STOCK WATCH ( 19 Oct To 23 Oct 2015 ) FGV ; AIRASIA; UEMS; PMETAL; SKPETRO & UNISEMS

|

FGV (5222)

|

|

|

|

FGV has been trading above its upward sloping 20-Day Moving Average which is a good sign. In addition, the price just broke the resistance of 1.73 reinforcing the bullishness in the recent price movement. This breakout was accompanied by a higher than average traded volume which shows the enthusiasm of the traders to push the price higher and past this resistance hence giving a higher probability of a successful breakout.

|

FGV is under close watchful eyes of our Prime Minister. Politically speaking, the share price should come close to its IPO price of 4.45 in 2012 in order to please the settlers in the longer run. However, with the current rally in palm oil price and the possible support from ValueCap; I foresee, in the near term, the price should tread to its 1st resistance of 1.80 and subsequently 2.00.

|

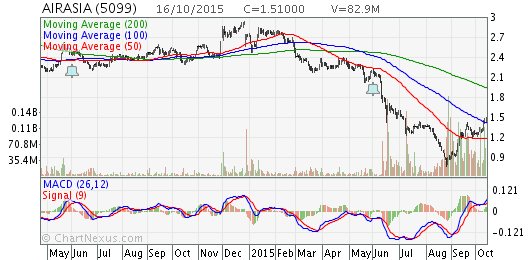

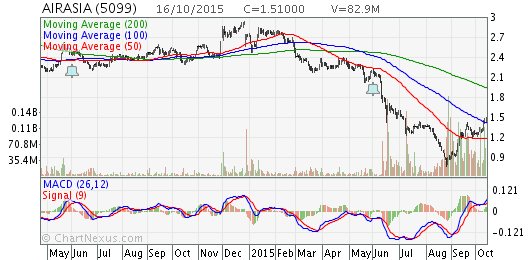

AIRASIA (5099)

|

|

|

|

AIRASIA has been trading above its upward sloping 20-Day Moving Average which is a good sign. In addition, the price just broke the resistance of 1.48 reinforcing the bullishness in the recent price movement. This breakout was accompanied by a higher than average traded volume which shows the enthusiasm of the traders to push the price higher and past this resistance hence giving a higher probability of a successful breakout. The resistance is tag at 1.62 & 1.71 and trader can exit if 1.43 is breached. There is talk of an impending privatization at 1.80 ( though denied by the company but Tony Fernandez remains silent). This will somehow generate interest in the market.

|

|

UEMS (5148)

|

|

|

|

UEMS has been trading above its upward sloping 20-Day Moving Average which is a good sign. Furthermore, the next resistance level is quite far at 1.25. The counter suddenly gapped up on closing Friday to 1.17 after trading for most of the vday at around 1.14 near it initial support. Support is at 1.14 and 1.04 with resistance at 1.25 & 1.28.

It is interesting to note that UEMS is a favorite GLC counter with huge land banks mainly in Johor. UEMS might be also one of the target for Valuecap to buy in.

|

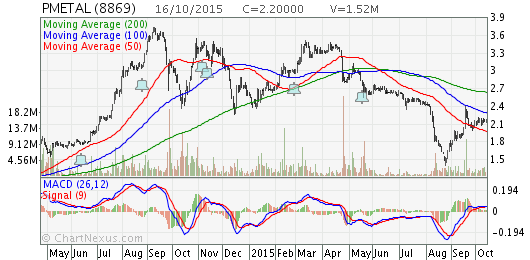

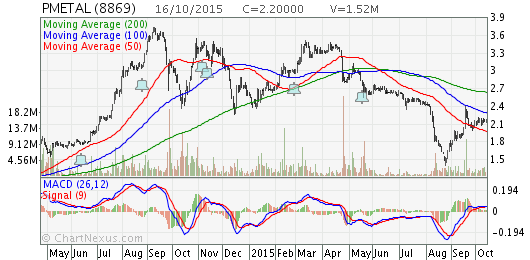

PMETAL (8869)

|

|

|

|

PMETAL has been trading above its upward sloping 20-Day Moving Average which is a good sign. This has brought the price near to the resistance of 2.21 where I expect a good fight between the bulls and the bears. For the upside to continue, the resistance needs to be broken conclusively, preferably with high volume. The indicator analysis on RSI is not exhibiting any extreme condition. Watch out for the 30% and 70% levels which indicate any oversold and overbought condition respectively. A strong support at 2.08 is seen and the next major resistance is at 1.35.

PMETAL closed Friday at 2.20 after gapping up in the last minutes of trading after trading mostly around 2.15 throughout Friday similar in pattern to FGV which indicates local & foreign funds are eyeing this counter.

PMETal has long been a foreign funds favorite counter and with the advent of foreign funds coming back to our local market; I foresee the 2.35 resistance should be broken with ease in the near term.

|

SKPETRO (5218)

|

|

|

|

SKPETRO has been trading above its upward sloping 20-Day Moving Average which is a good sign. It is important to calculate the risk/reward as the recent upward movement has pushed the price to be quite far from the support level of 2.05. SKPETRO closed Friday at 2.17, quite far from its strong support of 2.05. Its immediate resistance is at 2.23 & 2.26 with the next major resistance at 2.65.

SKPETRO is similarly a foreign & local funds favorite counter and even with the subdue current oil prices; I still believe it its still under valued. SKPETRO have huge book order which will be able to tide it through many years ahead. SKPETRO’s order book stands at MYR23bn. 54% of this is made up of work in the Americas, 27% in Malaysia and the rest come from Asia-Pacific, Australia and Africa works.

|

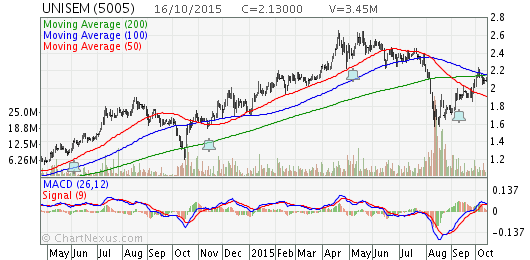

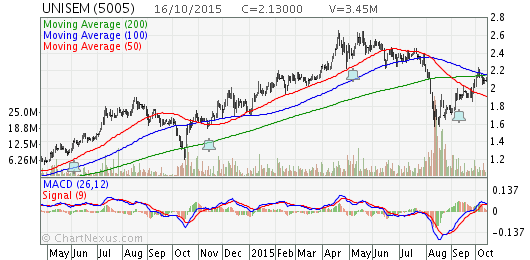

UNISEM (5005)

|

|

|

|

UNISEM has been trading above its upward sloping 20-Day Moving Average which is a good sign. The support and resistance level of UNISEM are 2.05 and 2.2 respectively. The next major resistance at 2.49.The indicator analysis on RSI is not exhibiting any extreme condition. Watch out for the 30% and 70% levels which indicate any oversold and overbought condition respectively.

It is interesting to note that UNISEM closed Friday at the highest level of 2.13 after trading at the range of 2.08 and 2.13 indicating investors enthusiasm to push the price higher next week. I believe, next week we should see the 2.20 & 2.23 resistance be broken and will be heading towards its major resistance thereafter.

It is anticipated UNISEM to release a better than expected quarter result which is due to be release end of this month. The last quarter saw its revenue and PAT shown a remarkable improvement.

TP expected 2.67

http://klse.i3investor.com/blogs/rhb/82763.jsp

|

|

|

|

apanama

Nice write up...keep it up

2015-10-18 17:56