RIDING THE LUMBER WAVE UPWARDS & ENTRY INTO RENEWABLE

ENERGY !!!!!

RIDING THE LUMBER WAVE UPWARDS & ENTRY INTO RENEWABLE

ENERGY !!!!!

Hello to all readers out there. Recently, infrastructure projects around the world have resumed as the COVID19 vaccine has been approved for public use. This has caused a surge in demand for LUMBER.

Having said the above, the stock which I'd like to talk about today is BTM RESOURCES BERHAD (BTM - Stock Code 7188, Main Market, Industrial Products & Services - Wood & Wood Products)

BASIC INFORMATION ABOUT BTM

BTM was founded in 1994 and was listed on BSKL in 1996, with core business in:

i) Logging, sawmilling, trading of sawn timber, logs and plywood, kiln-drying operations, timber moulding, etc

ii) Letting of plants and machineries

iii) Investment holding and provision of management services

Website : http://www.btmresources.com.my/

1. LUMBER PRICES MAKING A STRONG RALLY RECENTLY !!!

Refer below latest LUMBER chart. As we can see it had made a pullback after hitting a recent high in September 2020.

Recently, after the COVID19 vaccine was found, lumber prices started to uptrend towards its recent high. As of Friday night, it had closed at USD 850.3, which is very close to its recent high of USD 1,000.

This uptrend in prices would definitely benefit BTM as a company involved in lumber products. The upcoming quarters should be showing better results.

2. POSTED LATEST QR PROFIT AFTER MAKING 7 QR LOSSES !!!

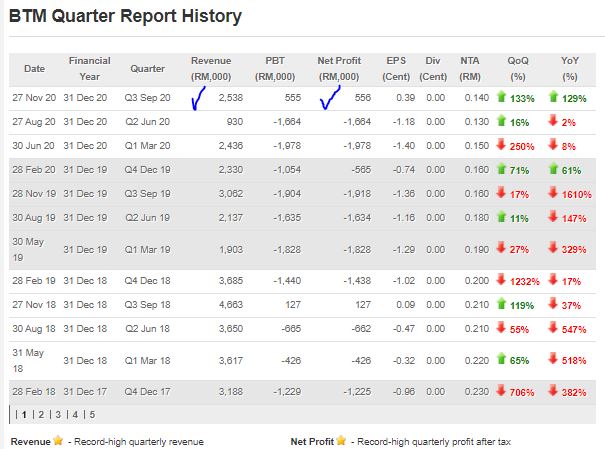

Below the latest summary of Quarter Results for BTM.

As we can see in the latest Nov 2020 QR, BTM had managed to record a net profit of RM 555,000 on the back of RM 2.5 million revenue. We note that the previous 7 quarter results were net losses.

Therefore, I opine that this turnaround, should it be sustained, would reward shareholders in the upcoming future quarters.

3. EXCITING PROSPECTS FOR ITS RENEWABLE ENERGY DIVISION !!!

Below the news coverage on BTM renewable energy diversification.

Recently, BTM subsidiary had received approval to build and operate a renewable energy electrical power plant of 10 Mega Watt (10 MW), in Chukai, Terengganu.

They had targeted the construction to commence in June 2021 and completion by December 2022.

Therefore, we shall see improvement in earnings from this diversification in the longer term.

https://www.theedgemarkets.com/article/btm-resources-receives-approval-operate-10mw-power-plant

4. TECHNICAL ANALYSIS - COLLECT IN SUPPORT ZONE

Refer below the basic price and volume chart with key EMAs for BTM daily chart :

A few observations on the daily chart:

i. BTM recently hit a high of 33.5c before making a pullback towards its support area between 20-22 cents

ii. Refer Volume, the volume of buying is high, whereas on the down days, the volume of selling is low. This means that investors are holding on for longer term gains

iii. The stock is trading above all key EMAs, indicating a long and short term bullish trend

iv. Should buyers be interested in this stock, we might see an upmove back to test the R1 resistance around 26c, then R2 resistance at 33c, before moving further upwards.

5. LOWER PRICE ENTRY VIA BTM-WB

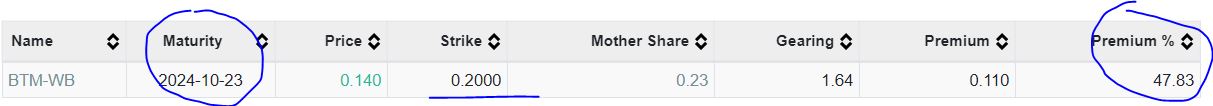

Refer below the profile of BTM WARRANTS B (BTM-WB) for those looking at a lower capital entry into this stock. A few key points to note :

i) Maturity in October 2024, which means ample time for the warrant value to appreciate

ii) Strike price of 20c, which is means that the mother is currently trading above its strike price, implying that the warrant will move more sensitively as the mother share price moves up

iii) Premium of 47%, considerably LOW and a BARGAIN for a warrant with 4 years life time

CONCLUSION

Considering all the above, I opine that current price for BTM is attractive due to below:

i) LUMBER prices uptrending which would also benefit BTM

ii) Posted turnaround QR profit, after previous 7 quarter losses

iii) Exciting prospects in its renewable energy subsidiary as it receives approval to build and operate a renewable energy plant in Terengganu, which would boost long term earnings

iv) Trading in bullish trend, and currently at the support price, implying a bargain entry into the stock

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

| Chart | Stock Name | Last | Change | Volume |

|---|

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

calvintaneng

LUMBER

WTK (4243) OIL PALM & LUMBER SALES OF LUMBER UP FROM 12,000 TO 26,000 TONNES

JTIASA (BOTH OIL PALM & LUMBER)

THPLANT (BOTH OIL PALM & LUMBER)

2020-12-20 23:25