The Reason Behind the Global Share Markets Crash in February 2018 (an Update)

ChloeTai

Publish date: Sat, 03 Feb 2018, 12:37 PM

My worst fear has come true. The following two charts on Friday's (2 February 2018) trading of Dow Jones and Hang Seng Index Futures speak for themselves.

Wall Street tumbled after US bonds yields soared following a strong US jobs report showing wage growth improved fuelling expectations for a faster pace of inflation, and monetary policy tightening.

The Labor Department said Friday, U.S. non-farm payrolls rose by 200,000 jobs in January. That beat economists’ forecasts for 184,000 new jobs. While unemployed remained at unchanged on the prior month at 4.1%.

Wage growth met expectations rising 0.3%, and was revised upward to 0.3% for December, triggering investor expectations that tighter labour markets could finally be starting to boost wage price pressures. This may spur inflation growth which could force the Fed to raise rates by more than what markets currently anticipate.

The 10-year Treasury yield rose above 2.8%, as some market participants expect the Federal Reserve to raise rates four times this year. BNP Paribas revised upward its assessment of core PCE inflation, the Fed’s preferred measure of inflation, to 2.2% from 2.0% previously, and said it expects the Fed to raise rates four times in 2018 compared to a prior estimate of just three hikes.

The Dow's highest closing record is 26,616.71 set on January 26, 2018.

The Dow has set 96 new record closing highs since the 2016 presidential election.

A 10% drop from the peak is 23,955 (defined as a correction) and a 20% drop from the peak is 21,293 (defined as a bear market).

Recall of Previous Global Financial Crisis

First Financial Crisis (2008 Lehman Brothers' Subprime Mortgage Crisis)

On September 15, 2008, Lehman Brothers filed for bankruptcy. With $639 billion in assets and $619 billion in debt, Lehman's bankruptcy filing was the largest in history, as its assets far surpassed those of previous bankrupt giants such as WorldCom and Enron. Lehman was the fourth-largest U.S. investment bank at the time of its collapse, with 25,000 employees worldwide.

Lehman's demise also made it the largest victim of the U.S. subprime mortgage-induced financial crisis that swept through global financial markets in 2008. Lehman's collapse was a seminal event that greatly intensified the 2008 crisis and contributed to the erosion of close to $10 trillion in market capitalization from global equity markets in October 2008, the biggest monthly decline on record at the time.

Second Financial Crisis (2000 Dot-com Bubble Burst Crisis)

The dot-com bubble (also known as the dot-com boom, the dot-com crash, the Y2K crash, the Y2K bubble, the tech bubble, the Internet bubble, the dot-com collapse, and the information technology bubble)[1] was a historic economic bubble and period of excessive speculation that occurred roughly from 1997 to 2001, a period of extreme growth in the usage and adaptation of the Internet by businesses and consumers. During this period, many Internet-based companies, commonly referred to as dot-coms, were founded, many of which failed.

During 2000–2002, the bubble burst. Some companies, such as Pets.com and Webvan, failed completely and shut down. Others, such as Cisco, whose stock declined by 86%, and Qualcomm, lost a large portion of their market capitalization but survived, and some companies, such as eBay and Amazon.com, later recovered and surpassed their stock price peaks during the bubble.[2]

Third Financial Crisis (1997 East Asian Financial Crisis)

The Asian financial crisis was a period of financial crisis that gripped much of East Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion.

The crisis started in Thailand (known in Thailand as the Tom Yum Goong crisis; Thai: วิกฤตต้มยำกุ้ง) with the financial collapse of the Thai baht after the Thai government was forced to float the baht due to lack of foreign currency to support its currency peg to the U.S. dollar. At the time, Thailand had acquired a burden of foreign debt that made the country effectively bankrupt even before the collapse of its currency.[1] As the crisis spread, most of Southeast Asia and Japan saw slumping currencies,[2] devalued stock markets and other asset prices, and a precipitous rise in private debt.[3]

Indonesia, South Korea, and Thailand were the countries most affected by the crisis. Hong Kong, Laos, Malaysia and the Philippines were also hurt by the slump. Brunei, China, Singapore, Taiwan, and Vietnamwere less affected, although all suffered from a loss of demand and confidence throughout the region. Japan was also affected, though less significantly.

First Opinion:

I respect Calvin Tan Eng very much and I read all of his articles. He is a very respected and optimistic person.

This is only a short term correction.

