Bursa Market Breadth - some perspectives

DividendGuy67

Publish date: Thu, 05 Sep 2024, 11:41 PM

Background

The past 6 weeks have been tough for many active traders in Bursa. As KLCI kept rising, many have found that their stocks did not participate in the rise but are instead falling. Market breadth has not been strong the past 6 weeks.

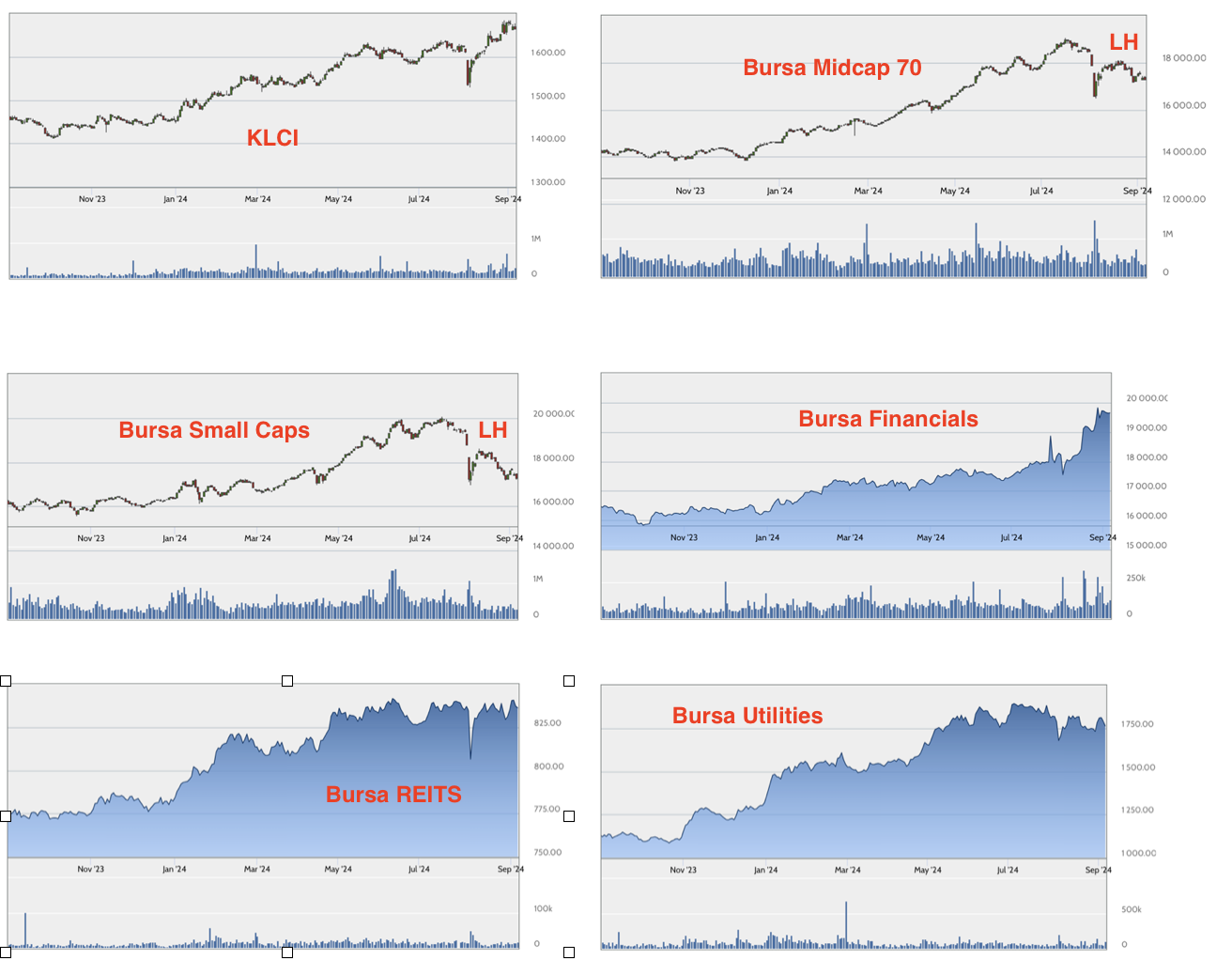

The following chart compares KLCI vs Small caps over past 12 months.

