HIGHEST NET PROFIT RECORDED ! HEADING TOWARDS GLORY !!!

GLOTEC - HIGHEST NET PROFIT RECORDED ! HEADING TOWARDS GLORY !!!

BURSAMASTER

Publish date: Sat, 12 Dec 2020, 12:19 PM

Hello to all readers out there. Recently, industrial activities have been picking up across the world as COVID19 vaccine sparks economic recovery.

Having said the above, the stock which I'd like to talk about today is GLOBALTEC FORMATION BERHAD (GLOTEC - Stock Code 5220, Main Market, Industrial Products & Services)

BASIC INFORMATION ABOUT GLOTEC

GLOTEC was listed on BSKL in 2012, with core business in:

i) Precision machining, stamping and tooling

ii) automotive components design & manufacturing

GLOTEC also has diversified into the following:

i) Harvesting and selling of fresh fruit bunches of oil palm

ii) exploration and production of oil & gas

Market Capitalization : RM 117 mil (as at writing)

Shares Float : 269 million

Website : http://www.globaltec.com.my/

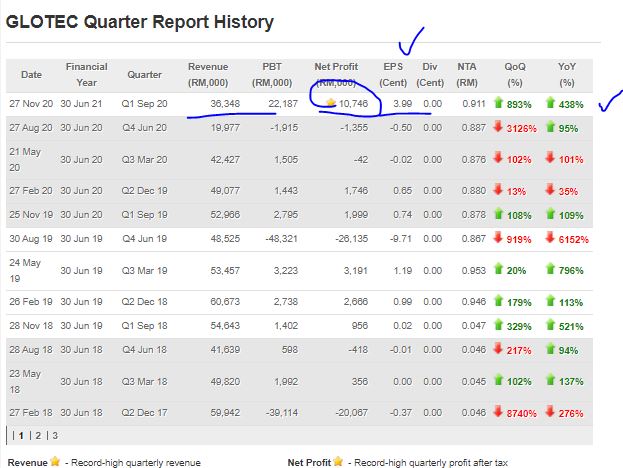

1. POSTED HISTORICAL HIGH NET PROFIT IN NOV 2020 QR !!!

Refer below latest quarter result in Nov 2020. As we can see GLOTEC recorded revenue of RM 36.3 mil and a historical high net profit of RM 10.7 mil.

This translates to Earning Per Share of 3.99c. This means that currently GLOTEC is trading at a very low 2.7X PE Ratio based on its forward earnings EPS of 12c per year.

Taking a reasonable 7-10 PE Ratio should reflect a target price if 84c to RM 1.20 in the longer term period.