These are the reasons why US is well supported:

1) USA is going ro reduce tax from 35% to 20%

This will pump money into US Economy

See https://www.rte.ie/news/business/2017/0927/907958-trumps-us-tax-plan/

2) USA 400 Billions or more will return to the US

https://www.cnbc.com/2018/01/05/apple-tech-companies-to-bring-back-400...

3) To overcome tariff, many Foreign Companies are shifting production to the US. This will create jobs in USA

http://fortune.com/2017/02/03/donald-trump-manufacturing-jobs-asia/

4) And USD 1 Trillion for Infrastructure works will boost economic growth

https://edition.cnn.com/2017/06/13/opinions/trump-infrastructure-econo...

SO THE GAME CHANGER BY TRUMP MIGHT POSTPONE THE CRASH TO A LATER TIME

Third Opinion:

I asked my remisier's opinion of the current market outlook and he replied "the whole world share markets have been breaking records after records. It is now not justified. At this moment, I don't see good of the market. Better get out of all markets (in Cantonese).

30/01/2018 16:15

Professional's opinion:

My humble opinion:

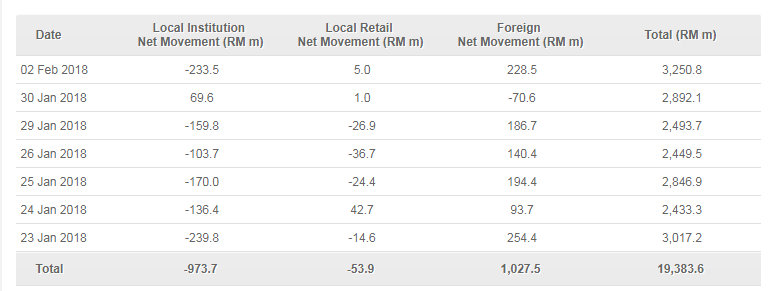

I have no idea of what will the Foreign Funds do but one thing for sure our own Local Institutional Funds will sell heavily and this will induce panic selling among Local Retailers (particularly stockists).

More articles on Chloe Tai Blog

Created by ChloeTai | May 30, 2024

Created by ChloeTai | May 22, 2024

Mah Sing export their plastic products to

More Than 50 Countries

around the world.

Created by ChloeTai | Apr 29, 2024

RHB Research - Going All Out; Keep BUY. New Target Price RM1.61.

Created by ChloeTai | Apr 25, 2024

Rakuten Research - Raised Synergy House Target Price to RM1.50

Created by ChloeTai | Apr 24, 2024

Estimated Q1 FY2024 will increase by 3 folds YoY.

Created by ChloeTai | Apr 21, 2024

Synergy delivering remarkable QoQ growth since their IPO. The company registered PAT of RM2.62 million, RM6.19 million, RM8.07 million and RM10.27 million. Immediate TP is RM1.48.

Created by ChloeTai | Dec 29, 2023

Kenanga Research give KGB an OUTPERFORM status with a target price of RM3.28 due to its record profit and high demand for ultra-high purity gases .

Discussions

Ha!

TRUMP IS GOING TO PUMP USD1.5 TRILLIONS (RM5.8 TRILLIONS) FOR USA ROADS, BRIDGES, FREEWAYS (HIGHWAYS IN MALAYSIA), AIRPORTS & SEA PORTS

THIS KEYNESIAN DOCTRINE WILL CAUSE BOOM IN DEMAND OF EVERYTHING

See how I wrote about US Trip in 1999:

(((Since the US is no longer competitive, they fiddled with low interest rates to promote growth by cheap credit. Here, let us share our US Hired Car Experience. One Day we rented a US made car for a day trip to Hoover Dam & Lake Mead.

We found out to our amazement the low quality of the US made car. You see, the automatic window on the driver side cannot close properly. Even the Malaysian made Proton Saga is better than the US made car. And US put the first man on the moon?)))

Further comments (Feb 3rd 2018)

For 20 years I drove on the left side of the road. For the first time after driving for 20 years I drove on the right side of the road in USA.

One Police car saw me turned into the wrong lane twice! Then watched us as we kept to the right side of the road.

In Malaysia you keep left. But in USA you keep right!

Ha! The drive to Lake Mead & Hoover Dam (Or Boulder Dam as Robert Kuok wrote in his Memoir) was a terrible 2 lane kampung road.

