MAGNUM - Position Trade Update

DividendGuy67

Publish date: Thu, 18 Jul 2024, 09:27 PM

I previously blogged about the MAGNUM Position Trade that I took on 20 May here.

Since chasing the entry at 1.16, MAGNUM rose a little but then fell back down to as low as 1.10, putting me 6 sen underwater.

However, the past 2 days, MAGNUM had a breakout. Closed 1.28. 12 sen win.

Question is should I sell?

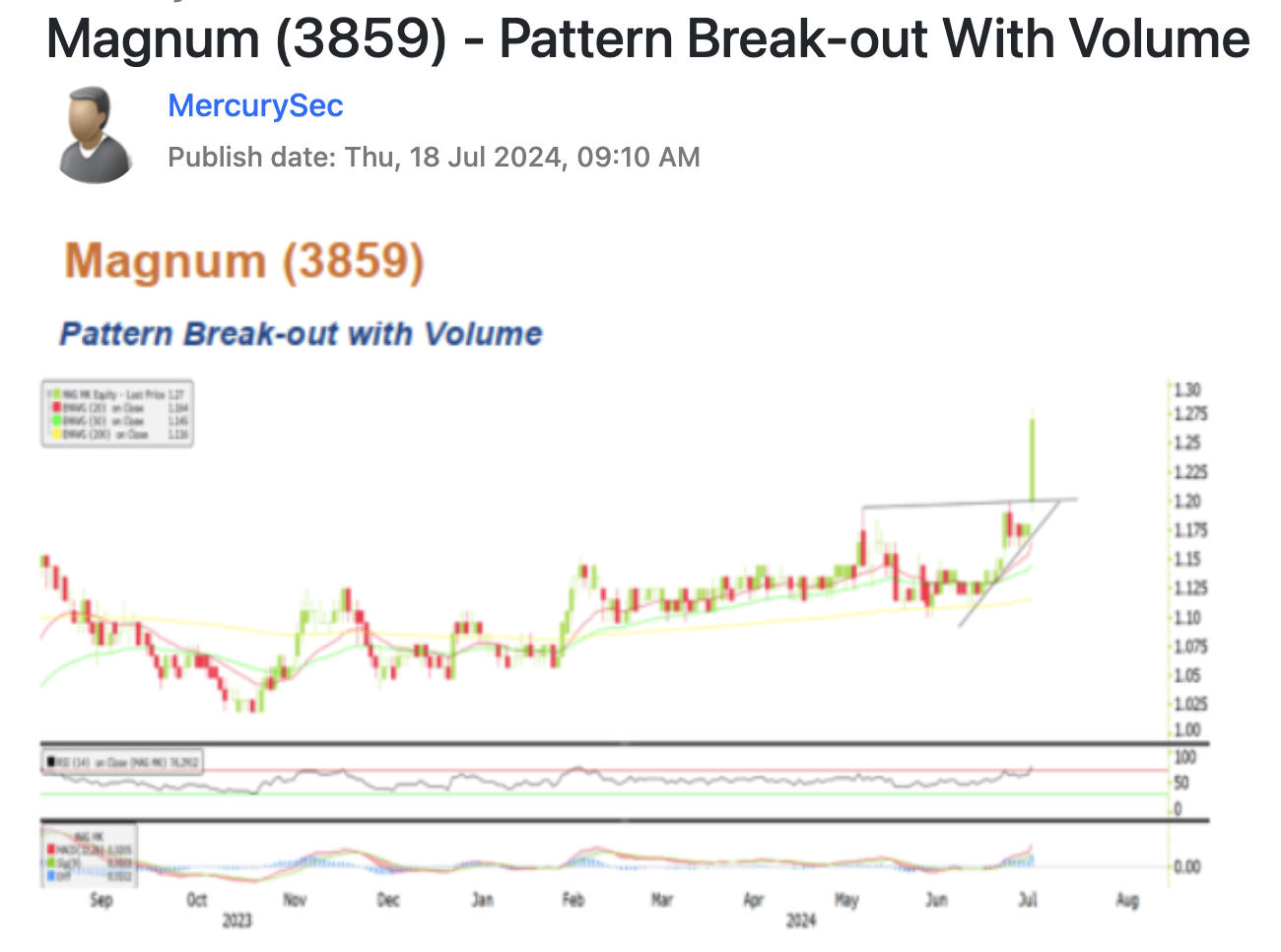

IB / Broker Call (Didn't resonate with me)

Today, one IB also published a trading idea (unfortunately, didn't resonate with me) as follows:

Now, there's no right or wrong in trading, but before you follow anybody's idea, it's important to form your own independent opinion.

