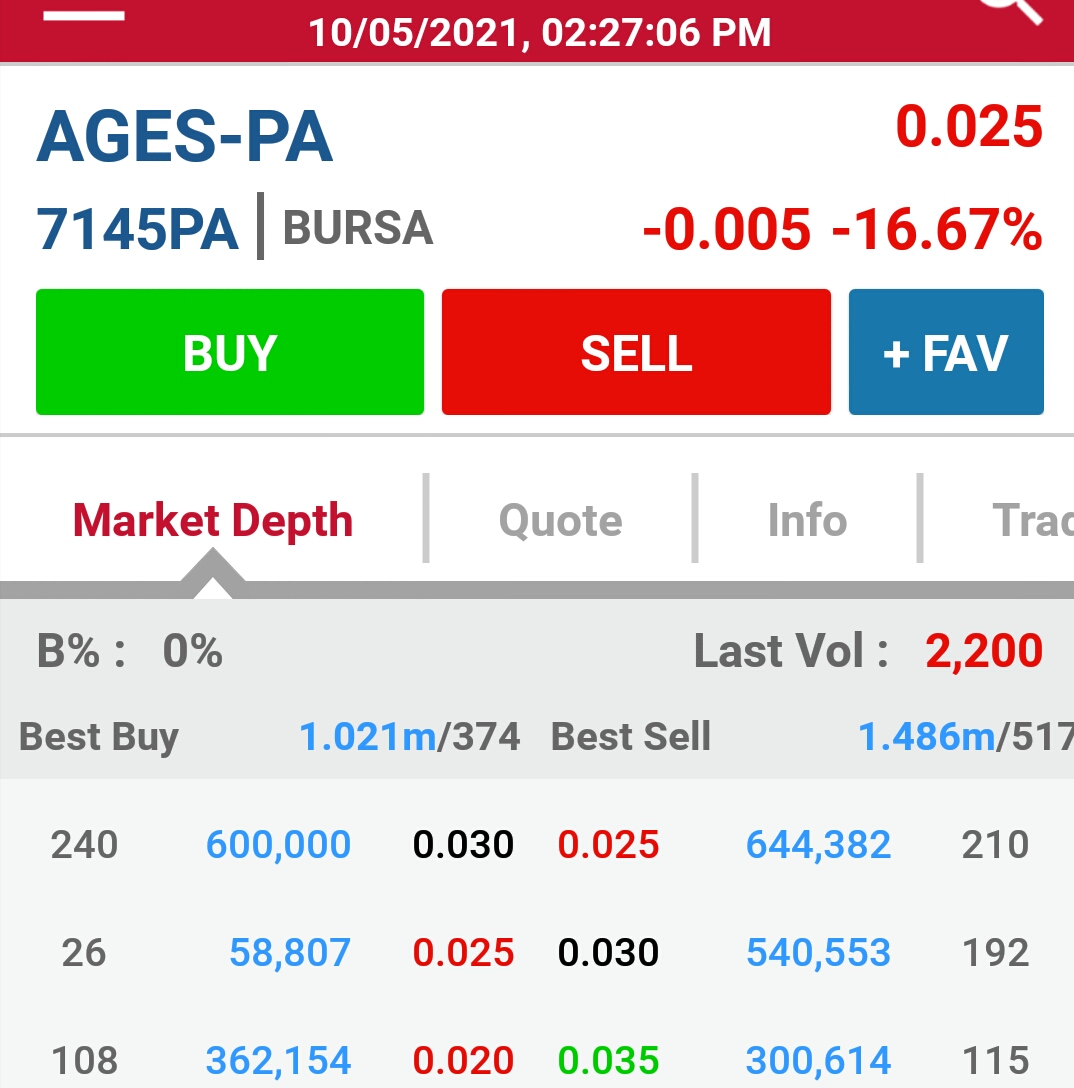

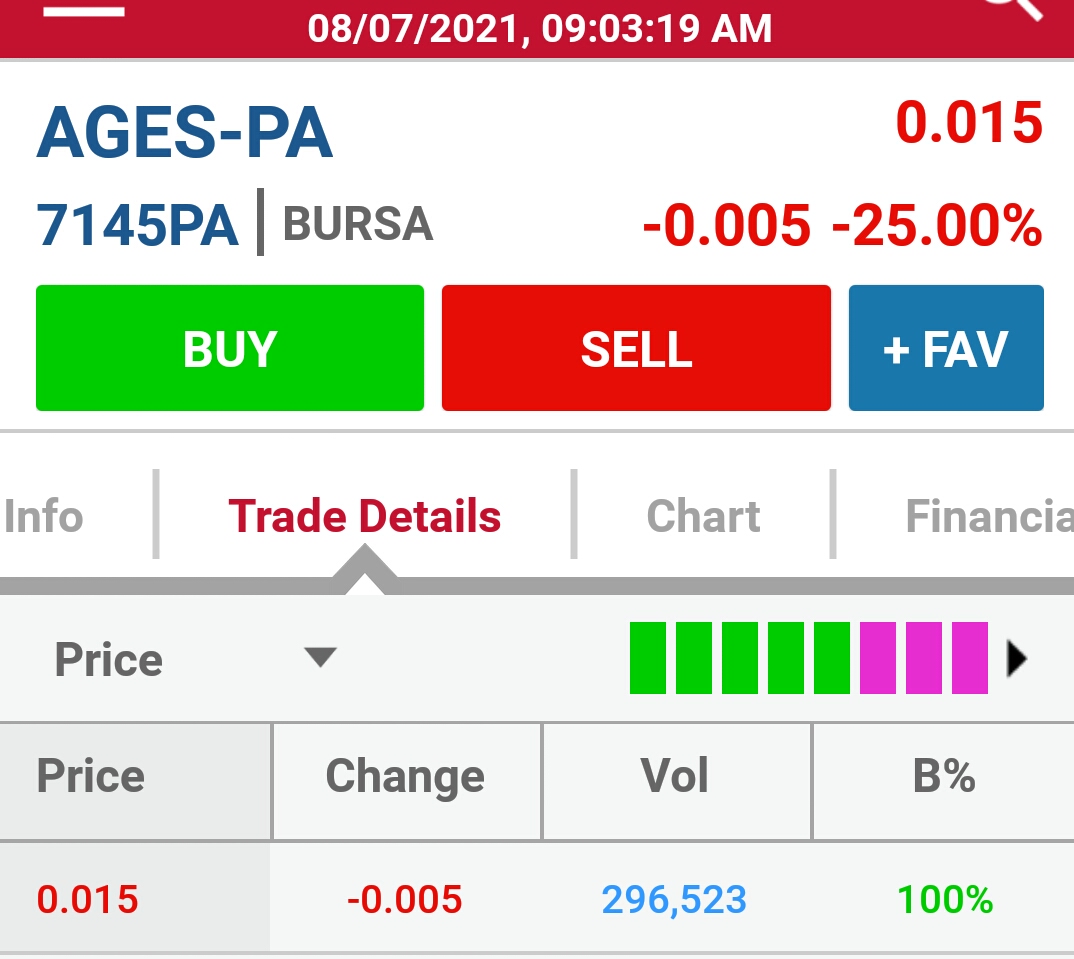

When news that ICULS proposal of 10 of 1 sen ICULS can be converted to 1 mother share; the prediction of mother share will drop from 13 sen to around 9.5 sen. Let says I have 60 million mother shares during price at 13 sen, I slowly release to the market and pocketed RM7.8 million. I used RM2.1 million to purchase 60 million Ages-PA shares at 2.5 sen (see detail 9) and another 29.6 million Ages-PA shares at 1.5 sen (see detail 10). Note: This details 9 and 10 are for illustration purposes; not traded by me. When mother shares drop to around 9.5 sen as per my prediction; I slowly collected back my 60 million shares with my balance of RM5.7 million. By this flipping, I gain around 89.6 million Ages-PA. Either I will convert this Ages-PA to mother shares for more ICULS entitlement or wait for Ages-PA conversion ratio/price adjustment. Moral of this story telling; rich will get richer, opportunity come once in awhile and stock market is NOT for the faint heart..

Detail 9: 60 million Ages-PA done after noon break..

Detail 10: 29.6 million Ages-PA done after morning 1st bell..

Happy Trading

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance

More articles on ICPS: It takes AGES to reach the Billion Shares Club

Created by BLee | Jan 01, 2023

Continuation of article on previous ICPS investment strategy.

Created by BLee | Mar 08, 2021