NO WONDER DONALD WANTS TO IMPROVE ALL THE INFRASTRUCTURES OF USA BY A MASSIVE RM5.8 TRILLIONS

After Subprime Collapse CHINA SAVED THE WORLD BY PUMPING USD600 BILLIONS (About Rm2 TRillions) See https://en.wikipedia.org/wiki/Chinese_economic_stimulus_program

CHINA DID IT!

SO THESE MASSIVE RM5.8 TRILLIONS US INFRAR JOBS WILL CAUSE HUGE ECONOMIC STIMULATION FOR THE US & BY PROXY THE WHOLE WORLD

WAIT FOR CALVIN'S NEXT ARTICLE ON

"AN INSIDER LOOK AT DONALD TRUMP" - A MAN WITH SUPERIOR IQ & INTELLIGENCE!" By Calvin Tan Research (Secrets about Donald you don't know!)

2018-02-03 14:05

aiinvestor wage growth -> improved inflation outlook -> US treasury yield rise -> bullish USD -> bullish USDMYR -> good for Malaysian export-oriented stocks

03/02/2018 13:53

MYR is getting stronger la..what have you been smoking...the 1mdb smoke screen is gone dy...once election comes..PREDICTED BN WILL AGAIN...myr will be even stronger.

2018-02-03 14:07

But I'm not sure if Malaysian stocks will get affected severely. In 2017 Malaysian stocks got affcted least by bullish US stocks. Malaysian stocks may get affected, but will probably end up with a less than 1% drop.

2018-02-03 14:10

monday morning drop 20 points, 2.30 pm minus 5 points , close flat, my prediction

2018-02-03 14:11

How deep a correction do you expect in the US and also in Malaysia?

2018-02-03 14:13

Calvin thinks this monday is BEST TIME TO BUY VALUE STOCKS IF THERE IS ANY SELL DOWN

1997/7 (MONEY FLED. All go begging IMF). No Money time

2007/8 (SUBPRIME CRISIS AS HOUSING BUBBLE BURST). Banks lost money

2017/8 (USA IS NOT NO MONEY. BUT TOO MUCH MONEY LEADING TO FEAR OF HIGHER INTEREST RATES?)

WILL INTEREST RATES GO UP 4 TIMES?

WHO SAY 4 TIMES?

SPECULATORS/ FORTUNE TELLERS?

DON"T BANK ON IT

YOU CAN BE SURE DONALD TRUMP WILL INTERVENE.

DON'T BE SURPRISED.

RAISING INTEREST RATE (4 X) MIGHT BE ABORTED BY TRUUMP'S DIRECT INTERVENTION AGAIN!!!

So don't panic

Read this in stead

https://www.marketwatch.com/story/get-set-to-buy-stocks-after-a-market-crash-2012-10-18

2018-02-03 14:18

Dear calvintaneng,

True fact is American want Face, si.ai.bin

The country is being financed by the Chinese speaking n look alike nations in the entire world today.

To continue spending n pay the creditor countries is their biggest problem, that's all.

But to pay they have to keep increasing their Debt Limit which is due next mth, i think.

the problem can become messy esply the bodoh president simply just drop all taxes everywhere for no economic reason in a best growing economy long created by obama.

This is causing the fear now.

n oso, DOW n partners r due to fall a bit in any way u look at them.

2018-02-03 14:18

Winner,

Try diving in US Nevada

See

https://www.youtube.com/watch?v=RETEJ1c3BHw

2018-02-03 14:35

Let me add what I heard then in 1998 Asian Financial Crisis.

Everybody knows from the Good Book that said, the yahudi can be 'severely punished' by only 1 colour people of the world.

So in 1997/98, starting from Thai baht, the asian currencies were falling easily n surely in purebear fashion 1 after another.

g soros n big timers were having fun n good times taking advantage of every falling currency in all the countries in the bloc.

Finally the final straw was to whack big havoc with Hong Kong dollar.

The story then said, China gave an easy statement to g soros n team i.e.

I, china n all my oversea Chinese look alike gov countries r holding the biggest USD assets in dollars.

only if u dare to proceed another inch into HK dollar, we will corporately throw our USD to U anytime now.

So the stock mkt began to pureBULL all the way from 1st Sep 2009

onwards ...

2018-02-03 14:47

Appreciate v. much your kind alert on possible impending major correction/ CRASH in financial markets n implications for BURSA Malaysia.

There was a similar siren sounded much earlier on Jan.8 2018 by an I3 blogger, which was titled :

KLCI BULLISH SELL ALL to them ,( esp. the O & G sharp surging up shares).

