Focus Dyn., AJR, Insas: The myth of Ir (not IngenieuR) vs R of CPS

BLee

Publish date: Sun, 01 Jan 2023, 01:08 AM

It seems I cannot find any good write up comparing IrRedeemable Convertible Preference Shares (ICPS) and Redeemable Convertible Preference Shares (RCPS) of bursa type; therefore I will try my best to list down some of the differences.

Reference of comparison (without Convertible) of PS:

https://invyce.com/redeemable-and-irredeemable-preference-share/

Reference of RCPS:

https://www.theedgemarkets.com/article/know-redeemable-convertible-preference-shares-devil-details

1) The most important consideration will be is it an asset or liability in the balance sheet?

ICPS - due to IrRedeemable upon maturity, it should NOT be considered as a liability in the balance sheet, shown as Equity.

RCPS - due to Redeemable upon maturity, it can be considered as a liability in the balance sheet.

Source Ref: https://www.klsescreener.com/v2/financial-reports/view/704663

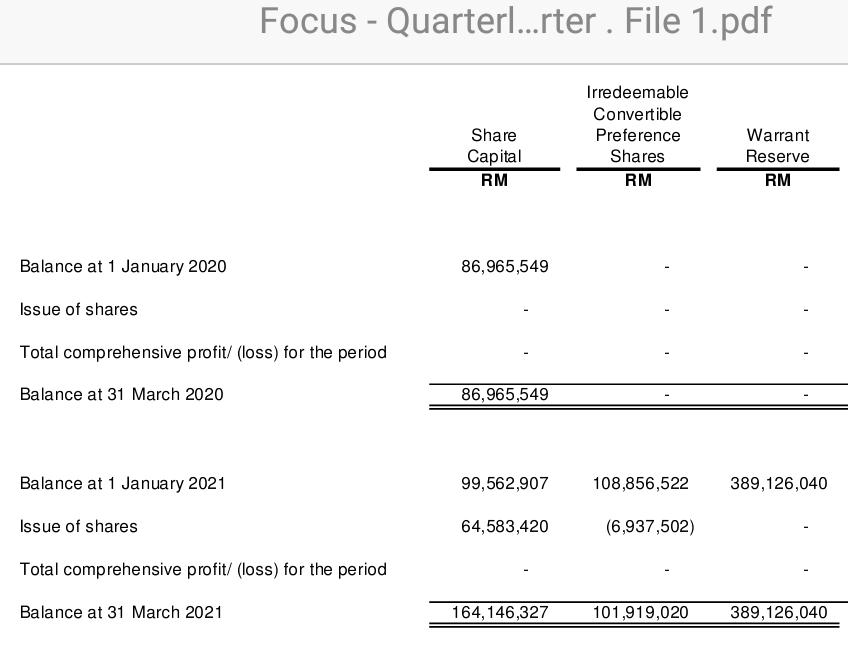

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2020

Snapshot 1: Focus Dyn. Dec. 2019 vs Dec. 2020 Equity ICPS account Entries

- RM109 million added in Dec. 2020 column vs Nil in Dec. 2019.

- Correspondingly accumulated losses of -RM419 million vs -RM47 million due to new warrant issuance (no free lunch and revert back after expiring or upon conversion?).

Source ref: https://www.klsescreener.com/v2/financial-reports/view/718827

Snapshot 2: Example of AJR RCPS account entries as Equity and Liabilities components

- looks more like a Liability than Equity?

Source ref: https://www.klsescreener.com/v2/financial-reports/view/718591

Snapshot 3: Example of Insas RPS account entry

- without the Convertible portion, will it be totally a Liability?

2) Will both instruments dilute the existing shares NTA upon issuance?

The answer shall be NO for both cases as no new Ordinary Share issued. The Cash received will be balanced off as equity or liability double entry?? (not sure as it differs in some cases?) EPS will be diluted as Preference Share will be part of the Total Shares in the calculation formula.

