VIX says - buy the fear this round

DividendGuy67

Publish date: Mon, 05 Aug 2024, 10:24 PM

Super busy at the office today, didn't even monitor markets and saw markets globally experiencing signficant falls.

In another forum, I shared Buffett has increased his cash holdings to nearly 30% of Berkshire's market cap, a record level for him and advised caution. Nevertheless, it's not my base case for markets to crash, when the Feds haven't even started to cut rates yet. So, I view this drop as a good opportunity to buy stocks in Bursa.

There are many reasons why I'm optimistic that Bursa will rebound.

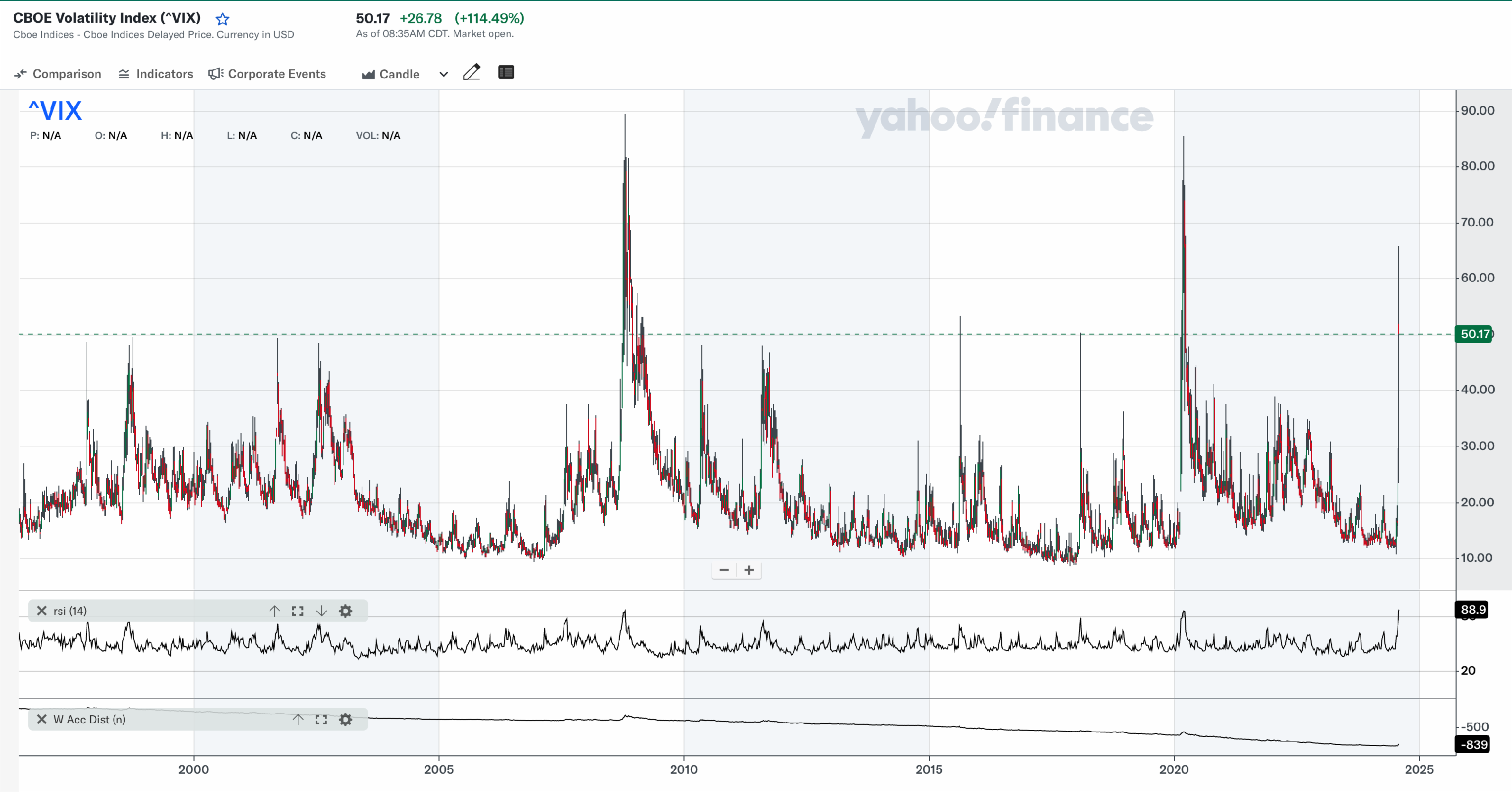

One indicator is the US VIX indicator. Most markets take the lead from US markets and VIX is the "fear index" that is inversely correlated to the S&P500 index.

- When S&P500 drops, fear spikes and VIX spikes up.

- When it is in a high region like 65 today, in the context of a bull market, the first time is usually safe to buy. But later stages gets more dangerous.

VIX is also mean reverting. This means, eventually, the fear will subside, S&P500 should eventually makes new high again - that's my base case scenario and I expect Bursa to be stronger.

- VIX so far has never turned into perpetual fear, and certainly, now isn't the time yet when Feds haven't even cut interest rates.

- The worst time in memory was during Global Financial Crisis where there was a "build up" period, and then VIX stayed high for over 2 years.

- During this time, majority thought this was becoming the "new normal", with VIX > 20. As usual, the crowd will always be wrong. As you can see from the chart below, VIX eventually reverted back, with markets making new highs.

If you own quality stocks in Bursa with strong recovery power, you should have no worries. Just close the screen, go away and one day, your stock will make new highs again. I have already blogged about quality stocks previously, using PBBANK as example.

So, here's the VIX chart I am seeing.

- I think >50% chance we may have seen the bottom in the US already today, i.e. good chance KLCI will bottom soon.

- KLCI is showing good strength against regional indices, falling relatively smaller than regional markets.

- <30% chance there's continuation of more downfall and <20% very serious continuation lasting weeks.