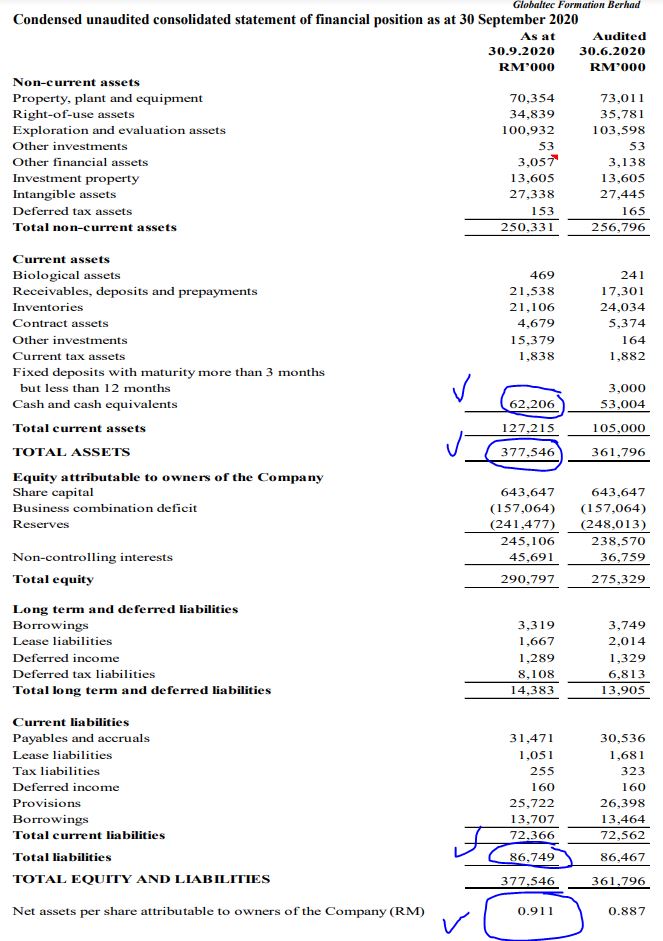

2. SOLID ASSET BACKING, NTA 91c, CASH IN HAND RM 62.2 MIL !!!

Below the latest Asset Vs Liability summary as of QR Nov 2020.

A few points to note:

i) Total Assets stood at RM 377.5 mil (NTA 91c)

ii) Total Liabilities stood at RM 86.7 mil

iii) Assets exceed Liabilities by a whopping RM 290.8 mil

iv) Total cash in hand stood at RM 62.2 mil improved from last year RM 53 mil

Based on latest closing price of 43.5c, the stock is trading at 52% discount to its NTA.

3. EXCITING PROSPECTS FOR ITS O&G DIVISION !!!

Below the Prospects mentioned on its oil & gas division.

As crude prices move up and o&g activities pick up, I opine that GLOTEC will soon be reaping its fruits in the o&g sector, with the approval of its gas development project in Indonesia very soon.

This will significantly boost up the revenue and net profit in upcoming quarters.

4. TECHNICAL ANALYSIS - BREAKOUT ABOVE EMA365, LONG TERM

UPTREND IN TACT

Refer below the basic price and volume chart with key EMAs for GLOTEC daily chart :

A few observations on the daily chart:

i. Latest closing price of 43.5c is above its EMA365 of 42.5c. This indicates a long term bullish trend in place

ii. Refer Volume, there has been a significant volume impact when buyers entered this stock. It shows that buyers are entering and holding on to long term prospects

iii. Support price seen at 40c

iv. The stock is trading above all key EMAs, indicating a long and short term bullish trend

v. Should buyers be interested in this stock, we might see an upmove back to test the R1 resistance around 49c, then R2 resistance at 56c, before moving further upwards.

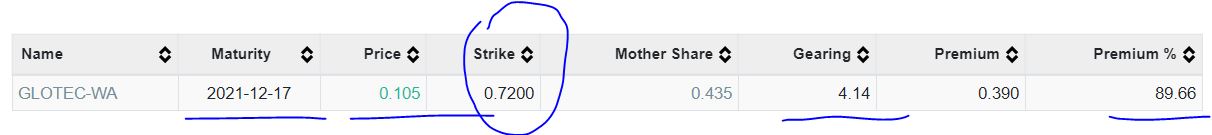

5. LOWER PRICE ENTRY VIA GLOTEC-WA

Refer below the profile of GLOTEC WARRANTS A (GLOTEC-WA) for those looking at a lower capital entry into this stock. A few key points to note :

i) Maturity in December 2021, which means ample time for the warrant value to appreciate

ii) Strike price of 72c, which is reasonable considering the stock NTA at 91c

iii) Premium of 89%, considerably OK for a warrant with 1 year life time

Refer Let's take a quick look at GLOTEC-WA chart:

Few points to note:

i) Circle 1, 2, and 3 shows that bullish volume keeps entering the warrants with price surging upwards

ii) Sellers are very weak, while buyers taking control of the price

iii) As of Circle 2, recent price resistance peak is at 23c. Therefore, latest closing of 10.5 still allows big upside room for investors

CONCLUSION

Considering all the above, I opine that current price for GLOTEC is attractive due to below:

i) Trading at VERY LOW PE RATIO of 2.7X earnings

ii) Strong NTA backing of 91c, with cash in hand of RM 62.2 mil

iii) Exciting prospects in its gas development project in Indonesia as o&g activities pick up

iv) Breakout above all EMAs including EMA365 indicating a long term bullish trend in tact

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

Discussions

another potential pump and dump counter. Very flawed analysis. Totally wrong way of interpreting the balance sheet. The writer did not even declare whether he own this counter or not. EPIC FAIL.