KLCI vs Small Caps

Key observations:

- The chart period is 12 months.

- Over the past 12 months, both KLCI and small caps have delivered positive returns that beats EPF. KLCI +14.4%. Small caps +7.1%.

- However, until KLCI which is more steady, the Small Caps have experienced very high volatility.

- At the peak in mid July, Small caps were up +24%. However, in 6 short weeks, that massive gain has dropped to only +7%, i.e small caps have lost 17% and the loss may not be over yet due to the series of "Lower Highs" observed (see above).

Also worth mentioning that the active traders "loss" in this type of chart pattern, is typically larger than a passive trader investing in small cap 12 months ago.

- This is because of the tendency to buy more as gains increases, resulting in greater commitment of capital and maximum commitment of capital at the peak.

- Up to mid July, such action to commit more would have been vindicated and resulted in larger gains.

- However, after today, likely such action will lead to negative returns (instead of +7.1%).

- Sadly, this is typical of markets - the majority of active traders lose monies.

Another perspective - where are the winning sectors?

Key observations:

- It's not just small caps that are weak. The mid caps are weak too the past 6 weeks.

- Probably the strongest 3 sectors are financials, utilities and REITS. Financials continue to steadily rise, due to under-valuations. Utilities is the big surprise 12 months ago - who would have thought the gain would have been like +60%! REITS did well in first half - second half trying to hold its gains.

- Worth mentioning if you monitor the US markets - both Nasdaq (technology) and Russell (small caps) are showing "lower highs". That of course is quite concerning if they don't stabilize in the near future.

Should you run into Cash now?

It's hard to advise here and I will not try to do so.

So, I will only share my own plans. I am lucky in that the majority of my funds are dividend investing in Financials, REITs, TENAGA and these sectors have done well for me for past 12 months. However, I am unlucky in the sense that I did dabble small amounts into the weaker sectors like small caps, tech and the other weak sectors.

So, for me, I still have no plans to exit my winning sectors as I still feel for example, banks are undervalued and my winners have not yet reached their full potential. However, I am not adding any more to the weaker trades. E.g. GENETEC is still 0.4% of my capital and no plans to add, even if it is now under-water by 10%, because 10% x 0.4% = 0.04% paper loss which is tiny. As long as I don't add to my losing stocks at the weaker sectors, I cannot lose big fast and I continue to protect my portfolio gains.

Keep the cash for the crash (if it comes).

Summary and Conclusion

As you know, I embed diversification in my portfolio as part of risk management.

We will never know which sector is going to do well in the future, and which ones won't.

I observed diversification has protected me so far, as market has not yet crashed in a big way.

Additionally, I have no plans to add to my losers in the weaker sectors.

Longer term, whilst I still think there's decent chances of recovery for some of the weaker sectors, I refuse to add, as there's no need to be greedy. If you add, it means you have taken a 100% view that price will recover when in reality, nobody is 100% certain and for me, I'm more like 55% instead of 100%, i.e. there's still 45% chance I could be wrong in my current positions in the weaker sectors.

Do not under-estimate the weaker sectors getting weaker due to the series of "LH". The payoffs and losses are not symmetric. If I'm right, it will take time to climb the wall of worry. If I'm wrong, prices like to crash down hard and fast.

So, keep the cash. Keep the EPF. Keep the other assets. Now is not the right time to even think of deploying them yet.

The right time to deploy them is when there's real blood on the streets. I don't see real blood yet.

The right time to deploy a little bit of them is when you have seen price stabilized and turnaround. Not yet happening with Lower Highs.

However, if you had lost monies in small caps when the benchmark is +7% returns on small caps, then, take a serious hard look at what you did wrong.

Disclaimer: As usual, you are responsible for your trading and investment decisions.