Bursa nods, Fast Energy gets green light on its multiple proposals

techinvestormy

Publish date: Mon, 01 Aug 2022, 05:05 PM

Bursa nods, Fast Energy gets green light on its multiple proposals

25th July was certainly a good day for Fast Energy and its shareholders, as the electronics turned energy player had finally gets green light from Bursa to proceed with its proposed share consolidation, proposed private placement as well as proposed acquisition activities.

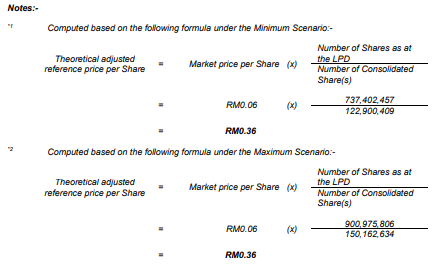

To recap, Fast Energy had approximately 737.4 million outstanding shares currently excluding any potential ESOS exercises and warrant conversions, and given the exercise value of Fast Energy standing at RM0.150, minimal conversion will be done at this juncture, and most likely the 6-to-1 consolidation exercise could be done smoothly.

Upon completion, it is expected that the company to have 122.9 million outstanding shares, with a share price of RM0.180 per share based on the 5-days VWAP.

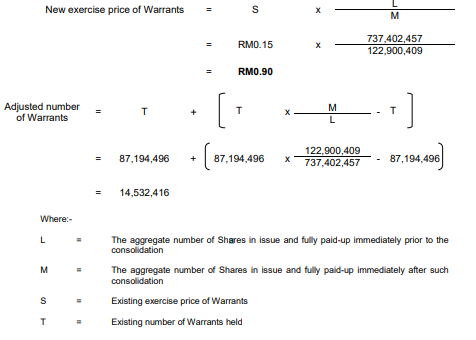

The warrants, however, would consolidate at the same manner from approximately 87.2 million units to 14.5 million units.

Obviously, the exercise price of the warrants would also increase in tandem, where investors may refer to the illustration below as proposed by the company few months ago.

Post consolidation, the company shall also issue up to 35% of the total number of outstanding shares in order to raise funds to finance the partial settlement of the cash consideration of RM23.97 million payable to the vendors of CCK Petroleum.

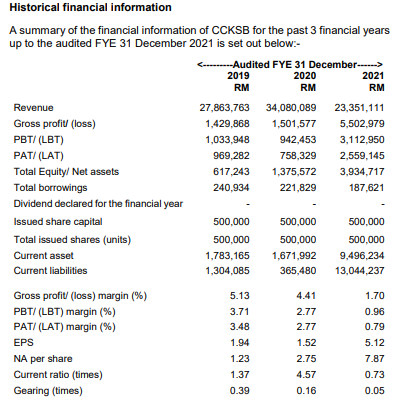

While many investors may not learn about CCK Petroleum prior to the announcement, it is important to note that CCK Petroleum is mainly involved in the trading of petroleum products which involves the trading of bunker oil, and provision of oil bunkering services, where bulk of the revenue were contributed from the trading of marine fuel oil.

And as you can see, the demand for marine fuel oil is higher than ever as economic activities had recovered post-pandemic era which had reflected in the financial performance of CCK Petroleum.

Most importantly, investors should now focus on the financed sum against the current share price of the company. Based on a minimum scenario calculation, the current share price of Fast Energy is approximately RM0.030 and post consolidation, the share would increase to RM0.180 theoretically with 122.9 million outstanding shares.

In other words, a full 35% private placement would result in RM7.7 million being raised. And for your information, the company intended to raise a minimum of RM12.6 million, which had 39% value difference based on its current share price. It is very likely something would be done to increase the VWAP of the company in order to increase the sum raised by them.

Plus, RM0.030 is essentially the recent low of the company for one to invest in.

The acquisition is of utmost important for the group to venture into the very profitable oil bunkering business, as well as extended their energy arm into the solar industry, which an announcement of solar-based subsidiary was incorporated by the company months ago.

I do think something interesting is going on for Fast Energy. What say you?

More articles on FDMsharing

Created by techinvestormy | Aug 24, 2022