Focus-PA and Fintec-PA: Negative ICPS

BLee

Publish date: Sun, 12 Sep 2021, 05:15 PM

I have been highlighting the positive side of the one sen bargain of NOVAMSC-PA, AGES-PA, NI HSIN-PA and ARBB-PA in my blog titled AGES-PA: 12 Billion of 2.5sen bargain. To balance this topic; I would like to cover the negative side of this 'bargain'.

Unlike warrants which usually detach 'free' from some form of rights issue, ICPS has a subscription value. I termed this 'Negative ICPS' as ICPS trading below ICPS rights subscription value. When a trading instrument trades below the subscription value (discount), is it a 'bargain'? The answer will very much depend on the trading price of the mother shares. Below are examples of this Negative ICPS.

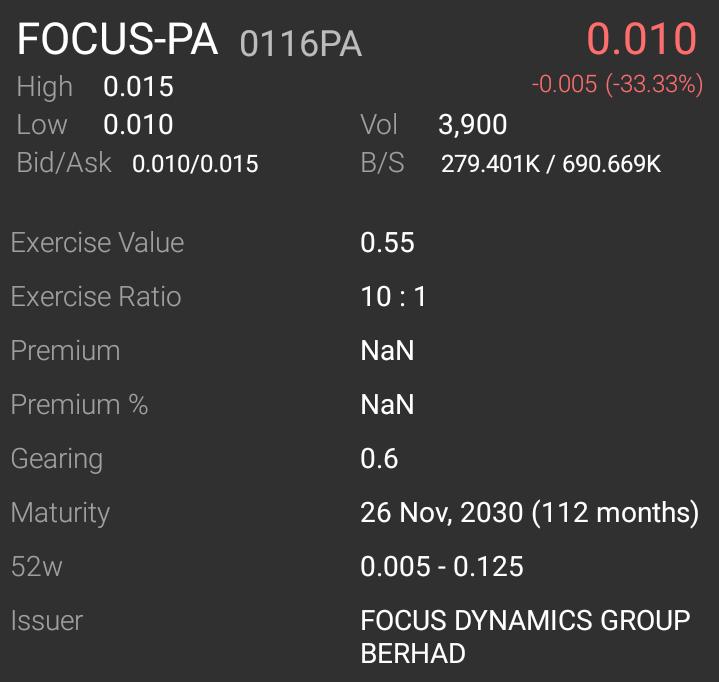

Example No. 1: Focus-PA

I have been widely covering Focus-PA in some of my write-ups in the i3 forum. In addition, below are the conversion details:-

Subscription price: 5.5sen

Conversion method No.1: 1 Focus-PA plus 49.5sen

Conversion method No.2: Combination of Focus-PAs plus balance of cash to the value of 55sen

Table No. 1: Details of Focus-PA as at 10th Sept. 2021

- Method No. 1 is out of money by (1+49.5) - 6 = 44.5sen

- Method No. 2 is out of money by (1x10) - 6 = 4sen

- The Gearing shown as the underlying mother price which is 6sen divided by (Focus-PA of 1sen x ratio of 10) = 0.6

In conclusion, the method No. 2 is still feasible as seen by recent climbing of mother share from 4sen to a high of 6.5sen.

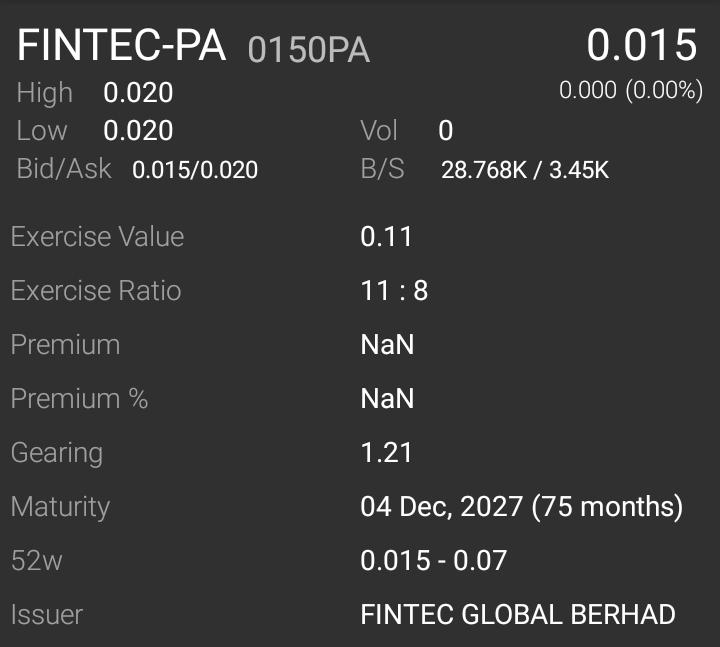

Example No. 2: Fintec-PA

I only invested in Fintec mother shares recently as the price came down to around 2sen which is almost equal to Fintec-PA long untraded price of 1.5sen. Another reason is the recent disclosure of all the average PP, ESOS and ICPS cost of 6.8sen as details in one of my Fintec forum posting below:-

