FGV & MSM - MIRROR IMAGE MOVING FORWARD !!!

Investhor

Publish date: Sun, 28 Jul 2019, 12:02 PM

Hi to all fellow investors and traders !

Today I would like to highlight a pattern which is forming between these 2 stocks:

FGV HOLDINGS BERHAD or FGV (Code 5222, Main Board, Plantation) &

MSM MALAYSIA HOLDINGS BHD or MSM (Code 5202, Main Board, Consumer Products & Services)

FGV & MSM - Mirror Image Chart Moving Forward

Here are my thoughts :

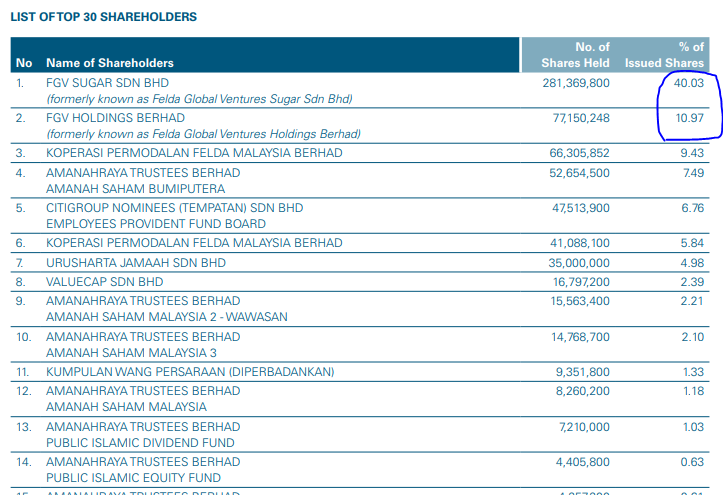

1. FGV As A Major Shareholder of MSM

Refer below screenshot from latest MSM List of Shareholding taken from Annual Report. We notice that FGV is a 51% shareholder of MSM. Therefore any movement in MSM will be reflected also in FGV share price.

2. Sale of Stake in MSM Will Also Be Positive for FGV (Similar Case Study - PROTON Sale to GEELY)

Refer below news articles from the edge. It was reported that 4 potential bidders are eyeing the stake :

1. IAG Capital Sdn Bhd (Vehicle of Datuk Seri Johari Abdul Ghani)

2. Singapore based Wilmar International Ltd (owned by Kuok Group)

3. Unnamed Indonesian company

4. Unnamed Chinese company

https://www.theedgemarkets.com/article/discussions-over-msm-stake-still-preliminary-stage-says-fgv

https://www.theedgemarkets.com/article/msm-surges-145-report-fgv-talks-sell-stake

Although the talks are still in early stage, this provides a clear direction to the market that FGV plans to secure a strategic partner in turning around MSM business.

MSM has been making losses the last 2 quarters on the back of decreased revenue. It is possible that FGV is looking to sell at least half their existing stake (so the new partner will have 25.5%, equal with FGV after the sale is complete), so that the new partner also will have enough meat in the business. The new partner might also be looking for a strategic position in MSM via board or management seats.

This move, I see is similar to PROTON selling strategic stake to GEELY, after which GEELY has partnered PROTON in providing its expertise to turnaround the company. As of recent, PROTON has been doing well since the launch of the new SUV - PROTON X70.

Therefore, I believe that investors would be looking to enter as early as possible, as when the new strategic partner is near to finalization, the price of both MSM and FGV might be already at the peak of the trend.

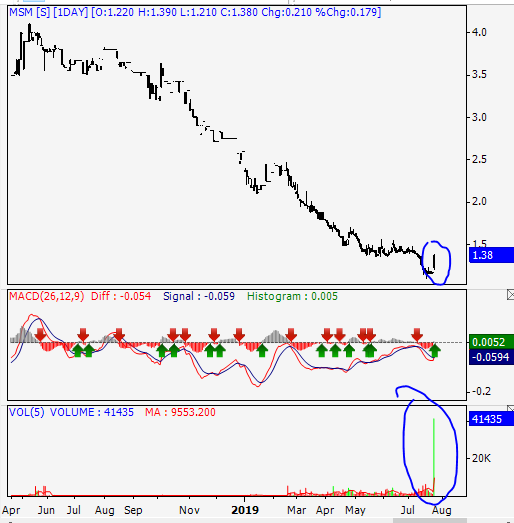

3. Technicals - Worst is Over for MSM & FGV ? Solid Identical Candles Appeared on Friday 26th July 2019

Refer below screenshots daily chart for FGV & MSM. Some similarities observed:

