Focus-PA: Where is the money?

BLee

Publish date: Sat, 03 Jul 2021, 05:50 PM

Please excuse me if I have make any mistake as I am a non-Accountant trying to dissect the cash flow from Focus-PA conversion to Mother shares. I am publishing this article in support of a group of Focus retail investors to defend the Focus share prices; and also to support my own ICPS investment. For information, I only own Focus-PA and no intention to purchase any Focus share.

The ICPS Rights Issue details..

FOCUS - RENOUNCEABLE RIGHTS ISSUE OF 2,044,266,042 NEW IRREDEEMABLE CONVERTIBLE PREFERENCE SHARES IN THE COMPANY ("ICPS") TOGETHER WITH 3,066,399,051 FREE DETACHABLE WARRANTS IN THE COMPANY ("WARRANTS D") ON THE BASIS OF 2 ICPS TOGETHER WITH 3 FREE WARRANTS D FOR EVERY 6 ORDINARY SHARES HELD BY THE ENTITLED SHAREHOLDERS OF THE COMPANY ("RIGHTS ISSUE OF ICPS WITH WARRANTS")

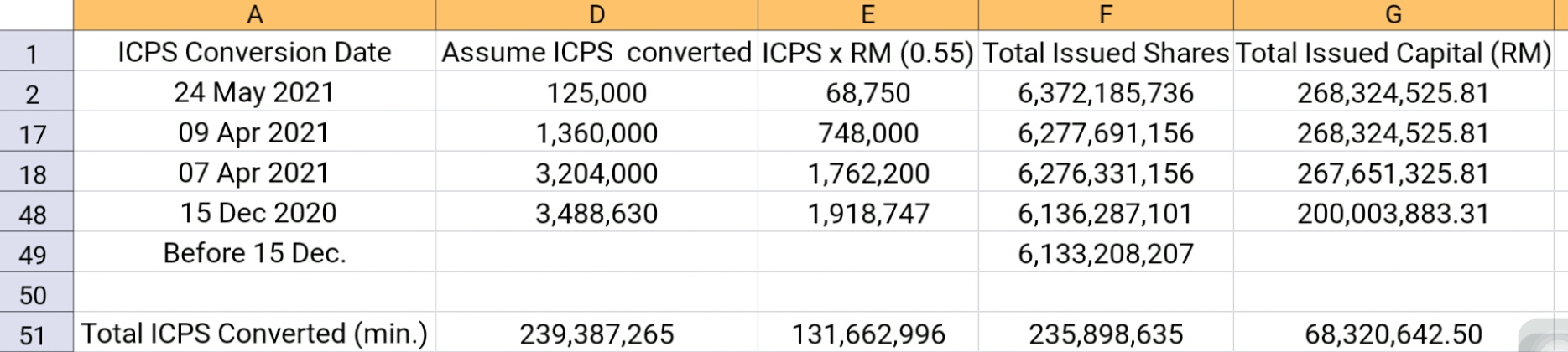

Detail 1: The First conversion dated 15 Dec., 2020

- Believed conversion based on 1 ICPS plus 49.5 sen for 1 mother share.

Detail 2: The conversion dated 7 Apr., 2021

- Believed conversion based on 1 ICPS plus 49.5 sen for 1 mother share.

Detail 3: The conversion dated 9 Apr., 2021

- Believed conversion based on 10 ICPS for 1 mother share as mother share prices retreated.

Detail 4: The conversion dated 24 May., 2021

- Believed conversion based on 10 ICPS for 1 mother share as mother share prices retreated. Noticed the no change in Issued Capital since 9 Apr. 2021 with numerous conversion.

Detail 5: Summary of the conversion

- My calculated cash collection: RM131,662,996

- My calculated cash collection since Apr. 2021: RM59,133,734 (when share price start decline whereby 10 ICPS conversion to 1 mother shares preferred?)

- My calculated cash collection based on 1 ICPS plus 49.5 sen conversion: RM63,342,353 (before Apr. 2021?)

