MKLAND - THIS STOCK IS TRADING WAY BELOW ITS NTA !!! BIG UPSIDE POTENTIAL POSSIBLE !!!

BURSAMASTER

Publish date: Mon, 21 Sep 2020, 05:29 PM

MKLAND - THIS STOCK IS TRADING WAY BELOW ITS NTA!!! BIG UPSIDE

POTENTIAL POSSIBLE !!!

Hello to all readers out there. In recent weeks, I saw that investors have been bargain hunting for stocks which are undervalued. One of the criteria to look at is the stock Net Tangible Asset (NTA).

Having said the above, the stock which I'd like to talk about today is MK LAND HOLDINGS BERHAD (MKLAND - Stock Code 8893, Main Market, Property)

BASIC INFORMATION ABOUT MKLAND

MKLAND was listed in BSKL in 1999, with core business in:

i) Property Development - Residential & Commercial

i) Property Development - Hotels, Resorts, Theme Parks

Market Capitalization : RM 181.09 million

Shares Float : 1.207 billion

Website : http://www.mkland.com.my/

1. TRADING AT 83% DISCOUNT TO ITS NTA OF 99 CENTS !!!

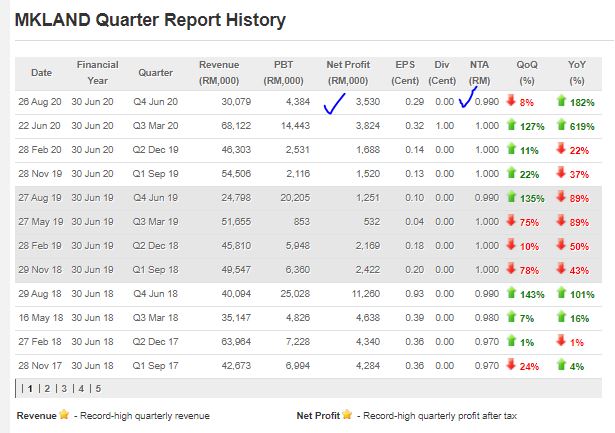

Below is summary of MKLAND latest quarter results. We can see that the company is still profitable despite recently Malaysia being under lockdown due to COVID19, therefore this shows us the strength and resilience of the company in facing hard times.

Also, we notice that the NTA stands at 99c. As of the latest closing price of 16.5c, this means that the stock is trading at 83% discount to its total NTA. Some long term investors might view this stock as undervalued and a bargain at current market.

2. NET ASSET VERSUS LIABILITIES ABOUT RM 1.2 BILLION !!!

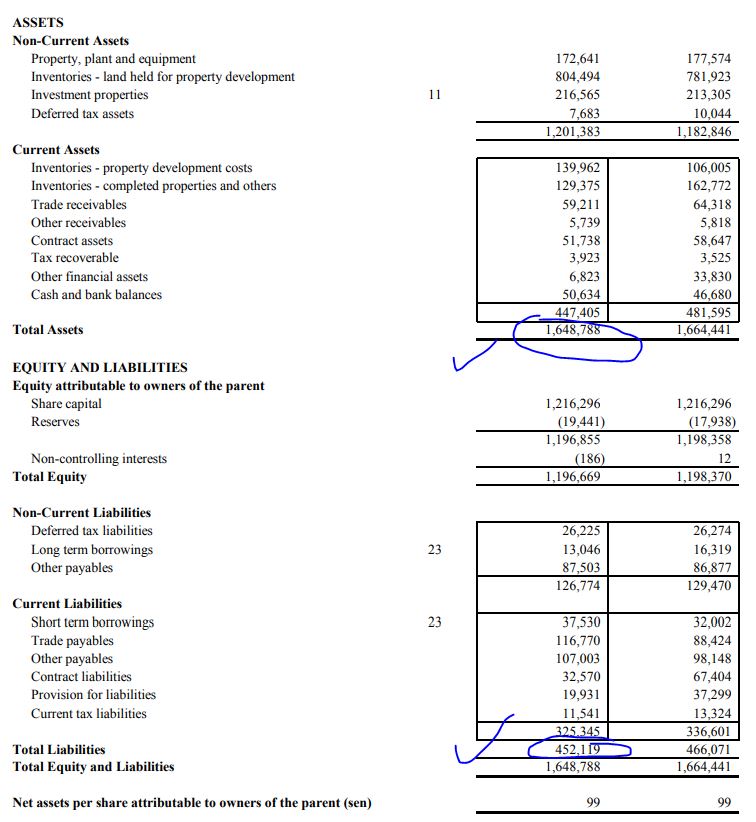

Refer below snapshot of the Assets Versus Liabilities summary taken from the latest QR.