- My buy orders today at lower prices was hit when I was not watching the markets.

Summary and Conclusion

Without monitoring, I bought today and plan to add to this dip tomorrow. But not in a greedy kind of way, since the dip is still fairly small in the broader scheme of things. If wrong, still have plenty of bullets left.

Disclaimer: As usual, you are fully responsible for your own trading and investing decision.

DividendGuy67

The past 3 days, I bought 12 different stocks cheaply on the basis of this indicator that suggested that majority odds US markets will recover.

Of course, I didn't know for sure that it will recover, just know that majority odds and if I buy across a wide range of stocks, I should do okay in 3, 6, 12, 24, 60 months time. In the end, I managed to buy 12 different stocks cheaply. Roughly half my orders were hit, the other half didn't. So, it was nice and I am thankful.

Our jobs as investors is to try to buy above average / good quality stocks at attractive prices especially during price dips, market corrections, market crashes, pandemics, during wars, etc. when prices are temporarily depressed, especially in the middle of a bull market.

And because we will never be sure, diversify, diversify, diversify. So, always watch position sizing too. During this round, I didn't need to withdraw monies from EPF, etc. Just use my own cash that has accumulated from various sources including dividends, realized gains, past profits retained, etc. with still balances in the stock account as not all buy orders were executed. I was eyeing for many good quality stocks but their prices didn't fall that much at all, so, nearly all of them were not triggered.

Many experts believe the yen carry trade might not be over yet. I don't know and don't really care much about their opinions as there are so many with different opinions out there. Yes, there's obviously a yen carry trade there given how low the yen interest rates are. But our jobs as investors is to find good quality / above average stocks to buy at an attractive price. I didn't fully manage to do so, but the more "speculative" stocks I bought seems to be doing good as they are bought near the lows. But let's see as markets are always unpredictable.

2024-08-08 00:38