HBGLOBAL - MARKET OVERLOOKED THE REAL VALUE OF THIS COMPANY ! UPLIFTED FROM PN17 & NOW TRADING AT ONLY PE RATIO 4X !!! !!!

BURSAMASTER

Publish date: Sat, 13 Jun 2020, 11:27 AM

MARKET OVERLOOKED THE REAL VALUE OF THIS COMPANY !

UPLIFTED FROM PN17 & NOW TRADING AT ONLY PE RATIO 4X !!!

Hello to all readers out there. Recently I saw that many penny stocks had rallied. But I wish to shift your attention to this penny stock in the MAIN Board which I feel had been overlooked by the market.

The stock which I'd like to talk about today is HB GLOBAL LIMITED (HBGLOB - Stock Code 5187, Main Market, Consumer Products & Services - F&B).

I saw some heavy accumulations in this stock for the past few weeks at 6.5-7c range and believe that once the accumulation is over, price will be trending upwards strongly.

BASIC INFORMATION ABOUT HBGLOB

HBGLOB is a leading international one-stop gourmet convenient food specialist in China.

Their food processing capabilities includes Cleaning, Slicing/Cutting, Blanching, Boiling, Frying, Vacuum Frying, Steaming, Smoking, Stewing and Barbequing.

They produce various types of food material and packed with quick freeze mainly to meet customers orders and distributors.

They produce more than 1,000 types of products, all of which are approved and export to more than 20 countries such as Japan, USA, Singapore, Australia and Korea

Market Capitalization : RM 35.1 million

Shares Float : 468 million

Website : http://www.hbglobal.asia/

1. UPLIFTMENT OF PN17 IN OCTOBER 2019 - PRICE SHOULD BE HIGHER THAN BEFORE WHEN THE STOCK WAS IN PN17 - MARGIN ACCOUNTS ABLE TO BUY IN THIS MAIN MARKET STOCK

Refer below news on 15th October 2019 where HBGLOB had risen to a high of 15.5c when it was announced that BURSA had uplifted its PN17 status as it no longer triggers any criteria under it.

However, as Khazanah wanted to exit from this company. the stock saw selling pressure to push it back to the prices before the company was uplifted on its PN17 status.

To me this does not look illogical, as normally, the price of a stock should be higher after it is uplifted of its PN17 status, and not lower.

However, maybe because this stock is not getting the right media or Investment Bank (IB) coverage, it has been overlooked by investors and traders alike.

The upliftment of PN17 status also means that margin accounts are able to take a stake in this company and be able to hold it for longer term investment purposes, as the stock is listed on Main Market.

https://www.theedgemarkets.com/article/hb-global-soars-active-trade-after-removal-pn17-list

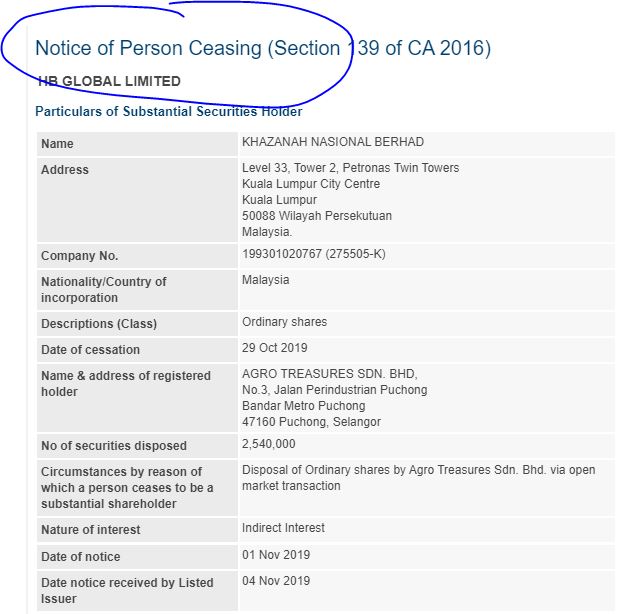

2. KHAZANAH CEASED TO BE A SUBSTANTIAL SHAREHOLDER AS OF 4TH NOVEMBER 2019 & POSSIBLY IS HOLDING 0 SHARES AS OF TODAY - LESS RESISTANCE FOR UPTREND

Refer below announcement on 4th November 2019 where Khazanah had sold off 2.54 milion shares and on the same day ceased to be a substantial shareholder in HBGLOB.

This means that Khazanah shareholding in this counter is less than 5% as at 4th November 2019.

After this sale, Khazah was left with 22.9 million shares which still might be a resistance for the price to move up (should Khazanah decide to sell all shares and be left with 0).

However, let me highlight one thing. You may refer to the monthly chart of HBGLOB below. From NOV2019 where Khazanah ceased to be a substantial shareholder, until latest closing on 11th June 2020, a rough total of 115 million shares volume had been traded (in comparison to the 22.9 million shares which Khazanah has left)

Therefore, in my opinion, it is HIGHLY LIKELY that Khazanah has sold all of its shareholdings and is left with 0 shares, should their management instructed them to do so last year.