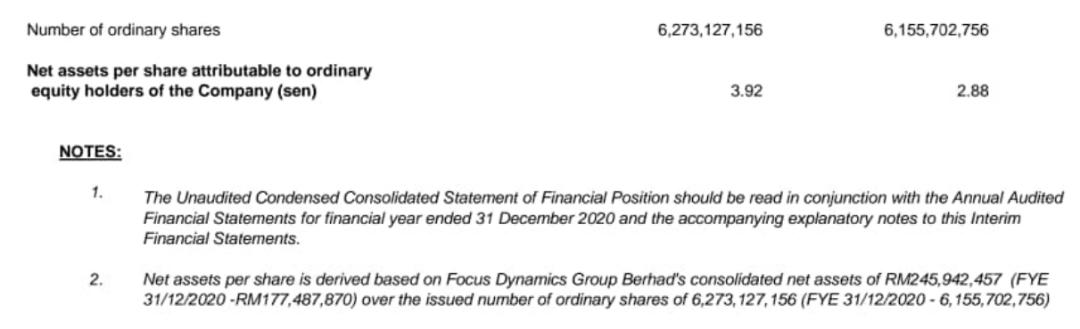

Snapshot 4: Focus Dyn. NTA increased slightly for the issuance period as there is a significant increase in Cash during the period.

- as in note 2, obviously NO NTA dilution. In this case NTA increased from 1.93 to 2.81 sen per share.

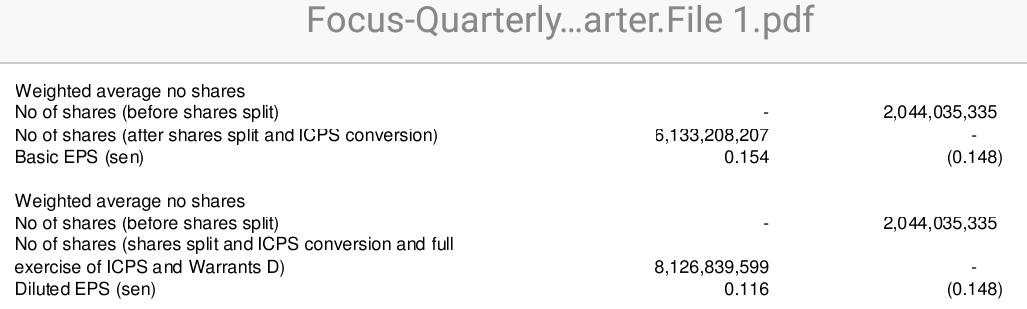

Snapshot 5: Focus Dyn. Dec. Qtr 2019 vs Dec. Qtr 2020 EPS

- EPS seems NOT a very good yardstick for share valuing as it can turn negative to positive and vice versa unpredictably.

Snapshot 6: Focus Dyn. Sept. Qtr 2021 vs Sept. Qtr 2022 EPS.

- The value of shares shall NOT be determined by just 1 Qtr. EPS as the value fluctuated due to many factors..examples profit gain from one off asset disposal or losses due to impairment.

