Focus-PA: Is it a 'con-stock'?

BLee

Publish date: Sat, 21 Aug 2021, 04:19 PM

I have written an article, AGES-PA: Dilution and is it a 'con-stock'? link: https://klse.i3investor.com/m/blog/BLee_AGES/2021-08-19-story-h1569829914-AGES_PA_Dilution_and_is_it_a_con_stock.jsp , I would very much like to cover another stock which is not so rosy and under intense attack in i3 forum. The stock is Focus Dynamics Group Berhad.(Focus D)

Holders of Focus-PA as at 20/08/2021 had converted roughly 235.918M Focus D shares bringing in roughly RM 131.673M into Focus D issued share capital/cash flow account. This represent roughly 48.8% of Focus D total issued share capital of RM268.324M.

This 235.918M new shares roughly constitute 3.68% of Focus D total of 6,372.2M Number of Outstanding SHares (NOSH). See the vast difference of 48.8% vs 3.68%? Could this be the reason of the intense attack? This RM131.673M ÷ 0.04/share could have bought 3,291.825M Focus D shares as at 20/08/2021!!

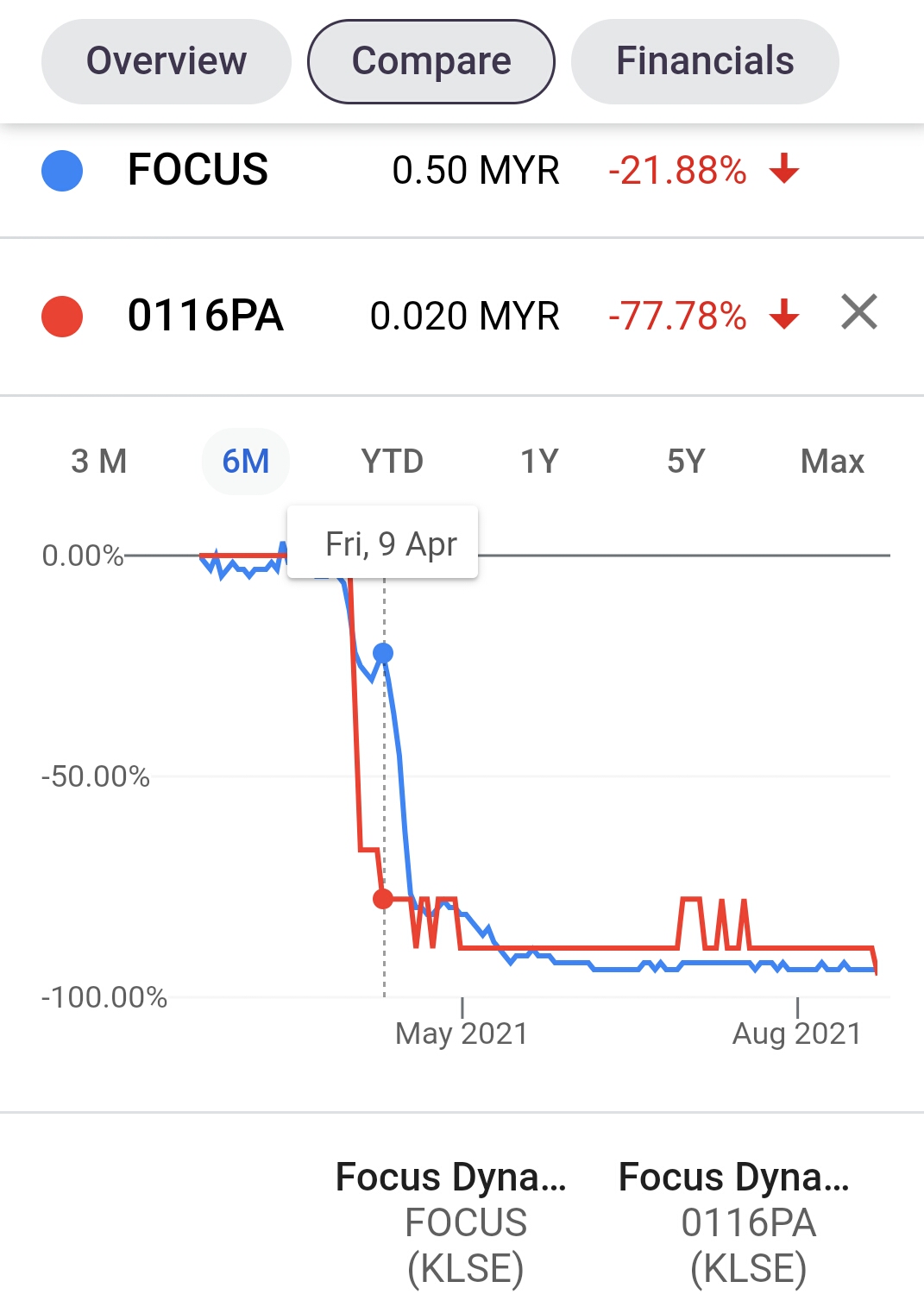

I presume most of this conversion utilised 1 Focus-PA plus 49.5sen cash during mother shares fell from 60 over sen to around 4 sen. (Please see Graphs 1, 2 and 3)

