FKLI Updates

11 Dec - Market in Range, awaiting Window Dressing

InvestorsDoctor

Publish date: Mon, 11 Dec 2017, 08:49 AM

11/12/2017

FKLI Dec 17

Previous Close: 1716 +4.5

Wall Street stocks were propelled to new highs on Friday (Dec 8) as a better-than-expected US jobs report boosted the Dow and S&P 500. On Friday, KLCI traded marginally higher with market breadth of 0.66 indicating the bears were in better control.

As near to end of the year window dressing, seller should be cautious on the current bearish trend in FKLI since October. Market is likely to experience regime shift in the near term with limited upside. Ringgit remain strong and foreign fund remained net buy in local market for 3 weeks, while local institution as net sell. For the near term, ringgit will remain bullish as market expecting a hike in overnight rate by bank negara on next month.

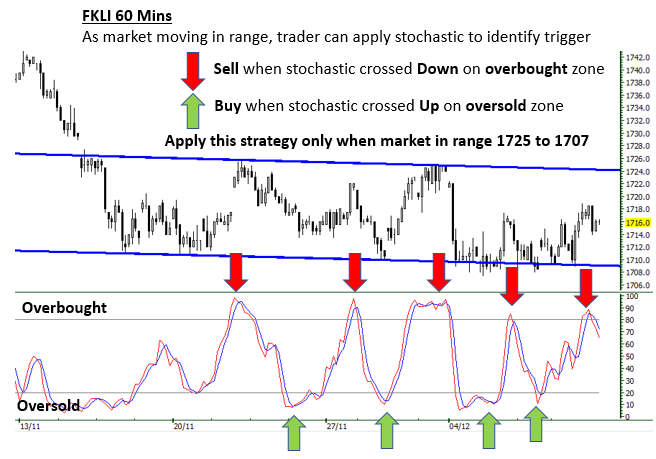

In FKLI chart, price have been moving in sideway between 1726 to 1707 for almost a month, intraday trade can perform range trading until price move out from current “flag formation” as illustrate in the attached chart.

Price Level to monitor today:

Resistance :1725

Support :1707.5

Recommend Trading Plan for the day:

1. Buy 1708 or below, stop 1703, profit 5pts or above.

2. Not Recommend to Sell

FKLI Margin Requirement

Intraday MYR 1750

Overnight MYR 3500

Spread MYR 500

Disclaimer: Idea for sharing purpose, trade at your own risk.

More articles on FKLI Updates

Daily Futures Commentaries: [FKLI Malaysia Index] 30/12/2019 - 1595 or 1620 wait for breakout

Created by InvestorsDoctor | Dec 30, 2019

Discussions

Be the first to like this. Showing 0 of 0 comments