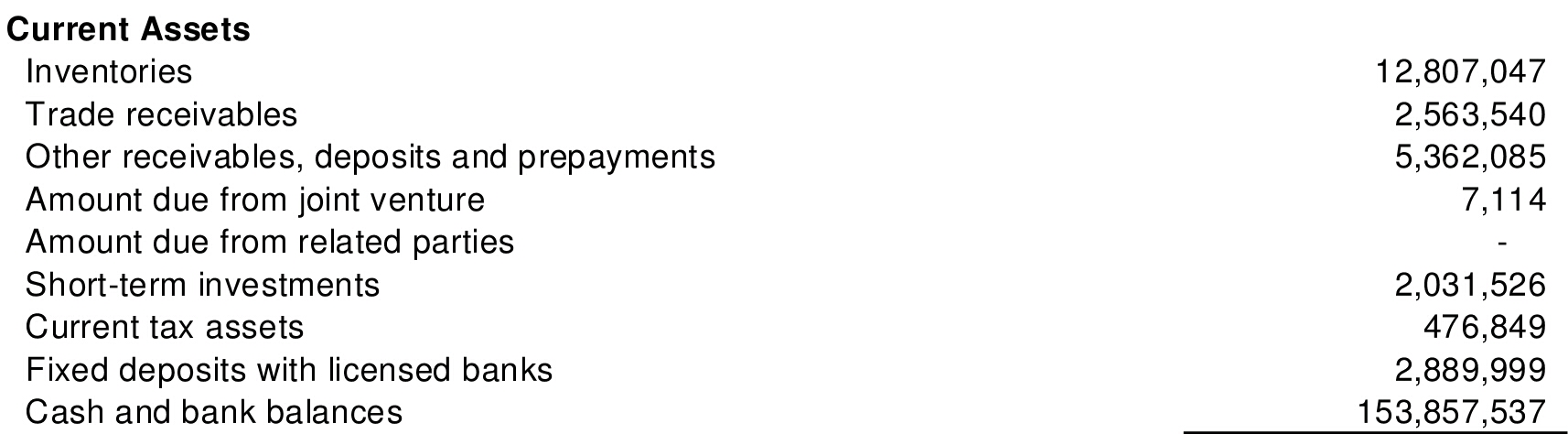

Detail 6: Last Quarter Current Assets

- Over RM153 million in cash?

Detail 7: Last Quarter Current Liabilities

- Close to debt free??