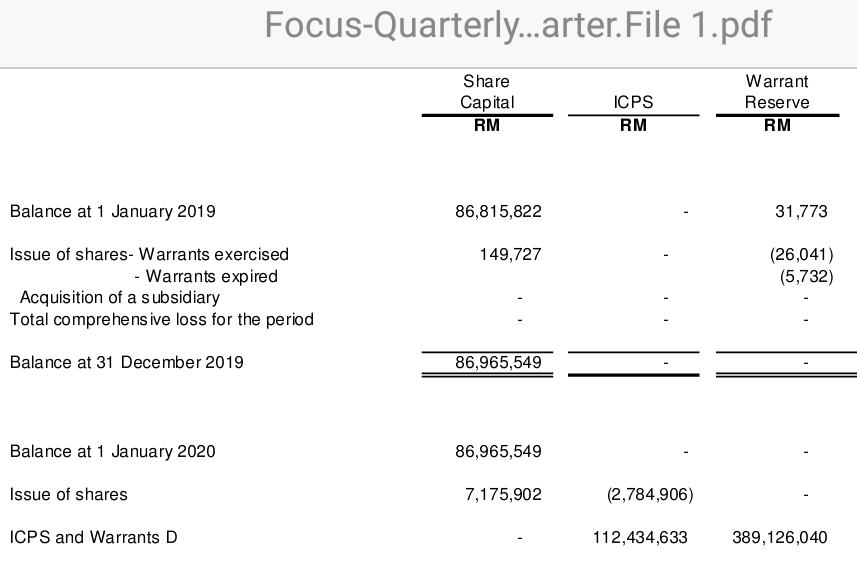

Snapshot 7: Focus Dyn. Changes of Equity from period Jan. 2019 to Dec. 2020

- Obvious Cash generation due to the ICPS issuance factor..

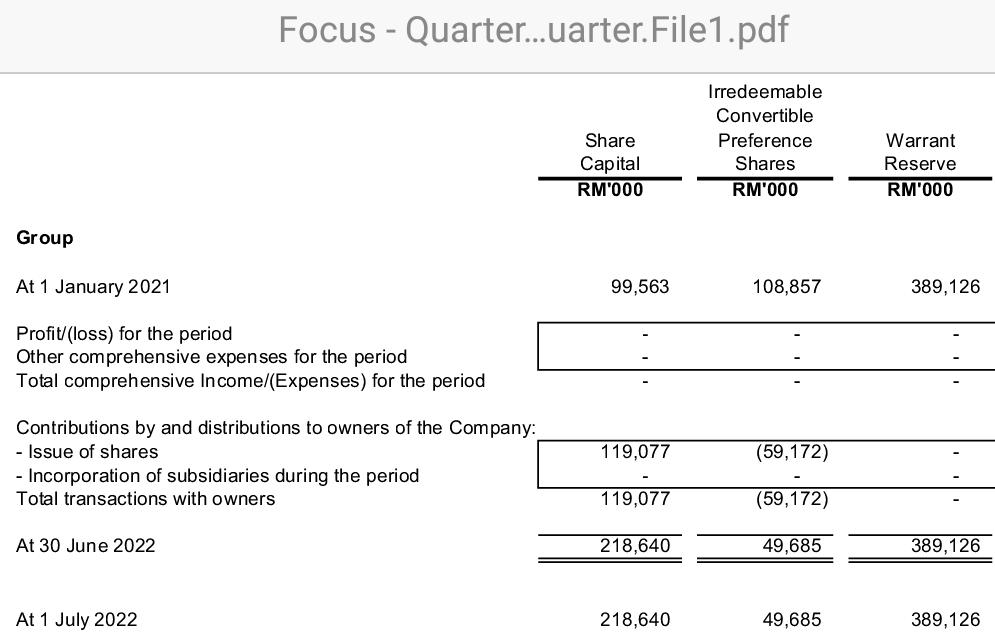

Snapshot 8: Focus Dyn. Changes of Equity from period Jan. 2021 to Jul. 2022

- Obvious Cash generation due to the ICPS conversion factor..

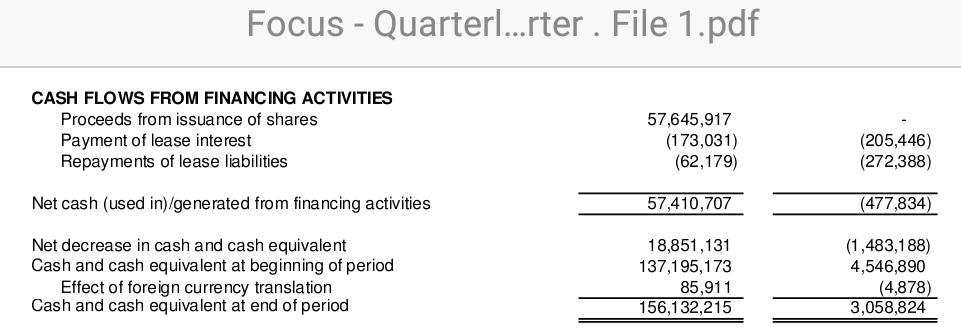

Snapshot 9: Focus Dyn. Cash flow changes for period Jan. 2019 to Dec. 2020

- Obvious Cash generation due to the ICPS issuance factor..

