HLFG - Is it too cheap?

DividendGuy67

Publish date: Sat, 27 Jul 2024, 11:42 PM

Background

An i3 forummer asked me what I thought about HLFG vs HLIND. It's a complex question, so, I'll share my thoughts on the first part of the question, namely HLFG here.

Introduction

According to i3 Profile:

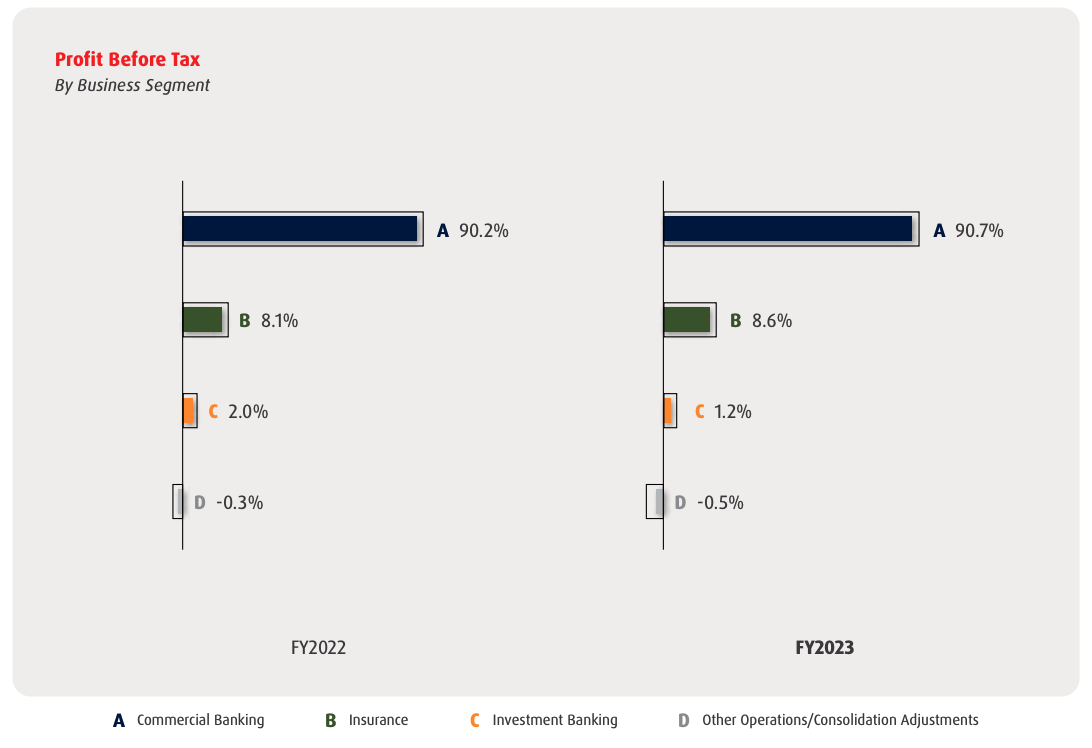

The Annual Report is more insightful on where are the profit drivers. Nearly 90-91% of its profits is derived from commercial banking, 8-9% from Insurance, 1-2% from Investment banking, i.e. this is mostly a conglomerate owning Bank+Insurance+Investment business.