2020-12-13 11:10

Just sell switch to very safe insas mah...!!

U still can make another 100% with insas loh...!!

STAY ON TRACK WITH INSAS, U DEFINITELY WILL MAKE MONIES MAH...!!

FUNDAMENTALLY VERY SOUND MAH....!!

JUST BUY LOH...!

Get ready for the coming big upside potential of insas in view of its growth potential, value rerating and big improvement in financial stock business mah....!!

Jump in & buy big b4 too late loh....!!

INSAS IS A MISUNDERSTOOD STOCK LOH....!!

IF U LOOK BACK AT INSAS FOR PAST 10 YEARS, IT HAS BEEN CREATING VALUE NON STOCK ALMOST EVERY YEAR WITH INCREASING SHAREHOLDER FUND MAH...!!

THATS THE REASONS WHY ITS NTA GROW FROM RM 1.00 SAY 10 YEARS AGO TO ALMOST RM 4.00- 5.00 AS AT NOW MAH...!!

INSAS BIGGEST WINNER LIKE INARI, CONTRIBUTE MORE THAN RM 1.4B MARKET CAP & SMALLER WINNER LIKE SENGENIC CAN CONTRIBUTE MORE THAN RM 60M LOH...!!

SMALL INVESTMENT LIKE OMESTI & DGSB ARE DOING EXTREMELY WELL LOH...!!

INSAS IS LIKE BERKSHIRE HATHAWAY BUSINESS MODEL LOH...!!

BUT UNLIKE BERSHIRE, ACTUALLY INSAS IS BETTER IT PAYS DIVIDEND BUT BERSHIRE DON'T PAY LOH...!!

THOSE INVESTING IN INSAS IS GETTING COMPOUND GROWTH RETURN AVERAGING 10 TO 12% PA EVERY YEAR LOH....!!

IF U BUY INSAS NOW U R PAYING RM 0.865 FOR A FAIR VALUE OF RM 4.00 IN INSAS LOH....!!

A GREAT INVESTMENT LOH...!!

BUT MOST EXCITING PART THIS INSAS IS GROWING WITH GOOD PROFITABILITY MAH!

Just look at the amazing growth track record of value creation of insas for the past 10 yrs

Sept 2020- Nta Rm 2.75

June 2019- Nta Rm 2.62

Dec 2018- Nta Rm 2.54

Dec 2017..Nta rm 2.49

Dec 2016 ...Nta Rm 2.18

Dec 2015..Nta Rm 1.96

Dec 2014..Nta rm 1.82

Dec 2013 nta..rm 1.71

Dec 2012 nta ..rm 1.51

Dec 2011 nta..rm 1.38

Dec 2010 nta...rm 1.22

Dec 2009 nta ..rm 1.14

INSAS IS GROWING STRONGLY MAH....ONLY THOSE PEOPLE DO NOT UNDERSTAND BERKSHIRE HATHWAY BUSINESS MODEL ARE SAYING INSAS HATHWAY BUSINESS MODEL ARE LOUSY LOH...!!

BUT INSAS BUSINESS MODEL ARE SAME SAME MAH, IN FACT INSAS GENERATE COMPOUND EARNINGS OF 12% PA SAME SAME AS BERKSHIRE WOH..!!...HOW COULD BE BERKSHIRE VERY GOOD & INSAS VERY BAD LEH ??

2020-12-13 11:25

Lapsap stock. The writer is promoting this stock in his telegram group. This writer never reads the report in detailed manner and doenst understand the reason behind huge leap in profit.

2020-12-14 10:40

ongth60

one time gain of ~22million due to gold royalty disposal. It will be net loss if taken out.

2020-12-12 17:40