How a Malaysian Fresh Grad like You can have RM 100,000 Sitting in Your Account by Retirement

NeoZach

Publish date: Sat, 25 May 2019, 03:00 PM

[This post is sponsored by 2Kupang. 2Kupang is a spare-change investing apps that rounds-up your purchases and invests it in investment portfolio based on your risk profile automatically, even if it is just 20 sen. Everything is automatic, no effort required from your side. 2Kupang’s slogan is “Sikit-sikit, Lama-lama Jadi Bukit”.]

Every Malaysian can have at least RM 100,000 sitting in your account by retirement, even if you’re only earning RM 2000 a month as a young person. Here’s how.

Imagine you’re a fresh graduate, you are 24 of age. You just get a job with a local company that pays RM 2,000 a month. That’s not a lot, but you know you’re just starting out. You are excited at the idea that you can finally stand on your own feet, and you are set out to achieve your big dreams from now on.

Back to the question, how do you have RM 100,000 in your account by retirement? The answer is astonishingly simple - RM 2/day. Just by saving RM 2/day, you’ll have RM 100,000 at the end. Let’s do the math and see if it’s true.

Scenario: Saving RM 2/day

You are 24 now. You have 36 years until the Malaysia’s legal retirement age of 60.

If you save Rm 2/day x 365 days = Rm 730/year

Rm 730/year x 36 years = Rm 26,280

Ehhh wait? I thought it is RM 100,000, why only RM 26,000? Because we are yet to go to the second scenario?

Scenario 2: Save Rm 2/day + Invest It Passively

Scenario 2 is similar to Scenario 1, but we have an additional step, which is to invest the savings.

Specifically, we are to invest the savings into something called Index Fund. (Disclaimer: Not trying to sell you any fishy investment schemes that gives you crazily high guaranteed return. Index Fund is something very established in the investing world that every professional investor knows about.)

First of all, I need to make clear what is an Index? To put it simply, Index is something that tracks a basket of securities/stocks. Even if you’re not familiar with the investing world, you might have heard of KLCI (Kuala Lumpur Composite Index) or DowJones or the S&P 500 index. KLCI index tracks 30 biggest companies that are listed in Malaysia. Tenaga Nasional, Petronas, Genting, Sime Darby, Hong Leong, Astro etc. These are the brand names that we are all familiar with. Similarly, S&P 500 tracks 500 biggest companies listed in the USA. (For more info, visit https://www.investopedia.com/terms/i/index.asp)

Index Fund is a fund that mimics the Index closely. For example, if KLCI has 5% weightage of Genting, 3% of Astro, a KLCI Index Fund will mimic that closely, they invest 5% of their total cash into Genting and 3% into Astro. (Visit https://www.investopedia.com/terms/i/indexfund.asp for more into on Index Fund)

Why Index Fund?

- Low Cost (no need to research/manage)

- Decent Return (Better than 95% of professional Fund Managers)

The philosophy of investing in Index Fund is a straightforward one – an Index Fund investor doesn’t believe that anyone can beat the market, hence the best strategy is to grow together with the market. Since an Index is a basket of largest companies by size, when a company does badly, it will be kicked out and be replaced by other rising stars, this basically guarantees that the companies in the Index are the strongest at a particular time. Therefore, to invest in an index is to ride on of the growth of the strongest companies.

In fact, evidence shows that Index Fund investors are right – it is hard to beat the market. Number shows that up to 95% of Professional Fund Managers couldn’t beat an index fund. You pay your fund managers more, but they still couldn’t beat the index anyway. (See https://www.cnbc.com/2018/01/03/why-warren-buffett-says-index-funds-are-the-best-investment.html) For people who can beat the market, like Warren Buffet the legendary investor himself even said that after he passed away, he would want his wealth to go into Index Fund, since that’s the easiest way to get decent return. (See link: https://www.cnbc.com/2018/01/03/why-warren-buffett-says-index-funds-are-the-best-investment.html) You don’t have to know what stocks to buy or when to buy them. Just follow the Index.