1. Both were on short term downtrends

2. Volume surged on Friday 26th July 2019

3. Solid candles formed on Friday 26th July 2019 (FGV +6 cts, MSM +21 cts)

A few individual observations below:

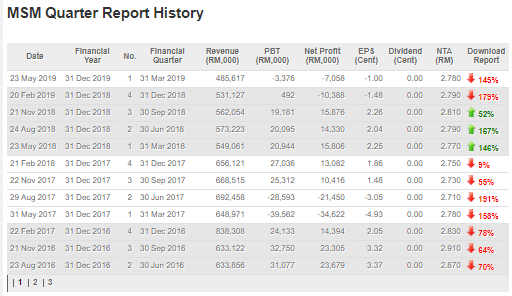

MSM:

MSM was trading at RM 4.50 - 5.50 range between 2011 and 2017. After recording its first quarterly loss in May 2017, the stock had been on a downward trend since then. However, we realized that the trading volumes were thin even on the downtrend. This was due to the low effective float of MSM shares. A lot of holders of MSM shares are long term shareholders and not traders.

In 2019, MSM had dropped below RM 2 and the trading volumes somewhat increased. After hitting a bottom of RM 1.10 recently, the price had surged to RM 1.38 as the talks to sell a stake to a strategic partner surfaced.

Therefore, if you ask me, I believe the worst is over for MSM share price and we will not see any more low prices moving forward. Should the stake sell be finalized soon, I am not surprised if MSM can break the RM 2 barrier and possibly head towards RM 3.

FGV:

FGV shares were on short term downtrend from April 2019 after a triple top formed at the price of RM 1.34-1.38 range. Seems there is strong resistance at this area.

Since then it had dropped to a low of RM 1.03 on Friday 26th July 2019, until talks of its sell of MSM stake surfaced. The price had surged to a close of RM 1.11 on the same day it hit the recent low. A very bullish engulfing candle had formed with significant volume increase.

First resistance seen at RM 1.20, then next at RM 1.35-1.38 range level.

CONCLUSION

Based on my opinion, FGV & MSM shall be forming mirror charts soon, based on below:

i. FGV being a 51% shareholder of MSM

ii. Sale of Stake in MSM to Strategic Partner, Benefits both MSM and FGV in the Long Run

iii. Similar Charting Characteristics formed on 26th July 2019 - Volume, Price Spread

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUYCALL AND ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

Discussions

given that global sugar price is at record low, MSM purchase will be a bargain for the purchasers. Hopefully FGV can fetch a good price for this asset.

2019-07-28 14:43

In the same interview, she revealed that her family once lent $3,000 (ringgit was then known as dollar) to Malaysian tycoon Robert Kuok when he wanted to be an entrepreneur in his younger days.

Read more at https://www.thestar.com.my/news/nation/2019/07/28/queen-speaks-of-chinese-lineage/#e94rpucYMXxQfY6h.99

2019-07-28 15:45

@wirasaham - thanks for the compliment, am glad to be of benefit and contribution to the community

2019-07-28 16:04

guess u must have taken a small position here at least, any idea when is the next resistance level ? thks

2019-07-28 17:09

Refer following news article from e nanyang on FGV:

https://www.enanyang.my/news/20190726/传fgv洽售大马糖厂-br郭鹤年或买回·股价飙18/

For MSM refer below:

https://www.enanyang.my/news/20190727/上升股大马糖厂阻力rm1-59/

As commented, FGV first resistance seen around RM 1.20 then RM 1.35 before further upward

As for MSM, resistance seen at RM 1.60 then RM 2.00

2019-07-28 17:57

Forget it. This one is my top pick https://klse.i3investor.com/blogs/investsmartway/217187.jsp

2019-07-29 12:48

yapyk

The above is definitely a buy buy buy....Fgv & Msm.

2019-07-28 12:31