Of course,in early Jan. BURSA was in a v.high mood, in the midst of v.enjoyable Bullish party.

Out came an early bird, with an unwelcome alert, u can guess the type of reception/response, from most people.

Many sifu in I3 were quick to shoot from the hip, to put this blogger in his rightful place.

Cant remember the name of this blogger, though.

But i think, level headed n right thinking I3 viewers should accord credibility to those whom it is due n remember who are those prone to shoot from the hips.

thks.

2018-02-03 15:57

If u dont know him good enough n if u eat too much too free nothing to do go to browse thru his past comments since 2015...

Basically he keeps repeating the same thing since 2015...fm jan to dec...fm mon to sun till now

2018-02-03 16:10

Dear CharlesT,

R u seriously loss in this beautiful key decision making thread ??

2018-02-03 16:13

A drop of more than 600 points in the Dow is very, very normal, since DJ up from16k point to 26 k point.

2018-02-03 16:19

What a bunch of idiots 2.5% all panic call for crash lol

Look at the US stock market after the idiots voted Trump into office, how many % rise, the few % drop is peanuts la

You must know the pullback is caused by what to find out if its going to be prolonged, or just a blip

And you will see that the drop is due to impending rise of interest rates, when interest rates rise, of course some money will flow out of equities to 'chase' the higher yields or else the portfolio managers are going to get fired la they are human beings also need to take care of their backside ma lolol

In fact, wage growth and inflation is a good sign for the economy because it means it is expanding. And with the rate rise already anticipated, what 'crash'? So easy to predict a crash ah Soros will be a trillionaire lo lolol. A crash by sheer definition will only happen from something that you cannot anticipate. If your portfolio cant take this small drop, that means your ability to pick stocks needs a lot of improvement. And if you cant bear to go through that small drop, go and keep money in properties or FD or other asset classes

2018-02-03 16:34

No major war, no natural disaster, no major terror.....this 665 drop due to US interest rate hikes means US economy is very healthy......means more US funds will flow into Malaysia.....next week Bursa CNY goreng starts.

2018-02-03 16:42

calvintaneng sifu can ask you now which is the best planatataion counters to buy

tdm? taan ?

2018-02-03 18:22

Nice to see you ozzie75

ivan9511

i like most of cpo stocks

best one?

it depends

KWANTAS FOR ITS LAND BANKS

RSAWIT FOR ITS 100% OIL PALM TREES

WTK FOR BEING BALANCED WITH TIMBER

HARNLERN FOR ITS PRIME JB PROPERTIES

TDM FOR ITS STABLE ASSET IN HOSPITAL

CBIP FOR ITS MODIPALM

THPLANT FOR DIVIDEND

JTIASA NOW SO CHEAP

DUTALAND FOR ITS COMING CASH HOARD

SO MANY MORE?

Whoa!

So many I am also not sure now

2018-02-03 18:31

cash is king if butaland got 750mil also interest rate up.....then kaboom. bonia is a dying industy just like parkson.nowday u see any young generation go and shop at bonia?

2018-02-03 23:00

wait jibby lose only can buy a lot on 4d.....now all control by a lot cannot kena,only his cronies can kena a lot.same goes to bursa.now only can buy and make coffee money cannot buy maserati

2018-02-03 23:08

Bloomberg said it was not even a correction (drop less than 10%. Cant be defined as correction) . You called it a crash. *facepalm. If Malaysia follows US index. KLCI is already above 3000 points

2018-02-03 23:54

Europe and Japan are recovering well. US economy is strong. Malaysia's fundamental is strong. Waiting for cheap sales next week to buy more

2018-02-03 23:58

World manufacturing starts 2018 on strong note

Purchasing managers' indices for major economies currently close to record highs

http://www.businesstimes.com.sg/government-economy/world-manufacturing-starts-2018-on-strong-note

2018-02-04 00:35

Dow sees worst day in two years as bond yields jump

https://www.reuters.com/article/us-usa-stocks/dow-sees-worst-day-in-two-years-as-bond-yields-jump-idUSKBN1FM1KC

2018-02-04 00:39

I read a document published by CME group. The title is Asian Stock Index Correlations.

The correlation between KLCI and the Dow is only 0.351 from January, 2007 thru March 14, 2014.

The correlation between KLCI and Nikkei 225 is 0.666 from January, 2007 thru March 14, 2014.

The correlation between KLCI and Hang Seng is only 0.612 from January, 2007 thru March 14, 2014.