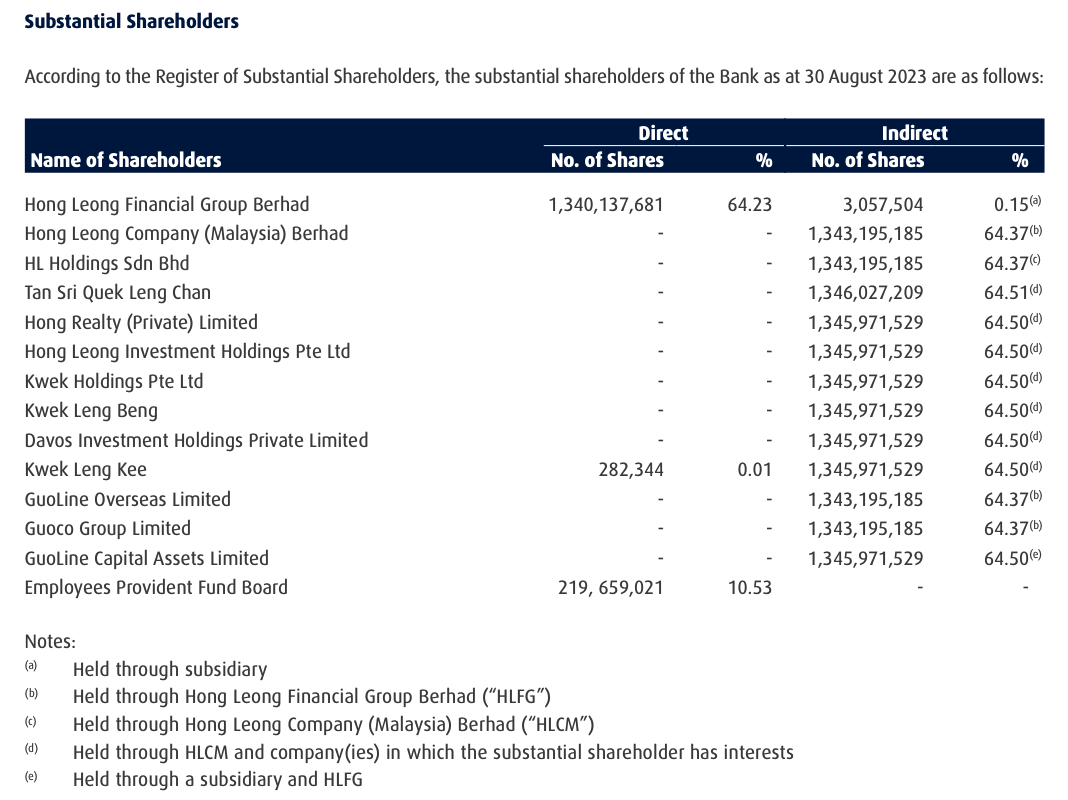

Shareowner

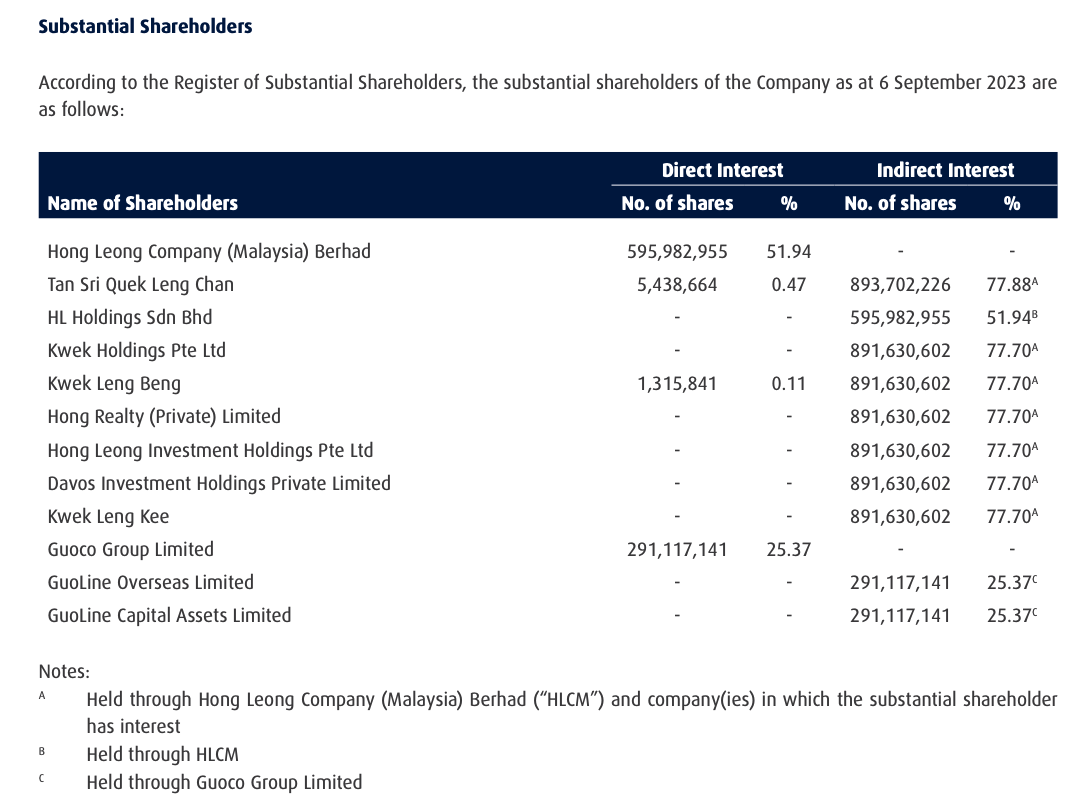

It's clear Tan Sri QLC owns 78%, leaving only 22% to everyone else. This is too tightly held.