How many % is Index Fund’s return?

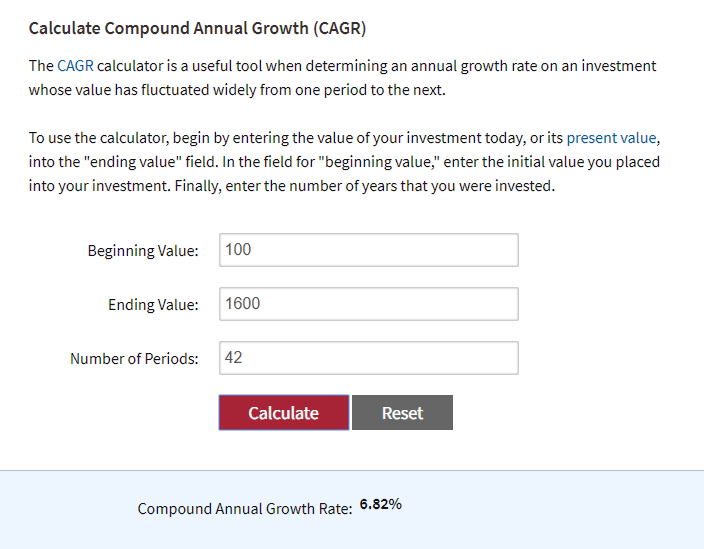

KLCI started at 100 points in 1977. It now stands at around 1600 points. Relatively, KLCI is worth 16x more today over the 42 years period. Using the financial calculator (https://www.investopedia.com/calculator/cagr.aspx), we get an annual return of 6.82% (For those who are familiar with finance, this 6.82% is the compounded annual growth rate or CAGR).

The 6.82% doesn’t include the dividends given out by the companies. If we look at the recent years (https://www.ceicdata.com/en/malaysia/bursa-malaysia-dividend-yield/bursa-malaysia-dividend-yield-ftse-composite-index), KLCI gives a dividend of at least 2.5% even at the worst years.

So 6.82% + 2.5% = 9.32% Annual Return on average from the KLCI Index Fund.

Similarly, S&P 500 has an annual return of 9.05%.

9% is pretty decent, especially when you don’t have to do any research. For those who have invested in mutual funds before, how many of your funds have an annual return of 9% over 40+ years? Most professional fund managers can’t beat 9% a year. This is why Index Fund is popular, it is easy and the return is decent. (Fun fact, Warren Buffet’s CAGR is around 20%. No wonder he is called The Legendary Investor.)

Limitation of Index Fund:

Index Fund only works over the long term. Market goes up and down every day. Over the short term, your fund might go down here and there. For example, if you invest in 2008 when the market collapse, you will see your account in the red, but over time the market recovers and have since doubled. To overcome the limitation, the key to invest in Index Fund is to be consistent and passive. Invest a little bit every month, over time things will average out and you will get the return of up to 9% a year.

Scenario 2 Calculation:

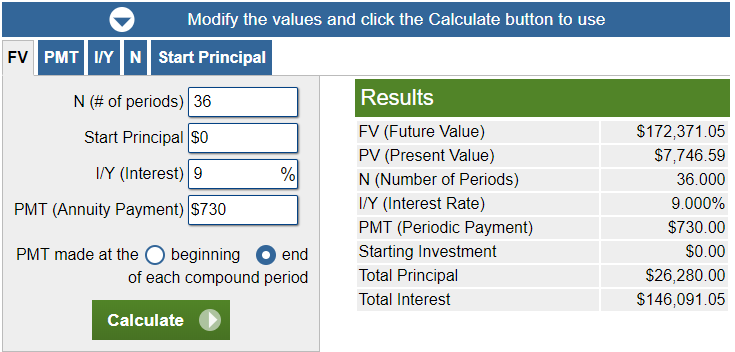

Coming back to Scenario 2, the calculation is as follow: (You can test it out yourself at https://www.calculator.net/finance-calculator.html?ctype=endamount&ctargetamountv=1000000&cyearsv=36&cstartingprinciplev=0&cinterestratev=9&ccontributeamountv=730&ciadditionat1=end&printit=0&x=107&y=25)

N: Number of Years

Start Principal: $0

I/Y: Interest/ Return (Assume 9% for Index Fund,as discussed above.)

