ANNJOO - Do less earn more

DividendGuy67

Publish date: Tue, 02 Jul 2024, 10:55 PM

I previously posted on ANNJOO here.

Today, ANNJOO spiked up the 2nd time 3rd round, and so, I took partial profit again (via GTC sell order i.e. don't watch market).

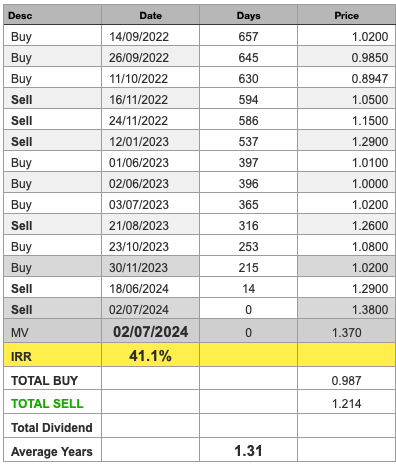

Here's a visual chart of my trades - it's 3 rounds of buys and sells and buys and sells and buys and now sell.

I don't use TA indicators. No exponential moving averages, no MACD, no RSI, no Bollinger Bands, nothing. Just price and volume chart. Maybe occasional trend line and Fibonacci related lines and maybe some wave counting from time to time but mostly that's all.

I don't watch markets daily. I don't watch price movements during trading hours too.

The red arrows show the dates that i bought. The smileys show the dates that I sold.

This table shows the dates that I bought at what price average, and the dates that I sold.

The Average period of my buys is 1.31 years. I don't sell all, I still hold a sizeable position, but the IRR of my trades including my MV is 41.1% per annum.

Key observations:

1. Trading profitably is about buying low and selling higher than bought.

2. Trading in a non-stress way is about looking at buy/accumulation zones and selling at sell/distribution zones - mostly chart based gut feel.

3. Don't stare too much - it should "jump out" at you - if it doesn't, maybe it isn't there. Trust your gut.

4. You'll never catch the top - see after my 3rd smiley, I didn't dispose a 4th amount at the peak. I missed the peak and that's perfectly OK.

5. ANNJOO's price action on the sell side made it easy to sell, because after I bought, price eventually rise above my buy price, making it easy to sell at a profit. Just lucky that the price action made it easy to sell profitably.

6. ANNJOO's price action on the buy side made it easy for me to buy back, because after I sold, price eventually fell below my sell price, making it easy to buy back. Just lucky that the price action made it easy here.

7. There's a lot of LUCK here. If the price action was flat, there was nothing I could do. Market decides how much profit we get, not our skills.

8. I trade very small here. So, buying 3 times or 5 times is not a problem. Selling 5-10 times is not a problem. The 6 sells I made so far is basically "self-paid dividends", except they are much larger than dividends.

9. I am thankful I am a self-investor. If I have been an institutional investor that must report my performance to my superiors and stakeholders every month, I would be criticized for holding lousy stocks like ANNJOO. With nobody watching and critiquing my trades, where temporary paper loss is meaningless, it's relaxed to trade and earn if you are patient and if you have identified the accumulation zone well.

Conclusion

ANNJOO's win size (realized and unrealized) is now larger than my number 1 stock pure dividend gains.

Feeling thankful that I am able to supplement my dividends with trading profitably using roughly 1/10th the size

But honestly, it's still easier to earn passive income using dividends, because whilst I am not stressed with ANNJOO at all, I hardly watched my MAYBANK dividends too.

Just sharing some reflections here.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Jan 22, 2025