This means that the path to uptrend now has lesser resistance, with one big fund out of the way.

3. MAJOR SHAREHOLDER (CEO), SHEN HENGBAO HAS STRONG GRIP ON HBGLOB AND NO SELLING IS SEEN FROM HIM IN NEAR FUTURE

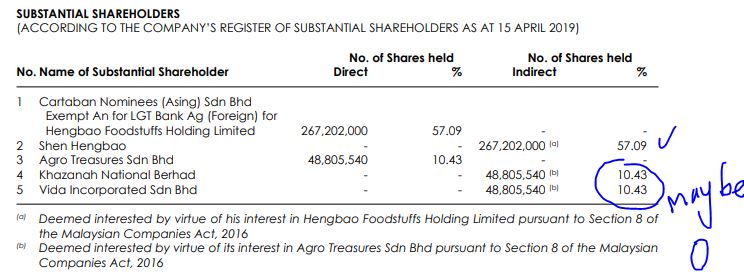

Refer below latest major shareholders of HBGLOB as at 15th April 2019. There are only 2 major shareholders who are:

i. Shen Hengbao who is also CEO of HBGLOB at 57%

ii. Khazanah Nasional Berhad at 10.43%

As explained above, if Khazanah had disposed their entire stake in this stock, I foresee that there will be less resistance on the path upwards as the major shareholder will not be selling his shares any time soon.

Therefore the public effective total float is only 43% of the total stock float.

4. TRADING AT VERY LOW PE RATIO OF 4X AND 82.5% DISCOUNT TO ITS NTA OF 43 CENTS

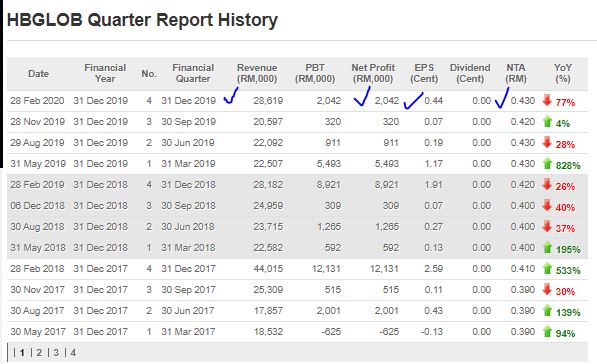

Refer below latest QR summary of HBGLOB. As we can see, since the company was uplifted of PN17, they have been profitable every quarter.

In the latest quarter, revenue was at 2 year high of RM 28.6 million and net profit at RM 2 million (EPS 0.44 cents).

The NTA stood at 43c, so this means at the latest closing of 7.5c, this is a discount of 35.5c or 82.5% of the NTA, which means the stock is trading way below its underlying asset value.

In terms of earnings, the total EPS for this year is 1.87 cents. This means that the stock is currently trading at only PE Ratio of 4X its earnings, which is considered quite low for a stock in f&b industry.

For the sake of comparison lets take a few profitable F&B stocks and see their PE Ratio:

a) OFI - PE Ratio 15X

b) PWROOT - PE Ratio 19X

c) SPRITZER - PE Ratio 13X

d) APOLLO - PE Ratio 18X

e) BIOHLDG - PE Ratio 13X

Therefore, if we look at above and take a conservative PE of 10X ratio, this values HBGLOB at least at 18 - 19 cents based on earnings. Taking a more aggressive PE Ratio of 15-20X, gives a fair value of 28-37 cents in the longer term.

5. TECHNICAL ANALYSIS - PENDING BREAKOUT ABOVE EMA365 OF 7.5 CENTS ON THE BACK OF IMPROVED VOLUME TRADING

Refer below the basic price and volume chart with key EMAs for HBGLOB daily chart:

A few observations on the daily chart chart:

i. Refer Circle 1 & 2, HBGLOB had hit a high of 15.5c before Khazanah decided to sell down its shareholdings in this stock

ii. Refer Circle 3 & 4, during the March 2020 COVID19 crash, HBGLOB dropped to a low of 3c, however this was on the back of low volume trading, indicating no major shareholders sold out during this time

iii. Refer Circle 5, HBGLOB close at 7.5c is above the EMA200 at 6.8c and the next important level to break is 7.5c to indicate a bullish trend for this stock

iv. Refer Circle 6, trading volumes are significantly improved, and we see that selldown volume is very small compared to buying volume

CONCLUSION

Considering all the above, I opine that current price for HBGLOB is attractive due to below:

i) Stock has been uplifted of PN17 in October 2019, which allows margin accounts to buy into this stock

ii) Khazanah ceased to be substantial shareholder as at 4th November 2019, and possible reduced to 0 based on volume analysis, allowing less resistance on path upwards

iii) Majority shareholder and CEO Shen Hengbao has strong grip on HBGLOB with 57%, and no selling in sight in the short term

iv) Trading at ONLY PE Ratio 4X which is very low compared to its other F&B peers. Also trading at 82.5% discount to its NTA

v) Price pending breakout of long term EMA365 at 7.5c on the back of improved volume trading

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

Discussions

p/s :- You should change your nickname from "Bursa master" to "Bursa pupil" !