PMT: Rm 2/day x 365 = Rm 730

With Rm 2/day or Rm 730/year invested into Index Fund, you get Rm 172,000 + when you retire. (I know we promise Rm 100,000, the extra is a bonus for you.) So now, are you convinced that everyone can have Rm 100,000 when they retire?

This strategy has two criteria:

- Save Rm 2/ day

- Invest the savings into an Index Fund

[Here's the ads time. ^_^ ]

How’s how 2Kupang can help:

Putting aside Rm 2 a day requires a lot of discipline. Investing into an Index Fund requires you to approach funds or buy through a stock investment account in the case of Index Exchange-Traded Fund (ETF). We think this is a lot of hassle.

And here’s how 2Kupang can help. To keep it simple, 2Kupang is a spare-change investing apps.

You link your debit card to 2Kupang apps and every time you make a purchase, 2Kupang will automatically round-up the change for the transaction. We have so many transactions every day, so saving Rm 2/day shouldn’t be a problem. If needed, 2Kupang even has a feature that allows you to save Rm 2/day as default to help you achieve the goal. So criteria 1 is cleared.

Next, 2Kupang will automatically invest your savings into one of the 3 portfolios: conservative, moderate, aggressive. (You can opt out of this automatic investing feature. This means you’ll only be saving money, but not investing.)

- Conservative: Made up of super safe investments (Fixed deposits, Money market funds and some corporate bonds), mainly to generate cash.

- Moderate: A mixture of some corporate bonds, Index Fund

- Aggressive: Index Fund and mainly stocks (including overseas stocks) for higher return

If you pick the Moderate option, your money will go into Index Fund. So criteria 2 is cleared too. (However, since some of the money will be invested into corporate bonds too, the overall return for Moderate option will be lower than purely investing in Index Fund. Nevertheless, the goal to accumulate Rm 100,000 by retirement with Rm2/day should still be achievable since based on the example shown above, we will get Rm 172,371, which is way higher than our goal of Rm 100,000. We have enough room for error.)

Now that we have shown you how it can be done, are you convinced that every Malaysian can have Rm 100,000 by retirement?

To learn more about 2Kupang, please visit: https://cutt.ly/bueXZP

Please sign-up if you think this is a good idea. We are just starting out. Help us make this come true!

For more useful (and unconventional) financial tips, please follow us on:

Facebook: https://www.facebook.com/2KupangMalaysia

Instagram: https://www.instagram.com/2kupangmy/

Discussions

I think Rm 100k savings is too little nest egg, when u retire loh...!!

Raider say Rm 500k to Rm 1000k are the just bare minimum u should have when u retire loh....!!

Do not be too proud that u have Rm 100k in your account when retire loh.....!! Bcos most people will achieve this in adequate amount mah....!!

The goal is that Your nest egg....should be big enough....to more than finance your retirement without worry about your finance loh...!!

2019-05-25 17:13

raider..only u trust insurance salesmen and unit trust sellers.........and your compounding....

2019-05-25 17:17

It is basic compounding mah....!!

With basic interest return of 3.5% pa

If u earn Rm 2k per month after graduate & your increment is just average 4% pa...i bet after 35 yrs of working...just your epf will have more than Rm 100k after retirement loh...!!

Posted by silom > May 25, 2019 5:17 PM | Report Abuse

epf allows one to do self contribution up to max 60k per annum, can save there too for the fresh grad, and think can get around 5.5% to 6% dividend which is much better than FD which is only around 3% .. can also withdraw for housing when needed.

qqq3

11255 posts

Posted by qqq3 > May 25, 2019 5:17 PM | Report Abuse

raider..only u trust insurance salesmen and unit trust sellers.........and your compounding....