Tan Sri is now in his 80s years old. Many questions, including who will continue his legacy - click here.

Monthly Chart

Long term uptrend very clear. Interesting, accumulation zone is very wide (maybe due to the tightly held shares).

Clear horizontal resistance around RM20. The triangle will converge around 2026-27.

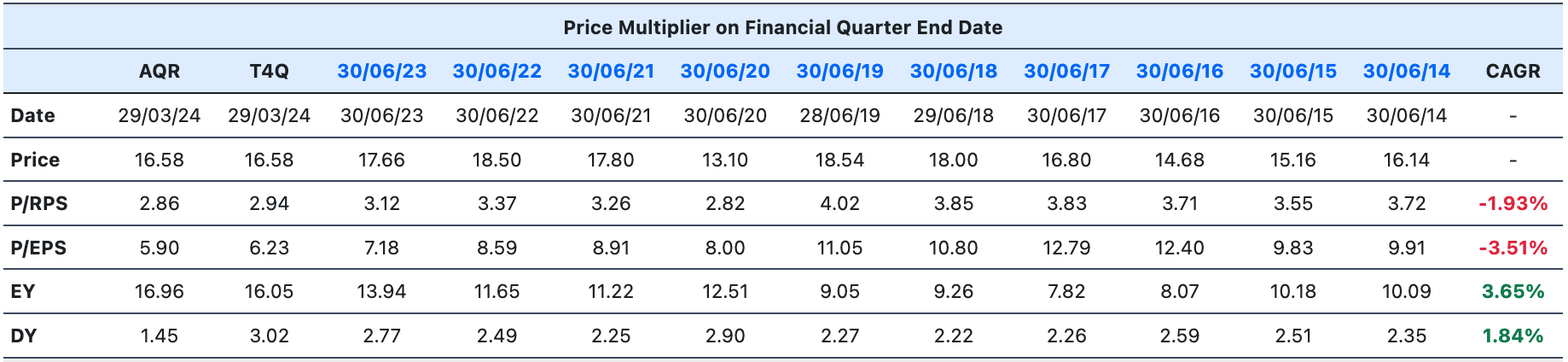

Past 10 Y Fundamentals

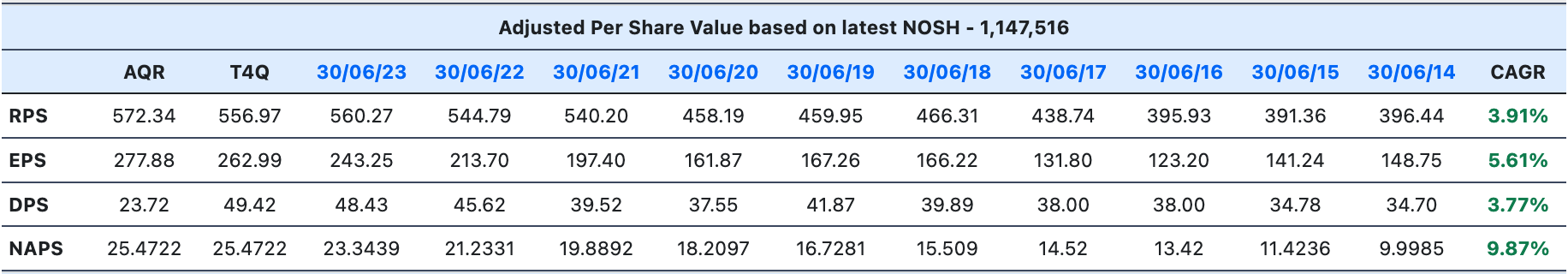

Nice 10Y CAGR, but actually, it mimics HLBANK (and slightly inferior to HLBANK on DPS).

It's PE multiple has been shrinking since 2017 peak. DY rising, but not as much as EY rise i.e. less sharing of profits.

It's clearly undervalued at both PE and Price to Book, but low PE and low PB is not necessarily enough reason to buy if you can't see the catalyst over the next 3 years, because 3 years can elapsed and if there's no visible catalyst, the stock could remain undervalued.