There are two methods of converting Focus-PA to Focus D. Before 1st April 2021, Focus D and Focus-PA was traded around 65sen and 9sen respectively. Due to foreign investor exiting Focus D, the shares price fell so rapidly so that the first method of converting 1 Focus-PA plus cash of 49.5sen to 1 Focus D share was no more tenable. The 2nd method of 10 Focus-PA converting to 1 Focus D became the preference during Focus D price fell passed 55sen and Focus-PA below 5.5sen.

Graph 1: Converting Focus-PA at 9 sen plus 49.5 sen cash still tenable when Focus D trading at 65 sen.

Graph 2: Converting Focus-PA at 6 sen plus 49.5 sen cash NOT tenable when Focus D trading at 50 sen.

Graph 3: Converting Focus-PA at 2 sen x 10, gaining 30 sen Profit when Focus D trading at 50 sen.

In a nutshell, if the conversion price is executed using 1 Focus-PA plus cash of 49.5 sen; will it be beneficial for the company/shareholders?? (i.e. increased in cash flow?)

A good read at (copywrighted?):

https://www.dummies.com/business/accounting/dilution-of-share-value/

https://www.investopedia.com/articles/trading/10/warrants.asp

On the topic of 'rubbish' or 'con-stock'; I would like to take below article as a yardstick.

https://klse.i3investor.com/m/blog/savemalaysia/2021-08-10-story-h1569679847-Beware_of_rights_issue_galore_MSWG_reminds_newbie_investors.jsp

How many points did Focus D meets the critera given?

1) Focus D ICPS was issued after "Enhanced Rights Issue Mandate which was introduced in November last year." Legalised 1st con? Proposal was done before November 2020.

2) Focus D did has had huge share base and with decent earnings. (See fundamental listing below) Huge share base due to split; not by additional of shareholders funding.

3) Focus D did not issued lots of shares under an employee share option scheme (ESOS) or under a private placement, thus diluting minority shareholdings.

4) Focus D did undertook huge rights issue exercise to raise fund from shareholders. 2nd con?

5) Focus D has had significant financial instruments that would has a shareholding-dilution effect in the future, such as warrants, irredeemable convertible unsecured loan stock (ICULS) or irredeemable convertible preference shares (ICPS). Yes, only a very small shareholding-dilution as shown above, and a very much smaller fraction for retailers...

6) Focus D did frequently announced numerous memorandums of understanding (MOUs) or collaborative agreements. Most of these either fizzle-off or are terminated or take an unreasonably long time for completion. Consider 3rd con?

7) Focus D did frequently churned out announcements of business ventures, joint ventures (JVs) to create interest and excitement. Good companies will not do this – they produce good results without hyping-up interest and excitement. Focus D did produce good results.

8) Focus D did shown profit quarter after quarter, for the last 5 quarters.

9) Focus D did used large portions of company’s funds to acquire non-core assets. Consider 4th con?

10) Focus D did used company fund to invest/speculate in listed stocks. Consider 5th con?

With 5 out of 10 con rating, will it be considered as a Half 'rubbish' or 'con-stock'?? Please do own due diligience.

Focus Dynamic performance as at 20/08/2021 (Rolling 4Q)

Profit/ (loss) : RM26.699M

EPS : 0.42sen, NTA : 0.0392

Dividend PS : RM0.00

Dividend Yield : RM0.00

Dividend Payout Rate : 0.000

Ex Div Date : -

ROE : 10.71

As at: 20/08/2021(not verified)

Market Cap : RM286.749M

P/E : 9.55

Price to Book Ratio : 1.7423

Price to Sales Ratio : 4.874

Profit/(loss), NTA for the 5 period Ending:

1) 31 Mar 2021 : RM10.723M, 0.0392

2) 31 Dec 2020 : RM 9.459M, 0.0281

3) 30 Sep 2020 : RM 4.188M, 0.0228

4) 30 Jun 2020 : RM 2.329M, 0.0208

5) 31 Mar 2020 : RM 0.748M, 0.0197

Happy Trading

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance.

More articles on ICPS: It takes AGES to reach the Billion Shares Club

Created by BLee | Jan 01, 2023

Continuation of article on previous ICPS investment strategy.

Created by BLee | Mar 08, 2021