Why this particular trading idea didn't resonate with me is because:

1. It asked us to chase (after a breakout), here, to buy between 1.27-1.28 which I feel is a bit late.

2. The Target gives only 3 sen win (1.31 - 1.28). After retail commissions (let say 1 sen), the net win is only 2 sen.

3. But the Stop Loss is so huge at 1.16 i.e. if you lose, you lose 12 sen + 1 sen brokerage = 13 sen.

4. Winning 2 sen, losing 13 sen means even if you win 6 times, and lose 1 time, your account shrinks.

So, I'm not convinced of this type of trading.

Additionally, the broker thinks the target price should be RM1.31 to RM1.41. Do I agree?

My view of Target Prices

First, there are many valid different target prices depending on your trading strategy.

Here is my target price for my kind of position trading (where I entered at 1.16 and plan to hold for 1 to 17 months). This strategy is not for everybody if you don't have the kind of patience or mindset towards markets like mine.

As usual, I turn to Monthly Charts, because my trading horizon is 1 to 17 months.

Here are my observations:

1. Yes, there's a breakout this month. (yey!)

2. The first target to me is the 38.2% Fibonacci Retracement which points to RM1.45.

3. The second target to me is the 50% Fibonacci Retracement which points to RM1.59.

4. The third target to me is the 61.8% Fibonacci Retracement which points to RM1.72.

5. Don't be greedy - see the 2 very strong overhead resistance downtrend lines spanning 1-3 decade. That kind of resistance is super strong. And they are just above.

6. In situations like this, price hitting these targets is enough reason to sell, due to that massive downtrend lines. Sell first, take profit and run. Stay in cash.

7. Then, wait. Wait for prices to come back down and retest that thick uptrend support line. The key is patience. Without patience, you won't win.

In short, successful trading doesn't have to be complicated.

My Position Trade RRR

RRR = Reward to Risk Ratio.

1. Reward = the Win size if price hits your target.

2. Risk = the Lose size if price hits your stop loss.

3. Ratio = Reward / Risk = RRR.

With this kind of price action, it looks like it's a lot less likely to revisit the low of RM1.10 than going up towards RM1.45.

So, it looks like my "Risk" = 6 sen (on paper). What about my potential win size in my plan?

1. If it goes to 1st resistance of 1.45, the win is 29 sen, i.e. 4.8 times the risk. (RRR = 4.8)

2. If it goes to 2nd resistance of 1.59, the win is 43 sen, i.e. 7 times the risk (RRR = 7)

3. If it goes to 3rd resistance of 1.72, the win is 56 sen i.e. 9+ times the risk (RRR = 9+)

With RRR like this (4.8 times, 7 times, 9+ times), you can afford to lose 3 times, win 1 time and you will still grow your trading account after hundreds of these kind of trades.

What's the Key to win at Position Trading?

1. Have a good trading plan, that is similar to above.

2. Discipline to execute the Plan and Patience.

Discipline

This simply means executing the plan. Even a child can execute this simple plan.

Patience

Don't self-sabotage by questioning yourself whether to deviate your plan or not.

Don't watch the market. Get a hobby. Focus on your lovely family and work. Get a life with friends and family outside markets. Read a book. Go out to a movie. Volunteer. Share. Write. Don't waste your life looking at price ticks.

Summary and Conclusion

Let's see how this trade goes the next 1-17 months i.e. by FYE 2025.

Good luck!

Disclaimer: As always, you and only you are fully responsible for your own Trading and Investing decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on https://dividendguy67.blogspot.com

Discussions

Magnum

1. Yes, there's a breakout this month. (yey!)

2. The first target to me is the 38.2% Fibonacci Retracement which points to RM1.45.

3. The second target to me is the 50% Fibonacci Retracement which points to RM1.59.

2024-07-20 20:14

DividendGuy67

https://www.thestar.com.my/news/nation/2024/07/09/high-court-rules-kedah039s-ban-on-gaming-licences-unconstitutional. Just saw this. Interesting that on 9 July, price bounced up but didn't break out. However, yesterday 17 July, price finally broke out ... I wonder why ...

2024-07-18 23:35