3) What happens for both cases if Converted to Ordinary Shares (OS) before Maturity?

The equity or liability Preference Share (PS) will be transferred as Ordinary Shares (OS). NTA Reverse Dilution or Dilution will depend on NTA above or below the Conversion Price. EPS will most likely be diluted due to the increase in Ordinary Shares.

Snapshot 10: Focus Dyn. for the Qtr Dec.2020 to Qtr Mar. 2021 shown a significant increased in Cash and Ordinary Shares (Share Capital) upon Conversion of ICPS

- Obvious Cash generation due to the ICPS conversion factor..

Snapshot 11: Focus Dyn. shown no dilution of NTA period ending Mar. 2021

- Obviously NO NTA dilution. In this case NTA increased from 2.88 to 3.92 sen per share.

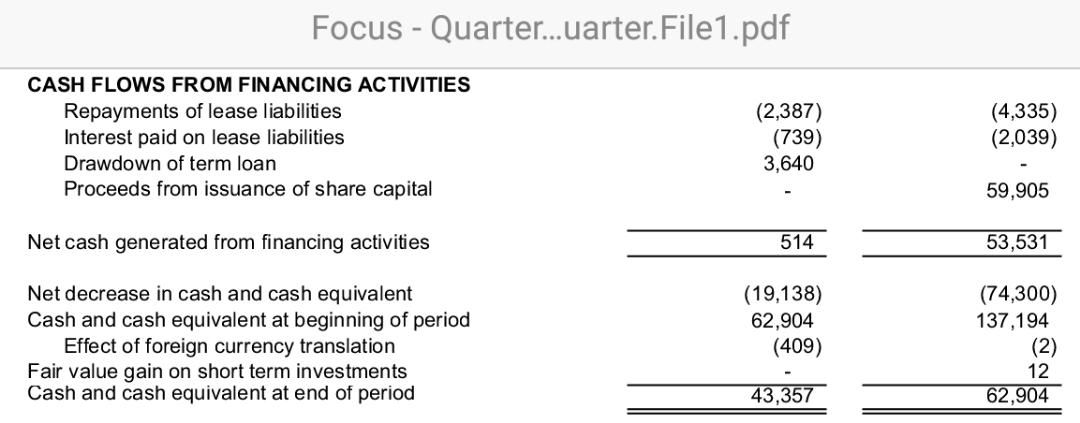

Snapshot 12: Focus Dyn. Cash flow changes for period Mar. 2019 to Mar. 2021

- Cash position ballooned to RM 137 million mainly due to RI of ICPS with free warrants

Snapshot 13: Focus Dyn. Cash flow changes for the period Jan.2021 to June 2022 (18 months) and July 2022 to Sept. 2022 (3 months)

- Still healthy Cash position of RM43.3 million

4) What happens to NTA upon ICPS Converted to Ordinary Shares (OS) on Maturity?

Effect will be as item 3. No snapshot as No example for any ICPS maturity..

5) What happens to NTA upon RCPS Redeem for Cash on Maturity?

Changes in NTA or EPS will be very minimal as NO change in Ordinary Shares and Liability vs Cash cancel off ignoring all the interest given out. No snapshot as No example for any ICPS maturity..

There might be other conditions which might have very minimal price movement upon conversion or maturity; it all depends on market conditions at the maturity timing.

- The risk of holding ICPS upon maturity will be the capital losses if the share market price is below the buying ICPS price.

- There is no risk for RCPS/RPS upon maturity as the capital invested will be cashed out plus the interest paid per annum throughout the invested period.

This article is my contribution to the New year 2023; hope it helps to understand what is the I, R, and C of the PS.. Happy New Year 2023 to ALL.

Disclaimer: The above article does not represent a recommendation for Holding, Buying or Selling any of above mentioned Financial Instruments; just a personal opinion and for sharing purposes only. Any offenses and errors are unintentional; my apology in advance.

More articles on ICPS: It takes AGES to reach the Billion Shares Club

Created by BLee | Mar 08, 2021

.png)