2018-02-04 08:24

Lol, correction and crash are total differ story. Correction usually after awhile of increasing trend while crash need few requirement. Plus last time market crash because of some incidents. Nowadays, we need to take account of few others things like, china new economy status, us interest rate trend and real economy turmoil that cause market crash. Us wont be that easy crash due to it current economy conditions which donald trump have to take care it main problem. Most probaly Donald trump need to increase US productivities before next crash as US now having huge debt and as interest going up, it serve more debt add on. While china own alot Us treasury bond too and big portion Us market (china export). US really have to reconsider self status again if china sucessful on his 一带一路 plan and neglected Us big market. Please take note that, many country already slowly thrown usd and buy gold last 10 years. Do take also we encounter coming GE14 as gov need to let ppl feel good enviroment lolz. Good luck all.

2018-02-04 09:04

Actually now penny can survive.

tomorrowb start maybe finance bank and bluechip will suffer

2018-02-04 12:41

Just Sharing...4 Tips From USA Today For Tomorrow... :)

1. Don't panic and stay the course

If you flee stocks now, you're going to miss out on potential gains ahead.

Economists remain bullish on growth. "We expect fiscal policy, financial conditions and firming global outlook to support strong economic growth of 2.7% in 2018," Nomura economist Lewis Alexander said in a note.

Experts have been predicting a correction. From the Dow's peak of more than 26,000 in late January, it would take a 2,600-point drop to hit that 10% level, and Alan Skrainka, chief investment officer for Cornerstone Wealth Management, has been predicting that's what will happen this year.

2. Consider buying the dip

Should you take advantage of the dip to buy more stocks?

The bull market is showing its age but few think the good times are at an end.

The U.S.'s unemployment rate, at 4.1%, is at the lowest level since December 2000. The tax-cut package delivered some of the biggest gains to corporations, and the benefit to profits is likely to support stock prices through the rest of the year.

But if you decide to snap up shares at lower prices, be selective, advises Joe Quinlan, chief market strategist for U.S. Trust. Consider your tolerance for risk over the long run, because your nerves are going to be tested as the market gets bumpy amid rising long-term interest rates.

In the U.S., Quinlan sees opportunity in financials, health care and industrials. Looking abroad, he favors stocks related to the e-commerce boom in China and robotics production in Japan.

3. Or wait and watch

The market may rebound in a big way following the recent turbulence, but it may take time..

Sam Stovall, chief investment strategist for CFRA, is predicting further declines before stocks stabilize. Given that the market has gone so long without a major setback, investors may be leery about jumping back in right away.

4. Realize the sell-off is a blip

Since 1900, the U.S. has seen 125 corrections of 10% or more, which is about one a year. Yet the market always goes on — and eventually up. Since 1980, the stock market has had positive annual returns in 28 of the last 37 years, Skrainka points out.

Remember that the drop Friday follows a 25% rise in the Dow last year.

"It’s really not much of a sell-off," says Stephen Janachowski, CEO of Brouwer and Janachowski, a wealth management firm based in Mill Valley, Calif. "A 3% to 5% decline doesn’t scream 'buy' or 'sell.' "

Investors who are already invested should take a deep breath and sit on their hands, he says. Those who were looking for an entry point can gradually buy into the market if it falls further.

https://www.usatoday.com/story/money/markets/2018/02/02/4-tips-following-stock-markets-666-point-drop/302443002/

2018-02-05 00:48

Hopefully miracle will happen. It is just one day affair drop. Just like Brexit, only took half a day to rebound.

2018-02-05 06:24

ivan9511

1996 posts

Posted by ivan9511 > Feb 4, 2018 12:41 PM | Report Abuse X

Actually now penny can survive.

tomorrowb start maybe finance bank and bluechip will suffer

see my advice

I already said before early

now penny maybe can survive other down

I said before that

2018-02-06 12:27

The consequence of exit fr QE 2. PPl thought that when bond yields start their climb, the Dow will go up n up.

Now which is which? Interest rates goes up - Dow goes up or Interest rates goes up - Dow goes down.

2018-02-06 12:51

PureBULL .

My friends here esp dear calvintaneng,

Wishing ALL best of LUCK n safe always at all times of the mkt ...

Just leave it to the AMERICANS.

DOW was down a scary 666 pts.

Yet AMZN, the most expensive giant plc that made its owner the Richest man in the entire world, was up a handsome 2.87% today with PE 232 times.

What say u ?

2018-02-03 14:00