2020-06-13 11:35

Can u trust failed China company & give them one more chance leh ?

SSlee pick on Xinguan is a very bad choice as kyy n sslee got conned, but sslee pick on Insas is a great choice for value investment loh...!!

https://klse.i3investor.com/blogs/Sslee_blog/2019-03-02-story196085-In...

‘Nothing destroy the share value of the company faster than a self serving or a conman CEO and many people lose his/her life saving and some even commit suicide because of insider con job/scam. The conman/scammer get away with murder because good man do nothing until when the victim is his own family member or close friends then only they regret not doing something to stop or expose the scam.

We as minority shareholders are perfectly capable and able to stop it before it happen if we just care to attend AGM ask the hard questions and hold the BOD and external auditor accountable. Follow up and report any irregularities/red flags to SC/Bursa.

Do not live a life of regret, remorse and guilt like spider man (Peter Parker) due to his selfish misjudgment and let go a robber that he can easily caught, who later turn up as murderer of his Uncle Ben. Knowledge is power and with great power come great responsibility’

Y

ou wrote: https://klse.i3investor.com/blogs/philip4/2019-02-04-story192361-Why_P...

And emotional piece ‘Why Pump and Dumpers deserve the Death Penalty’

Posted by Lewis Lee > Jun 13, 2020 11:57 AM | Report Abuse

"So, please stop being greedy and learn how not to lose money instead. Case in point: avoid horrible management."

I think this is Philip's gist of advice to you ! His words sometimes can be harsh but with good intention to shake you up !

No point fighting with the corrupt / biased / flaw systems (especially in Malaysia, those systems are meant to make those tycoons rich !), just need to be extra cautious with the management ! If the good businesses are run by dishonest conmen, you will never be fairly rewarded, so avoid at all costs !

I think even KYY was conned by Xinquan after visiting their factories in China and checking with his relative who worked as their auditors !!

2020-06-13 12:58

Do not trust China's listed shares, cos their audit is not reliable. That if there's one.

2020-06-13 19:14

Goreng friends, goreng chicken, goreng popiah.... this stock for goreng only.

2020-06-13 19:53

So many China stocks delisted without action been taken against the MD n Auditors for fraud Balance sheet. Who dare to buy Red chips. China business man cannot be trusted.

2020-06-13 22:08

red chip counter siphoned most malaysian's money .

recent one is CAP. asset turn negative is one night after being suspended for years.

2020-06-14 18:52

Cash and bank balance 1,574

Total Liabilities 139,751 <--- Enough cash to pay the debt. May be someone may manipulate the price to attract newbie to buy. But to me, it is just a rubbish companny, especially Xinquan, Csl shadow

2020-06-14 21:03

BURSAMASTER,

I saw you at Evolve Concept Mall before MCO eating Lay Hong Air Chilled fried chicken alone while sobbing.

Please return me my RM17.70 for lunchbox set.

Thank you

2020-06-14 23:30

A hint guys..check out Kawan Food Berhad - They manufactures and sells frozen food. The product portfolio includes – Paratha, Chapatti, Spring Roll Pastry, Naan, Bun, Bakery, and others.

The business is spread across Malaysia, Rest of Asia, Europe, North America, Oceania, and Africa.

HBGlobal - Food processing company specializing in the production of wide variety of ready-to-serve food and frozen vegetable

Latest quarterly results of Kawan Food Berhad EPS increased to 400%

2020-06-15 09:48

Kawan Food Berhad: Currently trading at PE ratio of 37x times

HBGlobal: Currently trading at PE ratio of 3.5x times

2020-06-15 09:48

THANK YOU BURSA MASTER FOR YOUR CUN CUN TIPS. DO YOU HAVE HP OR WEBSITE TO SHARE?

2020-06-15 10:06

dont compare hbglobal to other con man china company. Check their previous shareholder, khazanah - do you know that khazanah is extremely thorough in their due diligence before they invest? Buy now before the train is up in the sky

2020-06-15 10:09

CONGRATULATIONS to those who profited from HBGLOB... it made a high of 0.125 on underlying poor market sentiments.

2020-06-15 12:44

KEH CHUAN SENG acquire 150,000,000 consider good news?

https://malaysiastock.biz/Company-Announcement.aspx?id=1242968

2020-08-10 11:50

Lewis Lee

Market did not overlook ! Market simply can't trust their account reports with huge cash !

You must be a newest newbie in Bursa ,let me teach you one good lesson :- whenever you see a red chip china based company in bursa, RUN FOR YOUR LIFE and don't be cheated by their accounting !

Google "Xinquan", "Msports" (the first 2 tai koh china conman's company in Bursa) and research then you know what I mean !

Even our i3 stock god KYY was conned by Xinquan !! and many many more victims ....

2020-06-13 11:33