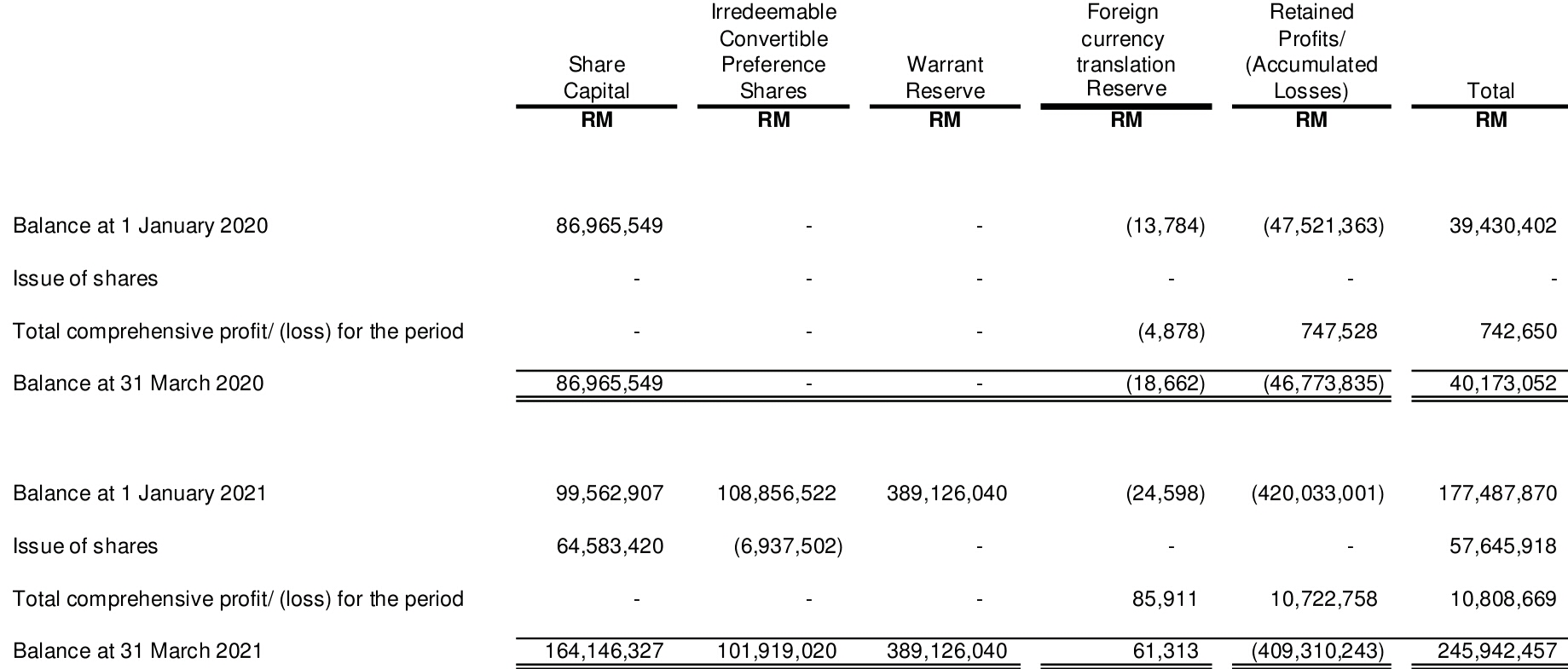

Detail 8: Equity Details

- Noticed that accumulated loses are actually due to issuance of free warrants??