As we can see, the total Assets stood at RM 1.648 billion, and total Liabilities stood at RM 452.1 million.

Therefore, this means that the total Assets exceed the Liabilities by about RM 1.2 billion, which shows the company having a solid asset backing.

Also, cash position improved to RM 50.6 million cash compared to RM 46.68 million in the same quarter last year.

3. TECHNICAL ANALYSIS - BREAKOUT OF ALL KEY EMAs, WITH BULLISH

VOLUME INTEREST

Refer below the basic price and volume chart with key EMAs for MKLAND daily chart :

A few observations on the daily chart:

i. Refer Circle 1, the closing price for MKLAND today 16.5c has broken up above all key EMAs, including long term EMA200 and EMA365, indicating a change of the bigger trend.

ii. Refer Circle 2, this move up in price is backed up by significant volume, which is indicating a surge in buying interest in this counter

iii. Refer blue regions, as resistance areas. For first resistance, MKLAND needs to break out above 19c, before testing the further resistances at 26-28 cents, then possibly making way further upwards towards its NTA value.

CONCLUSION

Considering all the above, I opine that current price for MKLAND is attractive due to below:

i) Trading at 83% discount to its NTA

ii) Net asset versus liabilities of RM 1.2 billion showing a healthy asset backing

iii) Chart showing a breakout above all key EMAs, with significant volume interest

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

Discussions

Wei, wei, this one NEVER move. You will hold for 150 years. Tahu tak. Look at their share price history lar!!

2020-09-22 11:50

PROPERTY KALAU TAK BOLEH= ECONOMY STILL BAD.IF ECONOMY IS GOOD ALL PROPERTY COUNTERS WILL FLY HIGH

2020-09-22 15:16

who says. PROPERTY IS SUPPLY> DEMAND NOW, not even counting 2nd hand house loh..............too greedy loh, every TOM DICK HARRY DO PROPERTY.

NOW EVERY TOM DICK HARRY WANNA DO GLOVES, BUT STUPID LOH. NO FDA LICENSE PUN, SELL TO GHOST AH?

2020-09-22 16:38

many stocks trading below NTA especially in property counter...nothing special

2020-09-22 18:02

I find it timing weeks away.As usual.Please lah.Choose approximate right time.There other who take a few months.Weeks never mind.TQ.

2020-09-22 20:36

Next month all must start to pay their loan installment. Many properties will be on auction. Real estate dead for another 3 years!

2020-09-22 21:20

This bursamaster should change his name to bursamonster ler. Check his blog, sanichi, smtrack, Appasia,domlite, mtouche.............................most of the stocks he mentioned, fall badily, included Mkland today. I think he shouldnt write any blog. His TA is very lousy

2020-09-22 21:26

lol...bursaretard, it is normal for property to have high nta. as they got landbank.

and is normal for tech stock to have low nta

2020-09-23 11:22

n This MK Land with an NTA of 99 sen a share is now available at only 14.5 sen. What a under valued gem not noticed by the public. This stock if buying has a very great potential of going up 300 to 400% and yet can consider cheap at 30 or 40sen. If only the group does a restructuring exercise like share splitting or share consolidation. It will fly like nobody business. Take for example. What if MK Land goes for share splitting 10 for 1. Now at 14 sen, the new share after splitting will automatically be adjusted to 1.5sen. So it is an automatic gain of 10% allready. But following the splitting, share prices are expected to move into step of 0.5 sen a share.

Therefore, if move up 0.5 se, MK Land price will become 2.0 sen which is already 30% increase. What a good idea if MK Land do proposes such a move in the near future. THINK ABOUT IT. MK LAND DIRECTORS. Either way, doing a share split or share consolidation (both ways) will increase MK Land shares upward tremendously because if consolidates, their NTA will become higher and higher. For example, if MK Land proposes 10 shares to 1, automatically their NTA becomes RM9.90 per share. What an idea? How can RM9.90 NTA share be selling at RM1.40 ? Right? Just THINK. MK Land directors can do it so easily.

2020-12-01 12:42

Yes. MK Land can do it and MK Land is moving towards its NTA of RM1-00 price. Today 29/12/2020, MK Land closed at 21 sen after breaching 22 sen half an hour before close. Congratulations to Bursamaster for highlighting MK Land. Thank you very much. You are excellent.

2020-12-29 17:15

evacla60

cashflow from operation is low. liquidity problem

2020-09-22 09:54