What is your Investment Objective?

DividendGuy67

Publish date: Tue, 16 Jul 2024, 09:37 PM

Do you have an investment objective in Bursa?

Can you articulate it in one minute?

If you can't, or cannot be specific, odds are you don't have one, and this is highly risky in the long run - quite likely, you are a gambler.

What is my investment objective in Bursa? It's simple.

Beat EPF returns over my lifetime, by at least 2%, by prudently targeting 9% per annum total returns (price gains and dividend yield) on my long term stocks. Stocks should be between 20%-45% net worth. Make at least half from dividend yields. Be highly diversified with at least 40 different stocks so that the complete loss of any one stock doesn't derail me from my lifetime investment objective.

Super easy to articulate.

Typical responses to that investment objective belongs to 2 categories:

1. Why so low?

2. Why so high?

Let's deal with each question below.

1. Why so low?

Gamblers / lottery buyers like to spend a small outlay (say RM10) in the hope of winning big (say RM1,000), or make say 100 times returns or 10,000% returns. So, 9% looks low in comparison. My question to this view is - would you spend RM1,000,000 to buy a lottery ticket? Answer is obviously no right?

So, if 10,000% returns is not the benchmark, so, what is?

Let's benchmark Warren Buffet, the world's greatest and world's richest investor in the stock market. How good is he? He started from nothing, invested from a young age, made everything and donated huge sums of monies and is still worth USD135 billion! He used to be the richest man in the world for many years. I feel he is a great person to benchmark but what is his annual % returns?

Look at Berkshire's Performance from 1965-2023 (58 year period).

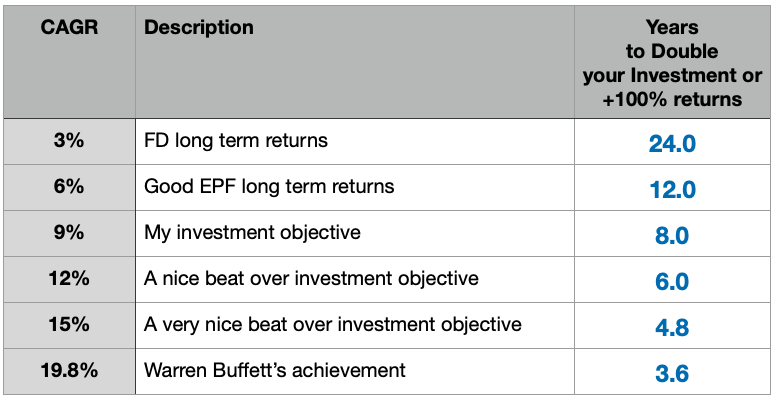

His CAGR is "only" 19.8% per annum over this period.

However, that 19.8% CAGR for 58 year period translated to 4,384,000% returns!

That's a lot more than that 10,000% returns.

How is it possible? Simple. Time.

Is 19.8% CAGR "safe"? Yes, if you invest following Buffet's principles.

So, whilst my 9% per annum is conservative (less than half of Buffet's), my actual achievement is somewhere in between 9% and 19.8% per annum since inception.

What does this mean in terms of how many years before doubling your monies? Here's how long it takes to double your monies at various rates of returns.

Is this good or bad? Is 9% per annum - which doubles your monies after 8 years - good or bad for you?

Simply put, imagine you have RM2,000,000 invested in stocks.

Is doubling your monies i.e. making RM2,000,000 in 8 years good or bad for you?

That works out to be roughly RM250,000 per year, or roughly RM21k+ per month by passive income.

Is this good or bad for you?

What about 12% per annum investment objective - which doubles your monies after 6 years - is this good or bad for you?

Imagine you have RM1,000,000 invested in stocks.

Is making RM1,000,000 every 6 years good or bad for you?

This works out to be roughly RM167k per year, or roughly RM14k per month by passive income - is this good or bad for you?

Another reality check - how many people in this world of nearly 8 billion population can become the world's richest stock investor? One. There is only 1 Warren Buffet in this world with proven success and he delivered 19.8% per annum returns.

I don't know about you, but I am no Warren Buffet, and if I make 9% per annum returns long term (which I am beating this well since inception), I know I would be very content and happy financially for the rest of my life. If I make 12% per annum returns long term, that's a very nice bonus over the long term.

In short, 9% per annum investment objective over my lifetime is not a low number for me provided I can sustain this for the rest of my life.

2. Why so high?

For those who thinks that 9% is too low, you may be surprised to know that there are a few individuals with high to very high net worth (7 digit, 8 digit) who have shared with me, that 9% per annum is far too risky.

It's all about the individual's proven skills and risk appetite.

As DIY investor in the stock market:

- You are the investor

- You are the one to choose which stock to buy

- You are the one who triggers the buy orders

- You are the one who needs to be able to sleep soundly every night after entry

- You are the one who will be making the sell/exit decisions.

- In short, You and only You must be happy with your investment process and your investment objective.

And if you think 9% per annum is too high, aim for lower number until you can "SWAN" (Sleep Well At Night).

Investing is not a competition. Whether your number is lower or higher than others should be irrelevant to you. The only opinion on that number that matters in this world is you and only you, as you are the DIY investor and it's your monies.

Summary and Conclusion

1. Investment objective is highly personal and private - everyone has their own unique number.

2. Investment objective is not a competition - the only opinion that matters is your own opinion.

3. Still, it's important to know your number before hand, and be able to articulate it instantly, so that it guides your every investment decision.

4. Apply reality check. Remember Buffet's actual 19.8% per annum returns.

5. Your objective should make you content and happy in your life, so that it frees you to pursue what you like to do in life.

6. Don't be greedy - never risk what you need, for what you want.

Best wishes!

Disclaimer: As always, you and only you are fully responsible for your trading and investment decisions.