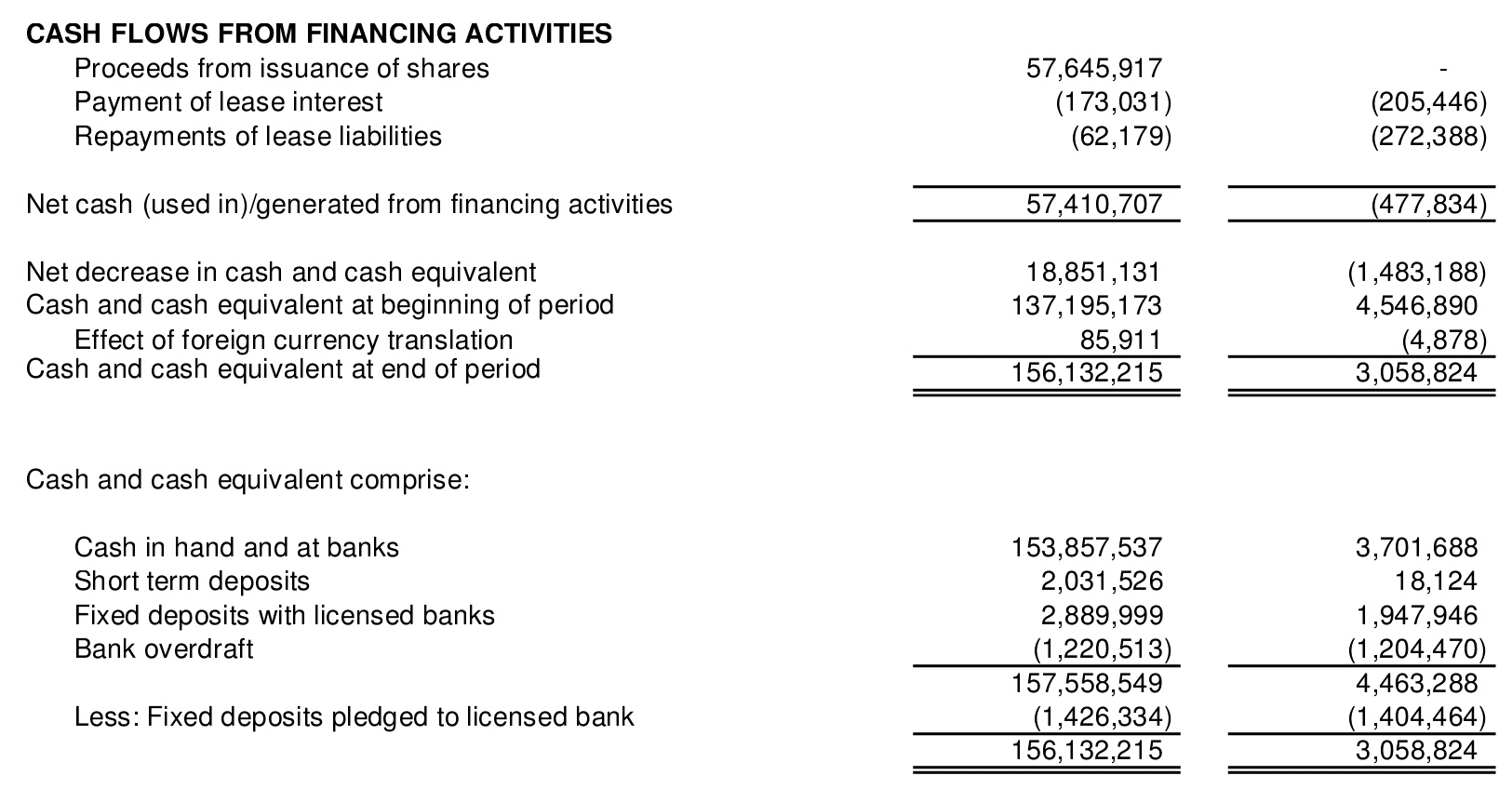

Detail 9: Cash flow Details

- Noticed that ICPS has had improved the cash flow from previous year.

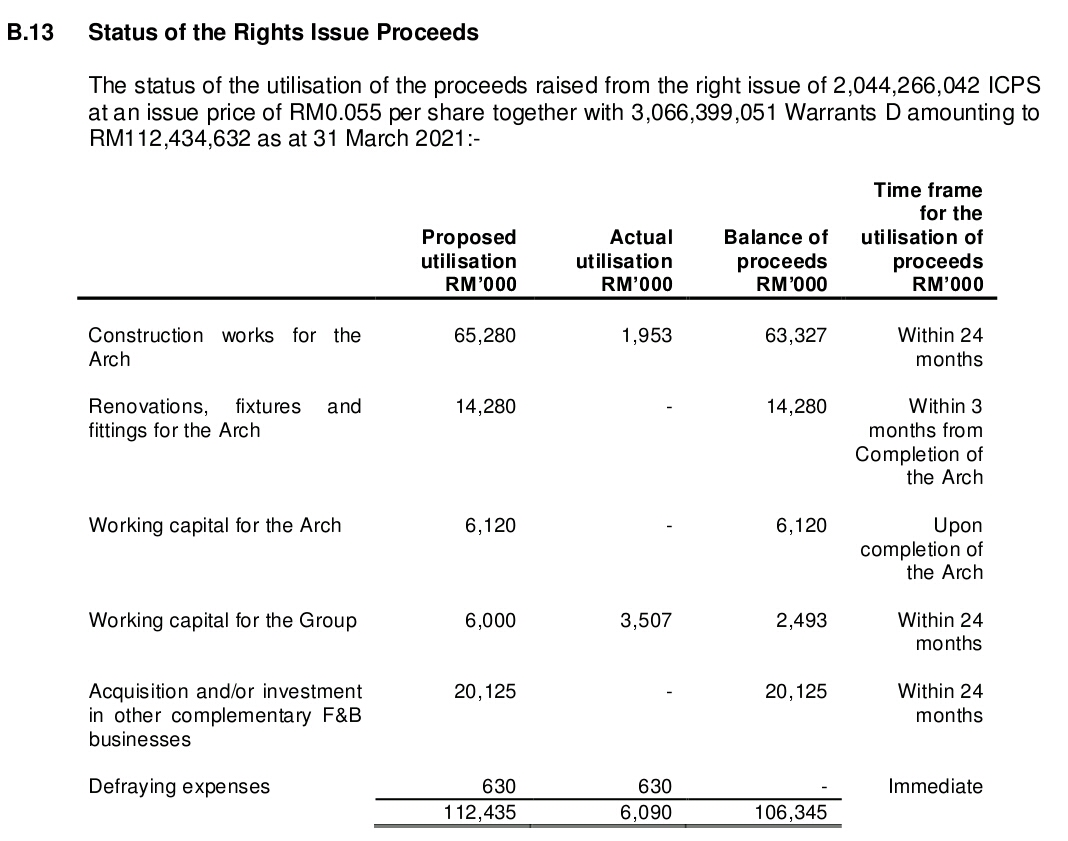

Detail 10: Usage of ICPS Fund

- The intended ICPS funds still hardly used; in coffer and not siphoned off as suggested by some naysayers..

Sources of Details: KLSE Screener

I believed the free cash flow of around RM59 to 63 million is used in the purchase of Saudee Rights issue?? What is the next move with the strong cash position??

Happy Trading

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on ICPS: It takes AGES to reach the Billion Shares Club

Created by BLee | Jan 01, 2023

Continuation of article on previous ICPS investment strategy.

Created by BLee | Mar 08, 2021