"1) Fintec issued ESOS for 21 times. Issued 1,531,452,600 shares valued at RM80,168,603; highest 9.25sen and lowest at 2.5sen; average 5.2sen per share.

2) 4 May 2020 - issuance of 82,110,000 new Shares at an issue price of RM0.0361 per Share valued at RM2,964,171.

3) 15 July 2020 - issuance of 100,000,000 and 182,144,000 new Shares at the issue price of RM0.0535 and RM0.0711 respectively. Total value of RM18,300,438.40; average 6sen per share.

4) 28 Dec. 2020 - issuance of 1,432,718,739 new Shares at an issue price of RM0.08 per Share valued at RM 114,617,499.12.

5) Feb. 2021 - Exercise of 48,000 Warrants C at the exercise price of RM0.08 valued at RM3,840

6) Apr. 2020 to LPD - issuance of 112,805,034 and 20,084,396 new Shares at the ICPS conversion price of RM0.16 and RM0.11 respectively. Total value of RM 20,258,089; average 15.2sen per share.

Grand total: 3,461,362,769 shares valued at RM236,312,640.02; average 6.8sen per share.

With the above data, is it at present around 2sen considered high price or good bargains??..I have become a 'cheapskate' investor to dive in around 2sen.

Please do own due diligence and Happy trading"

Below are the conversion details of Fintec-PA:-

Subscription price: 8sen

Conversion method No.1: 1 Fintec-PA plus 3sen

Conversion method No.2: 11 Fintec-PA will convert to 8 mother shares.

Table No. 2: Details of Fintec-PA as at 10th Sept. 2021

- Method No. 1 is out of money by (1.5+3) - 2.5 = 2sen

- Method No. 2 is in the money by (1.5 x 11)-(8x2.5) = -3.5sen

- The Gearing shown as the underlying mother price which is 2.5sen divided by (Fintec-PA of average 1.5sen x ratio of 11/8) = 1.21

In conclusion, as Fintec-PA is trading at around 1.5 to 2sen, below the subscription value of 8sen, it is at negative around 6 to 6.5sen. But the mother share also traded around 2sen during my purchase, considering both at a very attractive price.

For information, below is my answer to one of the Forumer question why I preferred ICPS over mother share and under what situation I will buy mother share over ICPS.

"Forumer question: BLee Could you kindly share why you prefer Focus-PA instead of mother share. TQ

11/09/2021 3:45 PM

BLee: Hi Forumer, the answer is in one of my write-up, link: https://klse.i3investor.com/blogs/BLee_AGES/2021-07-16-story-h1568014371-ICPS_My_investment_stretagy.jsp

In summaries:

1) Low investment, lower risk. At issuance cost 5.5 sen, we are paying at present around 1 sen. The risk of people subscribing at 5.5 sen to sell at 1 sen is much lower.

2) Will mature (auto-convert) and NOT expire like warrants investment. I can't stand losing it all. Just like buying insurance, I will prefer buying an endowment policy which upon maturity will give me back something in return.

3) 2 methods of conversion. The example given shows how the mother shares dropped to a certain level which triggered the change of methods of conversion. Holding mother shares will not have this advantage.

4) Anti-dilution. We cannot dilute the subscription cash if it is not converted. Any PP, ESOS, RI, etc will not dilute the ICPS as shown in the adjustment formula in my write-up.

I can only think of these few reasons. Maybe some experts can comment and add more.

If the ICPS and mother shares are almost at the same price, it is another story. Example: Fintec and Fintec-PA, both selling at a low of around 2 sen, I will go for the mother share.

Happy trading.

11/09/2021 5:19 PM"

Happy trading and TradeAtYourOwnRisk.

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on ICPS: It takes AGES to reach the Billion Shares Club

Created by BLee | Jan 01, 2023

Continuation of article on previous ICPS investment strategy.

Created by BLee | Mar 08, 2021