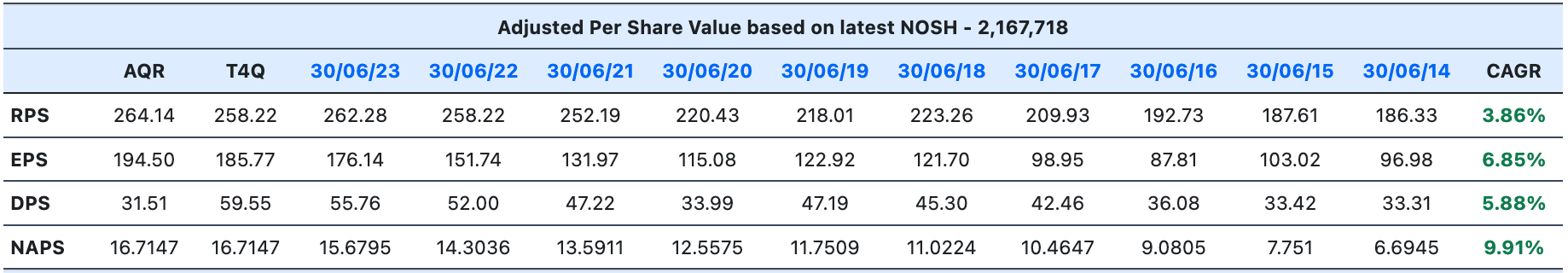

Comparison against HLBANK

As most (90%+) of its earnings are derived from HLBANK, you'd expect similarities:

RPS and NAPS CAGR almost similar (e.g. 3.9%, 9.9% when rounded to nearest 1 d.p.)

EPS bigger difference (HLB edges out at 6.9% vs. 5.6%)

DPS difference biggest (HLB 5.9% vs 3.8%).

Similar observations with DY and PE.

At FYE2023, HLFG DY = 2.77% smaller than HLBANK DY = 3.11%

Similar relationship with payout ratio too.

What all of this means is that the value of 1 HLBANK share in HLFG vs the Market is different.

In fact, Mr Market puts a higher value of HLBANK when traded in the open market, then, when it sits in HLFG.

Why the different valuations?

The reason is simple - compare Tan Sri QLC's % ownership. He owns less of HLBANK (64%), than HLFG (78%).

But why the different valuations? Isn't there arbitrage opportunities?

Short answer is no. Here, in this case, I would suggest that even Warren Buffett would not try to buy HLFG and then try to unlock value. Why? Simply because even during his arbitrage years before Berkshire, he has very successful experience in arbitraging and unlocking value by getting a seat at the board, convincing minorities, banding together and trying to get a majority to force the old shareowners to do something or get out. In this case, with Tan Sri QLC owning 78%, you can forget it. And if Buffett won't try, Mr Market will continue to discount the value of HLBANK inside HLFG vs outside.

Summary and Conclusions

- HLFG is undervalued - PE only 6-7, PB 0.64-0.75.

- However, it's DY is barely matches FD.

- HLFG derives 90% of its profits from HLBANK.

- However, comparing HLFG vs HLBANK:

- HLBANK DY is slightly higher.

- HLBANK shares its profits with shareholders better.

- HLBANK DY is slightly higher.

- However, comparing HLFG vs HLBANK:

- HLFG persistently underperform HLBANK, due to both "conglomerate discount" and Tan Sri's QLC's tight holdings on HLFG.

- Conglomerate discount because in Malaysia, there's not that many shareholder activist that will do something to unlock the difference in values.

- Further, Tan Sri simply owned too much of HLFG.

- With 78% ownership, he doesn't need to see a high dividend payout ratio on HLFG vs HLBANK.

- And he simply makes sure he will never be removed from the Board with such massive shareholding.

- This is where Malaysia is different than US.

- IMHO, Buffett would not try.

- There is also the question mark of successor.

- Tan Sri QLC is in his 80s. If you think his passing away could unlock his tight shareholdings, usually, the outcome is biased to the downside than upside.

- Additionally, he may outlive you, with the vast resources that he has. It won't happen in next 3 years.

- Downside because without his children taking over, odds are too high that one or more will be looking to sell, and the market simply cannot absorb such a massive supply then. The conglomerate also won't be the same.

- This goes against value investor's belief that with lower PE, lower PB, future price growth is higher. This is true for freely traded stocks, but not necessary for stocks like HLFG with Quek owning so much. We know privately held stocks (where owner owns 100%) are never valued as high as listed stocks.

- So, if you feel you must still own HLFG, then, make sure your Position Sizing in HLFG is much smaller than HLBANK and small overall. Else, likely your portfolio will lag behind HLBANK.

In short, I'll pass HLFG, as HLBANK looks better to me, even if it's is less undervalued, due to Tan Sri QLC's factor in HLFG.

Disclaimer: As usual, you are fully responsible for your own trading and investment decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Jan 22, 2025