2019-05-25 17:27

Posted by ks55 > May 7, 2019 11:12 PM | Report Abuse X

If you are 24 yo today, how much is your expected salary when you are at 60, i.e. 36 years from now?

For dumb-dumb, you will expect yearly increment of 4%.

For average or slightly above average, yearly increment 8%.

For high achiever, yearly increment 12% to 15%.

Say if you are with average performance, effective increment 8% yearly taking into consideration 4 promotions/job switch through out your working life, you are expecting 16x your current pay.

If you are earning 3k now, 36 years later (if you retire at 60), you should be earning 48k a month.

Based on last drawn pay at 48k, you need 5.76m equivalent to 120 months of last drawn pay.

If you are spending 60% of your income, when you retire at 60, last annual income is 576k. 60% means 345.6k a year.

If you can generate 10% to give 576k a year, you will be very much prepared for inflation up to 4% a year.

Planning for retirement is not calculate based on what you need today, but to be contemporaneous to the time of retirement.

2019-05-25 17:31

stupid questions here :

Public mutual agent always said dollar costs averaging ...continue buy even if down or up for longer period of time

so when retire will have enough money for retire as the price per unit will lower

any good wisdom people can advise ? buy into unit trust is it good ?

2019-05-25 18:21

Buying unit trust is relatively safe compared to investing directly in the market. However, there are a few provisos, 1) unit trust costs in commission must not be more than 2%, 2) you are patient enough to wait for a longer period of time to see profit, 3) invest in the correct fund at the right time

2019-05-25 18:29

(US/CHN trade war doesn't matter) Philip

Buying unit trust is relatively safe compared to investing directly in the market.

>>>>>>

Buying unit trust is investing directly into market. You are just paying someone else 1.5% + transactional fee assuming they know more than you do.

2019-05-25 18:39

Silom, Yes, I know as I am a client of fundsupermart. I just dont say it lest people think I am promoting for my own interest.

2019-05-25 19:48

i repeat many time, u should be the best fund manager....managing fund is not only fun, but very rewarding too....why pay other to do it for u? lol

2019-05-25 19:57

You don't count 42 year , you count 20 year and 10 year see , you will cry no tear , rubbish race make rubbish company make rubbish economy , Malaysia rubbish ! But I agree with you 95% investor can't beat market . Invest in US index iis good choice!

2019-05-25 22:18

@Philip

thanks for sharing

yes, as I dont have the time and skills to invest full time

2019-05-26 00:18

@lizi

thanks for sharing

yes, I also found its fun and interesting to manage my own fund

but my track record is not good , maybe I dont have enough experience and skills

have been reading this and that and still make loss , haiz , sad actually

maybe external market condition ...

2019-05-26 00:21

Just buy property lah.

After 15-20 yrs sure rich la.

Less headache.

This the trend of those who only play real estate only.

Stock market is very risky.

2019-05-26 09:11

Basically, this guy expects everyone to give an anonymous app access to their savings account LOL :) later they will blame the bank for their lack of security when someone cracks the app and takes money out of the account :)

2019-05-26 10:50

Im 26 this year,start investment on 22,graduate at 25 and start working, Now i have 140k value of stock =)

2019-05-26 22:54

100k enough kah marriage atleast 25k, provision after bla bla... if you have decent lifestyle.. humble2 one.dont greedy2...ermm can la maybe...but if suddenly fiat money become useless..u need to thikn other backup laa bro

2019-05-26 23:16

(US/CHN trade war doesn't matter) Philip

Which index fund is this? Who guarantees the fund of it is kept in a central CDS account? If kupang2 closes down, who gets their money back?

Finally, how do we know you are not using the money to invest in drugs, women and guns? Who is the third party monitoring? Who pays them?

2019-05-25 15:40